Is Releasing Equity a Good Idea? A Complete Guide

Equity release is becoming a major financial option for Brits over 55.

In 2022, a record number (93,421) of people used equity release to access cash tied up in their homes. No surprise then, that many retirees are considering it to improve their finances.

Perhaps you’re aware of this trend and tempted to tap into your home’s value, but unsure if it’s the right move.

Should you consider equity release? 🤔

Here’s the basic idea: equity release lets you access the cash in your home without having to move out or make regular repayments.

It sounds attractive, but caution is advised. ⚠️

This article will explain everything you need to know about equity release, including the pros and cons, and what to consider before making a decision.

There’s no one-size-fits-all answer to whether it’s good or bad – it depends on your circumstances.

Our aim is to give you a clear understanding of this financial option so you can decide if it’s the right fit for you.

What is Equity Release?

Equity release might sound like a complex financial term, but it’s quite a straightforward concept once you look into it.

It provides a pathway to the funds tied up in your property, granting you access to money without selling your home or taking on a traditional mortgage.

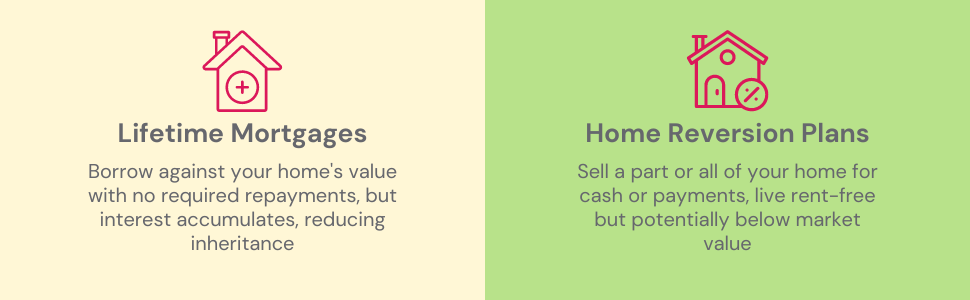

There are primarily two ways equity release can work: Lifetime Mortgages and Home Reversion Plans.

Lifetime Mortgages

Lifetime Mortgages are the most common type of equity release. Essentially, it’s a loan you secure against your home.

The amount you can borrow is influenced by your age and your property’s value. Instead of regular payments, the loan and its interest are settled either when you sell the property or enter long-term care.

Home Reversion Plans

With a Home Reversion Plan, you sell either a portion or the entirety of your home to a reversion company.

Though you can continue living in the property without paying rent, you’ll no longer have full ownership. This choice might resonate with those without heirs or those aiming to secure a certain inheritance.

How Can Equity Release Help?

Equity release isn’t merely a financial term; it’s a lifeline for many during their retirement years. From funding home renovations to supplementing pension income, it offers many benefits.

Here are some ways equity release can be a good thing:

- You can immediately access funds without monthly repayments.

- You can use it to pay off existing debts and reduce financial stress.

- Whether it’s a holiday or a new car, equity release can make your dreams attainable and enhance your lifestyle.

- It can be used as a strategic tool for inheritance tax-planning, allowing you to manage your estate’s financial obligations and potentially reduce the tax burden on your heirs.

It’s essential to weigh the equity release pros and cons carefully and consult with an advisor familiar with equity release.

Understanding the pitfalls of equity release and what the catch might be will help you make an informed decision.

The Pros and Cons of Equity Release

Equity release is like a two-sided coin, having its advantages and disadvantages. It’s important to consider both sides before deciding if it’s the right path for you. Let’s break down the pros and cons:

Pros

- Access to Tax-Free Funds. Unlock the wealth tied in your home without having to sell it, and enjoy tax-free cash.

- No Monthly Payments. Depending on the plan, you may not have to make monthly repayments, but some plans offer flexibility to make repayments if you choose.

- Ownership Benefits. You continue to own your home entirely, potentially benefiting from price rises, with the security of no negative equity guarantee provided by Equity Release Council (ERC) members.

- Regulation and Safety. Equity release is tightly overseen by the Financial Conduct Authority (FCA) and ERC, ensuring it’s a safe option.

- Flexibility. You can choose to get a lump sum or regular income or even choose a drawdown lifetime mortgage, providing more control over how and when you access your funds.

- Inheritance Protection. Some of the best equity release companies offer plans to safeguard an inheritance for your loved ones, including the ability to protect a percentage of the property value.

- Freedom to Move. You have the liberty to move homes, subject to your provider’s approval.

Cons

- Compounding Interest. The interest might compound quickly, increasing the final sum owed. Rates may be higher than traditional mortgages.

- Reduction in Inheritance. Your family’s inheritance may decrease as the loan will be repaid from the property’s sale.

