- What Happens When My Fixed-Rate Mortgage Ends?

- How To Remortgage?

- Should I Remortgage with the Same Lender or Change Mortgage Providers?

- Can I Remortgage Early To Avoid High SVR?

- When Can I Remortgage Without Facing Penalties?

- Can I Adjust The Loan Term On a Fixed-Rate Mortgage?

- Key Takeaways

- The Bottom Line: Should I Remortgage Now?

How Soon Can You Remortgage After A Fixed Deal?

Is your fixed-rate mortgage coming to an end?

Many homeowners face a jump in monthly payments when their introductory period expires. But don’t worry, you have options.

Remortgaging can SAVE you money by securing a new, potentially lower interest rate.

Here’s what you’ll learn from this guide:

- What happens when your fixed-rate mortgage ends 🔍

- How remortgaging with your current lender can be a quick and easy process ✅

- The benefits of exploring deals with new lenders for potentially lower rates 📉

- When to start planning your remortgage to avoid penalties⏰

- How a mortgage broker can help you find the best remortgage deal 🤝

In short, this article can help you decide the best path for your situation.

What Happens When My Fixed-Rate Mortgage Ends?

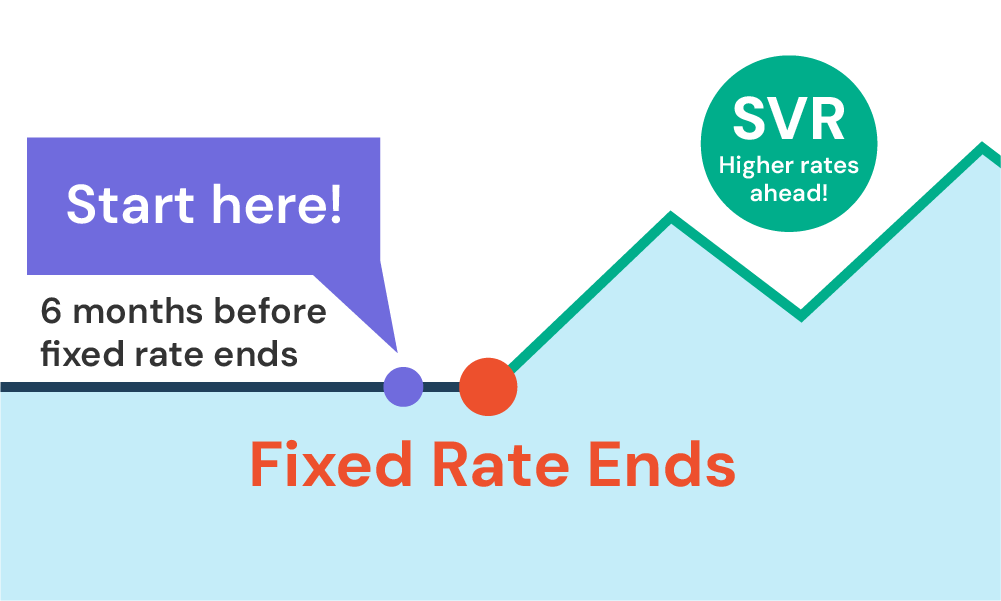

Once your fixed-rate mortgage ends, your payment plan becomes unpredictable.

In most cases, if you don’t take any action, your lender will automatically switch your mortgage to their Standard Variable Rate (SVR).

This rate is generally HIGHER than the fixed rates you enjoyed during the initial term. And this depends on market conditions and your lender’s discretion.

As a result, your monthly payments increase, making it harder to manage your finances.

With average SVRs sitting at 8.18%, it’s usually not wise to stay on your lender’s SVR, especially if you’re trying to SAVE on your mortgage payments.

To avoid this, you can:

