- What Are the Government Schemes for First-Time Buyer Mortgages?

- Things to Consider with Low-Deposit Schemes

- Factors Impacting Mortgage Eligibility with Schemes

- How to Apply for Government Mortgage Schemes?

- Which Providers Offer the Schemes?

- What Other Mortgage Deposit Loan Schemes Are Available?

- The Bottom Line

What Is the Best Way to Get Help with a House Deposit?

Are you struggling to save up enough for a mortgage deposit as a first-time buyer in the UK?

Don’t worry, there are several government schemes designed to help people like you get on the property ladder.

In this comprehensive guide, we’ll explore the top mortgage deposit assistance programs and how to take advantage of them.

What Are the Government Schemes for First-Time Buyer Mortgages?

The UK government understands the challenges first-time buyers face in affording a home.

To make homeownership more accessible, they have introduced various mortgage deposit schemes. Here are some of the most popular options:

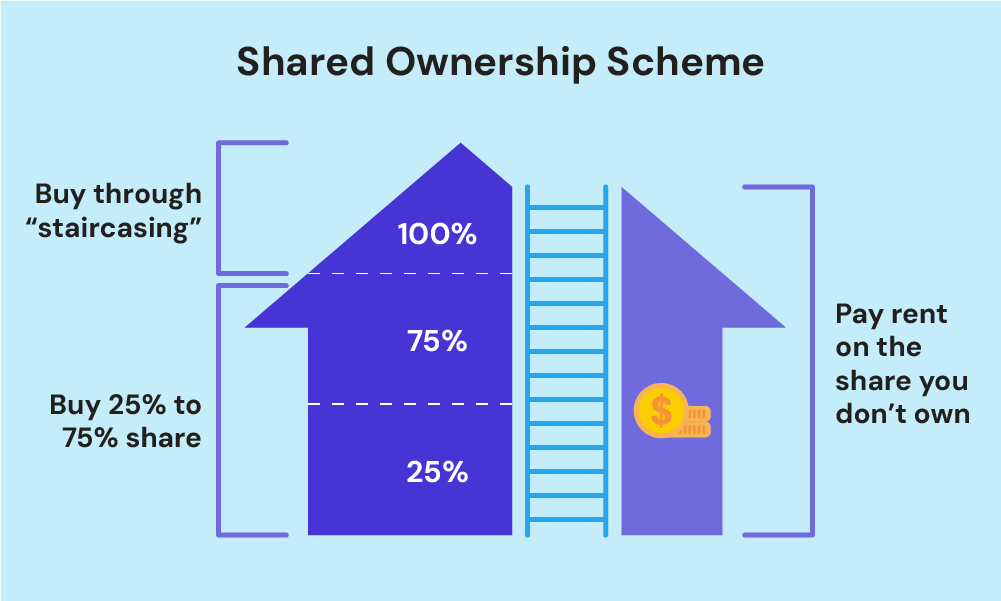

Shared Ownership Scheme

The shared ownership scheme allows you to buy a share of a property (between 25% and 75%) and pay rent on the remaining share.

This reduces the amount you need for a deposit, often to as little as 5% of the share you’re purchasing. Over time, you can increase your share until you own the property outright.

While shared ownership makes getting on the property ladder more affordable, it’s important to factor in the ongoing rental costs and service charges.

It’s also worth noting that you’ll need around £2,000 for legal and valuation fees when increasing your share.

Older People’s Shared Ownership

This scheme allows over 55s to purchase retirement-suitable properties. Like standard shared ownership, buy 25-75% share and rent the remainder.

This scheme offers two key advantages:

- access to specialised retirement properties, and

- the ability to build equity over time to fund your retirement lifestyle.

The scheme is available through various housing associations across England. Your share can also be inherited by your spouse/family members upon your passing.

First Homes Scheme

Launched in 2021, the First Home scheme offers properties at a discount of 30-50% compared to market value.

To be eligible, your household income must be below £80,000 (£90,000 in London), and you’ll need a minimum 5% deposit.

The number of properties available through this scheme is currently limited, but it’s set to expand significantly over the next few years, making it an attractive option for first-time buyers across England.

Lifetime ISA

A Lifetime ISA (LISA) is a savings account that allows anyone aged 18-39 to deposit up to £4,000 per year.

The government will then add a 25% bonus on your contributions, which can help you save for a deposit faster.

However, there are some important caveats. You must hold the LISA for at least a year before claiming the bonus, and the property price must be below £450,000 to qualify for the bonus.

Right to Buy Scheme

Eligible council/housing tenants can purchase their rental homes at a discount. You must have lived there for at least 3 years.

