- What Are Private Mortgages in the UK?

- How Do They Work?

- What are Private Mortgage Lenders?

- How Private Mortgage Lending Works

- Why Do Wealthy Borrowers Choose Private Lenders?

- Which Lenders Offer Private Mortgage Deals in the UK?

- Steps to Getting a Private Mortgage in the UK

- Can You Get a Second-Charge Private Mortgage?

- Can You Get a Private Buy-to-Let Mortgage?

- What If Youâve Missed Payments or Have Defaults?

- The Bottom Line

Private Mortgage Lenders Explained

You didn’t get where you are by settling for ordinary, so why start now?

Regular mortgages might work for most people, but when you’re dealing with serious wealth, they just don’t measure up.

Private mortgages, on the other hand, are in a league of their own.

Whether it’s a stunning countryside estate, a sleek London penthouse, or a savvy investment opportunity, these loans are made to match your ambitions.

But here’s the thing—it’s not just about money.

To get the most out of a private mortgage, you’ll need a smart approach and the right experts on your side.

This guide breaks it all down for you—quick, clear, and straight to the point.

Learn how private mortgages work, why they’re different, and how they can help you secure your next big move.

What Are Private Mortgages in the UK?

A private mortgage is a loan you arrange with someone other than a bank or building society.

The lender could be a family member, a friend, a private company, or even an investment group.

The benefit? You and the lender work out the terms together, giving you more say in how the deal is structured.

How Do They Work?

Private mortgages are similar to regular ones—you borrow money to buy a property and repay it over time, usually with interest.

But here’s how they’re different:

- Flexible Terms. Private mortgages are custom-built. You can negotiate repayment schedules, interest rates, or other details to suit both sides.

- Easier to Qualify. Private lenders are often more lenient than banks. They might overlook things like a patchy credit score or an irregular income if the deal looks promising.

- Unique Loan Features. Since private lenders take on more risk, these loans can come with higher interest rates or shorter repayment periods.

What are Private Mortgage Lenders?

Private mortgage lenders are like a VIP service for wealthy people who need loans.

They understand that if you’ve got big money, you don’t want one-size-fits-all solutions. Instead, they offer custom mortgages you won’t get from a regular bank.

To qualify for these loans, you usually need either:

- At least £3 million in assets, or

- An income of £300,000 or more a year.

These lenders don’t have to follow the same strict rules as banks, so they can offer more flexible deals. It’s all about making things work for your needs and lifestyle.

How Private Mortgage Lending Works

Private mortgage lending is all about making a deal that fits your situation. Unlike banks, private lenders don’t just care about how much you earn.

They’ll look at your overall finances—like your savings, investments, and any debts—to see how you can repay the loan.

Here’s how it usually goes:

- Have a Chat: You’ll talk about your goals, what you need the loan for, and how your finances look.

- Set the Details: You and the lender agree on the loan amount, interest rates, and how you’ll pay it back.

- Show What You’ve Got: You’ll share details about your income, savings, and assets.

- Offer Security: You might use your property or something valuable as backup for the loan.

Private mortgages are designed with wealthy clients in mind, so they often include perks like:

- Loans over £10 million

- Up to 95% of the property’s value covered

- Lower interest rates

- Interest-only payments with no extra repayment plans needed

To get the best deal, it helps to work with a good broker who knows the market and can find the right fit for you.

Why Do Wealthy Borrowers Choose Private Lenders?

If you’re wealthy, regular mortgage lenders can feel limiting. Their rigid rules often don’t work for the more complex finances of high-net-worth individuals.

Private lenders, however, offer flexible and personalised options that are better suited to your needs.

Borrow More Than Banks Allow

Banks usually cap their loans at 4.5 times your annual income.

Private lenders can offer you much more—sometimes 7 times your earnings or even higher. This gives you access to bigger funds while keeping extra cash free for other investments.

Access Exclusive Interest Rates

Private lenders offer deals you won’t see advertised to the public.

These often come with lower interest rates, which can even be below what traditional banks typically offer.

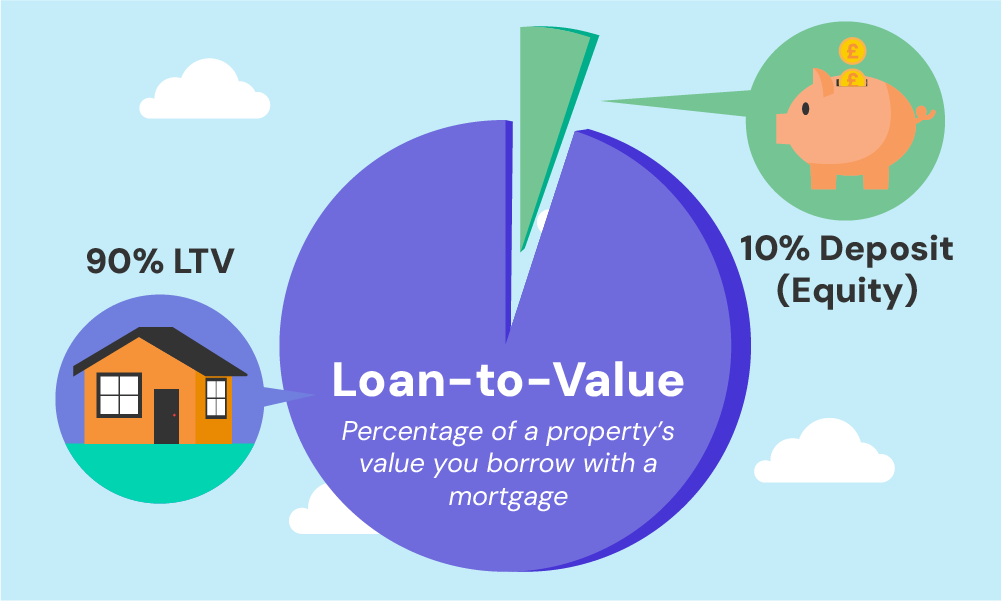

Higher Loan-to-Value (LTV) Ratios

With a private lender, you can borrow more against the value of your property.

