- What Is a Fixed Rate Mortgage?

- What Is a Variable Rate Mortgage and How Does It Differ?

- How Do You Decide Between a Fixed or Variable Rate Mortgage?

- Are Fixed or Variable Rate Mortgages More Popular in the UK?

- Should You Fix Your Mortgage for Two or Five Years?

- The Bottom Line: Which Mortgage Type Should You Choose?

Should I Get A Fixed Or Variable Rate Mortgage?

Right, so you’re taking out a mortgage – exciting times! But a big decision you need to make is whether to fix your interest rate or let it vary.

This choice affects your monthly payments and the total cost of the mortgage for years to come, so it’s worth getting it right. Let’s break down the pros and cons of each type of interest rate.

What Is a Fixed Rate Mortgage?

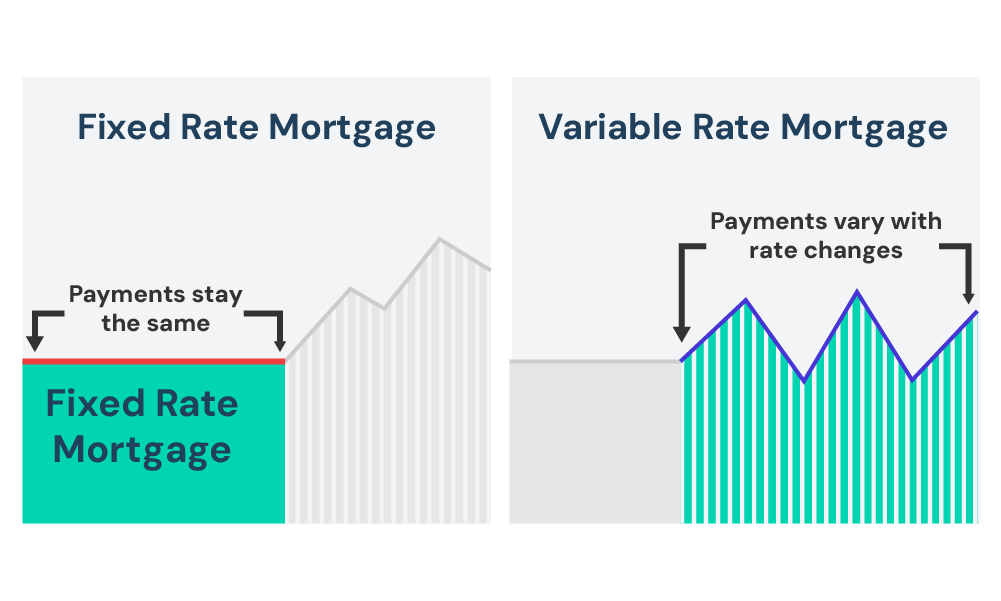

A fixed rate mortgage locks your interest rate for the entire term of your agreement. Whether it’s for 2, 3, 5, or even 10 years, the interest rate you agree to when you sign remains the SAME.

Some deals may even offer fixed rates for the life of your mortgage. This setup is sometimes referred to as the incentive period.

The main appeal here is PREDICTABILITY. No matter what happens to interest rates or the Bank of England’s base rate, your monthly repayments won’t change.

You’re shielded from ANY rate increases, providing a solid foundation for financial planning.

Advantages of Fixed Rate Mortgages

- Offers peace of mind with stable payments

- Simplifies budgeting with predictable monthly costs

- Shields you from rising interest rates

Disadvantages of Fixed Rate Mortgages

- Generally costlier than variable-rate mortgages

- Potential to pay more if interest rates decrease

- Early repayment charges if you switch deals early

What Happens When the Fixed Rate Period Ends?

