A Complete Guide: Mortgages for Professionals

If you’ve worked hard, got yourself qualified, and are ready to buy a house, you might be wondering if there are mortgages for professionals like you.

The good news is – there are!

Many lenders offer professional mortgages with favourable and flexible terms. As a professional, you’ve shown that you’re responsible and have a predictable career path. This makes you an attractive borrower to lenders, as they can easily assess your likelihood of defaulting on repayments.

But is your job the only thing that affects your chances of getting a mortgage? We’ve covered that in this article.

What is a Mortgage for Professionals?

Mortgages for Professionals aren’t a specific type of mortgage, but a term used to describe mortgages offered to professionals.

Technically, professionals can apply for the same mortgages as everyone else, but some mortgage lenders offer them special treatment. They might get lower interest rates, higher loan-to-value ratios, or faster mortgage approval.

As a professional, you’re seen as more reliable and trustworthy than other borrowers. This is because professionals typically have high levels of education and training, and carry a great deal of responsibility. You’re also more likely to have a steady income and a good credit history.

Being a professional makes you a low-risk borrower in the eyes of lenders. This means that they’re more likely to be flexible when assessing your affordability and offer you exclusive rates.

Which professions are considered to be low-risk borrowers?

Here are the professions that are considered low-risk borrowers by mortgage lenders:

Medical professionals

General professionals

- Solicitors

- Barristers

- Accountants

- Architects

- Surveyors

Key workers

- Police officers

- Firefighters

- Military

- Teachers

- Social workers

- Civil servants

High earners

- Individuals earning over £100,000 per year

- Company directors and executives

- Investment bankers

- Asset-rich individuals

If you work in one of these professions, you’re likely to have a stable job with a clear career path and internationally recognised qualifications. This makes you a lower risk to lenders, who may offer you a better deal on a mortgage. As a result, you can enjoy a number of benefits when getting a mortgage.

Benefits of Mortgages for Professionals

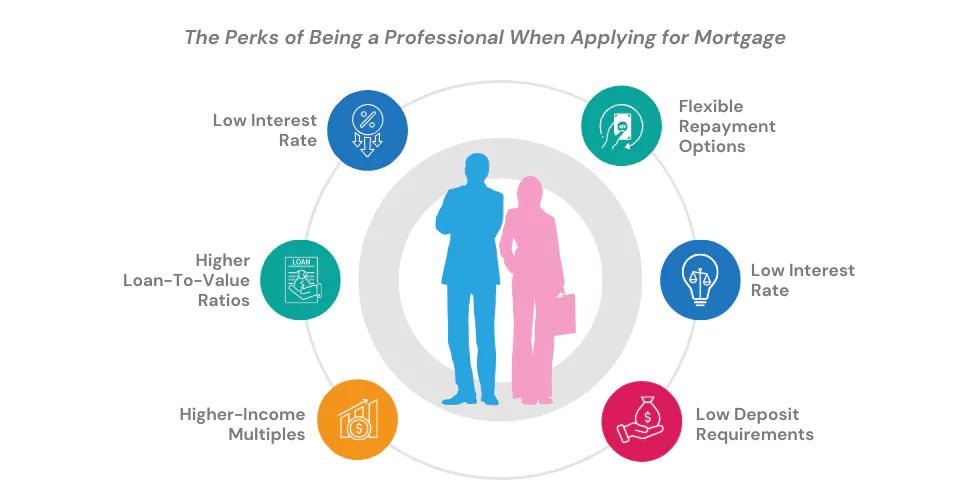

Here’s what you can get with a professional mortgage:

- Lower interest rates. Many lenders offer lower rates to professionals, so you could save hundreds or even thousands of pounds over the mortgage term.

- Lower deposit requirements. Some lenders may be willing to lend to professionals with a smaller deposit. For instance, an average mortgage borrower will have to pay a 15% deposit for a specific rate, but a professional may only need 10%. This can get you onto the property ladder sooner.

- Higher-income multiples. On average, lenders lend between 4.5 and 5 times your salary, but for professionals, some lenders will go up to 5.5 or even 6 times.

- Higher loan-to-value ratios. For example, 90% of the property value rather than 80% offered to other types of borrowers.

