Mortgages for Foster Carers: A Step-by-Step Guide in 2025

Buying your own home as a foster carer in the UK?

The impact you make on children’s lives is truly incredible. Every day you open your doors to children who need love, stability, and a place to call their own.

But when it comes to financing your own home, it can be a major challenge. That’s because many lenders usually don’t consider your foster allowance as income.

You might also be seen as self-employed, which can make it harder to get a better deal. Plus, the mortgage process can be daunting, leaving you unsure where to start.

These hurdles might have kept you from stepping onto the property ladder. So we’ve put together this guide to help you.

In this article, we’ve simplified the mortgage process into easy steps for a successful application. We’ve also included valuable insights to help you make smart decisions on your mortgage journey.

Whether you’re a first-time buyer, looking for ways to borrow, or dealing with bad credit. This step-by-step guide can help you understand how foster carers get mortgages in the UK.

Can Foster Carers Get Mortgages?

Yes, as long as you meet a lender’s criteria and can afford it, you can get a mortgage. There are no specific mortgages tailored for foster carers.

You can apply for the same standard mortgages as other borrowers.

Getting a mortgage when you’re a foster carer can make the process a bit more complicated though. Lenders may not be familiar with your income and might have extra requirements.

Not many lenders accept foster carers’ full allowance income, which limits your mortgage options. Your biggest challenge is finding a lender who understands your situation and counts all of your income.

How Much Can You Borrow?

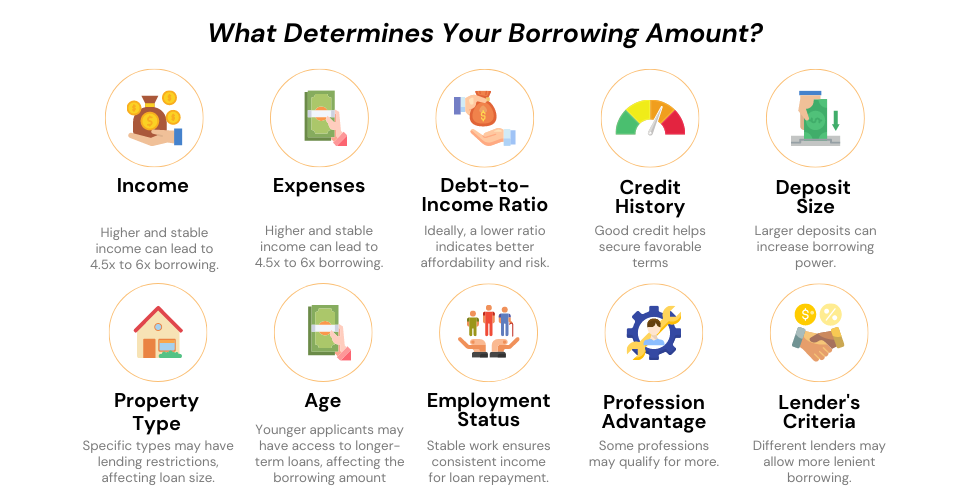

Lenders calculate your borrowing limit by multiplying your annual income by 4 or 5. But not all lenders do it the same way. They have different rules for including your income.

Some lenders don’t count fostering income, which can reduce your borrowing. For example, let’s say you earn £35,000 from a salary and £22,000 from fostering.

- With both incomes considered, you could borrow up to £285,000 ((£35,000 + £22,000) x 5).

- Without fostering income, your borrowing limit drops to £175,000 (£35,000 x 5).

They may also consider any children you have, including your own and foster children, as dependents when assessing your affordability. Your borrowing amount can be affected by your income, debts, credit score, and deposit size.

How to Prepare to Get Mortgages for Foster Carers?

Mortgages for foster carers work the same way as standard mortgages. The only difference is that lenders might have different requirements and terms. Here are some simple steps you can take to prepare for your application.

