- What is a Help To Build Mortgage?

- How Does Help To Build Scheme Work?

- What Types of Properties Qualify for Help to Build Mortgages?

- How Much Can I Borrow?

- What are the Terms for Help to Build Mortgages?

- Who is Eligible?

- Which Lenders Offer Help to Build Mortgages?

- Can I Use the Help To Buy Scheme As An Alternative?

- Key Considerations Before Applying for Help to Build

- The Bottom Line

Should You Get Help to Build Mortgages?

Building a home can be expensive, especially at the start.

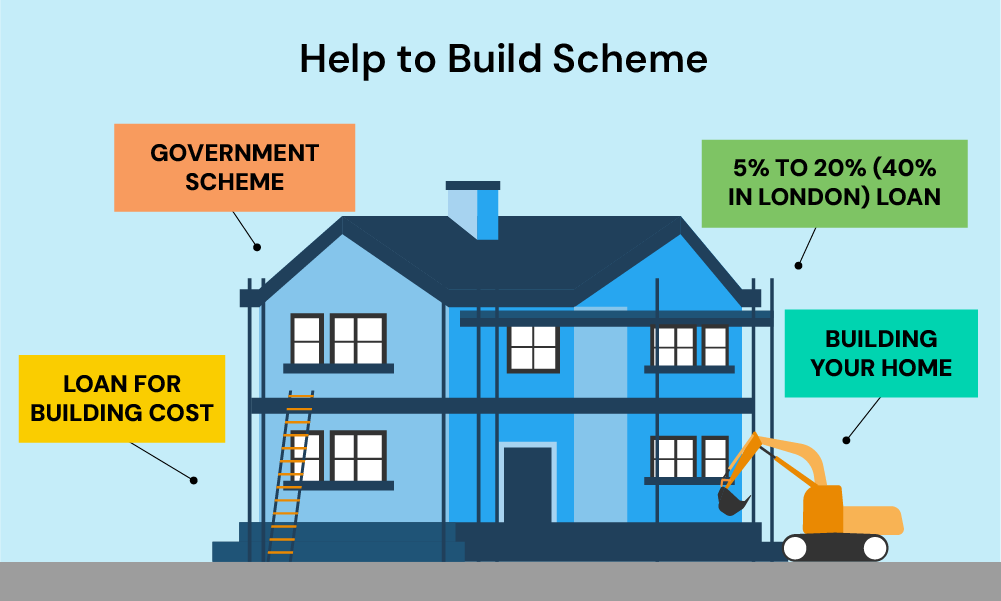

The UK’s Help to Build scheme recognises this challenge and offers a helping hand. It provides an equity loan, making it more affordable for you to manage the upfront costs of constructing your own home.

This scheme is particularly beneficial if you’re a first-time builder or find the usual building and mortgage processes a bit daunting. It’s designed to make the dream of creating a personalised home more within reach.

In this guide, we’ll explain all about Help to Build mortgages – how they work and how you can make the most of your building project.

What is a Help To Build Mortgage?

A Help to Build Mortgage is part of the Help to Build scheme, providing financial support specifically for self-building homes.

It’s a unique type of loan where the government lends you money to fund a portion of your building costs and land purchase.

This loan is then used alongside your mortgage to complete your project.

Unlike a standard mortgage, Help to Build is designed to reduce the upfront cost barrier, making it easier to start building your own home.

The significant difference between Help to Build and traditional mortgages or the Help to Buy scheme is its focus on self-built properties.

While traditional mortgages are for purchasing already built homes and Help to Buy assists in buying new builds, Help to Build is exclusively for those who want to construct their own homes.

This includes buying the land, laying the foundations, and managing the construction process.

It’s tailored to give you more control and creativity in building your dream home while providing a financial stepping stone to cover the substantial initial costs.

How Does Help To Build Scheme Work?

The Help To Build scheme is designed to support you in financing the construction of your own home.

Here’s how it works:

First, you apply for a government equity loan through this scheme.

