- What Are Self Build Mortgages?

- How Do Self Build Mortgages Work?

- The Pros and Cons of Self Build Mortgages

- Can You Get a Mortgage To Build a House in Scotland?

- What Are the Criteria for Self-Build Mortgages in Scotland?

- Who Offers Self-Build Mortgages in Scotland?

- Can the Help to Build Scheme Benefit Self-Builders in Scotland?

- What Are the Alternatives to Self-Build Mortgages in Scotland?

- The Bottom Line

How To Get Self Build Mortgages in Scotland?

Planning to build your dream home in Scotland is an exciting adventure.

Imagine creating a home that’s completely yours, from the very first brick to the final splash of paint.

But before you can make that dream a reality, there’s one important thing you’ll need to sort out: a self-build mortgage.

Getting this type of loan might seem tricky because there are several steps involved – like choosing the right lender, understanding all the terms, and making sure you qualify.

It’s not just about borrowing money; it’s about finding a mortgage that works for your project and your budget.

This article guides you through the process and financing options to help you understand how to build your own home.

What Are Self Build Mortgages?

Self build mortgages are unique loans tailored for individuals who intend to construct their own homes.

These are different from standard mortgages, where you typically receive the entire loan amount upfront to purchase a pre-built home.

With a self build mortgage, the money is released in stages corresponding to the completion of various construction phases. This method ensures that funds are used appropriately throughout the building process.

Unlike traditional mortgages, which are secured against the value of an existing property, self build mortgages are secured against both the land you own and the home you are building.

This means the lender has a safeguard should you be unable to complete the project or repay the loan.

How Do Self Build Mortgages Work?

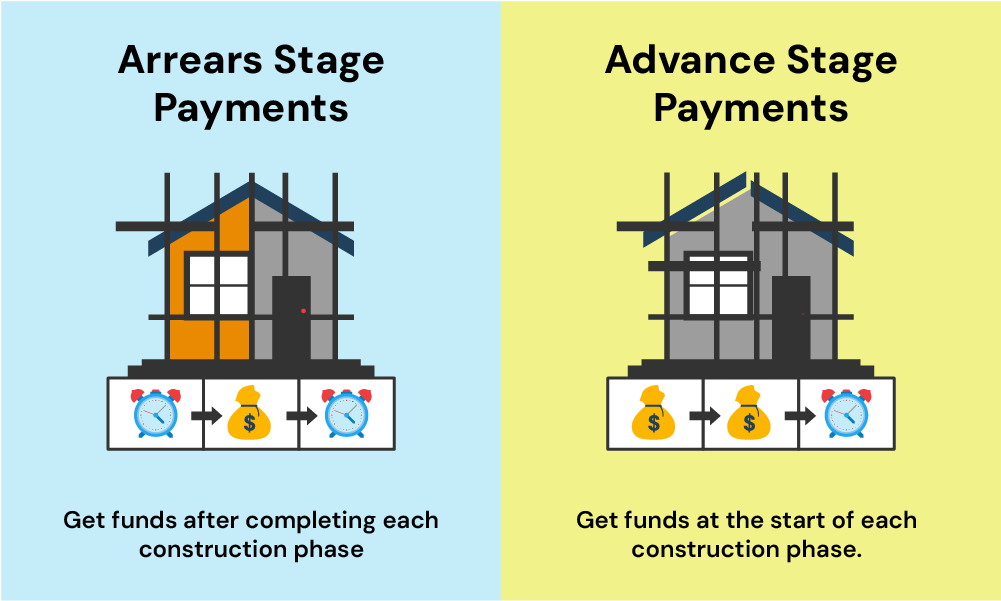

There are two main types of self build mortgages: ‘arrears’ and ‘advance’.

- Arrears Type – The most common type, where funds are released after each construction stage is completed. This ensures you’re only borrowing what’s needed for each phase.

- Advance Type – Funds are provided at the beginning of each stage. This option is less common but offers upfront financial support for each phase of the build.

The release of funds usually follows key stages of your build, like laying the foundations, building the walls, and so on. This way, the lender makes sure the project is on track before releasing more money.

The Pros and Cons of Self Build Mortgages

To help in your decision-making, here are the pros and cons you must consider before taking out this loan:

Pros:

- Stamp Duty Savings. If you opt for a self build mortgage, you’ll likely save on stamp duty. You only pay this tax on the land if it costs over £125,000. There’s no stamp duty on the construction of the finished home, which could mean significant savings compared to buying an existing property.

- Control Over Your Budget. Building your own home puts you in charge of the budget. You can make cost-effective decisions, from choosing materials to hiring contractors, potentially spending less than you would on a pre-built house.

- Boost in Home Value. Often, your self-built home could end up being worth more than what you spent on land, materials, and construction. This means you could see a higher property value once your home is complete.

