- Can I Get an Equity Release if I Have a Mortgage?

- What are the Different Types of Equity Release Schemes?

- The Pros and Cons of an Equity Release with a Mortgage

- Your Helping Hand in the Equity Release Process

- Equity Release When You’re Mortgage-Free

- Which Lenders Offer Equity Release Loans?

- What are the Alternatives for Equity Release?

- The Bottom Line

Equity Release With Or Without A Mortgage Explained

Equity release offers you a way to access the wealth tied up in your home without having to sell it. It can be an attractive option if you want to supplement your income or meet unexpected expenses.

However, the intersection of equity release and existing mortgages can be confusing. This article will clarify whether you can release equity with a mortgage and how it works.

Remember, an informed decision is always the best decision. That’s why this article will delve deeper into the subject to help you understand it better.

Can I Get an Equity Release if I Have a Mortgage?

Yes, you can.

Even with an existing mortgage, equity release remains an option. If you are over 55 years old, your circumstances may make you eligible or not, so it’s vital to explore what suits you best.

Here’s how it works: the equity you release is primarily used to settle your existing mortgage.

If there’s any surplus, it goes straight into your pocket. You might just wish to free up some monthly income, or you may want a cash lump sum after settling your mortgage.

However, using equity release to pay off your mortgage can have future financial implications, and it might even impact your estate.

That’s why it’s crucial to seek advice from a specialist broker. They’re the ones who can ensure you make a decision that’s right for your circumstances, taking into account all potential outcomes.

What are the Different Types of Equity Release Schemes?

Equity release is not a one-size-fits-all solution. There are different types of schemes, each with its unique features.

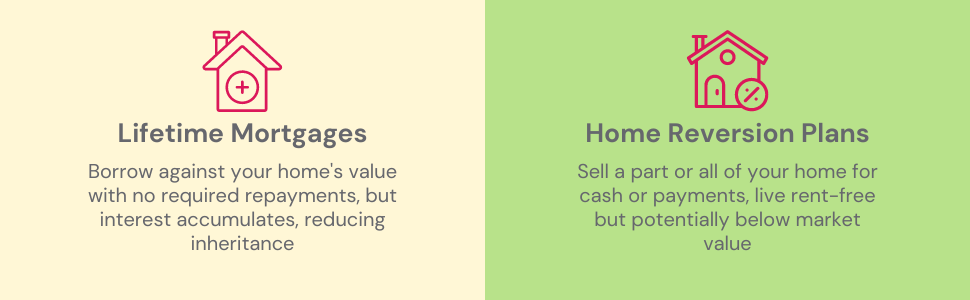

If you have an outstanding mortgage, there are two main types of equity release loans that you could consider: lifetime mortgages and home reversion plans.

Lifetime Mortgages

A lifetime mortgage is a popular choice for equity release. If you’re over 55, you may qualify for this type of loan.

The way it works is straightforward: you borrow an amount against your home’s value. This can be received as a lump sum or as regular payments.

The money released is initially used to pay off any outstanding mortgage, enabling the equity release provider to take the first charge on your property.

However, it’s worth noting that the amount you can release depends on your age and circumstances. It might not always be enough to cover your outstanding loan.

Furthermore, as the amount you borrow increases, so can the interest rates, which will influence the total cost.

Home Reversion Plans

Home reversion plans, although less common, offer another avenue for equity release. In contrast to lifetime mortgages, you’re not obligated to use the received cash to pay off your mortgage with a home reversion plan.

Under this plan, you sell a portion of your home to a provider at a rate below market value. In return, you receive either a lump sum of cash or regular payments, which you can then use towards your mortgage.

This means the amount you repay is fixed as a proportion of your home’s value, with no accruing interest.

But, there’s a catch. You’ll have to sell your share at a rate significantly lower than your property’s market value, making this option less popular than a lifetime mortgage.

Whether you opt for a lifetime mortgage or a home reversion plan, it’s crucial to evaluate each option’s potential impact on your financial situation. With this knowledge, you can make a more informed decision about releasing equity from your home.

The Pros and Cons of an Equity Release with a Mortgage

Deciding whether to opt for equity release with an existing mortgage involves a careful examination of its merits and drawbacks. It can be a gateway to freeing up additional funds but may also have implications for future financial planning.

To help you in your decision-making, here are some of the pros and cons of equity release with an existing mortgage:

Pros:

- Additional Funds Accessibility. Equity release enables you to tap into extra funds, allowing you to pay off your current mortgage or invest in other areas like home renovations or enhancing your daily living expenses.

- Potential for Lower Interest Rates. Equity release might offer interest rates that are more favourable compared to those on your existing mortgage, possibly making it an attractive financial solution.

- Freedom to Use the Funds. With equity release, you have the liberty to utilise the released funds for any purpose, providing flexibility in managing your financial needs.

Cons:

- Compulsory Mortgage Repayment. Part of the released equity might be automatically applied to settle your existing mortgage, limiting the actual funds you’ll have for other uses.

- Potentially Expensive Borrowing. Equity release can sometimes turn out to be a costly way of borrowing, especially if not managed carefully.

- Risk of Increasing Debt. If left unmanaged, the accruing interest on the new lifetime mortgage could lead to an escalating debt burden, making financial planning more complex.

- Impact on Inheritance. Opting for equity release will reduce the inheritance you can leave for your family, as part of your property’s value is tied up in the loan.