The maximum discount is £102,400 across England and £136,400 in London. Each year, this discount changes in line with the consumer price index (CPI).

To take advantage, you’ll need to get a mortgage to cover the discounted purchase price, with a minimum 5% deposit required. Lenders will check affordability as usual based on your income and credit profile.

For example, if the property value is £200,000 and you receive the maximum £108,000 discount, you’d need a deposit of £4,600 (£92,000 x 5%) and a mortgage of around £87,400 to purchase it.

Crucially, the discount amount is repaid if you sell the property within the first 5 years. There are also eligibility criteria around tenancy duration and property type that must be met.

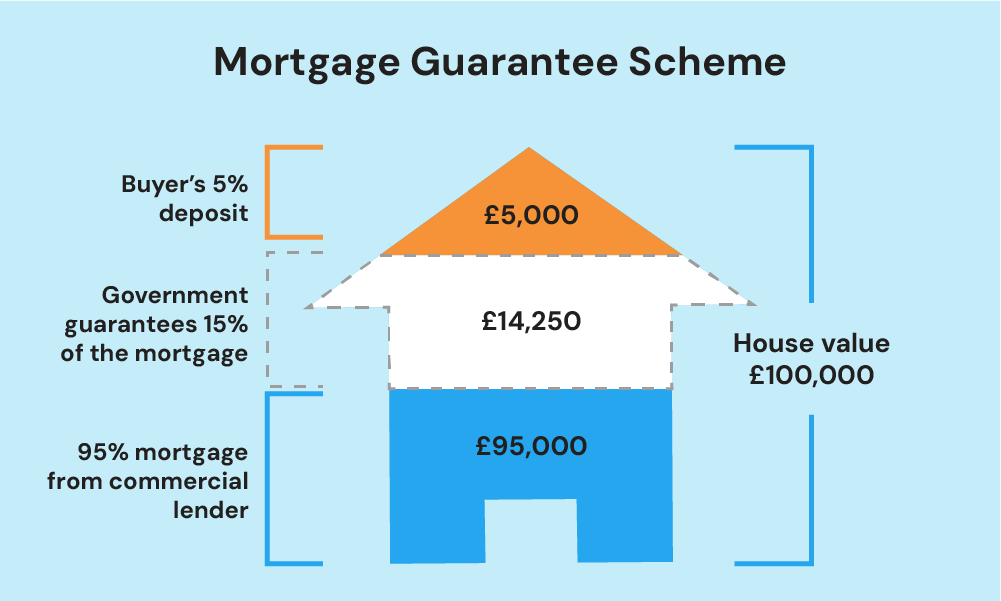

Mortgage Guarantee Scheme

The Mortgage Guarantee Scheme was introduced in April 2021 to help buyers secure a 95% mortgage on homes worth up to £600,000.

Under this scheme, the government compensates lenders if the property is repossessed, reducing the risk for them.

This allows buyers to purchase a home with just a 5% deposit while avoiding expensive private mortgage insurance premiums that typically come with low-deposit loans. Lenders can offer mortgages at their standard rates for those with smaller deposits.

For example, on a £200,000 home, you’d only need £10,000 as a deposit rather than saving up £40,000 for a 20% down payment.

The scheme is available for first-time buyers as well as existing homeowners looking to move properties.

Note: This scheme ends on June 30, 2025.

Deposit Unlock Scheme

The Deposit Unlock scheme is a more recent initiative launched in 2022 as the successor to the Help to Buy equity loan.

It involves lenders and housebuilders working together to offer mortgages to buyers with just a 5% deposit on new-build homes.

The builder effectively provides a cash indemnity fund to protect the lender if the property has to be repossessed, removing some of the risk for the mortgage provider.

So for a £250,000 new-build home, your deposit could be as low as £12,500 instead of £50,000.

The scheme is open to first-time buyers as well as home movers in England and Wales purchasing from participating developers.

Things to Consider with Low-Deposit Schemes

While these schemes can certainly help you get on the property ladder sooner, there are a few important points to keep in mind:

- You’ll be taking on a larger mortgage debt with higher monthly repayments compared to a bigger deposit.

- Interest rates tend to be higher for mortgages with smaller deposits.

- Your equity is lower initially, so your home could fall into negative equity if prices drop sharply.

- You may have to pay more for mortgage fees and insurance.

As with any major financial decision, it’s crucial to crunch the numbers, understand the full costs involved, and ensure the mortgage payments are truly affordable for your circumstances.

An independent mortgage advisor can guide you through the pros and cons.

Factors Impacting Mortgage Eligibility with Schemes

These government schemes aim to make mortgages more accessible. However, lenders still have their own eligibility criteria that buyers must meet.

