- Can You Get a £100,000 Loan?

- What Are Your Loan Options?

- Are You Eligible?

- What Can You Use a £100,000 Loan For?

- What Will a £100,000 Loan Cost You?

- How Long Will It Take to Repay a £100,000 Loan?

- How To Secure a £100K Loan?

- Can I Get a Loan with Poor Credit?

- How To Get a £100,000 Loan As a Self-Employed Individual?

- Is Remortgaging a Wise Decision?

- How To Secure a Loan with Lower Costs?

- How To Choose the Most Suitable Loan?

- The Bottom Line

How To Get A £100,000 Loan In The UK In 2025?

Big dreams often need big funds, right?

Whether it’s transforming your home, throwing the wedding of your dreams, or launching that business idea you’ve been planning, a chunky loan like £100,000 can make it happen.

Now, you might think you need to own property or have a perfect credit score to qualify for such a large loan in the UK. But guess what? That’s not necessarily true!

Even renters or those with a not-so-shiny credit history can still be in with a shot, especially if you’ve got something to offer as collateral.

Thankfully, we live in a time where applying for loans is as simple as clicking a few buttons.

Many online platforms let you compare deals without extra fees or damaging your credit score.

Plus, no need for those awkward face-to-face meetings—just a straightforward process that might even give you a decision on the same day.

In this guide, we’ll walk you through how to get a £100,000 loan, breaking it down into simple steps so you can focus on turning those big dreams into reality—without the stress.

Can You Get a £100,000 Loan?

Yes, it’s possible to obtain a £100,000 loan, regardless of your credit score. However, it’s vital to ensure that you can handle the repayments and offer property as security.

Many lenders, besides the well-known high-street banks, can provide such loans. They might not be famous, but they have a solid reputation and are approved by the Financial Conduct Authority (FCA).

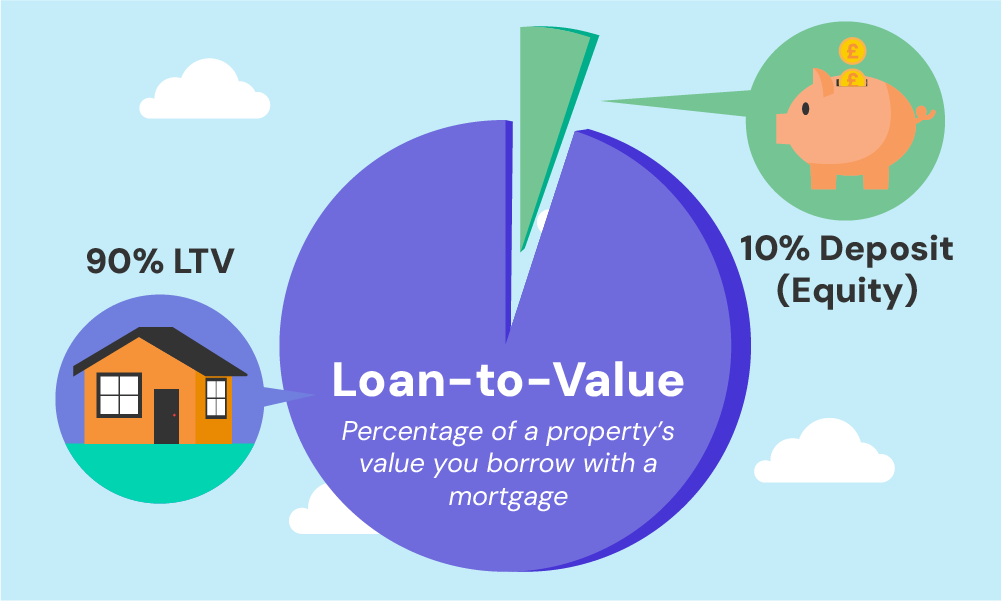

To secure a large loan, it’s necessary to have built up enough equity in your property. This involves considering the loan-to-value ratio (LTV), which determines how much you can borrow based on the market value of your property.