Cons:

- Be Mindful of Risks. When you build your own home, you face risks like unexpected costs and project delays. Planning well and having a backup budget are key to managing these challenges.

- Prepare for Higher Initial Costs. Self build mortgages usually require a larger deposit and might have higher interest rates. This means you need a good savings cushion to kickstart your project, and the overall cost might be higher over the mortgage term.

- Time Commitment. Remember, constructing a house from scratch takes a lot of time and effort. From securing the land to overseeing the construction, be ready for a significant investment of your time and energy to bring your dream home to life.

Can You Get a Mortgage To Build a House in Scotland?

Yes, you can. Self-build mortgages are available in Scotland, but there are fewer lenders compared to the rest of the UK. This means you might have fewer choices and could end up with a mortgage that has a higher interest rate.

Some lenders in Scotland also limit where they’ll lend, based on your postcode. This can make it even harder to find a lender.

However, if you work with a mortgage broker, they can help you find more options and choose the best one for your needs.

What Are the Criteria for Self-Build Mortgages in Scotland?

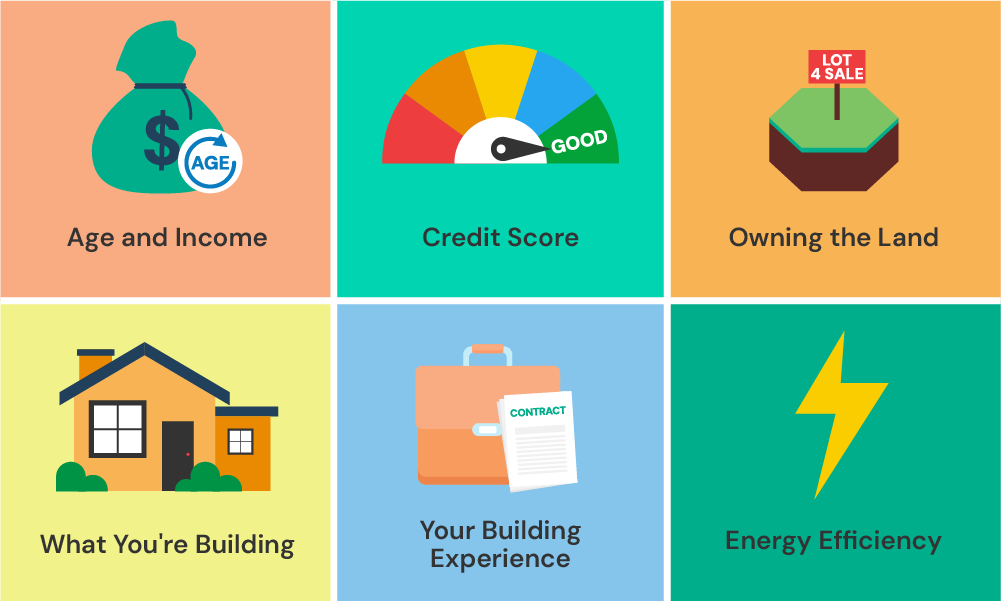

To get a self-build mortgage in Scotland, you need to meet certain criteria:

- Age and Income – Lenders will check how old you are and if you earn enough money to pay back the mortgage. They want to make sure you can afford the monthly payments.

- Credit Score – A good credit score helps you get better mortgage deals. But, even if your credit isn’t perfect, you might still be able to get a mortgage.

- Owning the Land – You need to own the land where you’ll build your house, or be in the process of buying it. The lender wants to see that your loan is for building the house, not buying the land.

- What You’re Building – The mortgage is for houses that you or your family will live in. The lender will also look at what type of house you’re planning to build. Some types, like those with timber frames, might not be allowed.

- Your Building Experience – You should show that you know about building houses, or that you have hired professionals who do. This gives the lender confidence that your house will be built well.

- Energy Efficiency – Lenders may ask for your house to meet certain energy efficiency standards. This is to make sure your house is environmentally friendly and not too costly to run.

Who Offers Self-Build Mortgages in Scotland?

In Scotland, a range of lenders offer self-build mortgages. Well-known options include the Scottish Building Society, the Mansfield Building Society, and the Newcastle Building Society.

Each of these lenders has unique eligibility criteria that you’ll need to meet. And it’s important to consider not just the interest rates and fund release terms but also their specific requirements, which might vary widely.

This is where a mortgage broker can be invaluable.

Brokers have a deep understanding of the market and can help you identify the most suitable lender based on your individual circumstances and project details. They can guide you through the options and help you make an informed decision.

Can the Help to Build Scheme Benefit Self-Builders in Scotland?

