- What is Debt Consolidation and How it Works?

- How Much You Could Borrow and Repayment Term Options

- Who’s Eligible for a NatWest Consolidation Loan

- Will NatWest Check Your Credit?

- What is Considered a Good Credit Score for NatWest?

- What Are NatWestâs Interest Rates And Fees?

- Can I Use NatWest Consolidation Loans for Any Purpose?

- The Loan Application Process

- The Pros & Cons: Is a NatWest Debt Consolidation Worth It?

- Alternatives To NatWest Debt Consolidation

- The Bottom Line

Should You Get a NatWest Debt Consolidation Loan?

Debt consolidation provides temporary relief by reducing chaotic payments into one. But loans must still be repaid.

If you’re considering this path to simplify your debts, NatWest’s Debt Consolidation Loan might be on your radar.

As you navigate the complex world of financial decisions, it’s crucial to have all the facts at your fingertips. This is not just about finding a quick fix for multiple debts; it’s about making a choice that aligns with your long-term financial health.

And while we’re here to provide you with comprehensive information, we also understand the value of personalised guidance.

To make the best decision, inquire with us. We’ll connect you with experts who can give you advice that fits your financial situation perfectly.

What is Debt Consolidation and How it Works?

Debt consolidation is a practical approach to managing multiple debts. Essentially, it allows you to merge various debts, like credit card balances and loans, into one loan.

This single loan typically comes with a fixed interest rate and a set repayment period. The process works like this:

- Combine Debts – You consolidate various debts into one new loan.

- One Monthly Payment – Instead of multiple payments, you make just one each month.

- Fixed Interest Rate – The interest rate is usually fixed, making it easier to budget.

There are several UK providers for debt consolidation loans, and one noteworthy option is the NatWest Debt Consolidation Loan.

If you’re considering this as a solution, here are some key facts about NatWest’s offering:

NatWest Debt Consolidation Loan Key Facts

- Loan Amounts – You can borrow from £1,000 to £50,000, suitable for various consolidation needs.

- Repayment Period – The loan can be repaid over 1 to 8 years, giving you flexibility in managing repayments.

- Eligibility – You must be 18 or older, a UK resident, and have a NatWest current account for 3+ months.

- Credit Requirements – A high credit score is typically required for approval.

- Representative APR – NatWest’s representative APR is 7.1% for loans between £7,500 and £14,950. Your rate depends on your borrowing amount and personal circumstances.

- Fixed Payments – Monthly payments are fixed, which helps with budget planning.

- Use of Loan – The loan can be used to pay off other debts, such as loans and credit card balances.

How Much You Could Borrow and Repayment Term Options

With NatWest’s Debt Consolidation Loan, you have the option to borrow between £1,000 and £50,000, offering flexibility to cater to various debt consolidation requirements.

The repayment terms are equally adaptable, ranging from 1 to 8 years. This range allows you to tailor the repayment schedule to your unique financial situation.

When making your decision, it’s important to strike a balance between the loan amount and the repayment term.

Choosing a loan amount within your means and a repayment term that matches your budget can significantly impact your financial well-being.

A longer repayment term might lower your monthly payments but could increase the total interest you pay over time.

On the other hand, a shorter term leads to higher monthly payments, but you’ll save on interest in the long run.

Making an informed choice, considering your income, ongoing expenses, and existing debt, is key to ensuring the loan supports your financial stability and goals.

Who’s Eligible for a NatWest Consolidation Loan

To be eligible for a NatWest Debt Consolidation Loan, you need to meet certain criteria:

- You must be at least 18 years old and a resident of the UK.

- You should have a NatWest current account that’s been active for at least 3 months. Alternatively, holding a NatWest credit card or mortgage for 6 months also qualifies.

- You must not have been declared bankrupt in the last 6 years.

- Ensure your loan request is for a purpose that NatWest deems acceptable.

Meeting these criteria is crucial to increase your chances of loan approval.

Will NatWest Check Your Credit?

Yes, NatWest will conduct a credit check for a Debt Consolidation Loan application. A high credit score is generally favoured, as it significantly influences the approval process.

While your credit history is an important consideration, a lower score could reduce your approval chances.

Before applying, it’s wise to assess your credit health for a clearer picture of your loan eligibility and potential interest rates.

Fortunately, obtaining a quote for the loan from NatWest won’t affect your credit score.

This allows you to explore your loan options without impacting your credit health. Remember, aiming for a good or excellent credit score can help you secure a loan with favourable terms.