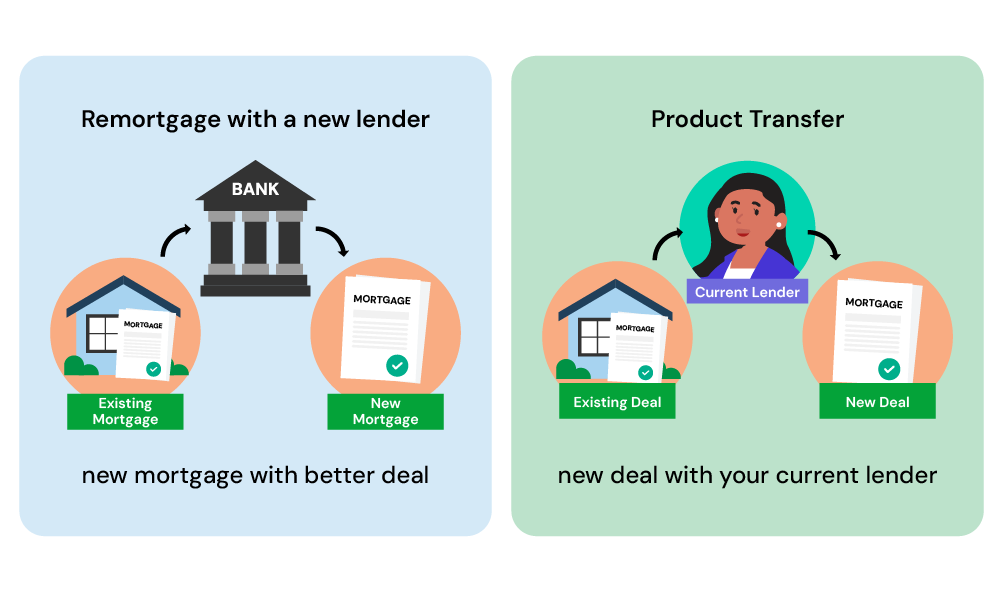

- Remortgage with your current lender (known as a product transfer).

- Remortgage with a new lender.

You can start planning 3-6 months before your fixed term ends. This gives you time to look at different deals, compare rates, and choose the best option for your needs.

How To Remortgage?

Remortgaging involves replacing your current mortgage with a new one. Most people remortgage to get better interest rates or release additional funds.

First, let’s tackle what to expect if you’re remortgaging with your current lender.

Remortgaging With Your Current Lender

Many homeowners (around 84% in 2022) choose to remortgage with their existing lender for a quicker and cheaper process. It avoids exit fees and extra paperwork that come with switching lenders.

This process is called product transfer—simply switching your existing mortgage to a new deal with the same lender.

To get started, contact your current lender and ask about remortgage options – they’re not always advertised.

Compare the deals they offer to your current mortgage. Look at interest rates, terms and any fees involved.

Product transfers usually mean less hassle. You may not need a new property valuation or legal checks, saving you time and money.

The process is also simpler in terms of financial checks. Since your lender already has your details, there’s less scrutiny. They might still check your credit score and current financial situation though.

If you find a suitable offer, the process is simpler because your lender already has your details. They may still check your credit score and current financial situation before finalising the remortgage.

Once you find a suitable offer, carefully review the new mortgage contract before agreeing to ensure it meets your needs.

The transition from your old mortgage to the new one is typically seamless, with no downtime in payments.

Your lender will confirm the remortgage is complete and give you details of your new payment schedule and any other changes.

Remortgage With a New Lender

If your current lender’s offer isn’t a good fit, remortgaging with a new lender can save you money. Be prepared for a more complex process though.

You’ll need to pass the new lender’s affordability checks and get your property valued again. You’ll also need a solicitor to handle the legal side of things.

When comparing deals, don’t just focus on the headline interest rate. Look at the total cost, including fees like arrangement and application charges, as well as any cashback offers.

These all affect the “true cost” of the mortgage over the fixed term. Comparing the true cost across different lenders is key to finding the best deal financially.

A good mortgage broker can be a big help here, especially if your needs are complex. They can find deals not available directly to consumers and guide you towards the most financially beneficial option.

>> More about Remortgaging

Should I Remortgage with the Same Lender or Change Mortgage Providers?

Remortgaging gives you a chance to reassess your mortgage deal.

To help you decide, here are the pros and cons of sticking with your current lender, also known as a product transfer:

Pros

- Less paperwork and admin tasks.

- No need for a new property valuation.

- Faster process as your lender knows you.

- Often no exit fees to pay.

Cons

- You might miss out on better deals available elsewhere.

- Your current lender’s new offers might not be the best for you.

However, exploring all options ensures you DON’T miss out on potentially better terms. Here’s what you should consider when thinking about remortgaging with a new lender:

Pros

- Access to potentially lower rates and better terms.

- Opportunity to find deals that better suit your current financial situation.

- Some lenders offer attractive incentives for switching to them.

Cons

- More paperwork and admin involved.

- You might need a new valuation and legal checks.

- Possibility of fees for exiting your current mortgage.

Choosing whether to stay with your current lender or switch is big. Think about what fits your needs BEST right now and what will SAVE you the most money.

Can I Remortgage Early To Avoid High SVR?

The simple answer is yes, but with caveats.

