- What is a 95% LTV Mortgage?

- Can First-Time Buyers Get a Mortgage with a 5% Deposit?

- How To Get a Mortgage with a 5% Deposit?

- What Are Your Options Beyond Traditional Mortgages?

- Will I Face Higher Interest Rates with a 5% Deposit?

- Who Will Consider My Mortgage Application?

- Key Takeaways

- The Bottom Line

A Quick Guide to 5% Deposit Mortgages for First Time Buyers

If you’re trying to buy your first home, you’re probably feeling the squeeze. With everything getting more expensive, saving for a big deposit can feel like climbing a mountain.

But here’s the deal: mortgages that let you put down smaller deposits exist.

This helps first time buyers and those struggling to save up for big deposits get onto the property ladder like everyone else.

Curious? 🤔

This quick guide teaches you all about 95% mortgages for first-time buyers in the UK.

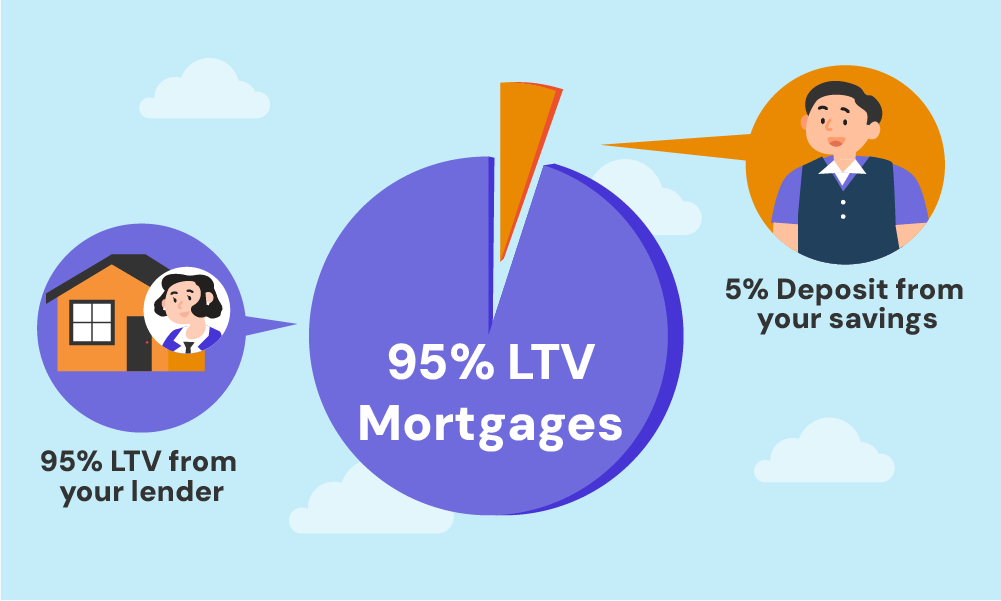

What is a 95% LTV Mortgage?

A 95% LTV mortgage means you borrow 95% of the house’s price from a lender, and you only need to pay 5% as a deposit.

The term “LTV” stands for Loan-to-Value ratio. This is the percentage of how much of the house’s total price your loan covers.

So, let’s say you’re eyeing a house that’s priced at £100,000 and you go for a 95% LTV mortgage, you’ll need to have £5,000 saved up for the deposit.

The lender covers the remaining £95,000.

This is best for people buying their first home because saving a lot of money for a deposit can be hard. It helps you get onto the property ladder faster.

Can First-Time Buyers Get a Mortgage with a 5% Deposit?

Absolutely! First-time buyers can secure a mortgage with just a 5% deposit.

Here’s what you need to know:

- You need to fit the bill – Like any mortgage, approval for a 5% deposit mortgage depends on meeting the lender’s criteria. This usually includes your credit score, income, employment status, and other financial commitments. Lenders want to ensure you can comfortably afford the mortgage repayments.

