- What Is a Joint Mortgage With Parents Exactly?

- So Why Get a Joint Mortgage With Parents?

- Joint Tenants vs Tenants in Common Setup

- Discussing Ownership and Responsibilities

- What Are the Potential Risks and Downsides?

- Mortgage Lenders’ Requirements for Parents

- Alternative Parent Assistance Options

- Mortgages For Friends or Non-Family Members

- Which UK Mortgage Providers Accept Joint Family/Friend Borrowers?

- Can I Add Someone To my Existing Mortgage?

- The Bottom Line

Joint Mortgage With Family & Friends: A Complete Guide

Buying a home feels like a mission impossible these days.

As house prices skyrocket, getting on the property ladder seems more daunting than ever for today’s young Brits. Sure, you could rent forever, but deep down you yearn for a place to truly call your own.

That dream might not be as far-fetched as you think. Because more and more, parents are stepping in with an ingenious solution: the joint mortgage.

By pooling incomes and sharing ownership with mum and dad, finally having your name on the deed could become reality.

It’s an unconventional path, but one that savvy homebuyers are embracing in this unaffordable market.

The question is, should you take the leap and go joint with parents to purchase property together?

In this guide, you’ll get a clear picture of how joint mortgages with parents work, the pros and cons, and whether it could be the right move for your household.

What Is a Joint Mortgage With Parents Exactly?

A joint mortgage with parents is when you and one or both of your parents co-borrow a mortgage and co-own the property together.

All applicants are legally responsible for making the full monthly mortgage payment. You all own equal shares of the home unless otherwise agreed upon.

This differs from just getting gifted deposit money from parents. With a true joint mortgage, your parents are just as much on the hook for repaying the loan as you are over the long term.

So Why Get a Joint Mortgage With Parents?

The biggest advantage is that it combines your income with your parents’ income when you apply. This boosts your overall household income which lenders use for affordability calculations.

Having parents as co-applicants provides more buying power for qualifying compared to just you solo.

You may be able to borrow a higher mortgage amount for a nicer home than you could get on your own.

Other benefits of going joint with parents include:

- Asking for a smaller deposit size if parents pitch in their share

- Parents can help a child with poor credit/employment history qualify

- Allows getting on the property ladder faster as co-owners

- Parents don’t have to gift large cash sums, just share the mortgage debt

The flip side is that parents now have legal liability on the mortgage debt. And there are some potential tax and age implications for including them.

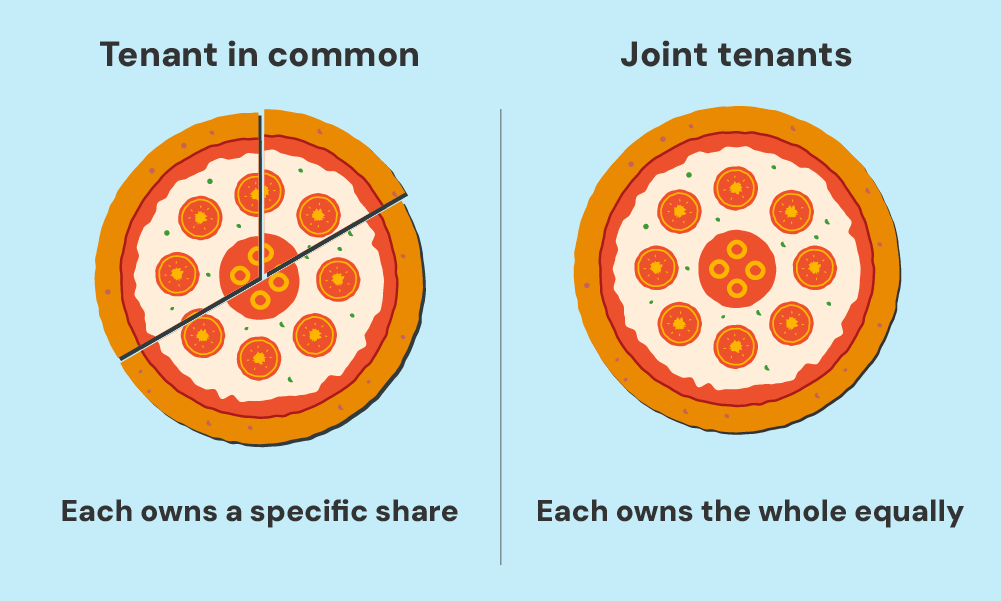

Joint Tenants vs Tenants in Common Setup

When taking a joint mortgage with parents, the ownership has to be specified as either:

Joint Tenants

With joint tenancy, all co-owners have equal ownership rights to 100% of the home and property value. If one party passes away, their interest automatically transfers to the remaining owners.