What is Considered a Good Credit Score for NatWest?

While NatWest doesn’t explicitly state a specific credit score threshold, it’s generally understood that a score categorised as ‘Good’ or ‘Excellent’ increases your chances of approval.

In the UK, credit scores are assessed by agencies like Experian, Equifax, and TransUnion. Each agency has its scoring system. Here’s a general guide for your reference:

| Credit Status | Experian | Equifax | TransUnion |

|---|---|---|---|

| Excellent | 961-999 | 811-1000 | 781 – 850 |

| Very Good | – | 671-810 | – |

| Good | 881-960 | 531-670 | 721 – 780 |

| Fair | 721-880 | 439-530 | 661 – 720 |

| Poor | 561-720 | 0-438 | 601 – 660 |

| Very Poor | 0-560 | – | 300-600 |

A higher score indicates to NatWest that you’re a lower-risk borrower, potentially qualifying you for better loan terms.

What Are NatWest’s Interest Rates And Fees?

NatWest offers a representative APR of 7.1% for Debt Consolidation Loans ranging between £7,500 and £14,950.

It’s important to note that the actual interest rate depends on individual circumstances and the amount borrowed, meaning it could be different from the representative APR.

Should you choose to pay back your loan early, an Early Repayment Fee applies.

This fee is calculated based on the length of the loan and is charged as additional days’ interest on the amount repaid early.

For loans longer than a year, the fee is 58 days’ interest, and for one-year loans, it’s 28 days’ interest.

Clearing the Jargon

APR, or Annual Percentage Rate, is the total cost of a loan, including the interest rate and any other fees, spread over each year.

APR Representative is the rate that at least 51% of borrowers receive when they take out a loan. This rate can vary based on individual credit scores and circumstances.

Can I Use NatWest Consolidation Loans for Any Purpose?

No, NatWest specifies certain restrictions on how their consolidation loans can be used, emphasising responsible lending practices. The loans cannot be utilised for:

- Buying or depositing on property, static caravans, or land.

- Paying household bills, rent, or mortgage payments.

- Covering car tax.

- Business-related expenses.

- Settling late payments.

- Participating in tax avoidance schemes.

- Managing court or solicitors’ fees.

- Gambling activities.

- Investing in shares or other investment funds.

These restrictions are in place to ensure that loans are used for financially sound and legal purposes, aligning with the ethical lending standards that NatWest upholds.

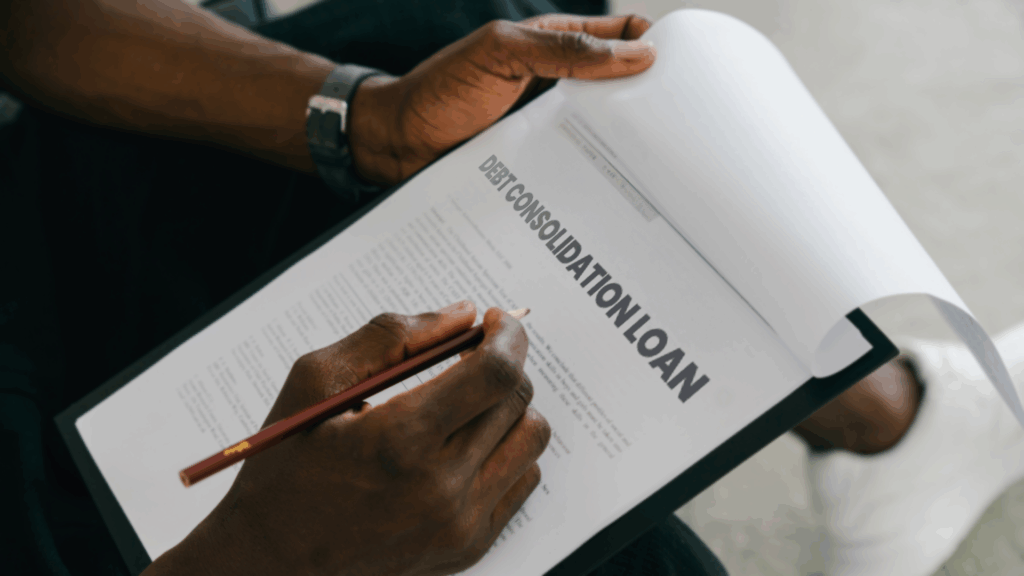

The Loan Application Process

Applying for a NatWest Debt Consolidation Loan is a straightforward process. It kicks off with a free quote that gives you an insight into your potential eligibility and the rate you might receive, without impacting your credit score.