- Your Options – After the pandemic, more lenders started offering 5% deposit mortgages again. This includes big banks and other lenders. It’s worth looking around or talking to a mortgage broker to find the best deal.

- Government Schemes – There are government schemes aimed at helping first-time buyers get into their homes with just a 5% deposit. This could include the Right to Buy, Right to Acquire, Shared Ownership, and First Homes Scheme.

- Things to Think About – A smaller deposit means you might pay more interest than if you had a bigger deposit. This is because lending you more money is riskier for the bank. But if you’re keen to buy your home sooner, this might be okay with you.

- Next Steps – Before you go house hunting, check your credit score and see if there’s anything you can do to improve it. You can also get a mortgage agreement in principle, which gives you an idea of how much you might be able to borrow.

How To Get a Mortgage with a 5% Deposit?

The key to securing a mortgage with a 5% deposit is preparation. Knowing what you need and having your documents ready in advance are crucial steps towards approval.

Here’s what you need to do:

1. Check Your Financial Health

You can get a FREE financial health assessment here. Moreover, you must make sure you meet the lender’s criteria. In the UK, every lender has its own set of requirements, but generally, you will need:

- You must have a minimum deposit of 5% of the property’s value

- The home you want to buy must be your main residence, not as an investment or a holiday home.

- The value of the property you’re looking to buy cannot exceed £600,000.

- You must have a valid ID and proof that you’re either a British citizen or have the right to live in the UK.

- A solid credit score and stable financial situation. Being on the electoral roll also boosts your credit health, making you more attractive to lenders.

When applying for a mortgage, you need to show the lender that you can afford the payments, even if things change. So, your next step is to gather all the necessary documents and proof of your income.

2. Gather Necessary Documents

To apply for a mortgage, you’ll need to provide several documents, including:

- Valid ID (passport or driver’s license)

- Proof of address (utility bills, bank statements)

- Three to six months of your payslips or P60 (for employed)

- Two to three years of business accounts and SA302 or tax returns (for self-employed)

- Three to six months of your bank statements

- Credit report (optional, but useful for your review)

- Details of your deposit

- Any additional evidence of your outgoings for the debt report.

Before you proceed, you can secure an agreement in principle (AIP) from a lender to know how much you can borrow for a mortgage.

While this is not mandatory, having an AIP during the property search shows sellers that you’re a serious buyer.

3. Start the Application Process

With your AIP and all documents prepared, you can confidently look for a property within your budget.

Once you’ve found it, proceed with the formal mortgage application.

It might be helpful to use a mortgage broker, especially if you’re applying for the first time.

They can help you understand the market, compare different mortgage products, and find a lender likely to accept your application.

What Are Your Options Beyond Traditional Mortgages?

If you’re a first-time buyer with a small deposit, there are some special deals just for you. The government has set up schemes to make it easier to get your foot on the property ladder. Here’s a quick rundown:

- Mortgage Guarantee Schemes. The government offers to take on some of the risks of your mortgage. If you can’t pay, the government guarantees to cover a part of your loan. It makes lenders more likely to lend to you, even if you’ve only got a 5% deposit.

- Right to Buy and Right to Acquire. If you live in a council or housing association home, these schemes could let you buy your home for less than its market value. It’s a great option if you’re eligible.

- Shared Ownership. With this, you buy a share of your home (between 25% and 75% of its value) and pay rent on the rest. It’s handy if you can’t afford the mortgage on the whole house.

- First Homes Scheme. This is for first-time buyers, particularly those in key worker roles, offering new homes at a discount (at least 30% off the market price) to make them more affordable.

- Guarantor Mortgages. If your deposit is small, a family member can act as a ‘guarantor,’ meaning they agree to cover your mortgage payments if you can’t. This gives the lender more confidence to offer you a mortgage.

- Family Offset Mortgages. Instead of acting as a guarantor, your family can help by putting their savings in an account linked to your mortgage. The money in this account is then ‘offset’ against your mortgage, potentially reducing the amount of interest you pay.