What Are Your Loan Options?

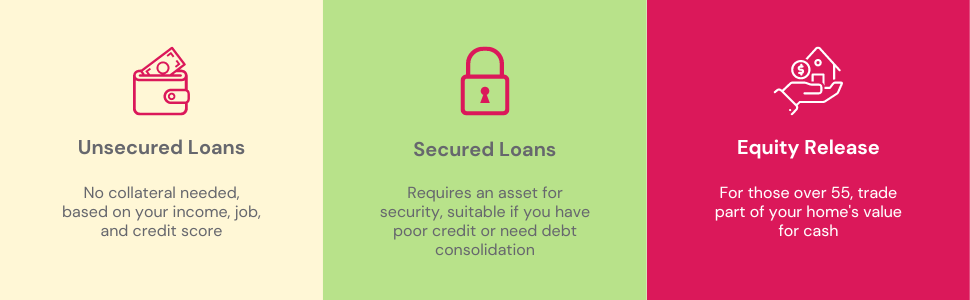

Loans generally fall into two categories: secured and unsecured loans. Let’s explore the details of each to assist you in making a wise choice.

Unsecured Loans

These loans don’t require collateral. Your eligibility is based on aspects like your income, job status, and credit rating.

Typically preferred by people with good credit scores, unsecured loans include personal loans, business loans, and other short-term financial options.

In this case, you need to offer a valuable asset, such as a car or home, as security. This pathway is suitable for individuals with poor credit or those planning to consolidate debts.

However, failing to meet repayments could result in losing your assets.

If you are 55 or older, equity release might be a good choice. This method allows you to exchange a part of your home for a significant tax-free sum, which can be used for various everyday expenses.

Are You Eligible?

Different lenders have varying criteria, yet generally, they require applicants to:

- Be at least 18 years old.

- Hold UK residency.

- Maintain stable employment.

- Demonstrate proof of a consistent income and the capability to manage repayments, evident through bank statements.

- Possess a decent or satisfactory credit rating for unsecured loans.

- Hold assets such as a car or house for secured loans.

Key Points to Consider When Choosing a Loan

- Loan Amount – Make sure the loan amount is necessary and affordable.

- Repayment Duration – Look for a lender that offers flexible repayment terms. Choose a timeframe that fits your budget and has a competitive interest rate.

- Monthly Instalments – Monthly instalments can be helpful, especially if you receive your salary monthly. Setting a fixed repayment amount makes budgeting easier.

- Early Settlement Option – Check if the loan allows early settlement without high fees, as some lenders charge for early repayment.

- No Initial Charges – Some loan options don’t have initial charges to attract borrowers.

- Credit History Considerations – Many lenders in the UK are willing to consider your application even if you have a poor credit score.

What Can You Use a £100,000 Loan For?

Lenders are generally more interested in your repayment plan than the purpose of the loan, but here are some common uses for a £100,000 loan:

- Buying a car or other vehicle

- Renovating your home

- Consolidating existing debts

- Covering unexpected expenses

- Paying for a wedding

- Funding funeral costs

- Starting a new business

- Gifting money to relatives or friends

- Settling tax debts

What Will a £100,000 Loan Cost You?

Taking out a loan as big as £100,000 might feel like a lot, but breaking it into simple numbers can make things clearer.