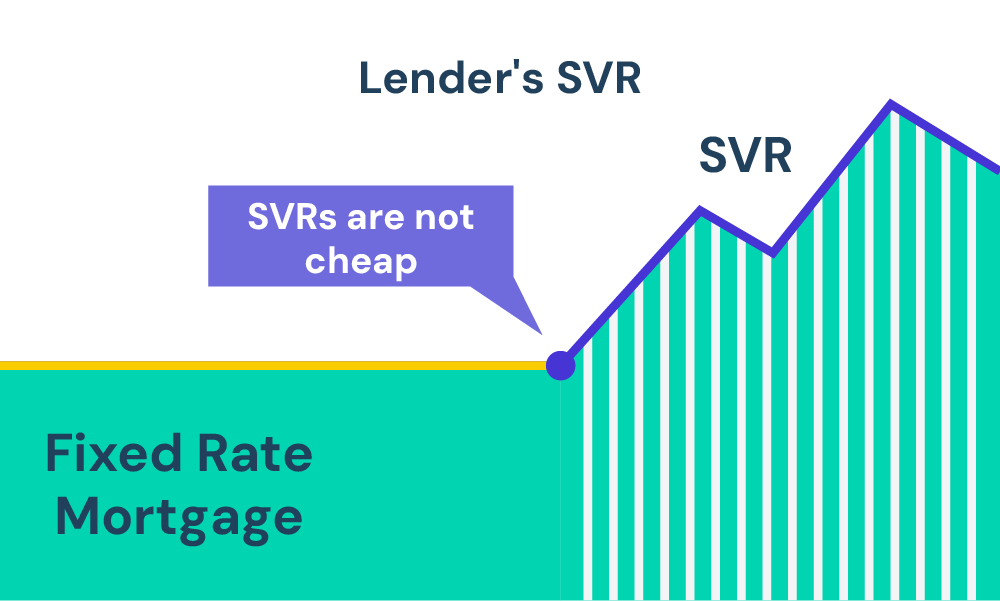

Once your introductory fixed rate or discount period is up, you usually get switched to the lender’s Standard Variable Rate (SVR). This SVR can change whenever the lender fancies, and it’s not always tied to the Bank of England’s base rate.

It’s also typically MORE expensive than the deals they offer new customers, which is why you might want to remortgage with a different lender to GET a better rate.

Your lender or broker will give you an idea of the current SVR when you take out the mortgage, but keep in mind this can change depending on the lender’s whim.

So, there’s no guarantee what the SVR will actually be when your fixed rate ends.

What Is a Variable Rate Mortgage and How Does It Differ?

Variable rate mortgages can change ANY time, depending on what’s happening in the bigger financial world–like how the UK economy is doing.

So, let’s say the economy is booming and inflation is on the rise. To cool things down a bit, the interest rate on your mortgage might go up, making it MORE expensive to borrow money.

On the other hand, if the economy takes a dip, they might LOWER the rate to encourage people to spend.

Advantages of Variable Rate Mortgages

- Often cheaper than fixed-rate options

- Benefit from lower payments when rates drop

- Usually no fees for early repayment, allowing flexibility to switch or prepay

Disadvantages of Variable Rate Mortgages

- Rates can increase, leading to higher payments

- Financial uncertainty from fluctuating interest rates

There are three main types of variable rate mortgages: trackers, standard variable rates (SVRs), and discount rate mortgages.

Each one has its own quirks and risks, here’s an overview:

Tracker Mortgages

Trackers are mortgages that follow an economic compass, usually the Bank of England’s base rate.

The interest you pay goes up and down along with this rate, plus a bit extra the lender tacks on.

For instance, a tracker mortgage follows the base rate + 1% on top, this means if the base rate is 5.25%, your tracker might be 6.25%.

Trackers are generally popular when rates are falling, as they often lead to lower payments. But watch out, if rates go up, so do your repayments.

These trackers can last anywhere from 2 to 5 years. Some lenders offer lifetime trackers that last the entire length of your mortgage.

Be wary though, if a tracker follows a rate the lender makes up, which can be a bit of a wild card compared to the base rate.

Pros of Tracker Mortgages

- Clear and predictable as it tracks the base rates and adjusts based on economic factors.

- Cheaper if interest rates drop (your payments go down too!)

- More flexibility with shorter terms (easier to remortgage later)

Cons of Tracker Mortgages

- You can’t have certainty, unlike fixed-deals, you don’t lock in a guaranteed rate for a set term.

- Risky – If rates rise, so do your monthly repayments, resulting to budgeting nightmares

- Switching to a different mortgage can be expensive (early exit fees)

Standard Variable Rates (SVRs)

As we’ve talked about earlier, SVRs are what you land on after your fixed introductory offer ends.

Unlike trackers, these aren’t directly linked to the Bank of England’s base rate. The lender sets the SVR, and it can jump around for all sorts of reasons, not just what the Bank says.

And let’s be honest, SVRs are usually a fair bit higher than the deals they offer new customers. We’re talking somewhere between 7% and 8.5% right now.

The big risk with SVRs is they can be a bit of a rollercoaster, going up and down based on the lender’s mood and the wider economy.

This means your repayments could shoot up if rates rise.

Note that there’s usually no penalty for paying off your mortgage early with an SVR. So if you only have a little bit left, the cost of switching lenders might not be worth the hassle.

Pros of SVRs

- No early repayment charges, so you can pay off your mortgage early without penalty.

Cons of SVRs

- Expensive–SVRs are usually much higher than introductory rates and can be significantly higher than the base rate.

- Uncertainty–your rates can change for various reasons.