- Flexible repayment options. Some lenders offer flexible repayment options, such as the ability to make overpayments or take a payment holiday, so you have more control over your finances and can manage your mortgage more easily.

- Faster decision-making. Lenders may be able to decide on your mortgage application more quickly if you are a professional, so you could save time and stress.

Eligibility for Professional Mortgages

There are tons of professional mortgage loans in the UK, each with its own criteria. But generally, you need to meet the following to qualify for the benefits:

- Be qualified in a profession recognised by a registered body.

- Be working in a professional role or currently training to be a professional.

- Have a good credit score.

- Have a stable income that can cover the monthly repayments.

- Have a debt-to-income ratio below a specified amount.

- Meet the lender’s deposit requirements.

If you meet all of these criteria, you’re likely to be eligible for a good mortgage loan. But don’t rush into anything. Take your time to compare different deals and find the best one for you.

How much can you borrow for a professional mortgage?

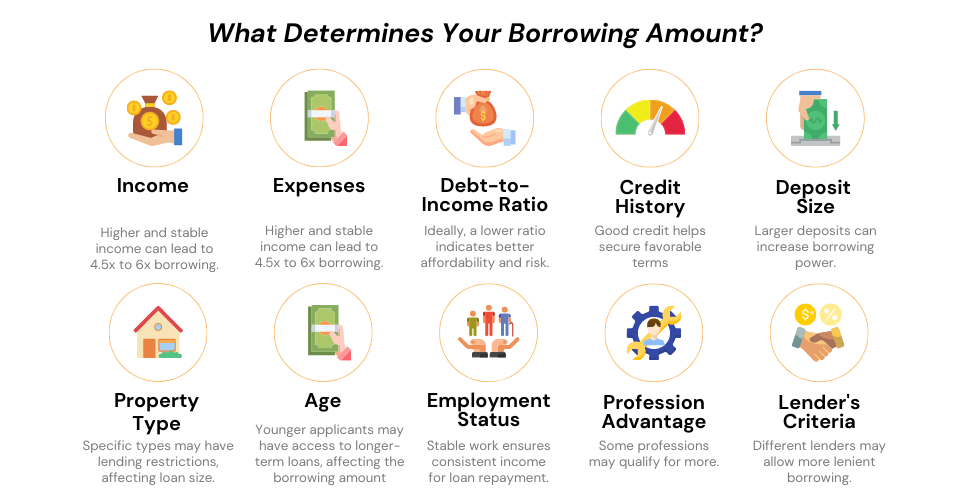

How much money you can borrow as a professional in the UK depends on a few things, like your income, profession, deposit size, and the lender you choose. In general, professionals can borrow more than the average worker.

Lenders usually lend up to 4.5 times a borrower’s gross annual income. But professionals with a high income and good credit scores can borrow up to 6 times. For example, a doctor with a gross annual income of £100,000 could borrow up to £600,000.

Some professions are seen as more stable and secure than others, and lenders may be more willing to lend to borrowers in these professions. For example, doctors, dentists, and lawyers are often seen as being in stable professions, and lenders may be willing to lend them more money.

The size of the deposit is also an important factor. A larger deposit shows lenders you’re a lower risk, so you may be able to borrow more money. Lenders usually ask for a 5% deposit, but only if you can afford the loan and have a good credit rating.

Finally, a professional’s borrowing power will be affected by the lender’s policies. Some lenders have stricter lending criteria than others. It’s a good idea to speak to a mortgage advisor to find the best mortgage for your circumstances.

Can self-employed professionals get a mortgage?

As a self-employed professional, you have invested a lot of time and money into your skills and qualifications, showing you’re determined and likely to stick at it. But, lenders might still ask about the stability and reliability of your income.

Self-employed professionals often have variable earnings, which means that their income can fluctuate from month to month. This is because their income is directly linked to the amount of work they do.

For instance, a self-employed architect might be asked to work longer hours or take on an extra project one month, which would lead to a higher income. However, the following month, they might have less work and earn less.

This can make it hard for mortgage lenders to work out how much you can afford to borrow. Instead of using income multiples of 4.5 to 6.5, lenders for self-employed borrowers often assess each case on its own merits.

