What Happens to My Mortgage If I Die? A Must-Read Guide

Mortgages – we know them, we pay them, but what happens to them when we’re gone? It’s a question some of us avoid.

But, as difficult as it might be, it’s a conversation worth having.

In the UK, your mortgage doesn’t vanish into thin air. It becomes a part of your estate and the way it’s handled can be a bit of a maze.

Clarity around this topic can give you peace of mind and arm your loved ones with the necessary knowledge. This can help prevent any surprises during a difficult time.

This guide offers clear, straightforward answers to your questions about your mortgage and property after death. From understanding the process to the handling of different types of mortgages, and the other options open if you can’t afford repayments, we’ve got you covered.

What Happens to a Mortgage When Someone Dies?

Contrary to what some might think, a mortgage doesn’t just disappear upon the death of the holder.

This becomes part of the estate and must be paid off before any savings or assets are distributed to family members or other beneficiaries named in the will.

The aftermath of a mortgage after the death of a borrower hinges on some factors:

- The type of mortgage you have.

- The remaining mortgage balance and any other debts.

- Whether there are any other borrowers still alive.

- Whether a life insurance policy exists

- The kind of property ownership.

- The relationship of surviving borrowers to you.

- The presence and specifics of a will.

If the legal process called probate finds that your surviving relatives can’t handle the mortgage obligations, or if no relatives are found, the lender can sell the property to get back the debt.

What to Do After Mortgage Holder Dies?

Step 1: Notify the Lender

When the mortgage holder passes away, the first step is to let the lender know. Typically, the person managing the deceased’s financial matters called the executor or administrator, takes on this task.

Even though it’s a tough time, telling the mortgage provider sooner rather than later can help avoid problems down the line.

Step 2: Present a Copy of the Death Certificate

To confirm the death, the lender will ask for a copy of the death certificate. This official document is crucial as it allows for the transfer of assets and the settling of any outstanding debts.

Depending on the situation, the lender might also want to see the will. After the lender knows about the death, they’ll usually start what’s called a ‘bereavement process’.

Lenders understand it’s a difficult time and might offer a short ‘mortgage payment holiday’. This breather gives you some time to sort out the estate and go through the probate process.

Just remember, during this break, the mortgage interest doesn’t stop. This means the total debt could end up being a bit higher.

During this period, it’s a smart move to get advice from a legal expert. They can help you understand what you need to do when transferring a mortgage after someone died.

Step 3: Initiate the Probate Process

This is where things get a bit legal. When someone dies, their estate, including property and any mortgages, has to go through a legal step called probate.

This process makes sure all of the deceased’s debts are paid and that any remaining assets are given to the right people.

The executor or, in the absence of a will, an administrator appointed by the court, navigates this step.

The Executor’s Role

The executor is the person named in the will who’s in charge of looking after the estate, including the mortgage. If there’s no will, the court picks someone, known as an administrator, to do these jobs.

The executor tells any creditors about the death, pays off debts, and gives out any remaining assets based on the will or the rules of intestacy.

Probate Timeline

The length of the probate process can change depending on how complicated the estate is.

During this time, the executor needs to keep making the mortgage payments. They might use the estate’s funds or arrange a payment break with the lender.

Step 4: Assess the Estate and Settle Debts

Here the executor or administrator takes account of the deceased’s estate. This comprises all their assets and liabilities, including the mortgage.

After this, any outstanding debts are settled from the estate’s assets. If the estate holds enough assets to clear the mortgage, it’s paid off at this stage.

Step 5: Distribution of Estate

After settling the debts, the remaining assets from the estate are distributed among the heirs as dictated by the will. In the absence of a will, these assets are divided according to the rules of intestacy.

Handling of property and the mortgage varies based on circumstances and ownership. This can also depend on the types of mortgage involved.