This loan covers a part of the cost of building your home, including land purchase, if necessary.

In addition, you’ll need a self-build mortgage from an accredited lender, along with a 5% deposit amount to cover the rest of the costs.

The government’s equity loan can fund between 5% and 20% of your project’s total cost (up to 40% in London). This reduces the amount you need to borrow from a mortgage lender.

For instance, if your self-build project costs £200,000, you might get a £40,000 equity loan from the government and a £160,000 mortgage from a bank.

Your 5% deposit, in this case, would be £10,000.

Remember, this is a loan, not a grant. You will have to repay the government’s equity loan.

For the first five years, the loan is interest-free. From year six, you’ll start paying interest on the loan, and the rate increases over time.

This scheme makes building your own home more affordable initially, giving you a financial head start.

What Types of Properties Qualify for Help to Build Mortgages?

Under the Help to Build scheme, you can use the equity loan for:

- Building a new home from scratch.

- Purchasing land to construct your home.

- Creating an ‘airspace development’ flat means building a new home in unused space above an existing building.

- Converting a commercial building into a residential home.

- Customising a shell build, which is finishing off a partially built house.

- Demolishing an existing property and building a new home in its place.

However, there are some restrictions:

- The loan cannot be used to build more than one home.

- It’s not for making upgrades or extensions to your existing home.

- You can’t use it for building a second home; the property you build must be your only residence. You’ll need to sell any other homes you own within 12 months of completing the new build.

How Much Can I Borrow?

Generally, you can borrow between 5% and 20% of the property’s estimated completed value.

If your property is located in London, you have an advantage, as you can borrow up to 40% of the property’s value.

In terms of total spending, there’s a cap on how much you can spend on your new home. Under the scheme, you’re allowed to spend up to £600,000.

This total includes the cost of the land if you’re buying it, and the construction costs, which cannot exceed £400,000.

It’s important to note that these costs are exclusive of VAT and any contingency budget. They may also cover costs for demolition if that’s part of your project.

What are the Terms for Help to Build Mortgages?

Equity Loan Repayments

With the Help to Build equity loan, there are specific times when you need to repay the full amount, along with any interest and management fees. These include:

- At the end of the equity loan term, typically 25 years.

- When you sell your home.

- After you’ve repaid your mortgage.

- If you don’t comply with the terms of your equity loan contract.

You can’t make regular monthly payments towards the loan principal, but you can repay part or all of it at any time. The repayment amount is based on your home’s market value at that time.

For partial repayments, the minimum you can pay is 10% of the home’s market value, with at least 5% of the equity loan remaining unpaid.

Fees and Interest

A £1 monthly management fee applies from the start of the equity loan until it’s fully repaid. For the first five years, there’s no interest. From year six, interest begins at a rate of 1.75%, calculated monthly.

Starting from year seven, the interest rate increases annually in April, based on the previous September’s Consumer Price Index (CPI) plus 2%.

The exact timing of your loan can affect the total interest paid, with early-year loans potentially accruing less interest.

Repayment Amount and Property Value

The repayment amount is linked to your home’s market value at the time of repayment.

If your home’s value increases, so does the amount you owe. This includes the land’s value, even if it wasn’t part of the original loan calculation.

Additionally, the home you build must be your only residence. You, or anyone you live with, cannot have interests in other residential properties, either in the UK or abroad.

You’ll have one year from completing your new home to sell any other properties. This applies even if you’re applying for the loan solo but living with a partner.

These terms are essential to understand as you plan your journey with the Help to Build scheme, ensuring you’re prepared for the financial commitments ahead.

Who is Eligible?

Eligibility criteria for the Help to Build scheme:

- Must be at least 18 years old.

- Must have legal right to live in England.

- The property being built must be your only residence.

- Cannot use the scheme for building a second home or a rental property.

Common disqualifiers:

- Not eligible if you’ve received a Help to Build loan in the past two years.

- Not eligible if you owe money on another government home ownership scheme.

- Must be able to secure a self-build mortgage.

