- What is a Bridging Loan?

- When Is a Bridging Loan a Good Idea?

- How Do They Work?

- Eligibility Criteria: What Lenders Really Want

- How Much Can You Borrow?

- The Pros and Cons of Bridging Loans

- What are the Types of Bridging Loans?

- Whatâs the Difference between ‘First Charge’ and ‘Second Charge’ Bridging Loans?

- What Will a Bridging Loan Really Cost You?

- Other Options to Think About

- How to Choose the Right Bridging Loan for You

- The Bottom Line

How Bridging Loans Can Finance Your Dream Home: A Full Guide

You’re eyeing a dream home but can’t seal the deal because your existing property hasn’t sold yet. Maybe you’ve found a property at auction and need to secure the funds quickly.

This is where bridging loans come in to save the day.

In this article, we’ll demystify what bridging loans are, how they work, their pros & cons, and much more.

What is a Bridging Loan?

A bridging loan acts as a financial life-saver when you need short-term cash. Let’s say you need to buy a new home before your current one sells; a bridging loan helps you “bridge the gap” between the two transactions.

Unlike a mortgage, the approval for a bridging loan can be swift—perfect if time is of the essence.

But, be cautious. Bridging loans are secured loans, meaning you’ll need to offer an asset—usually your property—as collateral. This makes them somewhat of a last resort in lending due to the inherent risk of losing your assets.

When Is a Bridging Loan a Good Idea?

A bridging loan comes in handy for several situations:

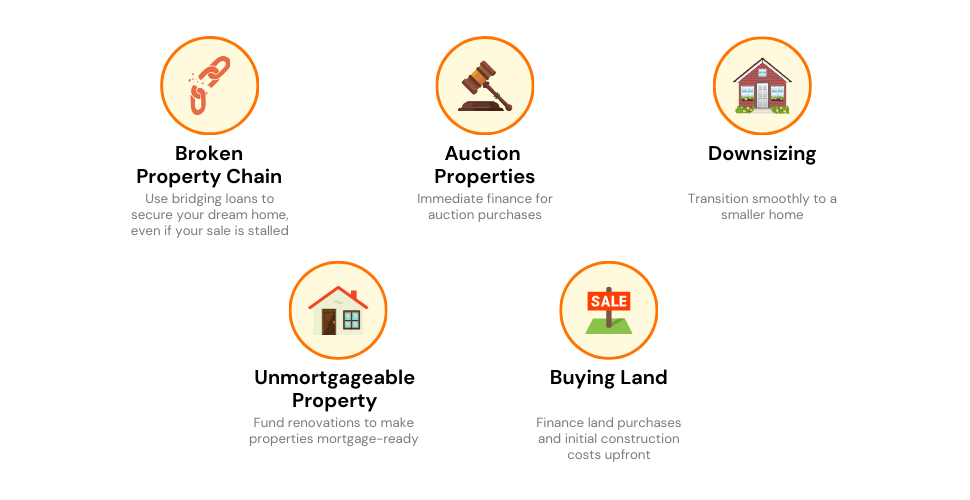

- Broken Property Chain – When the sequence of buying and selling homes stalls—for instance, someone pulls out of the deal—a bridging loan helps you hold on to your dream home while you sort things out.

- Auction Properties – If you’re bidding on a property at an auction and win, a bridging loan ensures you can pay for it right away.

- Planning to Downsize – When you want to move to a smaller place, a bridging loan lets you buy your next home before selling the current one. This way, you can wait for a good offer on your existing property.

- Unmortgageable Property – Found a fixer-upper? A bridging loan gives you the cash you need to make the property habitable, setting the stage for a traditional mortgage later.

- Buying Land – If you’re eyeing a plot of land for a building project, a bridging loan can fund both the land purchase and initial construction costs.

How Do They Work?

You can secure a bridging loan for as little as £50,000 or as much as £10 million, based on your available equity.

And here’s the kicker: Your income doesn’t affect your eligibility for a bridging loan. This means you get more financial flexibility than with a traditional mortgage.

The maximum you can borrow usually fits within a 75% loan-to-value ratio. You can secure this loan against one property or even spread it across multiple properties if needed.

To give you a clearer understanding, let’s look at a hypothetical scenario:

Imagine you’ve fallen in love with a property priced at £350,000. You need £150,000 for the deposit. Your current home hasn’t sold yet, and you have only £60,000 in savings.

Here’s where a bridging loan comes into play. You take out a loan to cover the remaining £90,000 deposit. After selling your existing property, you use the proceeds to pay back the £90,000 bridging loan.

