- What is Mortgage Affordability and Why is it Important?

- What Mortgage Can I Get?

- How Lenders Determine Mortgage Affordability

- What Information Do Lenders Need?

- What Type of Mortgage Can I Get?

- How Much Can You Borrow with a Joint Mortgage?

- Is Self-Employed Mortgage Affordability Different?

- How Affordability Works for Buy-to-Let Mortgages

- Affordability for Second Homes and Holiday Lets

- Key Takeaways

- The Bottom Line

Mortgage Affordability Explained: What Mortgage Can I Get?

Homeownership comes with big responsibilities, especially when it comes to money.

So before you jump in, ask yourself: Can you really afford a mortgage?

The last thing you want is to be caught off guard, struggling to make those payments.

That’s why we’ve put together this guide to help you understand mortgage affordability. It covers what it means, how much you might be able to borrow, and what lenders look for.

This information will help you decide if buying a home is the right move for you.

What is Mortgage Affordability and Why is it Important?

Mortgage affordability is all about your ability to comfortably manage monthly mortgage payments.

It depends on your income, debts, and overall financial situation.

Lenders assess your affordability to ensure you can keep up with payments, even if your circumstances change.

If you overlook affordability, you could end up missing payments, falling into arrears, or even facing repossession of your home.

That’s why it’s essential to check your affordability before taking out a mortgage—to avoid financial stress and make sure you can stay in your home.

What Mortgage Can I Get?

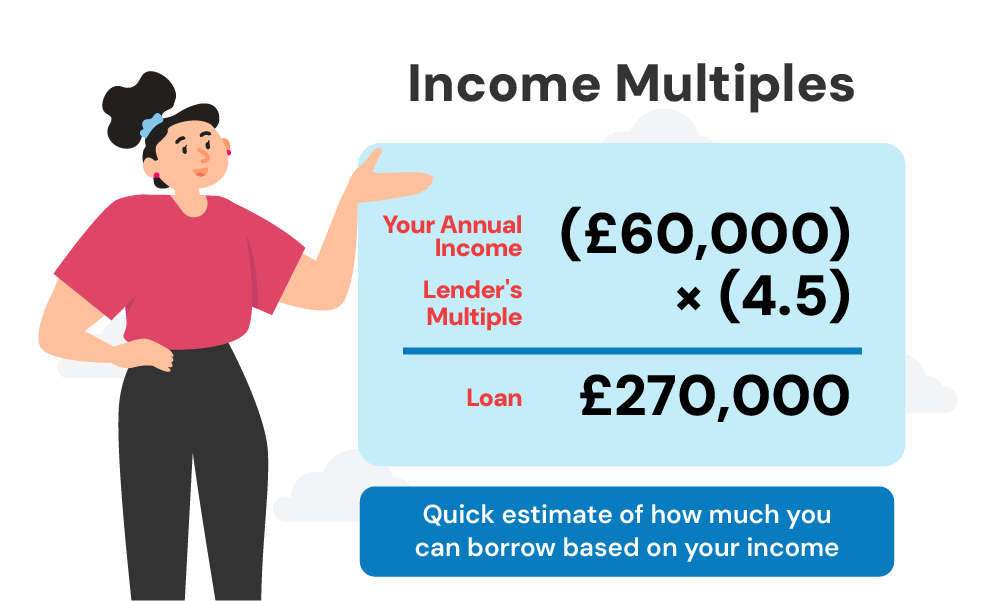

To see how much you can borrow based on your income, use our mortgage affordability calculator. This gives you a snapshot of what lenders might offer, using income multiples – usually 4.5 to 6 times your annual salary.

So, if you earn £60,000 a year, you could be looking at a loan range between £270,000 and £360,000.

But this is just an estimate.

For personalised advice and the best options, consult a mortgage broker to ensure your mortgage is affordable and sustainable.

How Lenders Determine Mortgage Affordability

Beyond income multiples, lenders assess your mortgage affordability in a number of ways.

Here are the key factors they consider:

Your Income

Lenders will look at how much you earn. They want to see if you have a steady income to cover your mortgage.

This includes your salary, bonuses, and any other money you get.

- Why does it matter? Lenders need to make sure you can afford your mortgage on top of your other bills.

- What do they look for? They want to see a regular income from a stable job. A permanent job is usually better than a temporary one.

Your Monthly Outgoings

Lenders will look at how much you spend each month on things like rent, bills, food, and travel.

- Why does it matter? They want to see if you have enough money left over after paying your regular bills to afford a mortgage.

- What do they look for? They want to make sure your spending is balanced. If you spend a lot compared to what you earn, it might be harder to get a mortgage.

Your Existing Debts

Lenders will want to know about any debts you already have, like credit card bills, car loans, student loans, or personal loans.

These debts cost you money each month.

- Why does it matter? Lenders need to see how much of your income is already spent on paying off debts. This helps them figure out how much you can afford to borrow for a mortgage.

- What do they look for? They want to make sure your debts are manageable. If you’re already spending a lot on debt repayments, it might mean you can borrow less for a mortgage.

