- What Is a County Court Judgement (CCJ)?

- Will a Satisfied CCJ Affect My Credit File?

- Can You Get a Mortgage with a CCJ?

- When is the Registration Date of Your CCJ?

- Does Settling Your CCJ Help in a Mortgage Application?

- Effect of the CCJ Amount on Mortgages

- Does the Number of CCJs Affect Your Mortgage Chances?

- How Your Deposit Size Can Affect Your Mortgage Chances?

- Types of Mortgages Available for Applicants with a CCJ

- How Much Can You Borrow If You Have a CCJ?

- Further Credit Problems and Their Impact

- Key Takeaways

- The Bottom Line

How To Get a Mortgage With a CCJ in the UK? A Guide

A County Court Judgement (CCJ) can make it harder to borrow money, especially for big things like a mortgage. It’s a black mark on your credit file that stays for six years, which can feel like a long time.

It’s easy to feel stressed and confused. You might worry about money, overthink everything, or struggle to understand legal jargon. This is completely normal.

But don’t worry, there’s a way forward. With the right advice and a plan, you can improve your situation. If you want a mortgage despite a CCJ, understanding the process and taking the right steps can help.

This article will explain how a CCJ affects your mortgage chances and share simple steps to help you reach your goal.

What Is a County Court Judgement (CCJ)?

A County Court Judgement, more commonly known as a CCJ, is a type of court order in the UK that might be registered against you if you fail to repay the money you owe.

This serious financial issue usually arises as a last resort after numerous unsuccessful attempts by creditors to recover their debt, such as through calls, letters, and notices.

If a CCJ is granted, it will be recorded on your credit file and checked every time you apply for credit, including a mortgage.

It’s essential to understand that having a CCJ on your record is not something to dismiss lightly. Not only can it pose challenges to your mortgage application, but it can also hinder you from opening a bank account or obtaining a credit card.

Generally, a CCJ will stay on your credit file for six years, irrespective of whether you settle it sooner.

If you think that the CCJs recorded against you are wrong, you can contest them with the credit reference agency and have them removed sooner.

Will a Satisfied CCJ Affect My Credit File?

As mentioned earlier, a County Court Judgement (CCJ) typically remains on your credit file for six years from the date it was issued. It’s like a scar on your credit report and it can significantly impact your ability to secure loans.

Every time you apply for credit, lenders will take a peek at your credit file to assess your creditworthiness, and spotting a CCJ can trigger alarm bells.

In the eyes of lenders, a CCJ is an indication that you’ve struggled to repay debts in the past.

Consequently, this could make them cautious about approving your application or result in you being offered less favourable terms, such as higher interest rates.

Can You Get a Mortgage with a CCJ?

Getting a mortgage with a CCJ is challenging but not impossible. Your chances depend on various factors, including:

- When the CCJ was recorded

- Whether it’s been satisfied

- The amount involved

- The number of CCJs on your credit file

- The size of your deposit

- The type of mortgage you’re applying for (e.g., residential or buy-to-let)

- Other issues in your credit history

While some lenders may hesitate, others might still consider your application, especially if your financial situation has improved. Factors like your income, expenses, job stability, and the age of the CCJ can also make a difference.

That said, approval isn’t guaranteed. Success depends on your financial situation and meeting the lender’s criteria.

A specialist mortgage broker can guide you to lenders more likely to consider your application, but there are no certainties.

When is the Registration Date of Your CCJ?

When it comes to mortgage applications, the age of your CCJ plays a significant role. It’s not just about having a CCJ, but when it was registered that matters to lenders.

Recent CCJs say within the last 12 months, could make mortgage approval more challenging. They signal recent financial difficulty which can understandably cause concern for lenders.

But, the effect of the CCJ on your application can lessen over time. If your CCJ is older, particularly if it’s nearing or past the four-year mark, it might be regarded as less impactful.

That being said, every lender has different criteria. Some may focus more on the size of the CCJ rather than when it was registered.

The key takeaway here is that the further away you are from the date your CCJ was issued, the better your chances could be.

Does Settling Your CCJ Help in a Mortgage Application?

Satisfying your CCJ – that is, paying it off in full – is highly recommended when considering a mortgage application.

Satisfied CCJs are viewed more favourably as they show lenders you’ve made a conscious effort to clear your debts, even if you’ve previously had problems.

If you have an unsatisfied CCJ, all is not lost. It might mean a narrower choice of lenders and potentially higher interest rates, but a mortgage isn’t entirely out of the question.

If paying the full amount isn’t feasible for you, it can be beneficial to demonstrate consistent efforts towards clearing the debt.

Any evidence that shows your commitment to resolving the issue could be looked upon favourably by lenders.

