- Can I Borrow Against My House?

- How To Choose the Best Way to Borrow Against Your Home

- Why Consider Borrowing Against Your Home

- What To Watch Out for When Borrowing Against Your Home

- How Much You Can Borrow Against Your Home

- Loan-To-Value Ratio Explained

- How To Work Out Your LTV

- Don’t Overlook Additional Expenses

- Can You Get a Loan Against Your Home with Bad Credit?

- Are You Eligible to Borrow Against Your Home?

- Can You Use Your Home Equity to Purchase Another Property?

- Should You Borrow Money Using Your Home?

- Key Takeaways

- The Bottom Line: How Can You Borrow Against Your Home?

Borrowing Against Your Home: What You Need to Know

If you own a house and need a lot of money, borrowing against your home’s value could be an option.

This type of loan lets you use your home’s value and the amount of equity you’ve built (the part of your home you fully own) to secure the money.

Lenders will check how much you earn and your credit history to decide how much they can lend you.

But there’s a risk—if you can’t keep up with payments, the lender could take your home away.

This option can be helpful, but it’s important to choose what works best for your finances.

In this guide, we’ll explain how borrowing against your home works and give you tips to help you decide if it’s right for you.

Can I Borrow Against My House?

Yes, you can borrow money against your home, especially if you have equity built up.

Equity is the difference between what your home is worth and how much you still owe on your mortgage.

For example, if your home is worth £200,000 and you owe £150,000, your equity is £50,000.

There are three main ways to borrow against your equity:

- Remortgage. This means switching to a new mortgage to borrow more money or get a better deal. Be aware that you might have to pay early repayment fees if your current deal hasn’t ended.

- Secured Loan. This is a loan where your home is used as security. If you don’t pay it back, the lender can take your home.

- Further Advance Mortgage. This lets you borrow extra money from your current mortgage provider, again using your home as security.

Missing repayments could put your home at risk, so think carefully before borrowing. In some cases, a personal loan or a credit card with 0% interest might be better options.

How To Choose the Best Way to Borrow Against Your Home

Your financial background and your plans for the funds dictate the best borrowing route for you.

Generally, people opt for a secured loan when they need to borrow a hefty sum, often exceeding £100,000.

On the other hand, you might favour a further advance mortgage or remortgage for financing home improvements or securing a deposit for another property.

Why Consider Borrowing Against Your Home

Embarking on this journey offers several perks, such as:

- Access to Larger Funds. Your property’s value could allow you to borrow a hefty sum.

- Lower Interest Rates. Since your property acts as a security net, lenders might offer lower interest rates compared to personal loans.

- Extended Repayment Duration. This choice often means you can spread your repayments over a longer period, possibly resulting in more manageable monthly instalments.

- Friendlier to Those with Poor or Limited Credit History. Lenders might show a kinder face as your loan is safeguarded by your property.

What To Watch Out for When Borrowing Against Your Home

However, this venture also has its drawbacks, including:

- Your Home is on the Line. Since your home backs the loan, you might lose it if you fail to keep up with the repayments.

- Potential to Incur Hefty Interest Over Time. Despite potentially lower interest rates, the long tenure could rack up a sizable interest amount over time.

- Possibility of Additional Fees. You might encounter various charges such as administrative costs, legal fees, valuation or broker fees, depending on your lender’s terms.

- Higher Interest Rates with Further Advance Mortgages. This option generally comes with higher interest rates compared to your primary mortgage.

How Much You Can Borrow Against Your Home

The amount you can borrow depends on a few things, like your credit score, how much money you earn, how much equity you have in your home, and the type of loan you pick.

Secured Loan

This type of loan often lets you borrow large amounts, usually more than £25,000.

If you’re thinking about a secured loan, you can use a loan calculator to estimate your monthly payments and see if they fit your budget.

Remortgage or Further Advance

These options can let you borrow more using your home. Mortgage calculators are great tools to help you figure out how much you might be able to get comfortably.