Eligibility Criteria: What Lenders Really Want

To get a bridging loan, you need two big things:

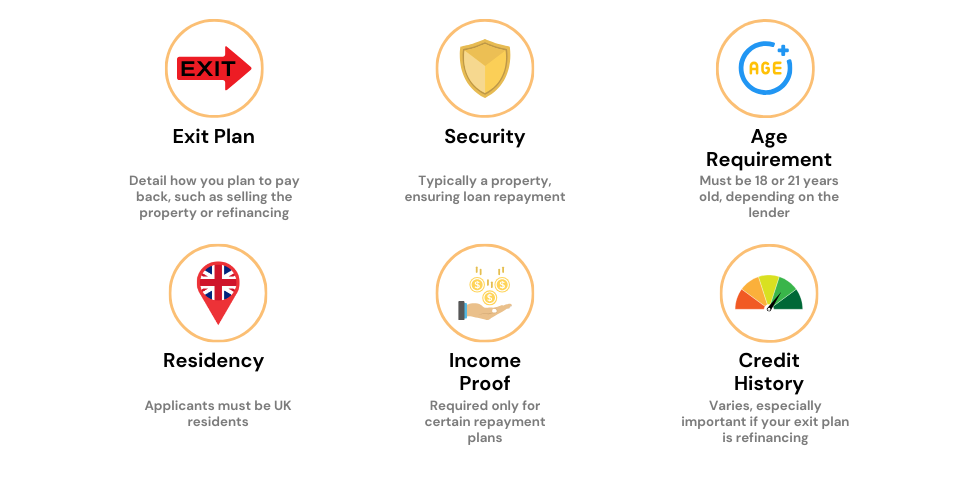

- An Exit Plan – Lenders will want to know how will you pay back the loan.

- Security – You’ll have to offer something valuable in case you can’t pay back the loan.

Using Property as Your Security Net

Most of the time, the property will be your security. Here’s what can count:

- Houses, flats, or bungalows

- Commercial buildings, but only if you plan to turn them into homes

- More than one property can be used

- Even properties that need a lot of repairs

- Projects that aren’t finished yet

- Land

Other essential requirements can be:

- You must be 18 or 21 years old or older.

- You must live in the UK.

- You do not need to prove your income unless you plan to repay the loan by refinancing or buying to let.

- Your credit history will vary. If you plan to refinance, you will need to prove that you will be approved.

Please note that these criteria may vary from lender to lender. Therefore, it is best to check with your chosen lender or broker for the specific criteria that apply to the loan.

How Much Can You Borrow?

The amount you can borrow ranges from £5,000 to a mind-blowing £25 million. It depends on how much your property is worth and your financial situation.

Generally, lenders will let you borrow up to 75% of your property’s value. If it’s a first-charge loan, you might even get more.

The Pros and Cons of Bridging Loans

Before you sign up for a bridging loan, it’s important to weigh both the benefits and drawbacks. Let’s break it down.

Advantages of Bridging Loans

- Quick Funding. When you’re in a hurry, especially for a property deal, bridging loans offer a rapid solution. You get the cash fast.

- Large Amounts. Want to borrow a large chunk of change? With bridging loans, you can.

- Custom Plans. Tailor your repayment schedule to match your circumstances.

- Alternative Paths. Even if mainstream lenders have turned you down, you could still qualify for a bridging loan.

Disadvantages of Bridging Loans

- Collateral at Risk. These loans are secured, meaning you pledge assets like property. If you default, you could lose your collateral.

- Steep Interest. Quick cash comes at a price—higher interest rates.

- Extra Costs. Watch out for additional fees, making your loan pricier than you initially thought.

What are the Types of Bridging Loans?

You’ve got two main options:

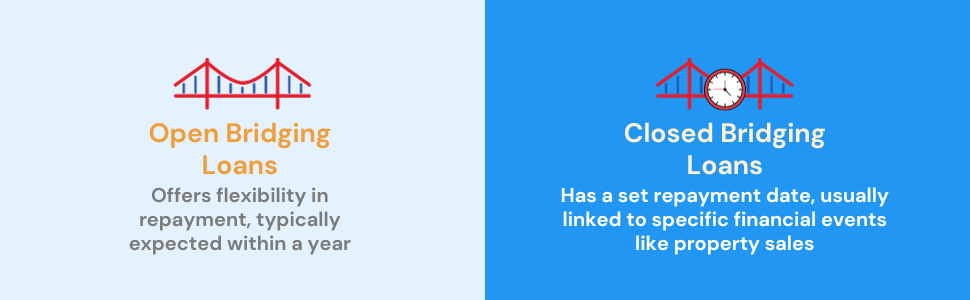

- Open Bridging Loans – No fixed deadline for repayment, but lenders generally want their money back within a year. Some might offer more time, but that’s rare.

- Closed Bridging Loans – There’s a set date for paying the loan back, often tied to when you expect to receive money, like from a property sale.

No matter which type you choose, be prepared to share your ‘exit plan’—how you intend to pay back the loan.

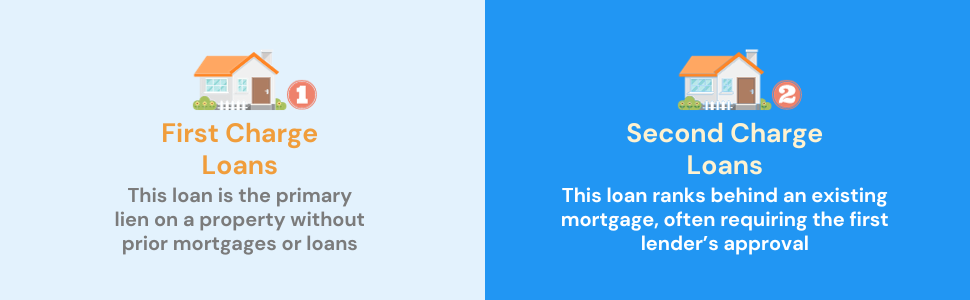

What’s the Difference between ‘First Charge’ and ‘Second Charge’ Bridging Loans?