- Limited Flexibility for Moving. It might affect your ability to move or downsize in the future.

- Affects Benefits. Releasing equity could have negative implications on any means-tested benefits you currently receive.

- Early Repayment Charges. Some plans might include penalties for early repayment.

- Fees and Costs. Arranging a lifetime mortgage typically costs between £2,000 to £3,000 in fees.

When is Equity Release a Good or Bad Idea?

Equity release isn’t a one-size-fits-all solution. Your situation will determine whether it’s beneficial or not.

Equity release might be an attractive option if:

- You don’t mind reducing your family’s inheritance or are actively looking to reduce an inheritance tax bill.

- You don’t have any dependents or heirs to leave an inheritance to.

- You want to boost your retirement income.

- You need to clear an outstanding mortgage.

- You want to avoid downsizing.

- You anticipate needing care in your later years.

On the other hand, equity release might not be suitable if:

- You want to preserve your entire property inheritance for your heirs.

- You are open to moving to a smaller home to release cash.

- You have other income sources, such as a pension or investments.

- You only need short-term funds, other financial products might offer a more suitable solution.

- You receive means-tested benefits.

Equity Release Calculator

The equity release calculator is a handy tool that you can use to get an estimate of how much you might be able to release from your property.

It’s a simple way to figure out what’s possible without committing to anything just yet.

To get an idea of what might be available to you, try our equity release calculator.

Is Equity Release a Safe Option in the UK?

Equity release is regulated by the Financial Conduct Authority (FCA) and the Equity Release Council (ERC).

This means that there are several protections in place to ensure that an equity release is a secure option for homeowners.

Here’s how the Equity Release Council’s Guarantees Protect You:

- Interest rates must be fixed or if variable, there should be a cap that remains constant for the entire term of the loan.

- You can move to a different property, given your provider agrees that the new home ensures the continued security of your equity loan.

- You must have the right to live in the property for the rest of your life or until you need care, as long as you comply with the loan’s terms and conditions.

- The lifetime mortgage has to include a ‘No negative equity guarantee’, ensuring that if the sale of the property doesn’t cover all the costs, neither you nor your estate will be responsible for the remaining amount.

- In addition to these product standards, the Council enforces strict rules and guidance on the sales process, requiring that you must have professional financial advice and independent legal counsel to take out a loan.

To ensure safety, choose a company that is a member of the Equity Release Council. Following these guidelines helps make equity release a secure financial option in the UK.

But it’s always wise to consult with a financial expert to see if it’s the right fit for your specific situation.

How To Choose a Reputable Company

Here’s a guide to help you find the best equity release companies:

- Check FCA Registration. Always verify that the company is registered with the FCA.

- Look for ERC Membership. ERC members are committed to higher standards of practice.

- Read Reviews. Customer feedback can provide insights into the company’s reputation.

- Consult Professional Mortgage Advisers. They can help you avoid potential equity release companies to avoid and direct you to the top 10 equity release companies.

Equity release can be considered safe, provided you take the necessary precautions and consult with the right professionals.

The key is to understand what is the catch with equity release and work with reputable companies. Equity release can indeed be a good thing when done responsibly.

