- What’s Different About Getting a Mortgage in Scotland?

- What Mortgage Deposit Do You Need in Scotland?

- How Long Does a Scottish Mortgage Application Take?

- How to Get Your Scottish Mortgage Application Right

- How Much Can You Borrow?

- The Top Mortgage Lenders for Scotland

- What Scottish Mortgage Schemes Are Available?

- Remortgaging Your Scottish Property

- The Bottom Line: Getting Expert Mortgage Advice in Scotland

How To Get Mortgages In Scotland? A Complete Guide

Dreaming of your own little corner of Scotland? 🏴

Whether it’s a cosy flat in Edinburgh’s historic lanes or a charming cottage in the Highlands, owning a home starts with one crucial step – getting a mortgage.

But the mortgage process in Scotland can feel like a daunting quest, filled with unfamiliar lenders, unique property practices, and confusing financial jargon.

Where do you even begin? Take a deep breath. 🧘♀️

This guide is here to be your trusty compass on the journey to a Scottish mortgage.

You’ll learn how mortgages work differently north of the border, from lenders’ footprints to loan calculations and government schemes.

Spoiler alert: it’s NOT as daunting as it seems once you understand the lay of the land! 🙂

More importantly, you’ll get a clear action plan on preparing for your application.

From collecting paperwork to understanding affordability to making the most of expert advice – this guide ensures you avoid potential pitfalls.

So put your feet up, get comfy, and let’s get started with how to get mortgages for your dream home in Scotland.

What’s Different About Getting a Mortgage in Scotland?

Owning a home in Scotland is exciting, but getting a mortgage there is a different experience compared to the rest of the UK.

In Scotland, the basics—income, credit history, affordability—stay the same.

But the process? It’s got its own quirks.

The first difference you’ll encounter is the number of lenders. Major banks are present, but there are fewer smaller building societies.

This is where a broker with Scottish market expertise can be your best friend. They can help you find and secure the best deal for you.

Solicitors also play a different role in Scotland. You’ll need one to place an offer on a property, much sooner than in the rest of the UK.

This early involvement makes offers legally binding quicker, reducing the chances of gazumping

Instead of stamp duty, Scotland has its own tax: the Land and Buildings Transaction Tax (LBTT).

The rates and thresholds are different from stamp duty in England and Northern Ireland, and LBTT applies to properties over £145,000.

Understanding these rates is crucial for your financial planning.

Scotland also has unique government schemes.

The First Home Fund offers interest-free loans for deposits. The LIFT scheme helps you buy a percentage of a property, easing the upfront cost. These are distinct from what you’ll find elsewhere in the UK.

Many properties in Scotland are tenements – buildings divided into flats with shared ownership of common areas.

Understanding the legalities and responsibilities here is essential.

The freehold system is mostly abolished, but it’s vital to consult your solicitor to clarify property rights.

Image showing the difference between the UK and Scotland mortgage market.

What Mortgage Deposit Do You Need in Scotland?

When it comes to deposit requirements, Scotland aligns with standard UK norms. Expect to need a minimum 5% deposit for most mainstream mortgages, though some lenders may go even higher.

If a 5% deposit feels out of reach, there are options like the government’s Mortgage Guarantee Scheme.

Or you could consider a guarantor mortgage, with a family member providing security.

The minimum deposit is just one piece of the puzzle though. Lenders will also scrutinise your income, existing debts, credit history and overall affordability.

Most will cap the amount you can borrow at around 4-5 times your annual income.

How Long Does a Scottish Mortgage Application Take?

From accepted offer to completion, buying a home in Scotland is generally quicker than in England and Wales. You’re typically looking at 6-8 weeks for the mortgage process.

That said, preparation is still key if you want things to go smoothly.

Getting your documentation ready, checking your credit reports and having an Agreement in Principle (AIP) lined up can all help shave time off the process.

Your broker will be able to advise on lenders with competitive turnaround times too. Some of the smaller, more specialised players can be particularly speedy.

How to Get Your Scottish Mortgage Application Right

Follow these tips to maximise your chances of approval:

1. Get your Documentation Ready.

Having all the necessary documents organised and available will streamline the process and show lenders that you’re a serious and prepared applicant.

Here’s what you’ll need:

- Proof of identity (passport or driving licence)

- Proof of address (utility bills or bank statements)

- Bank statements (last 3-6 months)

- Payslips (last 3-6 months for salaried individuals)

- P60 form (for salaried individuals)

- Self-employment income proof (tax returns, SA302 forms, or accounts if applicable)

- Proof of deposit (bank statements or savings account statements)

- Details of existing debts and loans

- Credit report

- Property details (estate agent’s listing and property valuation)

- Proof of other income (if applicable, such as rental income or benefits)

Make sure each document is up to date and easily accessible. This will help you manage the application process smoothly and boost your chance of getting a mortgage.

