- What Are Low Deposit Mortgages?

- Can You Buy a House in the UK With a Low Deposit?

- How Do I Qualify For a Low Deposit Mortgage?

- How Much Can I Borrow?

- Low Deposit Mortgage Options Available For You

- What Are the Pros and Cons of Low Deposit Mortgages?

- Can I Get a Buy-To-Let Mortgage With A Low Deposit?

- Can I Remortgage With A Low Deposit?

- Can I Get a Mortgage With No Deposit?

- Key Takeaways

- The Bottom Line

How To Secure Low Deposit Mortgages In The UK?

Not everyone can save a large deposit quickly. 😟

With house prices, rent, and bills constantly rising, saving for your first home can be a struggle.

The good news is, you can actually buy a property with a low deposit. 👍

In the UK, several mortgage schemes and deals let you buy a property with a smaller deposit. This is a great opportunity for those who want to get on the property ladder faster than they might otherwise be able to.

You just need to put down at least a 5% deposit. With average UK house prices currently around £281,000, this means you’ll need to save up at least £14,050 to buy your dream home. 🏡

This guide covers everything you need to know about making a low-deposit mortgage work for you✨.

Ready?

What Are Low Deposit Mortgages?

Low-deposit mortgages are loans that let you buy a property with a smaller deposit than usually needed.

In the UK, most mortgages ask for at least a 10% deposit, but low-deposit mortgages can drop to 5% or even lower.

This makes homeownership accessible to more people, including first-time buyers like you.

Can You Buy a House in the UK With a Low Deposit?

Yes, you can buy a house with a low deposit in the UK. But, there are a few things you have to keep in mind before jumping in.

Firstly, a low deposit means you’re borrowing more money relative to the home’s value. To cover this extra risk, lenders usually charge a higher interest rate.

Secondly, while these mortgages open doors for many, your monthly repayments might be HIGHER because you’ve borrowed more.

Thirdly, there’s the risk of negative equity. This means you owe more than your house is actually worth, which folks call being “underwater” on your mortgage.

The bottom line is, before you jump in, make sure you can comfortably afford the monthly repayments. This includes factoring in interest rates, fees, and any unexpected costs.

With a low deposit, your choices of lenders can be smaller. In this case, working with a good mortgage broker is your best bet. They can search the entire market and guide you based on your circumstances.

How Do I Qualify For a Low Deposit Mortgage?

To qualify for a low deposit mortgage, you need to:

- A good credit score that shows you’ve managed money well before.

- A regular income that proves you can afford the mortgage repayments.

- A healthy deposit, usually around 5-10% of the property value.

- Proof of being able to afford the monthly bills on top of the mortgage.

- Choose a property that fits the lender’s criteria, like price and condition.

If you’re thinking about buying a second property with a low deposit, here’s what to keep in mind:

- Prove stronger financial stability, as risks are higher for the lender.

- Show a good track record with your first mortgage.

- Have a larger deposit compared to first-time buying, often around 15-25%.

- Provide details of rental income if it’s a buy-to-let property, which must cover mortgage payments comfortably.

- Be prepared for stamp duty costs and other expenses.

- Strong credit history

- Some lenders ask for landlord experience and have age limit restrictions.

These criteria can vary widely between lenders. The best way is to talk to a good mortgage broker. They can guide you through your options and help find the right mortgage for you.

How Much Can I Borrow?