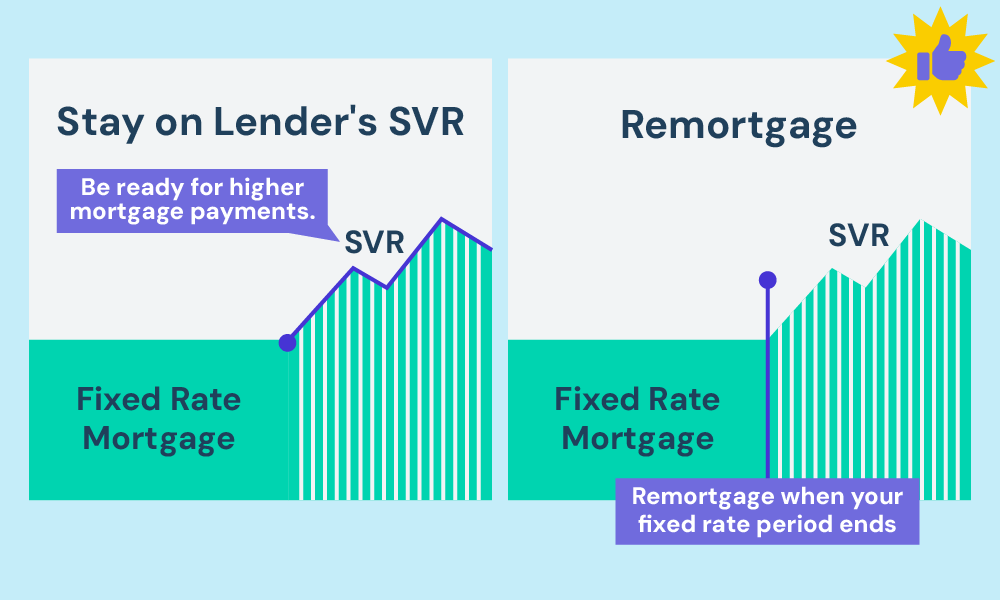

In the UK, most loans start with a fixed interest rate that lasts a few years—usually 2, 3, or 5.

After that, things can change. Your lender might move you to a standard variable rate (SVR), or you might remortgage to a new deal.

Because of this, the total cost of your loan might not look exactly like these examples.

Here’s a quick look at how much you could pay each month during the fixed-rate period:

Monthly Repayments for a £100,000 Loan (Initial Fixed Term)

| Interest Rate | Loan Term | Estimated Monthly Payment |

|---|---|---|

| 5% p.a. | 5 years | £1,887 |

| 9% p.a. | 5 years | £2,080 |

| 13% p.a. | 5 years | £2,280 |

And if you’re wondering how much you’d pay in total during that time, here’s the breakdown:

Total Repayments Over the Fixed Rate Period

| Interest Rate | Loan Term | Estimated Total Cost |

|---|---|---|

| 5% p.a. | 5 years | £113,202 |

| 9% p.a. | 5 years | £124,800 |

| 13% p.a. | 5 years | £136,800 |

Keep in mind, these figures are just examples to help you understand the basics.

What you actually pay will depend on your lender, the loan terms you agree to, and how rates change over time.

When your fixed rate ends, your monthly payments might go up or down depending on what happens next.

To keep things under control, it’s worth checking your options before your fixed term is up—like looking into remortgaging to lock in another deal.

Choosing the right loan term is all about balance. A shorter term means you pay off the loan quicker and save on interest, but your monthly payments will be higher.

A longer term spreads things out, so your monthly payments are smaller, but you’ll pay more interest in the long run. It’s all about what works best for your budget and plans.

How Long Will It Take to Repay a £100,000 Loan?

Paying back a £100,000 loan can take different amounts of time depending on a few things, like:

- how much interest the lender charges

- how long you agree to borrow the money for, and

- how much you can afford to pay each month.

One thing’s clear: the choices you make here can have a big impact on the total cost.

If you want smaller monthly payments, choosing a longer loan term might feel like the easier option.

For example, if you borrow £100,000 with a fixed interest rate of 5.5% for the first 5 years, your monthly payments could be around £660 with a 20-year term.

But there’s a catch—because you’re taking longer to pay it back, the total interest you’ll pay over time will be much higher than if you chose a shorter term.

Now, if you pick a shorter term, like 15 years, your monthly payments will be higher—about £790 during the fixed-rate period—but you’ll pay off the loan quicker and save money on interest.

That means you’d be debt-free sooner and could end up saving thousands in total costs.

