- What is a Day One Remortgage?

- How Day One Remortgages Work?

- Who Qualifies for Day One Remortgages?

- Why Consider a Day One Remortgage?

- How To Successfully Apply for a Day One Remortgage?

- Which Providers Offer Day One Remortgages?

- What Are the Alternatives?

- The Bottom Line: Make Smarter Choices with a Remortgage Broker

The Ins and Outs of Day One Remortgage: A Complete Guide

Remortgaging your newly bought property recently got a whole lot easier with day one remortgage.

Gone are the days of marking off the calendar until you’ve owned your property for a long.

The strategy lets you apply for a remortgage right after stepping into your new home, often in a matter of days.

Sometimes, speed is of the essence. But the remortgaging market is vast and diverse, so you should keep your watchful eye to land the best deal.

Here’s a detailed overview to help you devise a winning plan.

What is a Day One Remortgage?

Day one remortgages (sometimes known as “back-to-back” mortgages) let you switch your mortgage just after you’ve bought a property.

This seems like a quick fix to cash in on good market rates or sort out immediate financial needs. But, it’s not a straightforward process.

Many lenders follow a “six-month rule,” requiring you to have owned the property for at least half a year before they’ll even consider a remortgage. Some are even stricter, expecting you to wait a full year.

This rule came into play after the 2008 financial crisis to keep the UK housing market stable.

At that time, people were snapping up cheap properties, often at forced sales or auctions. And then remortgaging them at their full market value.

This risky behaviour led to negative equity for homeowners and forced banks into repossessing properties worth less than the amount they had lent.

Because of this rule, and its aim to protect the market, securing a day one remortgage is usually quite challenging.

But, some lenders have relaxed their rules a bit, especially if you have strong reasons like an emergency or stable income and good credit.

There are even specialist lenders who might consider your application if you can prove why you bought the property in the first place.

In short, day one remortgages can help you financially, but they’re often harder to get than regular remortgages. Knowing the lender’s rules and what’s happening in the market can help you out.

How Day One Remortgages Work?

Day one remortgages are like regular remortgages, but you can apply for them immediately after buying a property.

A crucial detail is that the Land Registry might not update your ownership status for up to six weeks, sometimes even longer.

During this period, your solicitor can verify your ownership to facilitate the remortgage process.

In terms of how much you can borrow, lenders generally offer a loan-to-value (LTV) ratio of 75% to 85%. In special cases, some lenders might go up to 95% or even 100%.

Before moving forward, it’s important to check your existing mortgage for any early repayment fees, which can range from 1% to 5% of the borrowed amount. These charges can make remortgaging more expensive than you might expect.

If you’re unsure about whether a day one remortgage is the right move, consulting a remortgage broker can provide clarity.

Brokers offer impartial advice to help you determine if remortgaging is in your best interest or if sticking with your current lender is a wiser choice.

Imagine walking out of a shop with a brand-new TV and immediately trading it in for a better model on sale. That’s a day one remortgage—quickly taking advantage of a good deal but with conditions.

Who Qualifies for Day One Remortgages?

If you’re thinking about getting a day one remortgage, there are a few key factors that can make or break your application.

Here’s a quick rundown:

- Strong Credit Score. Lenders want to know you’re reliable. A high credit score shows you’re good at managing debt and making timely payments.

- Stable Income. Whether you’re on a salary or self-employed, you’ll need to prove that you have a regular income. Lenders want assurance that you can cover the monthly repayments.

- Property Value. Generally, you can borrow between 75% to 85% of your property’s value. In some special cases, this could go up to 95% or even 100%.

- Valid Reason for Remortgaging. Lenders are more likely to approve your application if you have a strong reason for needing the remortgage, like an emergency expense or a chance to lock in a lower interest rate.

So, there you have it. Keep these points in mind, and you’ll be better prepared when applying for a day one remortgage.

Why Consider a Day One Remortgage?