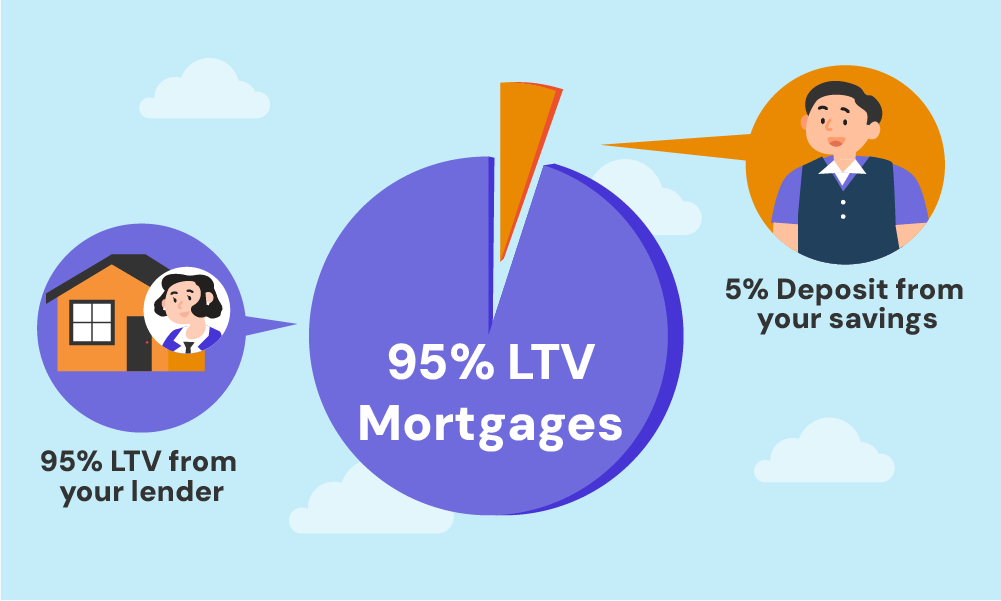

This largely depends on TWO things: your income and the value of the property you want to buy. Lenders use something called the loan-to-value (LTV) ratio, which compares the amount you borrow to the property’s value.

With a low deposit, your LTV is high, usually up to 95%, meaning you borrow most of the property’s price.

Lenders also look at your income to decide how much they’ll lend you. They often use income multiples, which means they lend you a certain amount based on how much you earn.

For example, if you earn £30,000 a year, they might lend you up to 4 times this amount, so £120,000.

To get a clearer idea of how much you might be able to borrow, try using a mortgage affordability calculator. This tool looks at your income and expenses to show how much a lender might offer you.

Low Deposit Mortgage Options Available For You

Buying a home with a small deposit can be challenging, but several options are available to help you get on the property ladder.

Here are some popular low-deposit mortgage schemes in the UK:

95% Loan-to-Value (LTV) Mortgages

These mortgages allow you to borrow up to 95% of the property’s value, requiring a deposit of just 5%.

While riskier for lenders, these mortgages can be a good option for first-time buyers with a limited budget. However, you may face higher interest rates and additional fees.

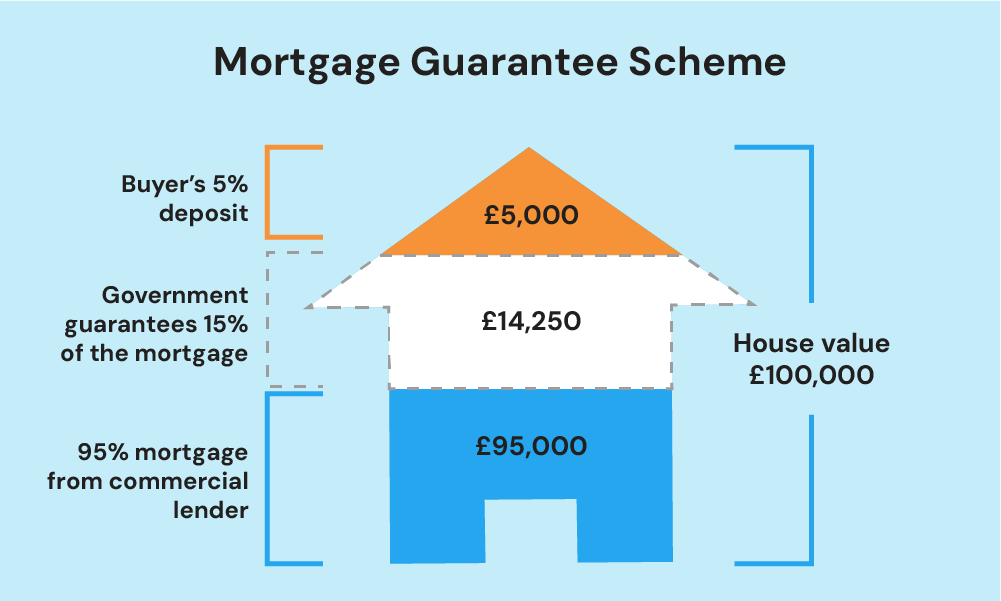

This government-backed scheme aims to help buyers with small deposits by providing lenders with a guarantee against a portion of the mortgage.