So, what’s the best choice? It really depends on what works for your budget and goals.

A secured loan calculator can give you a rough idea of your payments and help you see how different term lengths compare.

Just remember, these are only estimates, and the actual amount you pay might be different depending on your situation and what your lender offers.

If you’re unsure, it’s always a good idea to talk to a loan advisor. They can help you figure out a repayment plan that makes sense for you and your finances.

How To Secure a £100K Loan?

You can secure a £100k loan through an unsecured loan if you have a good credit score. This will allow you to receive the funds directly and easily.

If your credit score is not ideal, you can offer your home or other property as collateral.

Other ways to secure a £100k loan include remortgaging, taking out a homeowner loan, or releasing equity from your home.

Can I Get a Loan with Poor Credit?

Yes, you can get a loan with poor credit.

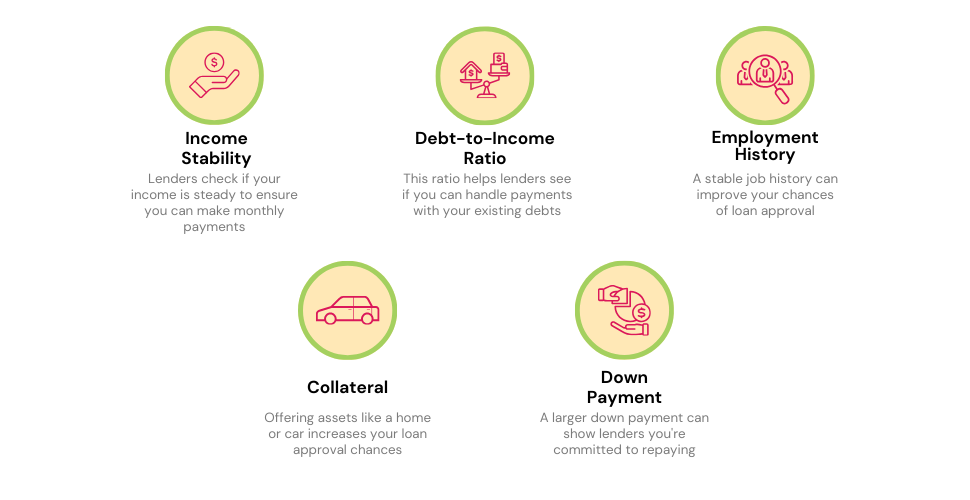

Many lenders are still willing to lend to people with poor credit, but they will carefully consider some factors to assess your ability to repay the loan. These factors typically include:

- Income stability – Lenders often look for a stable and regular income source to ensure that you can afford the monthly repayments.

- Debt-to-income ratio – This ratio, which compares your monthly debt payments to your monthly gross income, helps lenders assess your ability to manage the payments with your existing debts.

- Employment history – A steady employment history can sometimes offset the risks associated with poor credit.

- Collateral – As you mentioned, providing assets such as a home or vehicle as security can be a significant factor in loan approval. This offers lenders a safeguard in case of default.

- Down payment – In some cases, being able to make a substantial down payment can demonstrate to lenders that you are committed to repaying the loan, which can potentially increase your chances of approval.

But getting a loan isn’t a sure thing, even if you tick some of the boxes. It all depends on what loans are available and if you meet the lender’s rules.

Some lenders might still say no if they think it’s too risky, while others might agree but charge higher interest or add stricter conditions.

If you’re not sure what to do, it’s a good idea to talk to a financial advisor or look into lenders who help people with poor credit. They can help you figure out what might work for you.

How To Get a £100,000 Loan As a Self-Employed Individual?

It can be more difficult for self-employed individuals to secure a £100,000 loan because lenders perceive their income as being less stable.

But, some lenders specialise in homeowner loans for self-employed individuals.

Be prepared to provide additional documentation, such as:

- Two years of account statements, possibly approved by a certified accountant

- SA302 or tax summaries from HMRC

Is Remortgaging a Wise Decision?