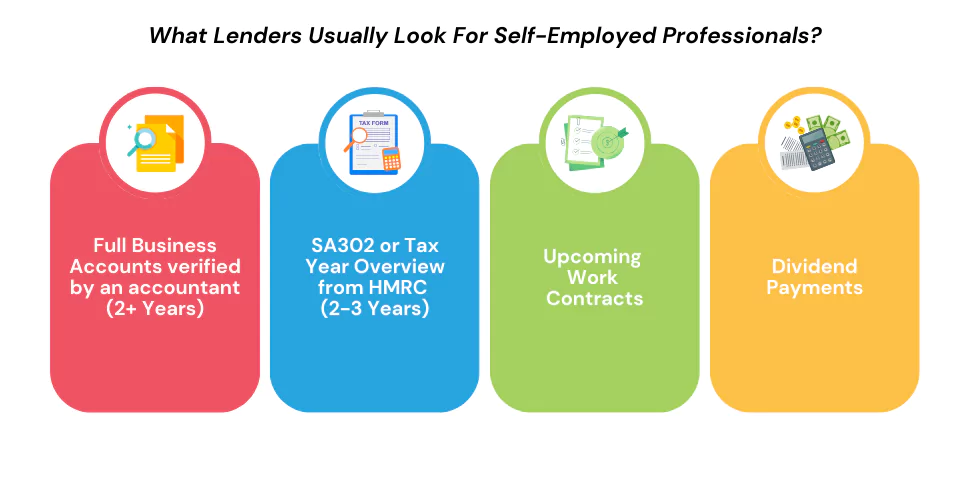

If you’re self-employed, be prepared to show your lender that your income is steady and reliable. Lenders will likely ask for two or more years of full business accounts, a SA302 or tax year overview reported to HMRC for the past two to three years, upcoming work contracts, or evidence of dividend payments if you’re a company director.

The Bottom Line

In the UK, degree-qualified professionals like doctors, teachers, accountants, lawyers, and other skilled workers are considered low-risk borrowers. Lenders are happy to lend to them because they have a stable career path and a predictable income.

Being a professional doesn’t mean you’ll get a mortgage from every lender. Your credit score, debt-to-income ratio, and the current market can all affect your ability to borrow. That’s where a mortgage advisor can come in handy.

A good mortgage advisor could be your financial tour guide, helping you avoid pitfalls and get to your destination safely. They know all the different types of mortgages and options available, so they can help you find the one that’s right for you.

Seeking help from a good mortgage advisor can save you time, money, and stress. To seize this opportunity, get in touch with us today. We’ll match you with an excellent mortgage advisor who specialises in mortgages for professionals.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

How do I get a professional mortgage?

The process of getting a professional mortgage is the same as getting a regular mortgage, but lenders see professionals as low-risk borrowers, so you may be offered better terms. Here are the steps to follow to get an exclusive deal:

- Get your paperwork in order. This includes your proof of income, employment history, and bank statements.

- Check your credit report. Make sure there are no errors or negative marks on your report.

- Save for a deposit. Most lenders require a down payment of at least 5% of the purchase price of the home. If you can afford to save more, you’ll get a better interest rate on your mortgage.

- Speak to a specialist mortgage advisor. A mortgage advisor can help you compare lenders and find the best deal for your needs.

Can I get a mortgage as a professional if I have debt?

Yes, it is possible. Lenders use your debt-to-income (DTI) ratio to decide whether to lend you money. A lower DTI ratio means you have less debt relative to your income. This makes you more attractive to lenders because you’re seen as a lower risk, and you’ll be offered more deals. If your DTI ratio is high, fewer lenders will be willing to lend you money, even if you’re a professional.

Generally, a good debt-to-income (DTI) ratio to aim for is between 36% and 43%. Some lenders may go higher, but the lower your DTI, the more likely you are to be accepted for a mortgage. Different lenders have different DTI requirements, so it’s important to compare multiple lenders before applying (Young and Zinn 2022, Forbes Advisor.)

Can newly-qualified professionals apply for a mortgage?

Yes. Some mortgage lenders will lend newly-qualified professionals up to 5.5 times their annual salary, like Clydesdale Professional Mortgage. You’re also more likely to get a mortgage than someone who recently started a new job in a line of work that lenders don’t favour.