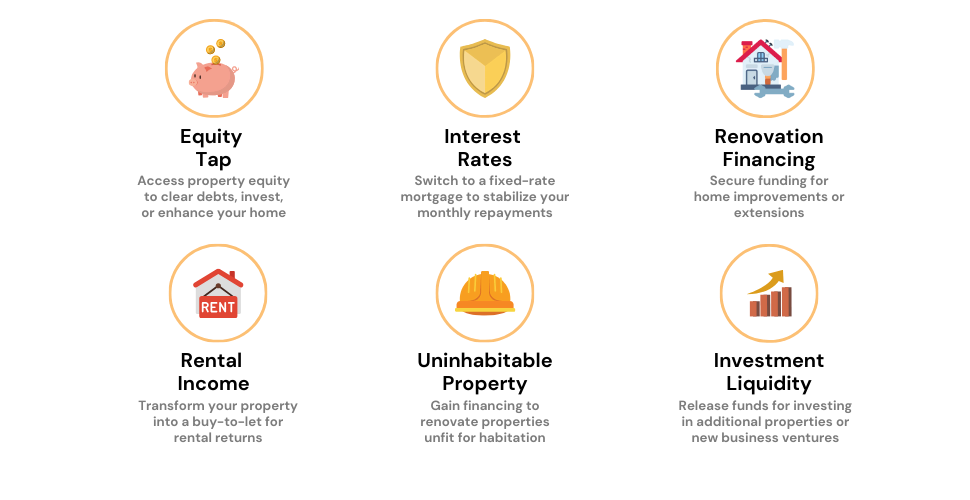

Brits opt for day one remortgage for diverse reasons. Let’s look at some of the most popular scenarios:

- Tap into the equity in your new property. Whether you inherited it or got a great deal, you can use the equity to pay off debt, invest, or make home improvements.

- Protect yourself from rising interest rates. Switch to a fixed-rate mortgage to lock in your monthly payments.

- Get the financing you need to renovate. Whether you’re adding value or making your home more livable, we can help you get the financing you need.

- Make your new property a rental. Switch to a buy-to-let mortgage and start earning rental income.

- Secure traditional mortgage financing. If you’ve acquired an uninhabitable property, we can help you get the financing you need to make it livable.

- Get the liquidity you need for your next investment. Whether you’re buying another property or starting a business, we can help you free up the cash you need.

While the benefits of remortgaging are plenty, they’re not for everyone. You should carefully assess your financial goals before joining the tide.

It’s generally best to consult professional remortgage brokers to ensure you leave no stone unturned when searching for the best deal.

These guys draw on exceptional market know-how and exclusive connections with lenders to ensure a perfect match.

To take advantage of this, reach out to us. Complete this form, and we’ll match you with a remortgage broker who can meet your financial needs.

How To Successfully Apply for a Day One Remortgage?

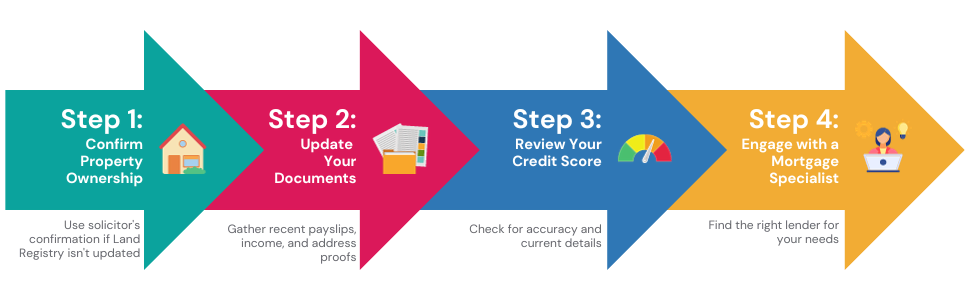

The process for a day one remortgage is quite similar to a regular remortgage. Here are the steps to make your application a success:

Step 1: Confirm Your Property Ownership

If the Land Registry hasn’t updated your name on the title deeds, you’ll need a different form of ownership proof.

Your solicitor can confirm when you became the owner and the price you paid for the property.

Step 2: Update Your Documents

The original purchase required payslips, proof of income, and proof of address. These documents might be outdated now, so gather the most recent ones.

Be prepared with all necessary papers to avoid delays.

Step 3: Review Your Credit Score

Before you apply, check your credit report for accuracy. Make sure it reflects your new address and current mortgage details.

There are online platforms where you can access your credit report for free.

Step 4: Engage with a Mortgage Specialist

Day one remortgages are specialised products. A mortgage advisor who specialises in this area will know the right lender for your situation.

Speaking to one can enhance your chances of a successful application.

Keep these steps in mind to make your day one remortgage application straightforward and successful.

Which Providers Offer Day One Remortgages?