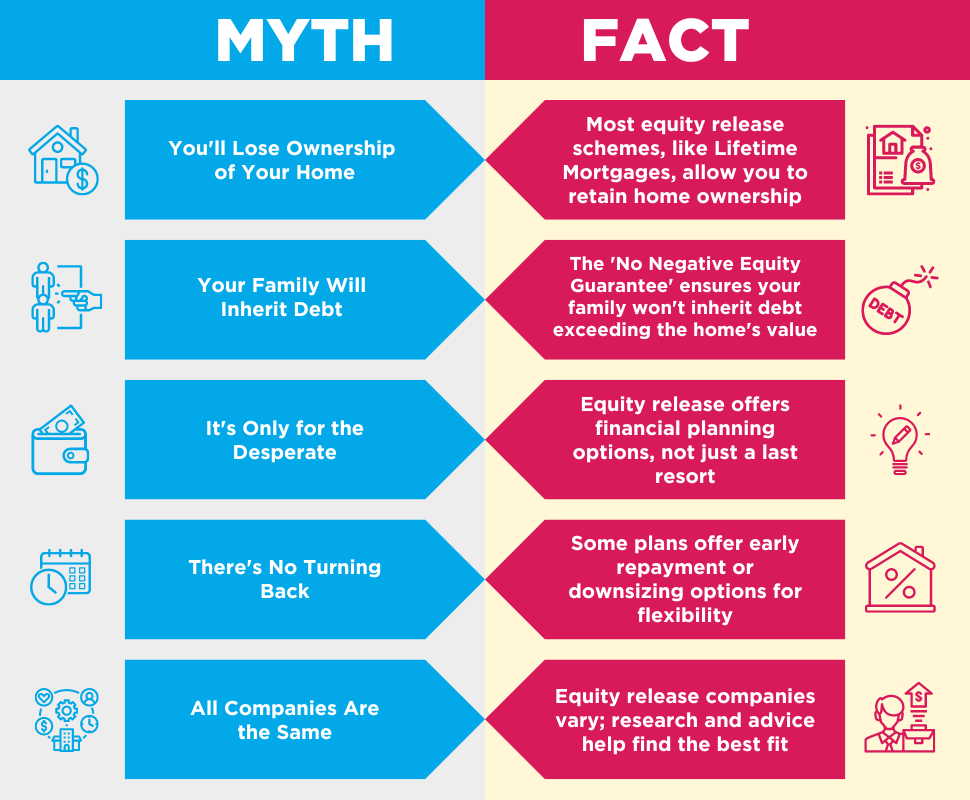

Facts vs Misconceptions about Equity Release

Equity release can be a slippery topic, filled with myths and misconceptions.

It’s easy to get caught up in sensational headlines and startling warnings like “equity release companies to avoid” or “equity release disadvantages.”

But what’s the real story? 🧐

Let’s dispel some common myths and dive into the truths behind them.

Myth 1: You’ll Lose Ownership of Your Home

💡Fact: With most equity release schemes, especially Lifetime Mortgages, you retain ownership of your home. The key is to choose the best equity release companies that offer transparent terms.

Myth 2: Your Family Will Inherit Debt

💡Fact: With the ‘No Negative Equity Guarantee,’ even if the housing market falls, your family won’t be left with a debt greater than the home’s value. Understanding the pros and cons of equity release helps you make informed decisions.

Myth 3: It’s Only for the Desperate

💡Fact: Equity release is not a last resort; it’s a financial planning tool. It allows homeowners over 55 to access funds tied up in their property, providing financial flexibility. So, is releasing equity a good idea? For many, it is indeed.

Myth 4: There’s No Turning Back

💡Fact: Some plans allow for early repayment or downsizing protection, enabling flexibility. It’s essential to discuss these options with a good mortgage adviser to understand what is the catch with equity release and how to work around it.

Myth 5: All Companies Are the Same

💡Fact: Not all equity release companies are created equal. Some may have hidden fees or less favourable terms. Researching and seeking professional advice can help you find the most suitable option for your needs.

Equity release isn’t without its risks and pitfalls. However, with the right guidance and by choosing reputable companies, it’s possible to mitigate those risks.

It’s crucial to understand the full picture and not be swayed by myths or exaggerated equity release disadvantages.

The Bottom Line

From understanding the various products like Lifetime Mortgages and Home Reversion Plans to weighing the pros and cons, we’ve covered a lot of ground.

We’ve delved into the safety regulations governed by the Financial Conduct Authority (FCA) and the Equity Release Council (ERC) and even debunked some common myths.

Is releasing equity a good idea for you? Only you, with the guidance of a professional adviser, can answer that. It could be a great financial tool, but it’s not without its pitfalls and equity release disadvantages.

If you’re thinking about equity release, don’t hesitate to seek professional advice.

We’ve teamed up with the best mortgage advisers who are well-versed in the equity release. They can help you navigate the landscape and avoid common pitfalls.

Thinking about taking the next step? Fill out this quick form, and we’ll match you with a top-notch mortgage broker who understands your needs and can guide you through the process.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

Is there a catch to equity release?

Yes. The catch with equity release is the need to repay the released funds, usually upon death or entering long-term care. This repayment may involve settling the borrowed principal amount and accrued loan interest (in a lifetime mortgage) or giving up exclusive ownership of the property (in a home reversion plan).

What is the downside to equity release?

Yes, the downsides to equity release include reducing your options for other sources of finance in the future. It’s vital to weigh the risks and benefits and explore alternative options.

Which equity release companies should I avoid?

It’s wise to avoid equity release companies that are not regulated by the Financial Conduct Authority (FCA) or members of the Equity Release Council (ERC), as they may not offer the same protections and standards.

Is it advisable to look at equity release statistics?

Yes, considering equity release statistics is wise, as released by the ERC. The current economic situation, including the cost-of-living crisis, has contributed to a growth in older borrowers accessing funds through equity release.

Is engaging in equity release considered ethical?

Over the past 30 years, equity release’s ethical standards have seen substantial improvements, driven by regulatory measures and industry initiatives by the Equity Release Council.

The Financial Conduct Authority also has strict regulations for the equity release sector. Always check your lender’s and broker’s credentials.

This article has been fact checked

This article was created, checked, and verified by the expert team at Money Saving Guru. Trust us, you’re in good hands.