- Joint Buyer Sole Proprietor Mortgages. This lets you apply for a mortgage with a family member (like a parent) to boost your income for the mortgage application, but you still get to be the sole owner of the property.

Each of these options has its benefits, depending on your situation, and could help you get onto the property ladder sooner than you might think.

Will I Face Higher Interest Rates with a 5% Deposit?

Yes, usually, the less you put down as a deposit, the higher your interest rate will be.

That’s because lenders see smaller deposits as a bigger risk. However, it’s not all doom and gloom.

With a 5% deposit, expect your interest rate to be about 1% higher compared to if you had a 10% deposit for a 90% Loan to Value (LTV) mortgage. Yet, your credit score and other factors can also affect the rates offered to you.

Also, there are government schemes that provide lenders with a safety net. In return, you can find competitive deals for 95% mortgages.

Remember, always look around for the best rates. Use comparison sites, talk to mortgage advisors, and don’t be shy to haggle a bit. You might get a better deal than what’s advertised.

In a nutshell, though higher interest rates are typical for smaller deposits, there’s room to find a deal that works for you

Who Will Consider My Mortgage Application?

Big banks and well-known lenders like HSBC UK, Barclays, Nationwide Building Society, NatWest, Santander UK, Lloyds Bank, Halifax, and Yorkshire Building Society are all open to 5% deposit mortgage applications from first-time buyers.

But there’s more to the story than just these household names. Specialist lenders also play a crucial role, often coming through with options that might suit you better, especially if your financial situation doesn’t fit the typical mould.

Mortgage brokers are key here. They have the know-how to connect you with lenders, including those special ones like Accord, known for their 5% deposit mortgages but only available through a broker.

So, while you’re exploring your options, remember that a broker can broaden your search and potentially secure you a deal that fits like a glove.

Key Takeaways

- A 95% LTV mortgage lets you buy a home with just a 5% deposit, making it ideal if saving a large deposit is difficult.

- First-time buyers can access mortgages with a 5% deposit through lenders, government schemes, or specialised options like Mortgage Guarantee, Right to Buy, Shared Ownership and First Homes Scheme.

- To secure a mortgage with a 5% deposit, you’ll need to prepare your finances, check your credit score, and gather essential documents like ID, proof of address, and income statements.

- Mortgages with a 5% deposit often come with higher interest rates, but government-backed schemes and good credit can help you find competitive deals.

- Beyond traditional mortgages, options like guarantor mortgages, family offset accounts, or joint buyer arrangements can help boost your application

The Bottom Line

Going for a 5% deposit mortgage has its ups and downs. It can get you into your home sooner, but you might face higher interest rates.

This is where getting the right advice makes all the difference. Mortgage brokers are pros at finding deals that fit your situation.

They use broker matching services to pair you with the perfect broker for your needs, giving you access to advice and mortgages that could save you money in the long run.

If you’re thinking about a mortgage, getting in touch with a broker could be your best first step.

To get started, reach out to us. We’ll connect you with the best mortgage brokers who can find the perfect 95% mortgage deal for you.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

How much can I borrow with my income?

Lenders usually let you borrow around 4.5 times your annual income. But, this can vary based on your specific situation and the lender’s rules.

>> More about Mortgage Income Multiples in the UK

Are 5% deposit mortgages more expensive?

Yes, typically, the interest rates are higher because lending you more money is riskier for the bank. But, government schemes and shopping around can help you find a competitive rate.

Do government schemes make it easier to get a 5% deposit mortgage?

Yes, schemes like the Mortgage Guarantee Scheme are designed to encourage lenders to offer 95% mortgages by reducing their risk. This can make it easier for you to get a mortgage with a small deposit.

This article has been fact checked

This article was created, checked, and verified by the expert team at Money Saving Guru. Trust us, you’re in good hands.