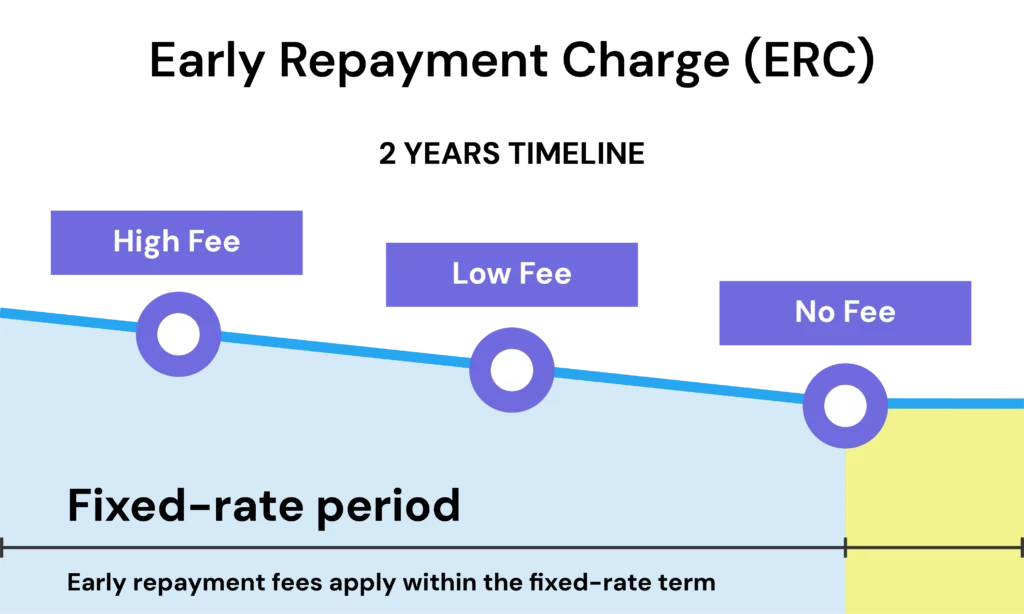

Remortgaging early can incur Early Repayment Charges (ERCs), which can be costly. These charges are usually a percentage of the loan and decrease as you approach the end of the fixed term.

Most lenders structure ERCs to decrease annually, so the closer you are to the end of your term, the less you will pay in penalties. Therefore, timing your remortgage to align with the end of these charges can save you a significant amount in the long run.

When Can I Remortgage Without Facing Penalties?

Legally, you can remortgage at any time, but financially, it makes sense to WAIT until you can avoid or minimise ERCs.

The best time to start the remortgaging process is about 3-6 months before your current fixed term ends. This allows you to avoid ERCs as most lenders allow you to arrange your new mortgage to begin as soon as your current deal expires.

Remortgaging during this period ensures a seamless transition to a new rate without the burden of the SVR or ERCs.

Can I Adjust The Loan Term On a Fixed-Rate Mortgage?

There isn’t a way to directly change the loan term on a fixed-rate mortgage during the fixed-rate period. However, you can achieve a similar result through remortgaging.

As we’ve discussed, remortgaging involves paying off YOUR current mortgage and taking out a NEW one with a different lender, potentially with a longer term. This new mortgage would have a new interest rate and monthly payment amount based on the longer term.

While remortgaging can lower your monthly payments, remember, you might end up paying more interest over time because of the longer repayment period.

It’s worth noting that some lenders might let you extend your mortgage term at any time, while others may only consider this after your fixed-rate period ends.

If you want to keep your current fixed rate and just extend the term, this isn’t usually allowed without paying early repayment charges (ERCs).

Key Takeaways

- When your fixed-rate mortgage ends, your lender may switch you to a Standard Variable Rate (SVR), usually higher than your fixed rate.

- Remortgaging with your current lender or a new one can prevent the switch to a potentially expensive SVR.

- You can start planning to remortgage 3-6 months before your fixed term ends to explore various deals and rates.

- Sticking with your current lender for a product transfer can save on paperwork and exit fees.

- If you remortgage with a new lender, you gain more access to lower rates and better terms, but expect more paperwork and potential fees.

- You can remortgage early to avoid high SVR, but watch out for Early Repayment Charges (ERCs).

The Bottom Line: Should I Remortgage Now?

The best time to remortgage depends on your finances, current mortgage deal, interest rate predictions, and the market.

If your fixed rate is ending soon, or rates might rise, locking in a new fixed deal could save you money. But, if your finances have changed or you plan to move soon, factor that in too.

Every mortgage deal is unique. That’s why getting advice tailored to your situation from a qualified advisor is crucial.

Looking for a broker? Reach out to us now. We’ll connect you with an independent mortgage broker who can help you remortgage and find a deal that suits your financial needs.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

What does locking in a mortgage rate mean?

Locking in a mortgage rate means securing a specific interest rate for your mortgage loan for a set period of time.

This protects you from potential interest rate hikes during the homebuying process, which can take several weeks or even months.

This article has been fact checked

This article was created, checked, and verified by the expert team at Money Saving Guru. Trust us, you’re in good hands.