While calculators give you a rough idea, speaking to a mortgage advisor is a smart move. They can explain all the costs, fees, and details so you know exactly what to expect.

This way, you can make the best choice that fits your financial plans.

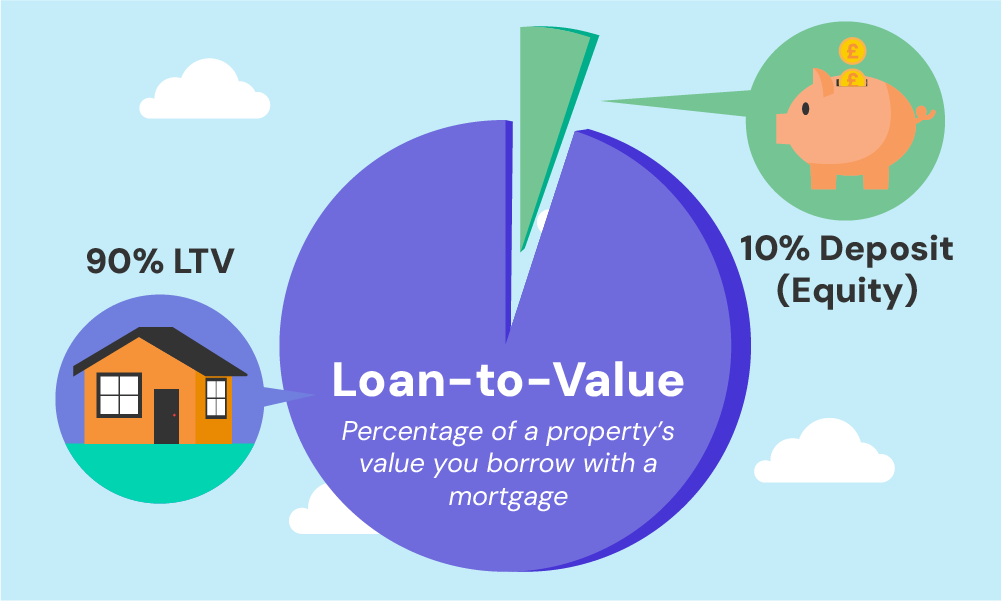

Loan-To-Value Ratio Explained

The loan-to-value (LTV) ratio is a simple way to figure out how much of your home you actually own compared to how much money you still owe.

It’s super useful for people buying a home or those looking to remortgage, as it helps lenders decide if they should approve your loan.

Think of it like this: the LTV ratio shows the size of your loan as a percentage of your home’s value.

For example, if your home is worth £100,000 and you borrow £80,000, your LTV is 80%. This means you own 20% of your home, and the bank technically owns the rest until you pay it off.

Lenders use this number to figure out how risky it is to lend you money.

A higher LTV means more risk for them because if you can’t repay the loan, it’s harder for them to get their money back by selling your home.

In the UK, there’s a limit to how high your LTV can be for most loans.

If your LTV is too high, your loan might not get approved, or you might need to pay for mortgage insurance to cover the lender if things go wrong.

Your LTV also affects how much interest you’ll pay.

A lower LTV is better for you because it often means lower interest rates and smaller monthly payments.

This makes it easier to handle your budget and might even help you borrow more money or get better deals if your home’s value increases or you’ve been making regular payments.

How To Work Out Your LTV

To calculate your LTV, just divide the amount you want to borrow by the total equity in your home. Here’s the formula:

LTV = Loan Amount / Home Equity

So, if your home equity stands at £400,000 and you plan to borrow £260,000, your LTV comes out to 65%.

Remember, if you’re still paying off your mortgage, you need to subtract that remaining balance from your home’s value to find your equity.

For instance, if your home is worth £400,000 and you have £70,000 left on your mortgage, you’re left with £330,000 in equity.

Now, if you intend to borrow £260,000, your LTV jumps to 79%.

Don’t Overlook Additional Expenses

When you’re sorting out your LTV, there are other costs to keep in mind too.