Effect of the CCJ Amount on Mortgages

A CCJ isn’t just a mark on your credit file – the amount owed as part of the judgement is also crucial. Typically, larger CCJ amounts are viewed more critically by lenders, as it might indicate a higher level of debt or financial mismanagement.

The sum, whether it’s a few hundred or a few thousand pounds, can be influential in a lender’s decision-making process.

However, just like with the age of the CCJ, different lenders will have different policies. While some might be hesitant with larger CCJ amounts, others might be more focused on when it was registered or whether it’s been satisfied.

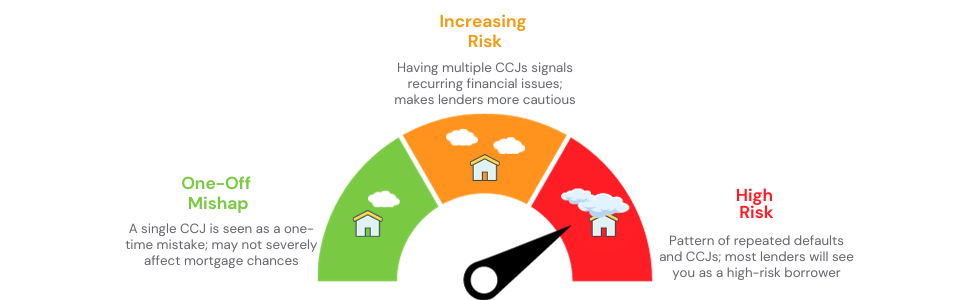

Does the Number of CCJs Affect Your Mortgage Chances?

The number of CCJs on your credit report can also impact your chances of securing a mortgage.

A single CCJ might be looked upon as a one-off mishap, but multiple CCJs could signal a pattern of financial difficulties, which might make lenders hesitate.

Every additional CCJ could potentially decrease your chances of mortgage approval or result in higher interest rates. But, it’s essential to note that having multiple CCJs isn’t an automatic disqualification.

It’s another aspect that lenders will consider alongside other factors such as the CCJs’ ages, amounts, and satisfaction status.

Remember, these are general observations. The actual impact of a CCJ on your mortgage application will depend on numerous factors, including the lender’s specific criteria, your overall credit profile, and how you’ve managed your finances since the CCJ.

That’s why it’s crucial to get professional advice tailored to your situation when applying for a mortgage with a CCJ.

How Your Deposit Size Can Affect Your Mortgage Chances?

A bigger deposit makes lenders more likely to lend to you, especially if you have a CCJ. For example, if your deposit is around 5%, lenders may prefer your CCJ to be over three years old.

If your deposit is 25%, you may still be able to get a mortgage even if your CCJ was registered within the last year. This shows how much weight lenders give to the size of your deposit when assessing risk.

If you can save up a deposit of more than 25%, you will have a much wider range of mortgage options available to you. This will give you more flexibility when it comes to buying a home.

These figures show how important a large deposit is in offsetting the risk of having a CCJ and in expanding your range of mortgage options.

So, when you are planning your financial journey towards homeownership, make sure to consider the important role that your deposit size plays.

Types of Mortgages Available for Applicants with a CCJ

The type of mortgage you want to get can affect your mortgage application. If you are already a homeowner and are considering moving or remortgaging, getting a mortgage with a CCJ may be the easiest option.

But, if you are looking at a new build or are a first-time buyer, mortgage providers are more cautious.

Some lenders may refuse applications with CCJs over £1,000, while others may require CCJs to have been settled for at least a year. Nevertheless, it is reassuring to know that some lenders may be willing to consider your case.

Buy-to-let mortgages are the most difficult to get if you have a CCJ. Mortgage providers may ask you to clear your CCJs before you apply, and they may expect a large upfront deposit.

Some may only consider your application if your CCJ has been on record for more than two years. But don’t give up hope. There are specialist lenders who can help people in difficult situations.