Tenants in Common

As tenants in common, each party owns a specified percentage share that doesn’t have to be equal. Each owner can name different beneficiaries to inherit their ownership stake when they die.

The tenants in common arrangements offer more flexibility and are commonly chosen for joint mortgages between parents and children.

For example, parents may own a 70% stake while the child owns 30% if that’s what their deposit contributions merit. A legal deed of trust document specifies each party’s ownership percentage.

Discussing Ownership and Responsibilities

Before finalising your mortgage, talk openly with everyone involved and a solicitor. Together, you can decide the best ownership structure for your situation.

Clear communication is key: everyone needs to understand their roles and responsibilities.

Here’s what you’ll need to discuss:

- Ownership percentages or how much of the property each person owns.

- Financial responsibilities of each party

- How to manage mortgage repayments and household bills.

- An inventory of personal belongings (furniture, appliances, etc.).

- How to handle disputes.

One of you must be in the bank account from which the mortgage direct debit will be paid.

Everyone needs to transfer their share into this account promptly. This account might also cover household bills or hold savings for emergency repairs.

Signing a deed of trust when choosing tenants in common is advisable. This document clearly defines each owner’s duties and responsibilities, helping to avoid misunderstandings or conflicts later.

What Are the Potential Risks and Downsides?

While getting parents or other family involved can be instrumental in purchasing a home, there are some drawbacks to keep in mind:

- All co-borrowers are “jointly and severally liable” for mortgage payments

- A default by any borrower can negatively impact everyone’s credit scores

- Your lender may have recourse against parents’ other assets if payments are missed

- Potential capital gains tax when selling if classified as a second home for parents

- Added costs like stamp duty surcharge if it’s an investment property for parents

- Relationship conflicts and fallouts over money can get extremely messy

- Differing long-term plans for keeping or selling the home

- You miss out on the first-time buyer stamp duty relief for homes valued up to £425,000 if your parents are homeowners.

Ultimately, joint mortgages with family require solid trust and communication to work. Otherwise, bringing in a joint income can become more of a burden than a benefit.

Mortgage Lenders’ Requirements for Parents

While most major UK mortgage lenders allow joint applications with parents co-borrowing, some have specific requirements:

Age Restrictions

Many lenders have maximum age caps for the oldest borrower, typically around 70-75 years old.

This limits how long the mortgage term can be extended based on the parents’ age. However, a few specialists cater to older borrowers over 80.

Affordability and Income

All applicants must prove their income and ability to afford payments both now and potentially into retirement. This includes parents providing pension details if nearing in retirement age.

Residency Status

Some lenders require all borrowers to occupy the home as their main residence. Others make exceptions if parents are only involved in assisting their child in buying.

Extra Stamp Duty

If the home is classed as a second or investment property for parents who already own another home, higher stamp duty taxes may apply wiping out some first-time buyer benefits.

Lenders view mortgages with parents as higher risk, so the criteria and documentation requirements are typically stricter. Having an experienced broker navigate the process is advisable.

Alternative Parent Assistance Options

Co-borrowing on the mortgage itself isn’t the only option parents have for helping their child buy a home:

- Gift a chunk of cash for some or all of the down payment deposit

- Act as a guarantor for the mortgage payments rather than a co-borrower

- Allow their income and assets to be used to supplement borrowing power

- Provide an interest-free loan to the child for upfront home purchase costs

- Utilise family offset mortgages

Your family dynamic and comfort level with financial involvement should guide which assistance path makes the most sense.

Mortgages For Friends or Non-Family Members

Although less common than with parents, it’s also possible to get a joint mortgage in the UK with friends, unmarried partners, or other third parties outside your family.