Discount Rate Mortgages

Discount mortgages are basically like getting a temporary sale on the lender’s standard rate (SVR). They offer a fixed discount off the SVR for a certain amount of time.

Even though the SVR itself can move around, the discount you get stays the same during that introductory period. But be warned, discount mortgage deals can be a bit tricky.

Marketing materials might not always show the clearest picture of what your actual rate will be after the discount is factored in. So, make sure you read the fine print carefully before diving in or ask a qualified mortgage broker for help.

How Do You Decide Between a Fixed or Variable Rate Mortgage?

The decision between a fixed and variable rate mortgage often hinges on your financial situation and appetite for risk.

Fixed rates offer you peace of mind, knowing your payments stay the same the whole time. On the flip side, variable rates are a bit of a gamble, but they could save you money if interest rates go down.

The key is how much risk you can stomach. If the idea of higher payments makes you sweat, stick with a fixed rate. It won’t leave you scrambling if rates jump.

But if you’ve got extra cash each month, a variable rate could be a good bet – you might end up paying less overall.

Choosing a mortgage isn’t just about the cheapest rate, it’s about what keeps you from tossing and turning at night.

Ask yourself: Can I handle some risk, or do I need the guaranteed stability of a fixed rate?

Choose the option that lets you sleep soundly at night.

Pro Tip

Think of it like a gamble. If you wouldn’t mind losing a little money on a risky bet, then the variable could pay off big time. But if losing would hurt, fixed is the safer option.

Are Fixed or Variable Rate Mortgages More Popular in the UK?

Historically, fixed rate mortgages used to be the clear winner in the UK, mostly because they give you peace of mind.

But lately, things have gotten a bit bumpy with the economy, and interest rates keep going up and down. This has made some folks look at variable rate mortgages as a maybe, instead of a straight-up no.

Should You Fix Your Mortgage for Two or Five Years?

Fixing your mortgage for two or five years is a personal call. Here’s the lowdown:

- Two years usually means a lower rate and more flexibility. Great if you’re not sure what the future holds or want a good deal upfront.

- Five years gives you longer-term security, like a safety net, but the rate might be a tad higher. Perfect if your income is steady and you plan to stay put for a while.

The Bottom Line: Which Mortgage Type Should You Choose?

Choosing between a fixed and variable rate mortgage boils down on your life, financial stability, and willingness to take risks with interest rates.

Both have their pros and cons. And the BEST way to figure out which one is right for YOU is to chat with a mortgage advisor.

They can give you specific advice based on what you’re trying to achieve with your finances and what’s going on in the economy right now. This will help you pick the mortgage that fits your long-term plans perfectly.

Need a mortgage advisor? We can help, simply fill out this form. And We’ll connect you with someone who can give you tailored advice about the best mortgage for your situation.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

How do tracker mortgages differ from discount mortgages?

Tracker rates move up and down with the Bank of England base rate. That’s a completely separate thing from lenders’ rates, so it’s quite transparent. If the base rate goes up by 1%, your tracker will usually go up by 1% too, unless the mortgage deal says otherwise. Make sure to check the details to avoid any loopholes.

Discount mortgages are a bit trickier. They start with a discount off the lender’s standard variable rate (SVR). That discount stays the same, but the SVR itself can change whenever the lender decides. Since the lender calls the shots on the SVR, your rate could jump around a bit unpredictably.

What is a 'collar' in variable mortgages?

A ‘collar’ on a variable mortgage is a limit that prevents your interest rate from dropping below a certain point.

Some lenders introduced this deal to limit losses when the overall base rate falls significantly. Always check with your lender and read the fine print to see if your mortgage has a collar and how it works.

How can I tell if I'm getting the best mortgage deal?

To find the best mortgage deal, don’t just look at the rates offered today. Consider how the rates might change in the future.

A good mortgage broker can help you compare not just rates but also terms and potential future changes. They can guide you to understand when one deal might become better than another based on rate changes over time.

Do tracker mortgages always align with the Bank of England's base rate?

Mostly, but not always. While many trackers follow the Bank of England’s base rate, some may be tied to other rates like the London Interbank Offered Rate (Libor rate), which is the rate banks charge each other for loans.

These can sometimes be used for specific types of mortgages like sub-prime or buy-to-let. Always check which rate your tracker mortgage follows.

Will the interest rate on my tracker mortgage change only when its benchmark rate changes?

Ideally, yes, but watch out for additional terms. A genuine tracker mortgage should only adjust its rate when the benchmark rate it follows changes.

However, some lenders may include terms that allow rate changes for other reasons. Always have your lender or broker confirm the specifics and check your mortgage offer documents carefully.

This article has been fact checked

This article was created, checked, and verified by the expert team at Money Saving Guru. Trust us, you’re in good hands.