Remortgaging is a popular option for homeowners who need a large amount of money. It involves changing your existing mortgage agreement and borrowing against the equity in your property.

If you have a lot of equity or can get a low mortgage rate, remortgaging may be cheaper than taking out a personal loan.

How To Secure a Loan with Lower Costs?

To minimise the costs associated with borrowing, you might consider consulting a loan broker who can assist in comparing loan rates and pinpointing the best deal for you.

Alternatively, comparison websites can be a handy tool in determining the most economical loan.

Affordable loan rates are within your reach, especially if your credit score ranges from good to fair. A history of timely credit repayments can potentially qualify you for rates starting around 3% APR.

Furthermore, secured loans tend to offer reduced rates. Lenders will assess factors like your income and credit status to finalise the rate they are willing to offer you.

How To Choose the Most Suitable Loan?

When looking for the best loan, the first step is to research the different types of loans available. You should then weigh the following factors when choosing a loan:

- Interest rates

- Loan term

- Loan type (secured or unsecured)

- Repayment options

- Loan duration

Once you have considered all of the factors, you will be able to choose the loan that best suits your financial situation.

Fortunately, many loan applications are now streamlined through online platforms, eliminating the need for cumbersome paperwork or multiple trips to the bank.

In cases where the lender requires documents such as bank statements, you can easily submit them via email.

Here are some additional tips for choosing the most suitable loan:

- Be clear about your needs. What do you need the loan for? How much money do you need? How long can you afford to repay the loan?

- Compare different lenders. Don’t just accept the first loan offer you get. Compare interest rates, terms, and fees from different lenders to find the best deal.

- Read the fine print. Before you sign any loan agreement, make sure you understand all of the terms and conditions. Pay attention to the interest rates, repayment terms, and any potential fees.

- Get advice from a loan advisor. If you are unsure about which loan is right for you, or if you have any other questions, speak to a financial advisor. They can help you assess your needs and choose the best loan for you.

The Bottom Line

As we wrap up this guide, remember that borrowing £100k is not a decision to be taken lightly.

You’ve explored the potential paths, considered the implications of your credit score, and understood the varied loan terms available.

Here are a few straightforward questions to guide you:

- Why do you need to borrow this amount?

- Did you think about other options before choosing a loan?

- Do you know which loan is right for you?

- Have you compared different loan choices?

Making a well-informed decision is important.

Be sure to fully understand the terms of your agreement, the expected repayments, and the potential consequences of failing to meet those repayments.

Additionally, seeking assistance from loan brokers can be a game-changer in navigating this complex process. They can help you identify the best options tailored to your financial circumstances, potentially saving you a considerable amount of time and money.

If the process seems daunting, reach out to us and we’ll match you with an experienced loan broker to help you choose a secure and beneficial loan.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

What salary do I need for a 100K mortgage UK?

To be eligible for a £100,000 mortgage in the UK, aiming for an annual salary between £20,000 and £25,000 is sensible. This range is advised based on the lending criterion that many mortgage providers follow, usually offering loans up to 4-4.5 times an individual’s yearly income. At this income bracket:

- You demonstrate financial stability to the lenders, which can secure you more favourable interest rates and repayment terms.

- You maintain a healthy debt-to-income ratio, ensuring you can comfortably manage monthly repayments along with other financial commitments, without straining your budget.

Remember, various factors influence the exact amount you’d be eligible to borrow, and consulting a financial advisor for personalised guidance is always beneficial.

What credit score do I need for a £100,000 loan?

To get a £100,000 loan, your credit score isn’t the only thing lenders look at. They also check how much value you have in your property and if you can afford the monthly payments. If you have a low credit score, there are still lenders who might help you, but be prepared for possibly higher interest rates.

If you’re not sure if you qualify for a £100,000 loan, it’s a good idea to talk to a loan broker. They can help you assess your creditworthiness and find lenders that are likely to approve your application.