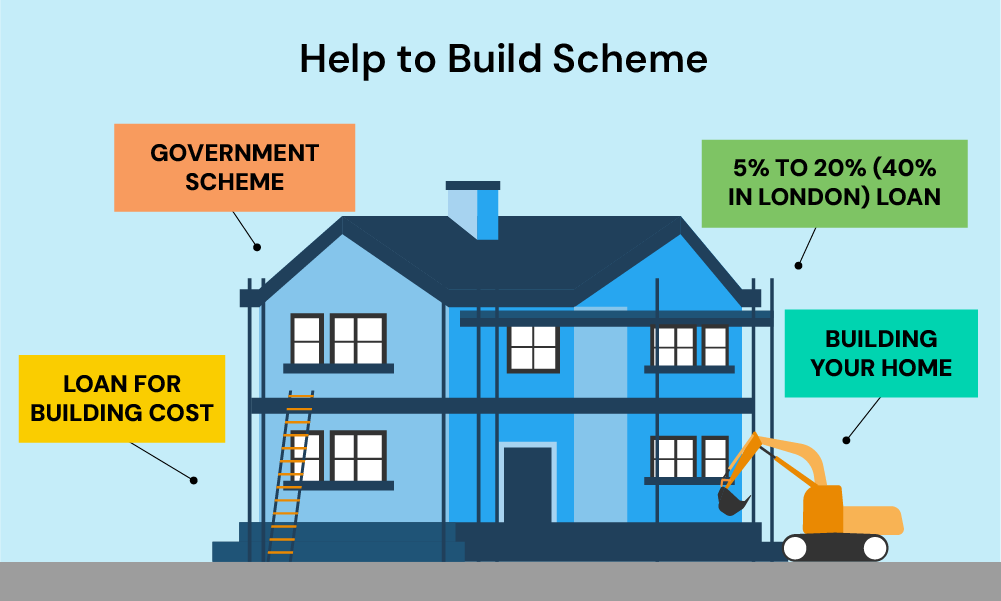

The Help to Build scheme in Scotland, also known as the Scotland Self-Build Loan Fund, is a great option if you’re planning a self-build project. It’s much like the Help to Buy scheme but specifically designed for self-builds.

To qualify, you need to:

- Show that regular bank loans won’t cover all your construction costs.

- Own the land or be in the process of buying a plot.

- Have both planning permission and a build warrant ready.

The fund offers loans for up to five years, with amounts up to £175,000 for eligible applicants. These loans are meant to help with building costs in both city and countryside areas.

Keep in mind that you can’t use these loans to buy the land.

This scheme could be just what you need to make your self-build project happen, especially if you’re struggling to get a standard loan.

To start your application, visit their website.

What Are the Alternatives to Self-Build Mortgages in Scotland?

If a self-build mortgage isn’t the right fit for you in Scotland, don’t worry. There are other options you can consider.

Scotland Self-Build Loan Fund

First, there’s the Scotland Self-Build Loan Fund. This is a great alternative if you find it tough to get a traditional self-build mortgage.

The fund offers loans to help with the construction of your home. It’s available for both urban and rural projects, but remember, it’s not for buying land.

This could be a good option if you already own the land or can manage the land purchase separately.

Bridging Loans

Another option is a bridging loan. These are short-term loans that can help you cover the costs while your home is being built.

Once your home is finished, you can either pay back the loan or switch to a regular mortgage. Bridging loans can be helpful, but they often have higher interest rates. They’re a good solution if you need money quickly and plan to repay it in a short time.

The Bottom Line

Before jumping in, it’s important to get tailored advice from an expert. A self-build project is a big deal, and you want to make sure everything goes smoothly.

A Self Build Mortgage broker understands the market and can give you advice tailored to your project. They can help you find the right lender, understand the terms and conditions, and guide you through the application process.

Here are a few tips for finding and working with a self build mortgage broker:

- Look for Experience – Find someone who has helped others with self-build projects. They’ll know the ins and outs of the process.

- Check Qualifications – Make sure they’re qualified. In the UK, look for brokers regulated by the Financial Conduct Authority (FCA).

- Prepare Your Details – Have all your project details ready. This includes your budget, plans, and any permissions you’ve secured.

- Ask Questions – Don’t be afraid to ask questions. The more you understand, the better decisions you’ll make.

If this all feels overwhelming or you just want to save time and stress in your search, reach out to us. We’ll connect you with the right broker who’s suited to your specific mortgage situation.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

Is planning permission required for a self-build mortgage in Scotland?

Yes, you need planning permission for your self-build mortgage in Scotland. This is an essential step. The planning permission shows that your local council approves your building plans. It’s a must-have before lenders will consider giving you a mortgage. Make sure you have this in place to avoid any hiccups in your journey to building your own home.

To learn more about how to apply click here.