2. Check your Credit Reports.

Correct any errors before applying as this could improve your eligibility. You can check your credit report in any of these credit agencies – Experian, Equifax, and TransUnion.

3. Get an Agreement in Principle (AIP).

An AIP is a statement from a lender on how much they might lend you based on an initial look at your finances.

Not a guarantee, but it sets your budget and shows sellers you mean business.

To get an AIP, share your income, outgoings, and credit history. The lender will do a soft credit check—no impact on your score.

If all looks good, they’ll give you an AIP document stating the amount they’re willing to lend.

An AIP can speed up your buying process. It signals to sellers and estate agents that a lender is likely to back your purchase. Usually valid for 60-90 days, so keep your finances steady during this time.

4. Use a Whole-of-Market Mortgage Broker

A whole-of-market mortgage broker can simplify and improve your mortgage application process. They know the market, the lenders, and the best deals.

Here’s why you need one:

- They tap into a range of mortgage products, including exclusive deals you can’t get on your own.

- Their advice is tailored to your financial situation and goals, ensuring you get the best mortgage deal.

- They handle the paperwork and communicate with lenders, saving you time and hassle.

- Brokers often secure better rates and terms, thanks to their industry connections.

- From initial application to final approval, they make the process less stressful.

- They can negotiate on your behalf, potentially getting you better terms.

- They provide ongoing support and can assist with future mortgage needs, such as remortgaging or additional borrowing.

Using a whole-of-market mortgage broker ensures you’re getting the BEST advice and options, making your mortgage journey smoother and more efficient.

>> More about Mortgage Applications

How Much Can You Borrow?

The amount you can borrow for a Scottish mortgage depends on factors such as your income, financial commitments, and the lender’s criteria.

Typically, lenders offer between 3 to 5 times your annual income.

For example, if you earn £30,000 a year, you might be able to borrow between £90,000 and £150,000. For a couple with a combined income of £60,000, this could range from £180,000 to £300,000.

Lenders also consider your credit history and the size of your deposit. A larger deposit not only reduces the amount you need to borrow but also shows financial stability, which can positively influence the lender’s decision.

For example, if you wish to buy a £200,000 property and have a £40,000 deposit, you would need a mortgage of £160,000.

With an annual income of £40,000 and assuming a lender offers you four times your income, you could qualify for the required mortgage.

The type of mortgage you choose, whether fixed-rate or variable-rate, can also impact your borrowing amount.

Consulting a mortgage advisor can help you determine the best option for your situation.

For an estimate, use our online mortgage calculator. It provides a quick snapshot of your borrowing potential, helping you plan your home purchase.

Keep in mind, these figures are estimates; the final amount will be determined by the lender after a detailed assessment.

[Embedded Online Mortgage Calculator]

The Top Mortgage Lenders for Scotland

So which mortgage providers should you be looking at for property in Scotland? All the big high street names are active, including:

- Lloyds Banking Group (Bank of Scotland, Halifax, Lloyds)

- RBS Group (NatWest, Royal Bank of Scotland)

- Barclays

- HSBC

- Santander

- TSB

Nationwide, the UK’s second-largest lender, also covers the whole of Scotland. Beyond that, you have building societies like Leeds, Furness and Norwich & Peterborough that lend in Scotland with some restrictions.

An independent broker can scour the entire market, comparing deals from all these lenders (and smaller niche players) to find the right match for your needs and location.

What Scottish Mortgage Schemes Are Available?

Across the UK, affordability has become an increasing barrier to homeownership.

Thankfully, the Scottish government has some useful schemes to make buying more achievable:

The Low-Cost Initiative for First-Time Buyers (LIFT)