Your Debt-to-Income Ratio

Your debt-to-income ratio (DTI) is a simple way to see how much of your income goes towards paying off debts.

It’s a percentage that shows how much you owe compared to what you earn.

To work it out, divide your total monthly debt repayments by your total monthly income before tax.

You can find an estimate of your DTI here and see how it might affect your mortgage chances.

- Why does it matter? Lenders look at your DTI to decide if you can afford a mortgage. A lower DTI is better as it shows you have more money left over after paying your debts. This means you’re more likely to be able to handle a mortgage.

- What do they look for? Most lenders prefer a DTI below 36%. If your DTI is higher, it suggests a large chunk of your income is already spent on debts, leaving less for a mortgage.

Your Family and Finances

Lenders will consider if you have children or other people who depend on you financially. Having a family means more costs like food, clothes, and childcare.

- Why does it matter?More people to look after means less money for a mortgage. Lenders want to make sure you can still afford your home with your family costs.

- What do they look for? They’ll check if you can balance your family budget and a mortgage. If most of your money goes to your family, you might be able to borrow less.

In addition to your income, debts, and monthly outgoings, they consider the following:

- Employment status — A steady job gives lenders confidence that you can handle mortgage payments.

- Deposit size – A bigger deposit often means better interest rates and a larger mortgage.

- Profession – Some jobs are seen as more secure or higher-paying, which can influence your mortgage offer.

- Age – Younger borrowers often get longer mortgage terms, while older people might have limits.

- Credit score – A good credit score can help you get a better mortgage deal.

- Mortgage Term – How long you take to pay back the loan matters. This usually ranges from 5 to 40 years. Shorter terms mean higher monthly payments but less interest overall. Longer terms mean lower monthly payments but more interest in the long run.

Together, these factors give lenders a complete picture of your financial situation, ensuring the mortgage you’re offered is affordable and sustainable.

What Information Do Lenders Need?

To work out if you can afford a mortgage, lenders need a clear picture of your finances.

This means you’ll likely need to provide:

- Proof of income – Payslips and bank statements show how much you earn.

- Debt details – Information about loans, credit cards, and other debts.

- Outgoings: Details on your regular bills and spending.

- Dependents – Information about children or others relying on you financially.

- Your deposit – How much you’re putting down and where the money comes from.

- Savings and investments – Details of any savings or investments you have.

It’s really important to be honest and open.

Lenders will check everything carefully, so hiding information could harm your chances of getting a mortgage.

What Type of Mortgage Can I Get?

There are lots of different mortgages out there, so it’s important to find the one that suits you best.

- Fixed-rate mortgage – This means your interest rate stays the same for a set period. This is great for budgeting as your monthly payments won’t change.

- Variable-rate mortgage – Your interest rate can go up or down. This means your monthly payments can change.

- Tracker mortgage – A type of variable-rate mortgage where your interest rate moves up or down based on the Bank of England’s base rate.

- Standard Variable Rate (SVR) – This is the default rate you’ll move to when your fixed or tracker deal ends. It’s usually higher than other options.

- Discounted variable-rate mortgage – You get a lower interest rate for a set period, but then it can change.

- Interest-only mortgage – You only pay the interest each month. You have to pay back the whole loan at the end.

- Offset mortgage – Your savings help to reduce the interest you pay on your mortgage.

- Lifetime mortgage – This is for homeowners over 55 who want to release some money from their home.

How Much Can You Borrow with a Joint Mortgage?

Getting a mortgage with someone else can often mean you can borrow more.

Lenders add up both of your incomes to see how much you can afford.

For example, if you both earn £30,000, you might be able to borrow around £270,000.

But it’s not just about your income. Lenders will also look at your combined debts, bills, and how many people depend on you.

Remember, you’re both responsible for the mortgage, so any financial problems will affect you both.

Is Self-Employed Mortgage Affordability Different?

Yes, it can be a bit trickier to get a mortgage if you’re self-employed.

Lenders want to be sure you can afford the mortgage, and because your income might go up and down, they need to see more proof of your earnings.

Instead of just looking at your payslips, lenders will ask for things like:

- SA302 or tax returns to see how much you’ve earned over the last few years.

- Accountant’s reports or business accounts to get a clearer picture of your finances.

Lenders might look at your average earnings over a few years or use the lowest amount you’ve earned.

This helps them make sure you can handle the mortgage, even if business is slow sometimes.

Here’s an example of how they might work out your average earnings:

| Year | Income |

|---|---|

| 1 | £45,000 |

| 2 | £35,000 |

| 3 | £50,000 |

| Total Income over 3 years | £130,000 |

| Average Income (Total ÷ 3) | £43,333 |

| Mortgage Amount capped at 4 – 6x | £173,332 – £259,998 |

Sometimes, lenders might choose the lowest income figure (in this case, £35,000) to decide how much you can borrow, especially if your earnings go up and down a lot.

Other things lenders look at:

- Your debts and spending – They’ll check how much you owe compared to how much you earn, and look at your regular bills.

- Your deposit – You might need a bigger deposit than someone with a regular job.

- Your credit score – This is still important, just like for anyone else.