Types of Mortgages and Their Specific Processes

As mentioned earlier, dealing with a mortgage after someone’s death can vary depending on the type of mortgage. Let’s look at a few common ones:

Repayment Mortgages

With this type of mortgage, you pay back the debt bit by bit over the mortgage term. If the borrower dies, whatever’s left of the mortgage debt is taken from the estate.

The executor usually uses the assets from the estate to pay off this debt, often by selling the property.

Interest-Only Mortgages

In an interest-only mortgage, you don’t pay back the main loan during the mortgage term, only the interest. The full balance is due at the end.

If the borrower dies before then, the remaining loan still needs to be paid. Usually by selling the property.

But, in some cases, the repayment strategy may rely on assets like stocks and shares expected to appreciate over time.

Buy-to-Let Mortgages

If a property owner with a buy-to-let mortgage dies, the property is usually sold, and the money from the sale is used to pay off the mortgage.

But, if the property is inherited, the new owner could decide to keep renting it out and take over the mortgage payments themselves.

Inheriting buy-to-let property may come with tax implications, making it essential to consult a qualified tax advisor and a mortgage broker who specializes in investment properties.

Joint Mortgages

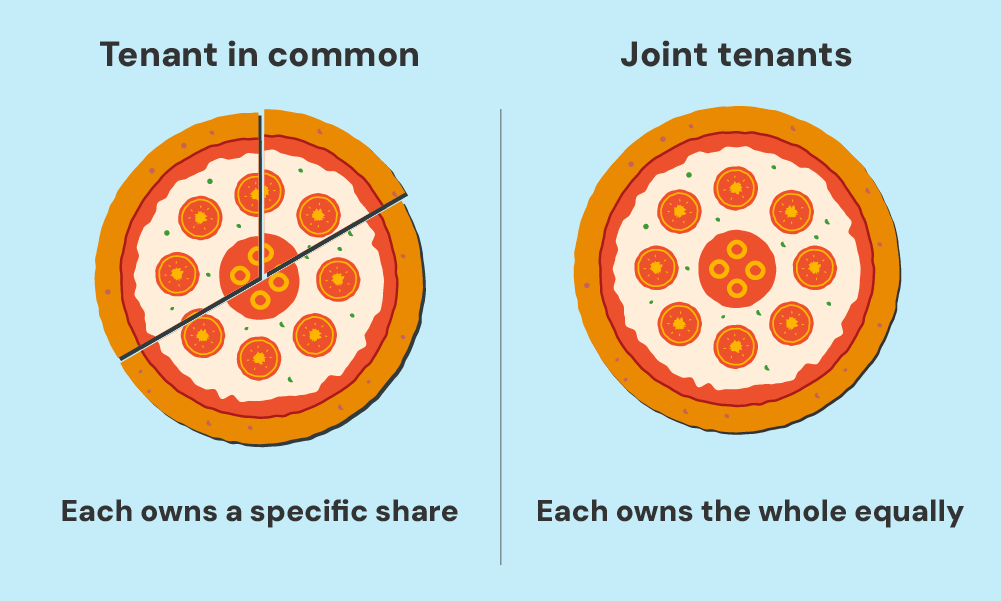

In a joint mortgage, the impact of death largely depends on the property’s ownership structure – joint tenancy or tenants-in-common – and whether the deceased had a will in place.

Joint Tenancy

If one owner dies, the other one automatically inherits the property and the remaining mortgage debt. But, they’ll need to show the lender they can afford the ongoing repayments.

Tenants-in-common

In this case, each co-owner holds a distinct share of the property. Upon death, their share doesn’t automatically transfer to the surviving co-owner(s).

Instead, it forms part of their estate and is distributed according to their will or the laws of intestacy.

Lifetime Mortgages (Reverse Mortgage)

In the UK, a lifetime mortgage lets homeowners aged 55 or over, take some equity out of their property.

After the owner’s death, the loan and any accumulated interest are usually paid off by selling the property. Any remaining equity is then distributed to the beneficiaries named in their will.

