- What Are Self-Build Mortgages and How Do They Work?

- Who Can Get Self Build Mortgages in the UK?

- Why Are Self-Build Mortgage Rates Typically Higher?

- What Are the Current Trends in Self-Build Mortgage Rates?

- How to Find the Best Self-Build Mortgage Rates in the UK

- How Does Your Project Affect Your Mortgage Rate?

- Common Pitfalls and How To Avoid Them for a Self-Build Mortgage

- The Bottom Line

Find The Best Self Build Mortgage Rates in 2025

Building your own home can cost less and feel very rewarding. But to make it work, you need to understand self-build mortgage rates.

These rates are usually higher than regular mortgages because lenders see building a house from scratch as riskier.

This guide will help you understand how these rates work. It’s important to know this so you can plan your budget and manage your money while building your dream home.

What Are Self-Build Mortgages and How Do They Work?

A self-build mortgage is a special type of loan designed for people who want to build their own home.

Unlike a standard mortgage where you receive the full amount when you buy a house, with a self-build mortgage, the money is released in stages as the build progresses.

This way, you get funds when you need them for each phase of your project.

One key difference between self-build and traditional mortgages is how the money is given out. In a regular mortgage, you get the full loan amount upfront when you purchase a property.

But in a self-build mortgage, the lender releases the money in chunks – often after each major stage of the building is finished. This could be after laying the foundations, getting the roof on, and other key stages.

Moving from understanding the nature of self-build mortgages, it’s equally important to know who can access these loans and the criteria involved.

Who Can Get Self Build Mortgages in the UK?

In the UK, those who can qualify for self-build mortgages typically include individuals or families looking to construct their own homes, rather than buying a pre-built property.

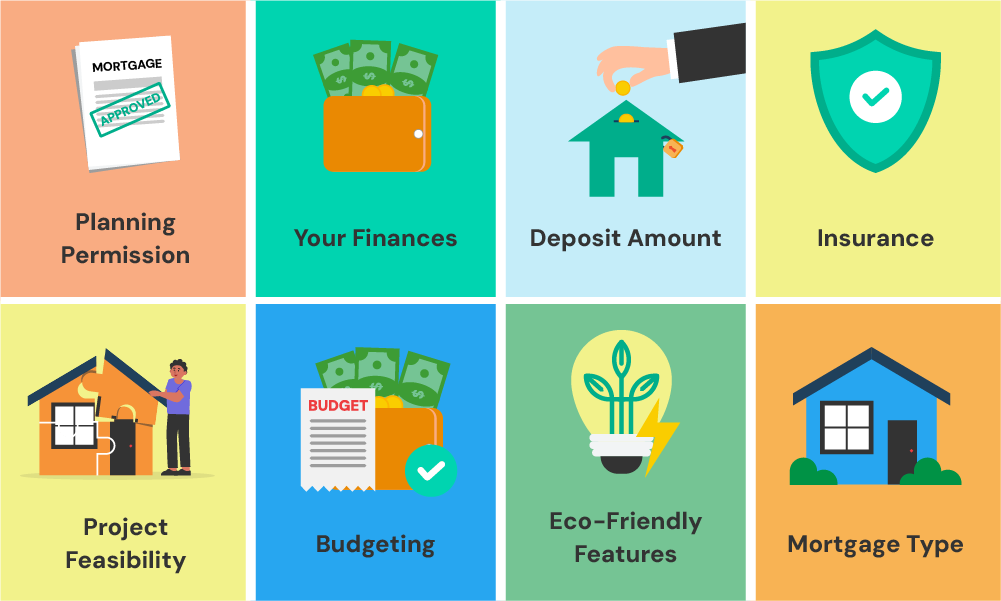

Here are factors lenders look for when applying:

- Planning and Building Permissions. You must have detailed building plans and the right planning permission for your home. Lenders want to make sure your project is properly planned and allowed.

- Your Money Matters. Lenders will look closely at your finances. This includes your income, how much you’ve saved, and your credit history. They need to know you can handle the mortgage payments and the costs of building your home.

- How Much You Can Put Down. Generally, you need a bigger deposit for a self-build mortgage than a regular one. It’s usually about 25% of the total cost, but this can change depending on the lender and your project.

- Insurance and Guarantees. You need the right insurance for when you’re building and a guarantee for the finished house. These protect your money and the lender’s interest.

- Can Your Project Happen? Lenders check if your building project makes sense. They look at where you’re building, your design, how you plan to build it, and who’s in charge of the project.

- Budgeting Right. It’s important to estimate your building costs accurately. You should also have extra money or a contingency fund set aside for surprises. Lenders want to see that you’re ready for unexpected costs.

- Environmental and Energy Efficiency Factors. If your project is eco-friendly, like using solar panels or energy-saving designs, lenders might see it more favourably.