High-street banks such as Natwest, Nationwide, and Barclays are among the lenders offering day one remortgages. However, lenders often have stringent criteria that you’ll need to meet.

For example, proof of property ownership from your solicitor will likely be required.

Some lenders may also impose conditions, like if you acquired the property below market value, perhaps at an auction; they might limit the remortgage to the purchase price only.

Given the different lender criteria, consulting a mortgage specialist who understands which lender best suits your needs can significantly improve your chances of approval.

What Are the Alternatives?

While day one remortgaging may tickle your fancy, it’s not always the wisest solution for your financial needs.

If you don’t face exceptionally strenuous circumstances and have time to wait, it might be wiser to stick with the classics and opt for standard remortgaging.

Waiting for a longer ownership period would allow you to build more equity and potentially access better mortgage terms.

Let’s now look at some other alternatives you have:

Second-charge mortgages (also known as ‘Secured Loans’)

This allows you to access a lump sum or a line of credit. Unlike day one remortgage which involves replacing your current mortgage with a new one, a second charge mortgage sits as a separate loan on your property.

This means you can keep your current mortgage intact, along with its interest rate and repayment terms. So if you need to switch to a better deal, this might not be your way to go.

These are short-term loans designed to bridge the financial gap between the purchase of a new property and the sale of an existing one.

Day one remortgages, on the other hand, are ideal if you want to take advantage of better mortgage terms or access equity shortly after acquiring a property.

If you opt for a bridging loan, remember, that bridges are meant to be crossed, not burned! These loans should be approached with caution as they almost always involve higher interest rates and short repayment terms.

The Bottom Line: Make Smarter Choices with a Remortgage Broker

Day one remortgaging offers the convenience of immediate access to mortgage funds.

Whether you aim to maximise the value of your property, venture into the buy-to-let market, or enhance your existing home, this financial option could be for you.

Remember though that the application process is not for the faint of heart, so you might need to consult brokers who can add a pinch of financial finesse.

Brokers are well-versed in the intricacies of mortgage products and the criteria set by different lenders.

They can guide you through the application steps, help you gather all the necessary documents, and even expedite the process by liaising directly with lenders.

Additionally, some brokers have access to exclusive deals not available to the general public, which could save you money in the long run.

If you’re feeling overwhelmed by the idea of a day one remortgage or just want to ensure you’re making the most informed decision, get in touch with us today.

We’ll connect you with a qualified remortgage advisor to guide you through the journey to financial freedom.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

What is the timeline for obtaining a day one remortgage?

Typically, the approval process takes around two weeks. Sometimes you can hear back in a mere 24 hours, but such instances are rare.

Note that the approval is just the beginning. The overall duration from offer to completion for a standard remortgage application averages around 12 weeks. This timeline may extend depending on the lender and your circumstances.

How can I get the best interest rates?

Decent interest rates depend on many important factors. Most importantly, a bad credit score can negatively impact your application and possibly result in exorbitant interest rates.

While some lenders may flat-out reject candidates with poor credit scores, others are willing to consider lending in such cases.

The amount of equity you have in your home is another important factor for calculating interest rates. Borrowers typically receive better rates when their loan-to-value (LTV) ratio is lower.

The lender’s choice may also be influenced by the sort of property you possess. Unusual properties, like listed structures, are frequently seen as a higher risk and may be turned down for approval.

To boost your chances of approval, carefully consider these factors and reach out to lenders who can cater to your specific needs.

What are the requirements to remortgage sooner than 6 months?

When seeking to remortgage within six months, approval is subject to more scrutiny and granted only in specific instances. While most eligibility requirements are similar to other mortgages, there are additional documents you’ll need to provide:

- Purchase Audit Trail. Documentation that outlines the history of the property purchase, including details of the transaction and any associated financial records.

- Confirmation from Solicitor. If you’re not yet listed as the owner in the Land Registry, you’ll need a solicitor’s confirmation to reflect your ownership.

- Completion Statement. A statement that verifies the original purchase price of the property.

- Evidence of Increased Valuation. If the value of your property has gone up due to renovations, you’ll need to provide supporting evidence, such as receipts and invoices.

It’s important to note that these requirements may vary depending on the lender and individual circumstances.

This article has been fact checked

This article was created, checked, and verified by the expert team at Money Saving Guru. Trust us, you’re in good hands.