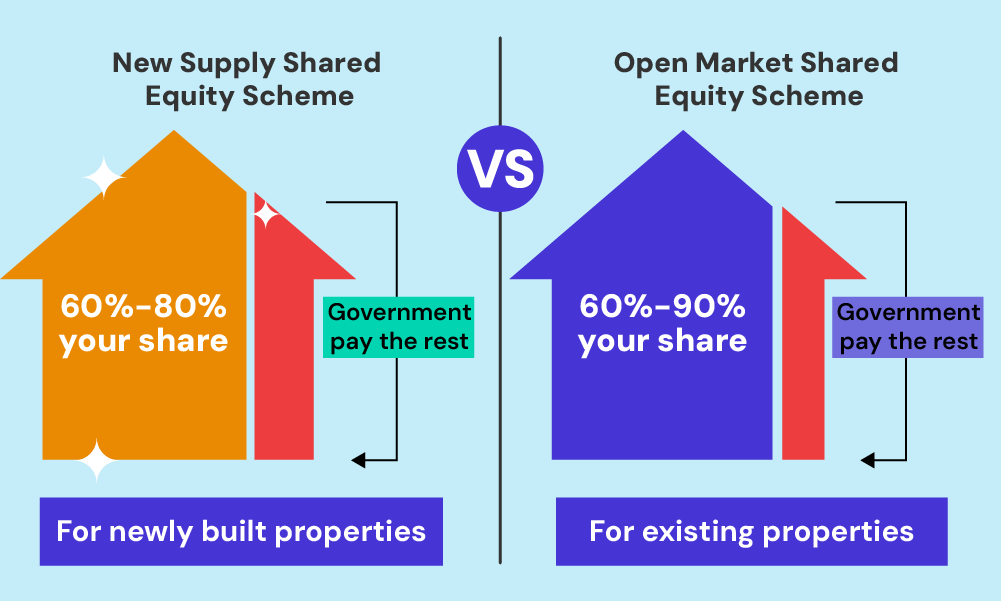

The Low-Cost Initiative for First Time Buyers (LIFT) offers two shared equity options.

1. New Supply Shared Equity Scheme

- This option allows buyers to purchase newly built homes from councils or housing associations.

- Buyers need to contribute between 60% and 80% of the home’s market value.

- The Scottish Government holds the remaining equity share, which can be bought out in the future when the buyer can afford it.

- It helps increase access to affordable new homes, particularly in areas with high housing demand.

2. Open Market Shared Equity Scheme

- This option enables buyers to purchase homes on the open market.

- Similar to the New Supply scheme, buyers contribute between 60% and 90% of the property’s value, with the government covering the rest.

- This scheme is particularly beneficial in allowing flexibility and choice, as buyers can select from a wider range of existing properties.

UK-wide Lifetime ISA (LISA)

Although not specific to Scotland, the LISA is a UK-wide initiative beneficial for Scottish buyers.

Available to those aged 18-39, it provides a 25% government bonus on savings used for purchasing a first home or for retirement.

Buyers can save up to £4,000 per year, with the government adding up to £1,000 annually, significantly boosting the savings towards a home deposit.

Your broker will ensure you’re taking full advantage of any support you’re eligible for.

Remortgaging Your Scottish Property

If you’re already a homeowner in Scotland and want to remortgage, the process follows the same lines as applying for a mortgage on a new purchase.

Lenders will reassess your income, credit profile, existing equity levels and overall affordability.

One advantage is that any equity you’ve built up can count as your deposit this time around.

The more equity you have, the lower your loan-to-value will be, opening up access to better rates.

You can also look at remortgaging to borrow more than your current outstanding mortgage, allowing you to release cash for renovations or other purposes.

The Bottom Line: Getting Expert Mortgage Advice in Scotland

While the mortgage fundamentals are the same, there are enough nuances in the Scottish market to make seeking professional guidance worthwhile.

An experienced broker will:

- Understand the differing lender footprints and criteria for Scotland

- Help you explore and maximise any support schemes you qualify for

- Advise on the optimal deposit level and mortgage amount for your circumstances

- Compare the entire market to get you the best rates and deals

- Manage the application process through to completion

Get in touch today to start your mortgage journey. We’ll connect you with an expert mortgage advisor who can help you find the cheapest mortgage for your dream home in Scotland.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

How long is a Home Report valid when selling a property in Scotland?

When selling a property in Scotland, a Home Report is valid for 12 weeks after it’s prepared.

If your property doesn’t sell within that time frame, you may need to refresh the report to reflect the current condition and value.

Even within 12 weeks, a buyer’s lender might ask for an update if the market or the property’s condition has changed significantly.

Are there any restrictions for foreigners buying property in Scotland?

No, there are no specific restrictions for foreigners buying property in Scotland. Non-residents and foreign investors can purchase property without any special permits or restrictions.

However, they should be aware of the legal and tax implications, such as Stamp Duty Land Tax (SDLT) and Capital Gains Tax (CGT), which may apply.

It’s advisable for foreign buyers to seek legal and financial advice to fully understand their obligations and the buying process in Scotland.

Can I get a 100% Loan-to-Value (LTV) mortgage in Scotland?

Getting a 100% mortgage (meaning borrowing the full value of the property) in Scotland is difficult – most lenders won’t offer them. They typically require at least a 5% deposit.

It’s best to speak to a mortgage advisor to see if you qualify for these schemes and find the best mortgage option for you.

Can I get a mortgage even with bad credit in Scotland?

Even with bad credit, getting a mortgage in Scotland is still possible, but it might be trickier. Lenders will check your credit history, and those with a poor score might face higher interest rates and stricter terms.

The good news is there are specialist lenders with bad credit mortgages for people in your situation. These lenders might ask for a bigger deposit, typically 15-30% of the property value, to account for the higher risk.

To improve your chances of getting a good mortgage deal, try to boost your credit score before applying.

This could involve paying off existing debts, keeping up with bill payments, and fixing any mistakes on your credit report.

Talking to a mortgage advisor who specialises in bad credit can also be helpful – they can guide you and find the best options for you.