Key factors that can impact how much you can borrow include:

- Income. Most lenders cap mortgages at 4-5 times your annual income. Higher incomes mean you can potentially borrow more.

- Deposit Size. Larger deposits reduce risk for lenders, so having a bigger down payment could allow you to borrow more.

- Credit History. A good credit score is crucial, as lenders will check your repayment history. Defaults or missed payments can limit how much you can borrow.

- Affordability. Lenders will “stress test” your finances to ensure you can still afford repayments if interest rates rise or your circumstances change.

- Employment Status. Those in stable, permanent employment may find it easier to get approved than self-employed or temporary contract workers.

To impress mortgage lenders, get yourself “mortgage fit“.

Here’s how: improve your credit score, show a steady income and save a big deposit. They look at everything, so tick all the boxes.

How to Apply for Government Mortgage Schemes?

The process for applying varies slightly across the different schemes:

- Shared Ownership. You can search for eligible properties and begin your application through your local Help to Buy agent.

- First Homes. Look for properties marketed as First Homes, which are available at a discount of at least 30% off the market price. Contact developers directly or estate agents to inquire and apply.

- Lifetime ISA. Open a LISA through any major bank or building society, provide your information, and start contributing.

- Right to Buy. Start by contacting your landlord to see if you qualify for the Right to Buy scheme and to request an application form.

- Mortgage Guarantee Scheme. Once you’ve checked if you qualify for this scheme, consult a mortgage broker to start your application. You’ll need to provide evidence of your income, employment status, and other financial details for affordability assessments.

- Deposit Unlock Scheme. This scheme is exclusively available through mortgage brokers. So it’s key to speak with one to start your application.

Many schemes require a period of residence in the local area to qualify for certain developments. Independent mortgage brokers can guide you through finding suitable properties and lenders.

Which Providers Offer the Schemes?

Here’s a summary of lenders for various UK government mortgage schemes:

- Shared Ownership. You can apply for a Shared Ownership mortgage through lenders such as Halifax, Virgin Money, Lloyds Bank, Santander, and Barclays.

- First Homes. The First Homes scheme is newer and specifics about lenders are less frequently advertised. It’s advisable to consult directly with housing developers or estate agents engaged in the First Homes scheme for information about available lenders.

- Lifetime ISA (LISA). Major banks and building societies like Barclays, Lloyds Bank, and Nationwide Building Society offer the Lifetime ISA.

- Right To Buy Scheme. Several lenders, including NatWest, Leeds Building Society, Barclays, Halifax, and Skipton, offer mortgages for the Right to Buy scheme. These are typically standard mortgages, but each lender has their own requirements and how much they’ll lend.

- Mortgage Guarantee Scheme. Lenders such as Halifax, NatWest, Barclays, HSBC, and Lloyds Bank participate in the Mortgage Guarantee Scheme.

- Deposit Unlock Scheme. Nationwide, Accord Mortgages, Perenna, Bluestone Mortgages, and Newcastle Building Society are notable lenders offering mortgages under the Deposit Unlock Scheme.

Working with a whole-of-market mortgage broker can ensure you get access to the full range of scheme options and lenders for your circumstances.

What Other Mortgage Deposit Loan Schemes Are Available?

In addition to the schemes mentioned above, other options could help you get on the property ladder, such as:

- Gifted deposits from family members

- Guarantor mortgages

- Concessionary mortgages

- Joint Mortgages

- Local authority lending schemes

The Bottom Line

Government schemes can help first-time buyers in the UK get on the property ladder.

These schemes come in different varieties, from shared ownership to the First Homes scheme. They’re designed to help all sorts of people with different finances afford a deposit.

Knowing about these schemes and using them alongside saving plans can make that mortgage deposit achievable and get you closer to owning your own home.

But, before you jump in, it’s key to consult an independent mortgage advisor to understand if this is the right way to finance your first home.

Looking for a broker? Get in touch with us. We’ll connect you with a qualified mortgage broker who can simplify the process and get you the best mortgage deal that fits your situation.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

Are there exclusive government schemes for people with disabilities in the UK to help me save for a deposit?

Yes, the UK has a special scheme called HOLD (Home Ownership for People with Long-Term Disabilities). This helps you buy part of a home suited to your needs if you have a long-term disability.

You buy some of the home and pay rent on the rest. You can buy more of the home over time. To use this scheme, you need to have a long-term disability and meet other conditions, like being a first-time buyer.

If you think aHOLD could help you, it’s a good idea to talk to a Help to Buy agent. They can tell you more about how to apply and find the right home.