Which Lenders Offer Help to Build Mortgages?

Initially, the scheme had a limited number of lenders, but this is expanding. For instance, the Darlington Building Society was one of the first to offer such mortgages.

They provide options with different interest rates, like 5.39% and 5.99%, usually under a three-year discount mortgage plan.

As the scheme grows, more lenders are joining in. This means you’ll have a broader range of choices in the future.

Each lender will have its unique offerings, including different interest rates, loan terms, and specific conditions.

Can I Use the Help To Buy Scheme As An Alternative?

No, you can’t use the Help to Buy scheme as a direct alternative to Help to Build. Although they share similarities, they serve different purposes.

Help to Buy is specifically for purchasing newly built properties and involves the government loan being paid to a single developer upon completion.

In contrast, Help to Build is designed for individuals who are building or significantly renovating their own homes.

It supports the costs associated with construction or major renovation projects, not the purchase of completed new builds.

Key Considerations Before Applying for Help to Build

Before you dive into the Help to Build scheme, here are some important points to consider:

- Not a Discount Scheme – Help to Build isn’t about reducing the overall cost of land and building. The costs remain the same as they would without the equity loan.

- Equity Loan Amount – The amount you borrow is initially based on the estimated costs of land and building. However, when it’s time to repay, it’s calculated based on the market value of the completed home, including the land value.

- Market Value Impact – If the market value of your home increases so does the amount you owe on your equity loan. This means if your home appreciates, you’ll repay more than you initially borrowed.

- Mortgage Requirement – You must have a self-build mortgage (interest-only) from a lender registered with Help to Build. Once your home is built, your lender will usually switch you to a repayment mortgage.

- Interest-Free Period – The equity loan is interest-free for the first five years. After that, you will start paying interest from year 6 onwards.

These considerations are crucial in understanding how the Help to Build scheme works and what it means for your financial planning and home-building journey.

Make sure you’re comfortable with these terms before proceeding.

The Bottom Line

If you’re dreaming of building your own home, Help to Build Mortgages could be a real game-changer for you.

This scheme, especially beneficial for first-time builders, offers a government equity loan. This loan cuts down your initial costs, making it easier to achieve your dream home.

But, before diving in, it’s important to check if you’re eligible. Look closely at your financial situation, your credit history, and the kind of home you want to build.

If everything matches up, it could be worth exploring. You can find more details and apply through the official website.

In this journey, a self build mortgage broker can be invaluable. They’re experts in guiding you through the process, providing advice that’s just right for you, and helping you find the best mortgage deals.

They know all about self-build projects, so they can smooth out the process for you.

If you’re looking to find the right broker without the stress, get in touch with us. And we’ll connect you with an FCA-qualified broker who specialises in self-build mortgages, ready to tailor their support to your unique situation.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

What does a self or custom build home mean?

A self or custom build home is one you design and build to suit your personal needs. The Self Build and Custom Home Building Act 2015 defines it as a house built by individuals or groups for their use. This approach differs from buying a standard new build house, as you don’t just follow a developer’s pre-set plans or specifications.

Can I access the Help to Build scheme in Scotland?

The Help to Build scheme is specific to England and isn’t available in Scotland. However, if you’re in Scotland and interested in self-building, there might be alternative programs or funds you can explore for your project.

>> More about Self-build mortgages in Scotland

How does my credit history affect Help to Build eligibility?

Your credit history plays a crucial role in your eligibility for Help to Build. Lenders will look at the details of your credit record, including any problems, their seriousness, and when they happened.

If your credit history concerns you, consider speaking with a mortgage broker who specialises in dealing with bad credit histories.

How long will the Help to Build Scheme run?

The Help to Build scheme is set to run until 2025. However, this timeframe depends on demand and funding availability. The scheme might close earlier if it receives more applicants than expected.

What is the self build project timeline?

After you receive your equity loan from Help to Build, you have three years to buy land (if needed) and complete your house. This period covers all stages of building your own home.