- What is Consent to Let and How Does it Work?

- Why Would You Need Consent to Let?

- How Do I Get Consent to Let?

- Can I Live in the Second Property I Purchase?

- Will You Need to Remortgage Your First Property?

- Telling Your Mortgage Lender is Essential

- Other Costs to Budget For

- The Bottom Line: Get Expert Advice

How To Get Consent To Let To Buy Another Property?

Renting out your current home to become a landlord is tempting, especially if you’re moving, your family needs more space, or you want to try property investment.

But before you put up “For Rent” signs, check with your mortgage lender.

You’ll likely need their permission to rent out your property.

While it can be a smart decision, there’s more to consider before taking the plunge.

Here, you’ll get the details you need about consent to let and how to get one.

What is Consent to Let and How Does it Work?

Consent-to-let is a formal agreement or permission from your mortgage lender to rent out your house temporarily. It’s not a new loan, but an approval from your lender.

Most residential mortgages don’t allow you to rent out your property without permission.

By getting consent to let, you can rent your home for a fixed period, typically between 6 and 12 months.

Why Would You Need Consent to Let?

There are a few common scenarios where you might want to get consent to let on your current property:

- You’re relocating temporarily for work and want to rent out rather than sell

- You’re trying out living with a partner by moving into their place

- You’ve inherited a property and want to rent out your current one while deciding next steps

Some lenders may charge a fee or higher interest rates if you want to rent out your property. It’s always best to check with your lender first to confirm their requirements.

How Do I Get Consent to Let?

To get consent to let, apply formally to your mortgage lender.

Lenders have different requirements, but common ones include:

- Details of your planned rental income and finances.

- A good credit history and up-to-date mortgage payments.

- A reputable letting agent to manage the property (in some cases).

Remember, you can’t rent out your property without consent. This breaks your mortgage agreement and could lead to fines or even repossession.

Can I Live in the Second Property I Purchase?

A popular strategy is to get consent to let on your existing home, and then use some of the rental income to help fund the purchase of a new residential property for you to live in.

If you take out a standard residential mortgage on the new property, then yes – you are perfectly entitled to live there yourself. The lender’s assumption is that this will be your main residence.

However, if you opt for a buy-to-let mortgage on the second property, then no – you cannot legally live there yourself. Buy-to-let mortgages require the property to be rented out.

So in that scenario, you’d likely want to:

- Get consent to let on your current home and rent it out

- Use a residential mortgage to purchase your new home to live in

That way you have rental income from property one, and your new main residence as property two.

Will You Need to Remortgage Your First Property?

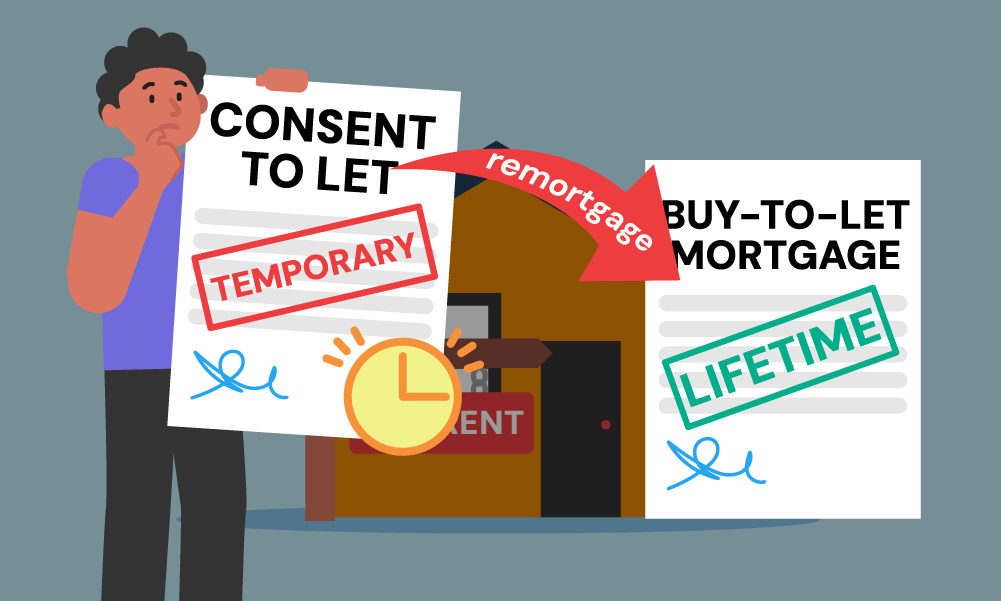

Yes, in order to rent out your existing property long-term you will need to remortgage onto a buy-to-let product. You cannot simply rent it out indefinitely with a residential mortgage.

You may be able to “consent to let” with your current lender for a bit while you sort out the remortgage. Or you may decide to remortgage with a different lender who can give you a better buy-to-let deal.

With buy-to-let mortgages, lenders take projected rental income into account when calculating what they’ll lend you.

So having that existing property already generating income makes it easier to get approved.

One option that some landlords consider is taking out the new buy-to-let mortgage on an interest-only basis.

This lowers the monthly mortgage payments during the mortgage term, but means you’ll need to pay off the full outstanding capital at the end.

Telling Your Mortgage Lender is Essential

We can’t stress this enough – you absolutely MUST notify your lender if you intend to let out a property with a residential mortgage, even if just for a short time.

Failing to do so puts you in breach of the mortgage contract.

Best case scenario is they’ll issue punitive penalties.

Worst case, they could try to force you to repay the mortgage in full, which could leave you in dire financial straits.

Lenders take this seriously as letting out a property increases their risk factor. They need to approve it, do affordability checks, and potentially move you to a different mortgage product.

Other Costs to Budget For

In addition to any consent to let fees from your lender, there are some other costs to factor in when letting out a property:

- Landlord insurance (essential for protecting your investment)

- Letting agent fees if using a management company

- Safety certifications for gas, electrical, fire etc.

- Potential mortgage booking/arrangement fees when remortgaging

- Maintenance and repair costs for the rental property

It’s also worth considering income tax implications if you’ll be earning rental income from multiple properties. Tax on rental profits operates differently than tax on employment income.

The Bottom Line: Get Expert Advice

As you can see, there are quite a few moving parts involved in getting consent to let on one property while buying another. The process can get complicated quickly if you don’t know what you’re doing.

That’s why we always recommend speaking to an experienced mortgage advisor before making any decisions. They can walk you through all the requirements and costs based on your specific situation.

With good planning and expert advice, getting consent to let can be a great way to build your property portfolio. But try to wing it alone and you could quickly run into issues with your lender.

The main takeaway?

If letting out your current home is part of your plan to buy another property, get full consent first – don’t slip into accidental mortgage fraud.

Need a broker? Reach out to us. We’ll connect you with a qualified mortgage advisor who can help you decide about buying a second property.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

Can you switch from consent to let to buy to let?

Yes, you can switch from renting out your property temporarily (consent to let) to renting it out long-term (buy-to-let mortgage). This is a good option if you’ve decided to be a landlord.

Here’s the catch: Buy-to-let mortgages are different from residential mortgages. They consider your property’s rental income but may have stricter requirements.

Talk to your lender or a mortgage advisor to understand the specifics.

How much can you borrow on a second charge?

How much you can borrow with a second-charge mortgage depends on how much of your home you own (equity) and your ability to repay.

Generally, lenders might allow you to borrow up to 75-85% of your home’s value, minus what you still owe on your main mortgage. But this can vary.

To get an accurate idea of how much you can borrow, speak to a lender or mortgage advisor. They can consider your income, credit history, and other financial commitments.