If you’re considering equity release with a mortgage in the UK, it’s crucial to be aware of both its potential benefits and implications.

Seek expert advice and make an informed decision that aligns with your financial goals.

Your Helping Hand in the Equity Release Process

Equity release can be a tad complicated. Especially if you have an existing mortgage, the process becomes even more complex.

This is where specialist brokers step in. They are there to simplify things for you.

Specialist brokers are knowledgeable about the intricacies of equity release. They can help you determine which type of loan – be it a lifetime mortgage or a home reversion plan – suits your situation. They’ll guide you on the amount to borrow and the most efficient way to use the money.

And there’s more. Specialist brokers can introduce you directly to lenders who offer the best rates.

This could potentially save you a significant amount of money in the long run. So, you see, the right guidance can have a huge impact on your financial situation.

If you simply fill out this quick form, we’ll organise an equity release broker to contact you directly for an informative, cost-free talk with no pressure attached.

Equity Release When You’re Mortgage-Free

When you have no mortgage to worry about, equity release presents even more options. The absence of an existing mortgage provides you with added flexibility when it comes to borrowing options.

Both the lifetime mortgage and home reversion plan options are still on the table. But, without a mortgage, the money you release will flow directly to you and doesn’t need to cover any existing home loan. You could end up borrowing less, giving away a smaller portion of your home.

Furthermore, you won’t have the concern of needing to borrow enough to cover an outstanding mortgage.

To get an estimate of how much capital you could potentially release from your property, use our equity release calculator.

Understanding these aspects of equity release could help you decide whether it’s the right move for you, and if so, how to go about it in a way that suits your circumstances.

Which Lenders Offer Equity Release Loans?

Equity release loans are not typically offered by high-street banks. You’ll need to go to a specialist company, or to a provider like Aviva or L&G, who are more likely to offer these types of loans.

The market is full of providers willing to offer equity-release loans. Each provider has unique features, restrictions based on age, and different borrowing requirements. It can feel a bit overwhelming, but there’s no need to worry.

Here’s where a specialist broker can be a real game-changer. Brokers can help match you with the best providers for your circumstances. They’ll help streamline the process and ensure you’re getting the best deal. Their help can make all the difference.

What are the Alternatives for Equity Release?

Equity release isn’t your only option for tapping into your home’s value. Let’s briefly explore some other choices.

Retirement Interest Only Mortgages

A retirement interest-only mortgage, or RIO, is a mortgage that lasts for life, or until you move into long-term care.

The difference between this and a lifetime mortgage is that you’ll be making monthly interest payments. It can be a cost-effective option if you have a stable retirement income.

Downsizing

If additional debt isn’t for you, downsizing might be the answer. By moving to a smaller or cheaper home, you can release equity without taking on a loan.

But it’s a big step. You’ll need to consider practical elements like moving costs and emotional aspects like leaving a family home.

Personal Loans

Another alternative is taking out a personal loan. Unlike equity release, you’ll be repaying both interest and capital every month.

Depending on the loan size, it might or might not be secured against your property. It’s a less risky option if you’re confident in your ability to repay.

Equity release is just one way to free up cash on your property. Considering all your options will help you make the best decision for your unique situation.

The Bottom Line

Equity release might be the solution you’ve been seeking. With options like lifetime mortgages and home reversion plans, you have the means to tap into the value of your home.

Whether you want to clear an existing mortgage, enhance your daily living expenses, or make essential home renovations, the possibilities are broad.

However, these decisions are significant, and understanding their long-term effects is crucial. That’s where specialist brokers can make a difference for you.

They will guide you through the choices, ensuring that you make an informed decision that aligns with your personal circumstances.

Now is the time to explore your options and take control of your financial future. Reach out to us, and we’ll connect you directly with an expert equity release broker.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

What happens if I get equity release, and it doesn't settle my existing mortgage?

If the equity release falls short of covering your existing mortgage, you’ll likely need to explore additional means to clear the balance. This might involve using savings or seeking other financial products.

Engaging with a financial specialist can provide tailored guidance to your situation, ensuring the best course of action for your individual needs.

What must I meet for equity release eligibility?

You typically must be over 55 years old, own your property, and meet the lender’s specific borrowing criteria. Consulting a broker can clarify your particular requirements.

Are there risks associated with equity release?

Yes, equity release carries risks such as potential reduction in inheritance and changes in your financial situation. Professional advice is vital to understand these risks fully.

Is equity release possible with a fixed-rate mortgage?

Yes, you can get equity release with a fixed-rate mortgage. The equity release would usually be used to pay off the existing mortgage first.

Can I remortgage my property to free up equity?

Yes, remortgaging is an option for releasing equity, but you should consult with a mortgage specialist to understand the terms and conditions applicable to your situation.

>> More about Remortgaging to Release Equity

Can I opt for equity release if I'm in negative equity?

No, obtaining equity release with negative equity is generally not possible, as there wouldn’t be sufficient value in your home to borrow against.

Can I borrow more if I've taken an equity release lifetime mortgage?

Yes, it may be possible to borrow more, but it depends on various factors like your age, property value, and existing lender’s terms. Speaking to a specialist or broker is advisable to understand your specific options.

This article has been fact checked

This article was created, checked, and verified by the expert team at Money Saving Guru. Trust us, you’re in good hands.