This allows lenders to offer 95% LTV mortgages with more competitive rates and terms.

Under this scheme, first-time buyers can purchase newly built homes at a discounted price, typically 30% to 50% lower than the market value.

This reduces the amount you need to borrow, making it easier to put down a larger deposit.

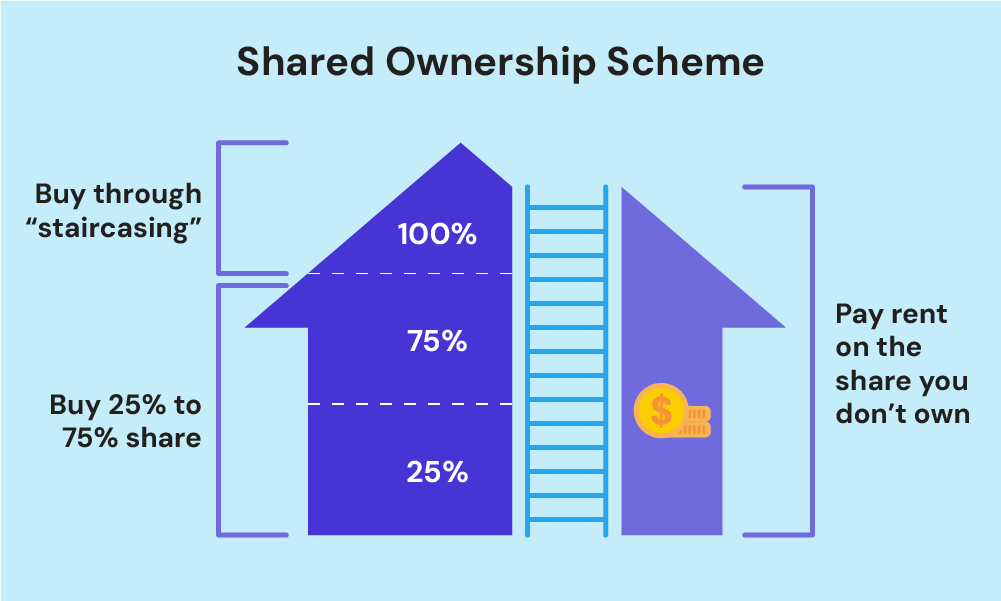

With shared ownership, you co-own the property with a housing association.

You buy a share of the property (usually between 25% and 75%) and pay rent on the remaining share. This reduces the amount you need for a deposit, and you can increase your share over time.

If you live in a council house, you may be eligible for the Right to Buy scheme, which allows you to purchase your home at a discounted price. This discount can help you save for a larger deposit.

These mortgages allow family members to provide security for your deposit in the form of a savings pot or charge on their property.

This helps you access a more favourable interest rate while your family’s money remains untouched unless you default.

With a guarantor mortgage, a third party (usually a family member) agrees to cover your mortgage payments if you fail to make them.

This can help you secure a mortgage with a smaller deposit, but the guarantor’s credit score and income will be taken into account.

Applying for a mortgage with a partner, friend, or family member can increase your combined income and deposit. This makes it easier to secure a mortgage with a smaller individual deposit.

Some lenders will let you use gifted deposits from family members. However, you may be offered higher rates and very few will accept third-party deposit gifts.

If you get a discount on the true market value of a house, some lenders will allow you to use the discounted sum as your deposit.

For example, if your property purchase is discounted by 5%, you can use this as part of your deposit.

What Are the Pros and Cons of Low Deposit Mortgages?

Low-deposit mortgages offer an attractive path to homeownership, but they come with their own set of advantages and disadvantages.

Here’s what you should consider:

Pros

- You can buy a home sooner without saving a large deposit.

- Accessible to more buyers, especially first-time buyers.

- Various government schemes help make it achievable.

- Family can help with options like guarantor or springboard mortgages.

Cons

- Higher interest rates, meaning more paid over the life of the loan.

- Higher monthly repayments compared to larger deposit mortgages.

- Risk of negative equity if house prices fall.

- Stricter credit and income checks by lenders.

Can I Get a Buy-To-Let Mortgage With A Low Deposit?