The application process and lender requirements are essentially the same:

- All borrowers need to meet credit score, income, and affordability standards

- Clear co-ownership details on rental profits, maintenance costs, sale proceeds

- Legal paperwork in place establishing borrower roles and responsibilities

- Mortgage payments coming from a single nominated borrower’s bank account

Lenders tend to scrutinise these joint mortgages among unmarried parties more compared to spouses/civil partners. They want to see that a clear co-ownership agreement exists.

Which UK Mortgage Providers Accept Joint Family/Friend Borrowers?

Mortgages with multiple joint borrowers outside of a spouse/partner situation are not as widely available. But there are still a decent number of options among UK lenders including:

- Halifax

- Nationwide

- Barclays

- NatWest

- HSBC

- Santander

- Metro Bank

- Family Building Society

- Bath Building Society

- Newbury Building Society

Smaller building societies and niche lenders tend to be more accommodating for unique joint borrower scenarios.

Can I Add Someone To my Existing Mortgage?

Yes, you can add someone to your existing mortgage through a process known as a Transfer of Equity.

Here’s how it works:

- Adding a New Borrower. You can add a new spouse or civil partner to your mortgage after marriage or union. This involves updating your mortgage documents to include the new borrower, who must meet the lender’s criteria.

- Removing an Existing Borrower. If you can qualify for the mortgage on your own, you can remove your parents from the mortgage. This often happens once you have sufficient income and credit history.

- Transferring the Mortgage. If parents pass away, the remaining mortgage can be transferred to a child. This requires reapplying for the mortgage with the updated borrower.

To make these changes, you’ll need to undergo a full affordability assessment. The lender will review your income, credit score, and overall financial situation.

If approved, the lender will reissue the mortgage documents with the updated borrowers. You may face early repayment charges depending on your lender’s terms.

In some cases, lenders might require you to remortgage to add or remove a borrower, especially if significant changes to the loan amount or terms are involved.

Remortgaging involves applying for a new mortgage under updated terms, which can include adding or removing borrowers.

So, while a Transfer of Equity is typically sufficient for adding or removing a borrower, you might need to remortgage if the lender requires it for your specific situation.

Always check with your lender to understand their requirements.

The Bottom Line

Taking out a joint mortgage with parents or other third parties should never be taken lightly. There’s a huge amount of upfront planning, paperwork, and legal arrangements required.

While it can be the perfect solution in some cases, it’s not suitable or risk-free for everyone. Getting mortgage advice from an expert broker should be the first step before applying.

An experienced broker can:

- Review all of your joint application and documentation requirements

- Lay out the full pros, cons, and risks you may not have considered

- Set expectations around ownership structures based on deposit contributions

- Only match you with lenders that allow joint mortgages with parents/third parties

- Ensure you have all co-ownership agreements and deeds of trust completed properly

Making an uninformed decision on a joint mortgage can quickly turn into a headache for friends or even close relatives. So take advantage of mortgage advisors’ expertise in this arena.

Looking for the right broker? Get in touch. We’ll connect you with a qualified mortgage broker for a free, quick, and no-obligation consultation.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

What happens if one person can’t make their mortgage payment?

When someone with a joint mortgage can’t make their payment, everyone on the mortgage is still liable.

With joint mortgages, all borrowers are equally responsible. If one person defaults, the others have to cover the missing amount.

If they don’t, everyone’s credit score takes a hit, and they could even lose the house in foreclosure. The key is to talk to the lender as soon as money gets tight.

They might be able to help with things like payment holidays, changing the loan terms, or getting a better interest rate.

What options are available if someone wants to move out of the property in a joint mortgage?

If one person wants to leave a joint mortgage, there are a few solutions. The remaining co-owners can buy out their share, removing them from the mortgage entirely. This requires agreeing on a price.

Renting out the vacant room(s) is another option, though you’ll need the lender’s approval first.

Finally, selling the property and splitting the proceeds amongst co-owners is a clean break, but requires agreeing on a selling price and factoring in estate agent fees.

It’s wise to consult a mortgage broker for tailored advice on the best course of action.

Does everyone on the joint mortgage have to live in the home?

Not everyone on a joint mortgage needs to live in the house. For instance, a parent might help their child buy a place by co-signing the mortgage but keep living in their own home.

The catch? The person who doesn’t live there is still on the hook for the mortgage payments and any problems that might crop up.

Make sure everyone involved fully understands their responsibilities and potential risks before jumping into this kind of agreement.