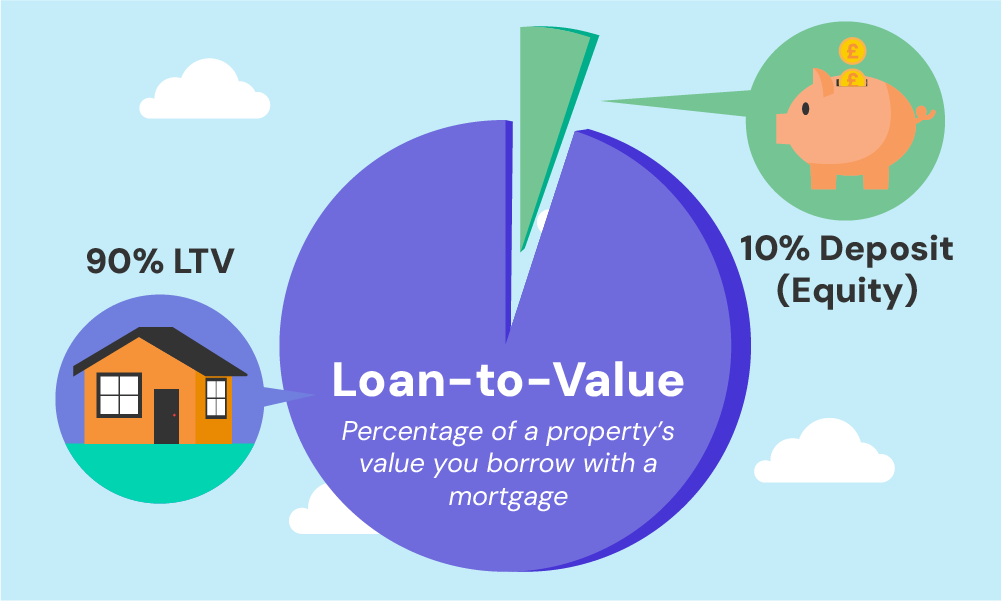

How Much Can You Borrow If You Have a CCJ?

As a mortgage applicant with a CCJ, you might be wondering how much you can borrow. The answer largely depends on two key concepts: Loan-to-Value (LTV) and income multipliers.

LTV is the ratio of your loan to the value of the property. For instance, if you have a 10% deposit, the LTV is 90%.

Generally, the lower the LTV, the more favourable the terms you can secure. With a CCJ on your record, a lower LTV can be particularly beneficial in securing approval.

On the other hand, the income multiplier, as the name suggests, is a multiplication of your income.

Typically, lenders might lend between 3 and 4.5 times your income. But, if you have a CCJ, they might lean towards the lower end of this scale due to perceived risk.

Further Credit Problems and Their Impact

In addition to a CCJ, any other credit issues you’ve experienced can affect your chances of securing a mortgage.

For instance, missed payments, defaults, IVAs, or bankruptcies can compound the difficulties of obtaining a mortgage.

Each issue can further decrease your creditworthiness in the eyes of a lender. As a result, you might face higher interest rates, stricter terms, or more stringent approval criteria.

Key Takeaways

- A County Court Judgement (CCJ) is a court order for unpaid debts that stays on your credit record for six years, making it harder to get loans, credit cards, or mortgages.

- You can still get a mortgage with a CCJ, but it depends on things like how old the CCJ is, how much you owe, and whether you’ve paid it off. Lenders also look at your income, deposit size, and overall finances.

- A bigger deposit (like more than 25%) can boost your chances of getting approved, even if your CCJ is recent or unpaid, because it lowers the risk for lenders.

- Working with a specialist broker can connect you with lenders who accept CCJ cases, but there’s no guarantee you’ll get approved.

The Bottom Line

A CCJ might feel like a hurdle when trying to get a mortgage, but it doesn’t mean it’s impossible.

Several things can influence your chances, such as the size of your deposit, how old your CCJ is, whether it’s been paid off, the type of mortgage you want, the amount of your CCJ, and any other credit issues you might have.

Getting expert advice can help you:

- Find lenders more likely to approve your application.

- Understand and improve your financial situation.

- Create a plan to boost your chances of success.

- Stay up to date with changes in the UK mortgage market.

If you feel overwhelmed or want someone experienced to guide you, reach out. We can connect you with a trusted broker who will offer personalised advice tailored to your needs.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

Will a CCJ impact my mortgage application?

Yes, a County Court Judgement (CCJ) can affect your mortgage application. Lenders may see it as a risk, possibly leading to stricter terms or even refusal of your application. But, several factors can influence this, including the age of the CCJ and whether it’s been satisfied.

Can I secure a mortgage if I have more than one CCJ?

Yes, it’s possible to get a mortgage with multiple CCJs. But, the more CCJs you have, the more difficult it can become. Lenders will look at factors like when the CCJs were registered and whether they’ve been settled.

Is it necessary to clear my CCJ before applying for a mortgage?

Clearing your CCJ before applying for a mortgage can increase your chances of approval. It’s not strictly required, but having a satisfied CCJ can look better to lenders. Some mortgage providers may even insist on it.

How can I improve my credit score after getting a CCJ?

To improve your credit score after a CCJ, you can take several steps. These include paying all your bills on time, limiting your credit utilisation, and regularly checking your credit report for errors. If you satisfy your CCJ, ensure it’s recorded on your credit report. Over time, your credit score can recover.

This article has been fact checked

This article was created, checked, and verified by the expert team at Money Saving Guru. Trust us, you’re in good hands.