- Appraisal Fees. The lender might need to check your home’s value to make sure it matches how much you want to borrow. This is called an appraisal, and while the lender arranges it, you might have to pay for it. The cost can change depending on where your home is or how much it’s worth.

- Insurance Costs. Lenders usually require you to get home insurance, especially if your LTV is high. This insurance protects both you and the lender. It covers things like damage to your home or helps if you can’t keep up with loan payments.

Can You Get a Loan Against Your Home with Bad Credit?

Having bad credit can indeed pose challenges when seeking a loan, but it doesn’t close all doors.

Lenders might still extend a credit offer to you if you can secure the loan with a high-value asset, such as your home.

This strategy reassures lenders of repayment, albeit with the stark risk of losing your home if you fail to meet the repayment obligations.

Are You Eligible to Borrow Against Your Home?

To qualify for a further advance mortgage, remortgage, or secured loan on your home, you must already hold a primary mortgage.

Lenders will also request information on your:

- Current income and expenditure patterns

- Credit history

- Available equity in your property

- The present market value of your property

Can You Use Your Home Equity to Purchase Another Property?

Yes, many homeowners successfully use the equity in their home to invest in another property, be it for rental purposes or a new residence for themselves.

When you release these funds, you can use them as a down payment for the new property, albeit you must demonstrate your ability to manage increased mortgage repayments on your initial home.

Should You Borrow Money Using Your Home?

Borrowing money against your home, like getting a second mortgage or remortgaging, could be a good idea if:

- You can’t get other types of loans, like personal loans or credit cards.

- Your credit score has gone down recently.

- You want to improve your home or buy another property.

But it might not be the best choice if:

- You’re already having trouble paying your current mortgage, as this will mean extra or higher monthly payments.

- You want to use the loan to pay off other debts. Borrowing this way often costs more in the long run, with higher interest over a longer time, and it could put your home at risk if you can’t keep up with payments.

Key Takeaways

- You can borrow money using your home’s equity, which is the amount your home is worth minus what you still owe. Popular ways to do this are remortgaging, secured loans, or further advance mortgages, each with its own pros and cons.

- Having a lower loan-to-value (LTV) ratio can mean lower interest rates and smaller monthly payments, making it easier to afford.

- Be ready for extra costs like fees to check your home’s value and home insurance, and make sure to add these to your budget.

- Borrowing this way can pay for things like home upgrades or other big expenses, but if you miss payments, your home could be at risk.

The Bottom Line: How Can You Borrow Against Your Home?

If borrowing against your home feels like the right choice, here’s how you can get started:

- Look at different secured loan deals to find the best option.

- Check out remortgaging options to see if they work for you.

You can also ask your current lender about a “further advance mortgage,” which is another way to borrow more money.

It’s a smart idea to talk to a qualified mortgage advisor before making any decisions. They can help you figure out the interest rates and how much the loan will cost overall.

If you want help finding the right broker, reach out to us. We’ll connect you with someone who will understand your situation and find the best solution for you.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

What are the prerequisites for borrowing against my home?

To borrow against your home, you generally need to have a substantial amount of equity built up in your property, a stable income, and a satisfactory credit history. It’s important to consult with a financial advisor to understand all the prerequisites in detail.

What are some alternatives to borrowing against my home?

Alternatives to borrowing against your home include personal loans, credit cards, or other types of unsecured loans which don’t require collateral. Each of these options has its pros and cons, so it’s vital to evaluate them based on your financial situation and goals.

What kinds of improvements can I finance by borrowing against my home?

You can finance a variety of home improvements, including but not limited to, kitchen and bathroom renovations, adding an extension or a conservatory, landscaping, and upgrading heating or cooling systems. Remember, such improvements can potentially increase the value of your home.

What steps can I take to protect my home when borrowing against it?

To protect your home, ensure that you can manage the monthly repayments comfortably without stretching your budget too thin. Also, consider insurance options that protect your property and income to minimise the risk of defaulting on the loan.