This means you’ll need to use less of your own money upfront, leaving more available for other financial goals.

To check your loan-to-value ratio, use the calculator here.

Tailored to Fit Your Needs

Private mortgages are built around your goals, not rigid rules. They’re customised to match your specific financial plans.

Specialist brokers can help you find the perfect solution, making these loans ideal for property investors or anyone needing a larger amount of funding.

Which Lenders Offer Private Mortgage Deals in the UK?

Some high-street banks have private arms that cater to wealthy clients, but their mortgage options can feel a bit basic.

They often lack the creativity and flexibility that dedicated private lenders provide for high-net-worth individuals.

Specialist private lenders currently offering loans in the UK include:

- Paragon

- Precise Mortgages

- Together Money

- Masthaven Bank

These lenders don’t usually work directly with the public. Instead, they rely on specialist brokers to connect them with the right clients.

Brokers act as the bridge, helping you access exclusive deals and preferential rates.

Partnering with an experienced broker is key if you want to take advantage of these private lending options.

Should You Use a Bank or a Private Lender?

Big banks do offer private mortgages, but they usually come with borrowing limits—typically between £5-10 million.

If you need a larger or more complex loan, private lenders are often the better choice.

Private lenders create tailored mortgage solutions specifically for wealthy clients. They work closely with brokers who have the right connections and expertise to make the process smoother and help you secure the best deal.

Steps to Getting a Private Mortgage in the UK

To get a private mortgage in the UK, you can follow these three simple steps:

- Talk to a Specialist Broker. Look for a broker who understands private lending for wealthy clients. They’ve got the connections with top lenders to find you the best deals.

- Get Your Financial Documents Ready. Gather proof of your wealth, including details about what you own and owe. Lenders need this to understand your financial situation and offer a loan that fits your needs.

- Let Your Broker Do the Talking. Leave the negotiations to your broker. They know how to secure exclusive deals that aren’t advertised. A good broker will find a mortgage that works perfectly with your property plans.

Can You Get a Second-Charge Private Mortgage?

Yes, private lenders do offer second-charge mortgages, especially for high-net-worth clients. These loans let you borrow against the equity in a property that already has a mortgage.

Since they involve more risk for the lender, second-charge mortgages often have higher interest rates than first mortgages.

But, private lenders usually offer better rates than traditional banks—typically around 3-4%, depending on your deal.

The big plus? Flexibility.

Second-charge mortgages can be customised to suit your borrowing needs, whether it’s for major expenses like renovations or consolidating debts.

Just remember, your property is at risk if you can’t keep up with repayments, so make sure it’s the right choice for you.

Can You Get a Private Buy-to-Let Mortgage?

Yes, you can, private lenders are a great choice for wealthy investors, especially if you own a few properties.

Using all your properties as backup can make it easier to get a loan for growing your investments.

Unlike regular buy-to-let mortgages with lots of rules, private lenders offer flexible options to match your plans.

They can adjust things like how much you can borrow, your interest rate, and how you pay it back.

Some even let you make interest-only payments, which can be great for keeping extra cash handy. Just make sure this works for your long-term goals.

A good broker can help you find the best deals. They know which lenders are most likely to work with you, especially if you have a tricky property portfolio or want to invest in a unique market.

What If You’ve Missed Payments or Have Defaults?

Don’t worry if your credit history isn’t perfect.

Private lenders care more about what you own and whether you can make repayments, not just your credit score.

If you’ve got valuable assets and can prove you’re able to pay back the loan, many private lenders are happy to overlook past problems.

Be honest about any financial hiccups so your broker can find the right lender for you.

Even if you’ve had some trouble in the past, you can still get a private mortgage as long as your finances are strong now and you haven’t had major issues recently.

The Bottom Line

If you’re wealthy and thinking about a private mortgage, it’s easy to see the perks.

You can borrow more, get lower interest rates, and enjoy flexible terms that fit your financial situation. Private mortgages are especially helpful if you have a complex income but own significant assets.

The secret to getting a private mortgage that works for you? Teaming up with a specialist broker.

They’ve got the know-how and connections to find options that suit your goals and make the process smooth and straightforward.

Interested in exploring private mortgages? Get in touch with us for a free, no-pressure chat, and we’ll connect you with an expert broker to help you find the best options for your needs.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

How does a private mortgage affect my overall financial picture?

Private mortgages can add variety to your investments, especially if you’re putting money into real estate. Choosing a private mortgage can help you use your assets wisely, which may lead to better returns on your investments and a better overall financial strategy.

What are the taxes I'll have to pay on a private mortgage?

The taxes you’ll have to pay on a private mortgage depend on your situation and how you use the loan. It’s a good idea to talk to a tax expert to find out how a private mortgage could affect your taxes, especially considering the larger loan amounts and different terms of these mortgages.

Can I refinance a private mortgage?

Yes, you can refinance a private mortgage, which can give you more flexibility in managing your debt as your financial situation changes. Refinancing can be a good option if interest rates go down or if your financial situation has improved since you first took out the loan.

How long does it take to get a private mortgage?

The time it takes to get a private mortgage can vary, but it can be faster than getting a traditional mortgage because private lenders offer more personalised services and have simpler processes. The exact amount of time it takes will depend on things like how complicated your financial situation is and how quickly your broker can negotiate the terms of the loan.