Getting a buy-to-let mortgage with a low deposit can be tricky. Most of the time, you’ll need to put down at least 25% of the property’s price.

This is because these types of mortgages are seen as higher risk by lenders. They worry that if rental income drops or you have empty periods, you might struggle to pay the mortgage.

There are a few lenders who might offer buy-to-let mortgages with as little as 15% down, but these deals aren’t common. They also come with higher interest rates, and you’ll need to meet strict rules to qualify.

You should have a good credit score, solid income, and ideally, some experience in renting out property.

To boost your chances, showing that the rent you’ll charge will comfortably cover the mortgage payments is crucial. Lenders usually want the rent to be 125% to 145% of your monthly mortgage payment.

If you’re thinking about this, talking to a mortgage broker could really help. They can explain everything and might find a deal that fits your situation.

Can I Remortgage With A Low Deposit?

Remortgaging with a low deposit can be a bit difficult. When you remortgage, you usually need some equity in your home.

This equity acts like a deposit. If your home hasn’t increased in value since you bought it, or if you haven’t paid off much of your original mortgage, you might not have enough equity to remortgage easily.

If house prices in your area have gone up since you bought your home, you might have more equity than you think. This can make remortgaging easier and might even get you a better deal.

Can I Get a Mortgage With No Deposit?

Getting a mortgage with no deposit isn’t generally possible. Most lenders need you to put down at least 5% of the home’s price. This shows them you’re serious and have some skin in the game.

However, there are a few ways you might buy a home without saving a deposit yourself. For example, some family mortgage products allow your family to help out.

They might put money into a savings account that counts as their deposit or use their own home as security.

Another option could be through government schemes like the Mortgage Guarantee Scheme, where you only need a 5% deposit, and the government guarantees up to 15% of losses if you default in your loan.

Key Takeaways

- Low-deposit mortgages let you buy a house with a smaller deposit (usually 5% of the property price). This can be helpful, especially if you’re buying your first home. But, they can be more expensive in the long run, so make sure you’re prepared for the costs.

- If you put down a small deposit, you have to borrow more money, which means your monthly payments will be higher, and you’ll pay more interest.

- There is a risk called “negative equity,” which means you could end up owing more money than what the house is worth if house prices drop.

- To get a low-deposit mortgage, you usually need a good credit score, a steady income, and proof that you can pay the mortgage and other bills.

- There are different schemes and family options, like Shared Ownership, First Homes, Family Springboard, and Guarantor Mortgages, which make it easier to get a mortgage with a small deposit or help you get a better deal.

The Bottom Line

Despite the challenges, a small deposit needn’t prevent you from buying a home. While you might encounter higher interest rates, larger monthly payments, and fewer options, don’t be discouraged.

An experienced mortgage broker can help you:

✓ Understand different mortgage products to find the BEST fit.

✓ Find DEALS you might not discover on your own, widening your options.

✓ Explain everything in simple terms, so you fully understand YOUR choices.

✓ Compare different lenders to GET the best interest rates, potentially SAVING you money.

✓ Handle ALL the paperwork, saving you time and reducing stress.

✓ Check your qualifications before applying, increasing YOUR chances of approval.

✓ Negotiate terms with lenders on your behalf, aiming for the MOST favourable conditions.

✓ Provide personalised advice tailored to YOUR specific financial circumstances.

✓ Access exclusive deals not available to the general public, offering you better terms.

✓ Support you throughout the ENTIRE mortgage process, from inquiry to closing.

✓ Speed up the application process, helping you move into your NEW home sooner.

In short, using a broker SAVES you time, energy, and potentially money in the long run.

Need a broker? Get in touch with us. We’ll link you with a seasoned mortgage broker who can search the entire market and get the best deal for your situation.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

What is the lowest deposit for a mortgage?

The lowest deposit you usually need for a mortgage is 5% of the property’s purchase price.

What’s the difference between a 5% and a 10% deposit?

If you put down a 5% deposit, it means you’re paying 5% of your home’s price upfront and borrowing 95%. For example, if your home costs £200,000, a 5% deposit would be £10,000.

With a 10% deposit, you’d pay £20,000 upfront and borrow less, just 90% of the home’s price. A bigger deposit like 10% often gets you lower interest rates, which means you pay less over time.