Step 1: Get Your Finances in Order

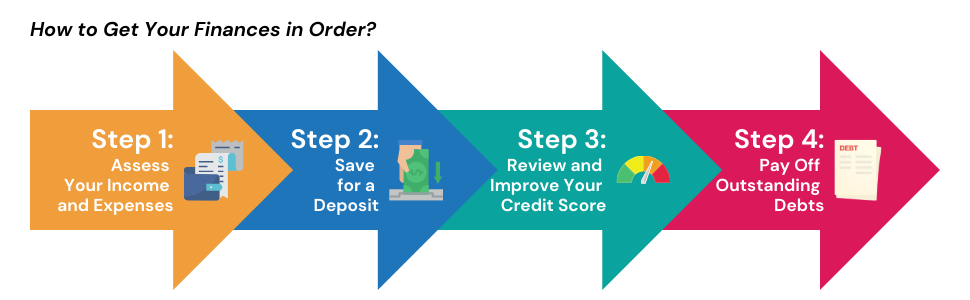

It’s important to have a clear picture of your financial situation before you apply for a mortgage. Here are some steps you can follow:

> Assess Your Income and Expenses

Make a list of all your monthly income and expenses. This will help you see where your money is going and how much you can afford to spend on a mortgage.

Lenders want to see that you’re able to afford a mortgage. So it’s best to have a good track record of managing your finances.

> Save for a Deposit

A bigger deposit gives you better options. Lenders usually ask for a 5% deposit. But you’ll get better rates with 10% or more for residential properties. For buy-to-let properties, you’ll need a 25% deposit.

Consider opening a separate savings account specifically for your deposit. Look for ways to boost your savings, like cutting down on non-essential spending or finding extra sources of income.

> Review and Improve Your Credit Score

Get a copy of your credit report from Experian, Equifax, or TransUnion. Check for any mistakes or issues that could be affecting your score.

Lenders will look at your financial stability and creditworthiness. So it’s a good idea to pay off any debts and improve your score if you can.

> Pay Off Outstanding Debts

Lenders check your debt-to-income ratio (DTI). This is the percentage of your monthly income that goes towards debt repayment.

A lower DTI ratio will make you look like a more reliable borrower. To reduce your DTI ratio, you can pay off outstanding debts. You can start by prioritizing high-interest debts, like credit cards or personal loans.

Step 2: Get Your Documents in Order

As a foster carer, here are the documents you need to get ready:

- Proof of income and proof of being a foster carer:

- Remittance slips for at least 6 months to know how long you’ve been a foster carer

- A letter from your fostering agency or local authority stating that you will continue fostering in the future.

- Proof of identification: Passport, driver’s license or other government-issued ID

- Proof of current address: Utility bills or bank statements

- Proof of your savings and deposit

- Details of any outstanding debts

Some high-street lenders treat foster carer income as self-employed. They usually ask for 2 years of accounts and SA302 tax returns, which are official summaries of your annual income reported to the UK’s HM Revenue & Customs (HMRC).

These lenders may only consider your net income – earnings after expenses and taxes. This can lower your borrowing amount.

So it’s important to shop around and compare lenders, including those that specialise in lending to foster carers.

Step 3: Get a Good Mortgage Advisor

A good mortgage advisor can help you get a mortgage by making the most of your income and finding a lender who is a good fit for you. They will:

- Understand your income sources and make sure all of your income is counted.

- Find lenders who are willing to lend to foster carers.

- Help you get the best possible deal on your mortgage.