- Type of Mortgage. There are two main kinds of self-build mortgages. One kind gives you money after each building stage, and the other kind gives you money before you start each stage. Your choice depends on your financial situation and what the lender offers.

With these criteria in mind, it’s clear that securing a self-build mortgage requires careful planning and understanding of lender requirements. This brings us to another crucial aspect of self-build mortgages – the cost.

Why Are Self-Build Mortgage Rates Typically Higher?

Here’s why you usually find higher rates for self-build mortgages compared to standard residential mortgages:

- Increased Risk. For lenders, self-build projects carry more risk. Unlike a regular mortgage, where the property is already there, self-builds have uncertain elements like possible delays or going over budget. To cover these risks, lenders often charge more.

- Staged Fund Release. With self-build mortgages, money is given out in stages as your home gets built. This means the value of the property increases gradually. Lenders see this as risky because they’re lending against a home that’s not yet fully built.

- Smaller Market. The self-build mortgage market is quite specialised and not as big as the standard mortgage market. This lack of competition can lead to higher rates because there aren’t as many lenders offering these types of mortgages.

Remember, these are general reasons, and rates can vary. It’s always a good idea to shop around and compare offers if you’re considering a self-build mortgage.

What Are the Current Trends in Self-Build Mortgage Rates?

If you’re looking at self-build mortgages, the rates can change depending on things like your financial situation and what the lender is willing to offer.

Generally, they’re around 1% to 2% higher than the average mortgage rate. But they can go up or down depending on the market and your personal details.

The table below shows a few examples of what some lenders might offer.

Keep in mind that these are just examples, so they may not match what you’d actually get.

Your exact rate, monthly payments, and overall costs could be different based on things like your credit history, how much you borrow, and what the lender decides.

This table is based on a 2-year repayment term and includes fees as part of the total cost.

| Lender | Product | Rate | Max LTV | Fees | Initial Payment | Total Repayment | Mortgage Term |

|---|---|---|---|---|---|---|---|

| Hanley Economic | Discounted Variable | 5.75% | 60% | £1,498 | £1,120 | £28,778 | 2 years |

| Penrith Building Society | Discounted Variable | 5.99% | 75% | £750 | £1,146 | £28,608 | 2 years |

| Saffron Building Society | Discounted Variable | 5.99% | 75% | £890 | £1,146 | £29,098 | 2 years |

| Suffolk Building Society | Discounted Variable | 6.09% | 80% | £1,198 | £1,157 | £29,208 | 2 years |

If you’re planning a self-build project, it’s best to speak to a qualified mortgage broker. They can help you find the most up-to-date rates and guide you to the best deal based on your unique needs.

How to Find the Best Self-Build Mortgage Rates in the UK

Getting the best self-build mortgage rates in the UK means you’ll need to do a few key things:

Look at All Your Costs

It’s important to start clearly understanding all the costs involved in your building project. This isn’t just about what you’ll pay for materials and workers.

Remember to include any extra fees, insurance, and maybe even your living expenses if you can’t stay in your home during the build.

When you’ve got all these numbers, add about 10% more as a safety net for unexpected costs. This will give you a clearer idea of how much you need to borrow.

Gather Information on Your Building Team

Lenders feel more confident when they know your project is in experienced hands. If you’re working with contractors or builders, their track record on similar projects can help you get a better mortgage rate.

Make sure you can show lenders how experienced your team is. If you’re doing a lot of the work yourself, you’ll need to show that you’re well-prepared and capable.

Research and Compare Offers

Beyond these specific steps, continue to research and compare different mortgage products from various lenders, including building societies and specialist lenders. Use online comparison tools for a broad view of the market.

Negotiate with Confidence

Armed with your detailed financial plan and knowledge of what’s out there, you’re ready to talk to lenders.

If your finances are strong, try to negotiate. See if they can match or beat the rates others have offered you.

Get Advice from a Mortgage Broker

Lastly, consult with a good mortgage broker who specialises in self build projects. They can guide you through the process, give you tips, and help you find a mortgage that fits your project.

They’re experts in making sure you plan your project in a way that saves you money and gets you the best mortgage rates.

To connect with your ideal self build mortgage advisor, reach out to us.

How Does Your Project Affect Your Mortgage Rate?

Your self-build project can influence the mortgage rate you’re offered. Here’s how:

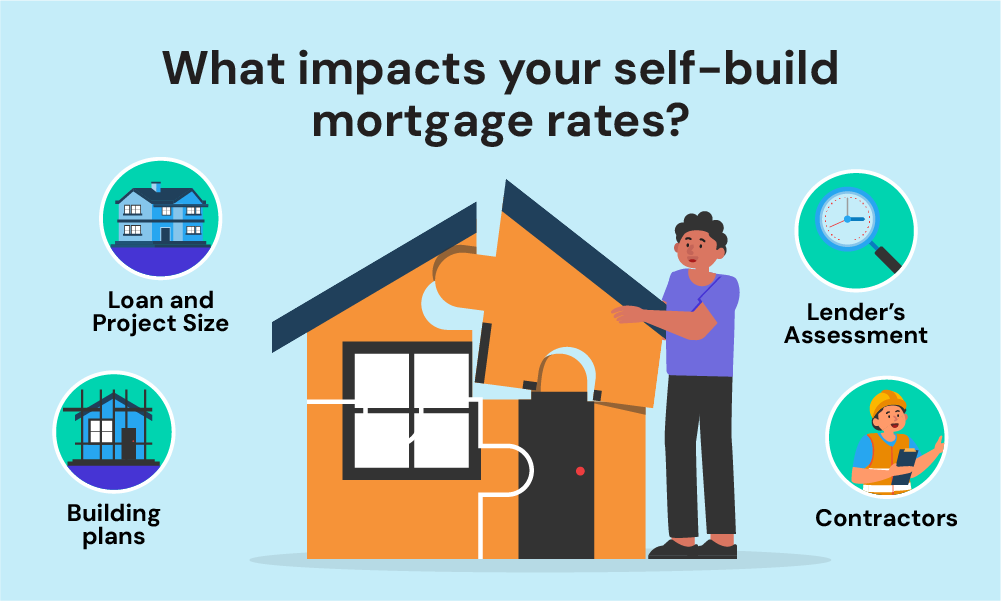

Size and Complexity of the Project

Bigger and more complex projects often mean higher rates. This is because they tend to be riskier for lenders.

More things can go wrong with a larger project, which could affect your ability to repay the loan.

Lender Assessment of Self-Build Projects

Lenders look closely at your project to determine how risky it is.

They’ll consider the location, design, and your experience with such projects. If they think your project is riskier, they might offer you a higher rate.

Detailed Plans and Reliable Contractors

Having detailed building plans and a team of reliable contractors can positively affect your mortgage rate.

It shows lenders that your project is well-managed and more likely to be successful, which can lower your risk level.

Common Pitfalls and How To Avoid Them for a Self-Build Mortgage

Applying for a self-build mortgage in the UK requires careful planning and awareness of potential challenges. Here’s how you can steer clear of common pitfalls:

- Get the Right Architect. Choosing a skilled architect is essential. They’ll help ensure your home meets both your current and future needs, translating your vision into a practical plan.

- Choose the Right Plot Carefully. Before purchasing land, confirm it’s suitable for your planned build. Ensure you can obtain the necessary planning permissions to avoid any legal complications.

- Understand Your Building Plans. Distinguish between planning and technical drawings. Planning drawings focus on aesthetics, while technical drawings detail the construction specifics and compliance requirements.

- Budget Realistically. Accurately budget your project, including all costs. Consider hiring a professional estimator to keep track of expenses and avoid overspending.

- Engage Necessary Professionals. Involve the right experts at different stages, like ecologists, structural engineers, or planning consultants, to ensure all aspects of your project are covered.

- Secure a Solid Building Contract. A comprehensive building contract is crucial to manage the project’s scope, timeline, and budget effectively.

- Conduct a Soil Survey. Performing a soil survey before construction starts is vital to understand the land’s suitability and inform your foundation choices, impacting your budget.

- Resolve Legal Issues. Ensure all legal aspects, such as easements or rights of way, are addressed before commencing the build to prevent future disputes or delays.

- Ensure Material Availability. Check the availability of required building materials in advance. Be prepared for possible delays or price fluctuations in the market.

- Effective Planning and Insurance. Have appropriate insurance in place and manage the planning stage effectively, including a pre-application if necessary, to streamline your project.

The Bottom Line

When it comes to getting the right mortgage for a self-build project, a mortgage broker can be a real asset.

They have a wide network and can access various mortgage products, some of which might not be directly available to you. Their expertise lies in comparing different mortgages to find the one that fits your project best.

Specialised advice is particularly beneficial for self-build mortgages. These professionals understand the unique aspects of self-build projects and offer guidance tailored to these specific needs.

It’s important to choose a broker who has experience with self-build mortgages and is qualified. They should be able to grasp the particulars of your project and offer advice that suits your situation.

If you’re looking to make the mortgage process easier and more efficient, speaking with a professional broker can be a wise move.

To find the right one, get in touch with us. We’ll match you with the perfect mortgage advisor specialising in your situation.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

Can you get a mortgage to build a house in Scotland?

Yes, you can get a mortgage to build a house in Scotland. However, it’s important to note that the self-build mortgage market in Scotland is somewhat smaller compared to the rest of the UK. This smaller market means that you have fewer lender options to choose from, which could lead to higher interest rates for your mortgage.

Furthermore, some lenders in Scotland may have specific restrictions based on your location or postcode, which can sometimes make it more challenging to find a suitable lender for your self-build project.

To navigate these challenges, it’s often beneficial to work with a mortgage broker who specialises in self-build project.

>> More about Self Build Mortgages in Scotland