What to Do If You Can’t Afford the Repayments?

Coping with a mortgage after one’s death can be emotionally tough. This might also pose a financial challenge.

But, if the surviving relatives can’t afford the repayments, there could be other options to consider.

- Payment Holiday: Many lenders understand how hard this time can be and might offer a ‘payment holiday’. This break gives you some time to get your finances in order.

- Extend the Mortgage Term: Making the repayment period longer can reduce your monthly payments, making them more manageable.

- Remortgage for a Lower Interest Rate: If interest rates have gone down since the mortgage started, a remortgage could be a good idea. This move can lead to lower monthly payments.

- Change to Interest-Only Mortgage: Switching the mortgage to an interest-only loan could cut your monthly payments significantly, as you’ll only be paying off the interest.

- Selling the Property: If other options are not viable, selling the property might be the best course of action. After clearing the mortgage, the remaining funds can be divided among the heirs.

- Downsizing: This involves selling the current property and moving to a smaller, more affordable one. This could free up cash to help pay off the mortgage.

- Insurance Payouts or Employer Death-in-Service Benefit: Using funds from insurance policies or an employer’s death-in-service benefit could help pay off a portion of the mortgage.

Why Writing a Will Matters?

A well-written will is an invaluable guide when it comes to inheriting property and dealing with mortgages after death. Here’s why:

- Clear Instructions on Inheritance – A will states clearly who gets the property. It simplifies the process and can prevent potential disputes among surviving relatives.

- Instructions on Property and Mortgage – Your will can provide clear instructions about your property and mortgage, ensuring your wishes are respected.

- Safeguarding Partners Living in the Property But Not on the Mortgage – If your partner lives with you but isn’t named on the mortgage, your will can make sure they have a right to continue living in the property.

Writing a will is key to ensuring that your wishes are honoured and that the transition process for your loved ones is as smooth as possible.

Key Takeaways

- Mortgages don’t disappear after death. They become part of your estate and must be settled.

- The fate of the mortgage depends on factors like the type of loan, ownership structure, and whether a life insurance policy exists.

- The executor of the will or an appointed administrator is responsible for managing the estate, settling debts, and ensuring mortgage payments continue during probate.

- If the mortgage can’t be covered by the estate, the lender may sell the property to recover the debt, unless surviving relatives take over payments or remortgage.

- Different mortgage types, such as joint, interest-only, buy-to-let, and lifetime mortgages, have specific rules that impact how they’re handled after death.

- If surviving family members can’t afford the mortgage, options like a payment holiday, extending the term, remortgaging, or selling the property may help.

- Writing a will ensures that property inheritance is clear, reducing disputes and making it easier for loved ones to handle mortgage responsibilities.

The Bottom Line

Handling a mortgage after someone passes away can be stressful, but having a plan in place makes things much easier.

Whether you’re managing a loved one’s estate or planning for your own future, taking the right steps now can save a lot of hassle later.

Speaking to a mortgage expert can help you understand your options and make informed decisions. Every situation is different, so getting the right advice is key.

Need guidance? Simply fill out this quick form. Our team is ready to connect you with a reliable mortgage broker who can provide clear, personalised advice.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

Can I assume my parents' mortgage responsibilities if they die?

Yes, if you inherit the property and meet the lender’s criteria, you can take over the mortgage repayments.

Is it possible to maintain a mortgage under the name of a deceased individual?

Temporarily, yes. But it’s advisable to transfer it to the new owner’s name as soon as possible to prevent potential issues with the lender.

What happens if my husband died and my name is not on the mortgage UK?

You can usually still inherit the property even if your name isn’t on the deed. But, you need to register the ownership in your name with the Land Registry and add your name to the mortgage paperwork. You can negotiate with the current lender or remortgage with another provider. This process may also differ depending if there is a will and the type of property ownership.

This article has been fact checked

This article was created, checked, and verified by the expert team at Money Saving Guru. Trust us, you’re in good hands.