Make sure to stay organised and keep good records of your income and expenses.

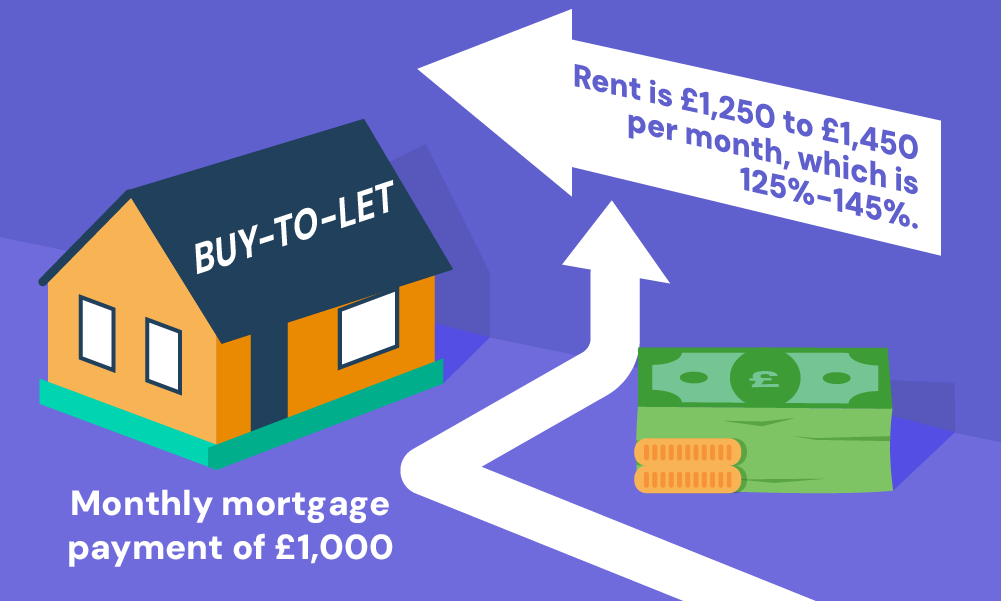

How Affordability Works for Buy-to-Let Mortgages

Getting a buy-to-let mortgage is different to getting one for your own home.

Lenders focus on the money you’ll make from renting out the property, not your personal income.

Basically, they want to be sure the rent you charge will cover the mortgage and other costs like repairs and empty periods.

Most lenders say the rent should be 125% to 145% of the mortgage payment.

For example, if your mortgage is £1,000 a month, you’d need to charge rent of between £1,250 and £1,450.

Lenders might also check if you could still afford the mortgage if interest rates go up.

Your own income and spending still matter, but they’re not as important as the property’s earning potential.

If the rent looks good, you’ve got a better chance of getting the mortgage.

Affordability for Second Homes and Holiday Lets

If you’re thinking of buying a second home or a holiday let, lenders will look closely at your finances.

Second Homes

For a second home, lenders want to be sure you can afford both your main mortgage and the new one.

They’ll look at all your income, including any money from investments or pensions, and compare it to your outgoings and debts.

It’s important to remember that having two homes can be expensive, so lenders need to be confident you can handle it.

Holiday Lets

With a holiday let, the focus is on how much rent you can make.

Lenders want to see that the rent will cover the mortgage and other costs, even when the property is empty. They often say the rent should be 125% to 145% of the mortgage payment.

Like with a second home, lenders will also check your overall finances to make sure you can afford the mortgage.

Key Takeaways

- Mortgage affordability ensures you can comfortably manage monthly payments based on your income, debts, and financial situation.

- Lenders usually let you borrow 4.5 to 6 times your yearly income, but a mortgage broker can give more precise advice.

- Lenders look at your income, spending, debts, debt-to-income ratio, and financial dependents to decide how much you can borrow.

- Self-employed people need to show extra proof of income. Lenders may average your earnings or use the lowest figure.

- For buy-to-let mortgages, lenders focus on rental income, which should cover 125% to 145% of the mortgage payment.

The Bottom Line

It’s really important to know what you can afford when you’re looking for a mortgage. Borrowing too much can cause big problems later on.

Be honest with yourself about your finances.

If you’re not sure what you can afford, a good mortgage broker can help. They’ll give you advice, find the best deals, and show you ways to save money.

You can also use online tools and do your own research.

But if you want to save time and get expert help, get in touch with us. We’ll connect you with a trusted mortgage advisor for free.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

Can I improve my mortgage affordability?

Yes, you can. To improve your mortgage chances, increase your income, and reduce monthly expenses. Pay down your debts and work on improving your credit score. Save for a larger deposit and avoid big financial commitments before applying.

What is a mortgage affordability calculator, and how can it help me?

A mortgage affordability calculator shows how much you can borrow based on your income, expenses, and finances. It helps you understand your borrowing capacity and plan your budget. Use this tool to get a clear picture before speaking to a lender.

Are there any government schemes to help with mortgage affordability?

Yes, schemes like Shared Ownership, and the Lifetime ISA can make mortgages cheaper. They offer lower deposits or equity loans to first-time buyers and those with limited savings.

Check eligibility and details to see if you qualify.