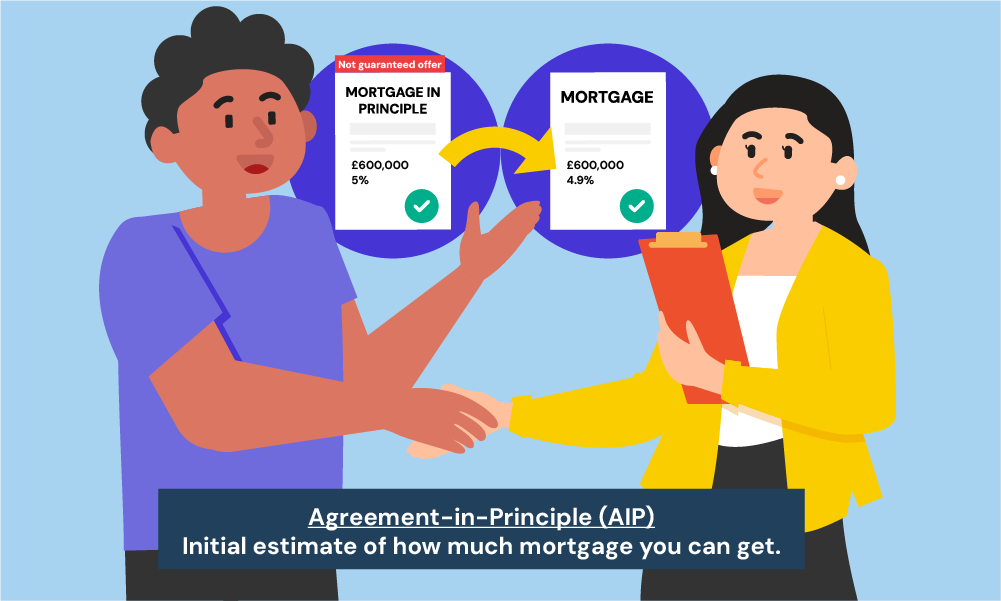

Step 4: Get an Agreement-in-Principle (AIP)

An AIP (agreement in principle) from a lender shows how much you can borrow to buy a home. It’s not a guaranteed mortgage offer, but it can help you get started on your house hunt.

When you’re viewing properties, an AIP shows sellers you’re serious and helps you budget for your search. To get an AIP, you need to give the lender some info about your finances. It’s best to complete step 1 first.

Once you’ve applied, the lender will assess your ability to repay a mortgage and will then issue an AIP. This is valid for 60 to 90 days. That’s plenty of time to find a property and apply for a mortgage.

Avoid unnecessary AIP applications in a short period. Some leave a mark on your credit file, potentially impacting your credit score. Lenders might think you’re struggling to borrow money.

If you’re buying a home, get an AIP early on. It’ll help you make informed decisions and know you’re on the right track before viewing properties

Mortgages for Fosters Carers with Bad Credit

Bad credit can make it harder to get a mortgage. The severity and length of your bad credit will affect your options. But that doesn’t mean it’s impossible.

Some specialist lenders will lend to you. They will evaluate based on your circumstances, like how bad your credit is, what you’ve done to improve it, and your overall finances.

If you have bad credit, you may have to pay a higher interest rate, put down a larger deposit, or get a guarantor. So it might be best to wait until you improve your credit before applying for a mortgage.

Do Mortgages to Help Foster Carers Exist?

Yes. Foster carers qualify for professional mortgages. Certain lenders have specific eligibility criteria and benefits for you. They recognise the valuable service you provide to the community.

There are also government schemes that can help you to buy a home. These schemes aren’t specifically for foster carers, but they can still be helpful. Here are a few of the schemes available:

- First Homes – offers discounted homes to first-time buyers.

- Shared Ownership – allows you to buy a share of a home and rent the rest.

- Right to Buy – gives council tenants the right to buy their homes at a discounted price.

Learn more about this on the government website.

The Bottom Line

Securing a mortgage as a foster carer in the UK can be tough, but it’s not impossible.

Specialist lenders who understand your situation and will include your fostering income exist. So it’s important to find the right lender for you.

To ace your mortgage application, follow the steps in this guide. From sorting your finances to saving a deposit, improving your credit score and getting your paperwork ready.

It will take time but it’s worth the wait to be financially secure before heading to a mortgage lender.

If you’re still struggling to get a mortgage, team up with a good mortgage broker. To do this, simply drop us a line today. We’ll put you in touch with a good broker who specialises with foster carer mortgages and can help you get the best deal for your needs.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

Can I remortgage my home as a foster carer?

You can remortgage as a foster carer, but you’ll need to find a lender who accepts your full fostering income. You can use a remortgage to get a better deal, consolidate debt, or pay for home improvements.

It’s a good idea to check the equity in your property before you remortgage. Equity is the difference between the value of your home and the amount you owe on your mortgage. Once you know how much equity you have, you can start shopping around for a better deal.

Some lenders offer lower fees and interest rates for foster carers, so it’s worth comparing your options.

Do foster carers get charged higher interest rates on mortgages?

Not always. Mortgage rates can vary depending on your finances, credit history, and the lender you choose. Fluctuating income from fostering may affect interest rates, but not always. A good mortgage advisor who specializes in foster carers can help you find the best deal.

This article has been fact checked

This article was created, checked, and verified by the expert team at Money Saving Guru. Trust us, you’re in good hands.