To start, make sure you align with NatWest’s eligibility criteria. Next, NatWest will need to verify the device you’re using for the application, be it a mobile or another type.

The NatWest app is recommended for a smoother application process, so if you’re using a mobile, it’s best to have the app installed.

Finally, you’ll choose between an individual or a joint loan application. If opting for a joint loan, remember that both applicants must meet the set eligibility requirements.

This organised approach ensures you have all the information and tools needed for a successful application.

The Pros & Cons: Is a NatWest Debt Consolidation Worth It?

Deciding if a NatWest Debt Consolidation Loan is right for you involves weighing its advantages against potential drawbacks.

Pros:

- Simplified Repayments. It combines your debts into one, making it simpler for you to manage and budget.

- Potential for Lower Overall Interest. You could save on interest if the consolidated rate is lower than your current rates.

- Credit Rating Protection. Streamlining your debts into a single payment can help protect your credit rating by reducing the risk of missed payments.

- Repayment Holiday. NatWest offers a three-month repayment holiday, providing you with financial flexibility.

Cons:

- Higher Representative APR. The APR might be slightly higher compared to other options.

- Restricted to NatWest Customers. The loan is only available if you’re already a NatWest customer.

- Potential for Higher Overall Repayment. Depending on the loan’s terms and duration, you could end up paying more in the long term.

- Additional Fees for Early Repayment. If you pay off the loan early, you may face extra charges.

It’s crucial to consider these factors with your financial situation before making a decision. This assessment will guide you in determining if NatWest’s solution aligns with your financial goals and needs.

Alternatives To NatWest Debt Consolidation

While NatWest’s debt consolidation loan is a viable option, there are other debt solutions in the UK:

- Individual Voluntary Arrangements (IVAs). A formal agreement with creditors to pay off a portion of your debts over a set period.

- Debt Management Plans (DMPs). An informal agreement with creditors to pay back non-priority debts at a rate you can afford.

- Bankruptcy. A legal status where you’re unable to repay debts owed, potentially leading to debt relief but with a significant impact on credit and assets.

It’s also recommended to seek free debt advice from UK charities like StepChange and National Debtline for personalised guidance

The Bottom Line

NatWest’s Debt Consolidation Loan presents a viable option for managing your debts more efficiently. It offers competitive interest rates, which might be beneficial depending on your specific financial situation.

However, our verdict is that while it has its merits, the decision to go for this loan should be made after careful consideration of your financial situation, the loan’s higher APR, and the requirement to be an existing NatWest customer.

Each of these factors plays a crucial role in determining whether this loan is the right fit for you.

If you’re contemplating this option, we recommend consulting with a professional mortgage broker. They can offer personalised advice and help you understand the nuances of debt consolidation loans.

With their expertise, you can make a more informed decision that aligns with your financial goals.

Eyeing a NatWest Debt Consolidation Loan? Feel free to reach out to us. We’re here to connect you with a seasoned mortgage broker who will help you scrutinise this option, making sure it’s the right move for your financial journey ahead.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

Who is NatWest?

NatWest, established in 1968 from the merger of National Provincial Bank and Westminster Bank, is a major part of the Royal Bank of Scotland Group. They are one of the UK’s “Big Four” banks, providing a broad array of banking services.

Can self-employed individuals apply for a NatWest loan?

Yes, self-employed individuals, including contractors, sole traders, company directors, and those working under a partnership, can apply for a loan. Requirements include being 18+, a UK resident, having a NatWest current account for 3+ months, and providing the last two years of finalised accounts or Self-employment SA302 Tax Returns, among other documents

Is it possible to repay a NatWest loan early?

You can repay your loan early, but an early settlement fee applies. The fee is 58 days’ interest (28 days if the loan term is 12 months or less) on the amount being repaid early. If the remaining term is less than 58 (or 28) days, interest is charged for the remaining days

What is NatWest’s Quick Quote?

Quick Quote is a feature that provides a personalised loan quote. It uses a soft search to assess your borrowing likelihood without impacting your credit score. This search is recorded on your credit file but isn’t visible to other lenders, so it won’t affect your credit score.

Do NatWest loans offer instant decisions?

Yes, NatWest typically provides instant decisions for online loan applications. They use a soft-search eligibility checker to assess your approval odds without affecting your credit score.