A ‘charge‘ is essentially a claim the lender places on your property if you can’t repay the loan.

- First Charge Loans – If you don’t have any existing loans against your property, the lender’s claim will be the first in line.

- Second Charge Loans – If you have another loan, like a mortgage, then the bridging loan becomes a second-charge loan. This is riskier for lenders, making it more expensive for you. Plus, you’ll need approval from the first charge lender, usually your mortgage company.

What Will a Bridging Loan Really Cost You?

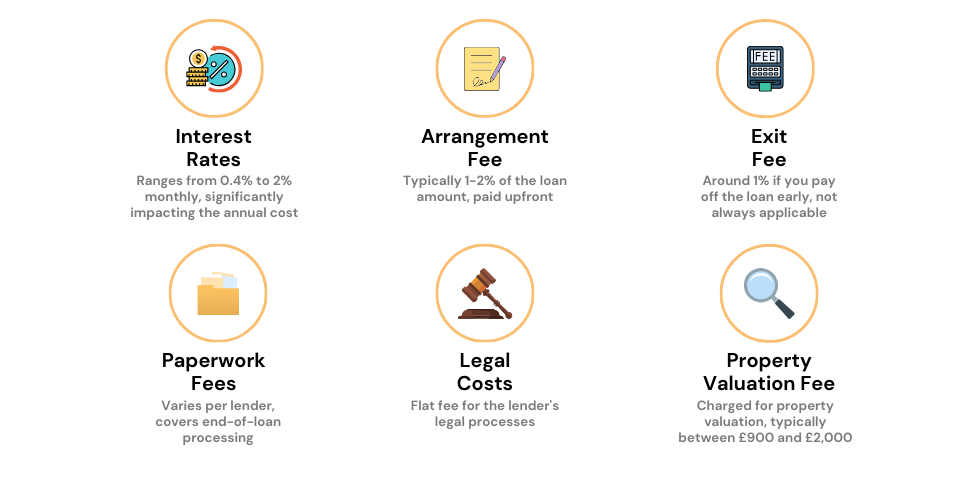

Before you sign any papers, let’s talk about how much you might have to pay. Bridging loans can be pricier than you think. Here’s the breakdown:

First off, you’ll see that interest rates on bridging loans are high. They’re usually charged by the month, not by the year like other loans. These monthly rates can start at 0.4% and go up to 2%.

Now, you might think that’s not a lot, but it adds up fast. For example, a 1% monthly rate turns into an APR of 12.7% when you count compound interest. And a 2% monthly rate? That’s a whopping 26.8% APR.

Some companies give you the choice to delay your interest payments. That means you pay all the interest at the end of the loan term. This might sound like a good deal, but remember: The longer you wait to pay, the more it’ll cost you.

Alongside with the interest rates, there are other fees you can’t ignore:

- Arrangement Fee – You’ll have to pay this right when you get the loan. It’s usually between 1-2% of the total loan amount.

- Exit Fee – If you decide to pay off your loan early, some companies will charge you an extra 1%. But not all companies do this, so check the fine print.

- Paperwork Fees – At the end of your loan, you’ll have to pay for the admin work. This cost varies, so ask the lender for details.

- Legal Costs – Companies will usually charge you a flat fee to cover their legal work.

- Property Valuation Fee – You’ll have to pay for a surveyor to check the value of your property. This can cost anywhere from £900 to £2000.

Note that, some companies might have even more fees. So make sure you read everything and ask questions before you pick a loan.

To sum up, bridging loans aren’t cheap. You’ve got high-interest rates and a bunch of different fees.

But if you know what you’re getting into, you can make a smart choice. Always read the fine print and ask questions so you know exactly what you’re signing up for.

>> More about Bridging Finance Costs

Other Options to Think About

While a bridging loan is an excellent choice for quick, short-term funding, it isn’t your only option. Let’s explore some other avenues:

You can remortgage your current home to unlock some funds. But hold your horses—this is a long-term commitment.

Think about future interest rate changes and how they could impact your finances. If you’re at all uncertain, it’s a good idea to consult an expert for advice.

Let-to-Buy

Another route is switching your current mortgage to a buy-to-let one. This allows you to tap into your home’s equity to buy another property, whilst renting out your original home.

However, do consider the risks. What if you can’t find tenants? Or what if interest rates jump, making two mortgages hard to manage? If you have any reservations, it’s prudent to seek professional counsel.

Secured loans often have more agreeable interest rates and allow you to borrow larger amounts compared to personal loans. But, like bridging loans, they come with a catch—your property could be at risk if you don’t keep up with repayments.

Personal Loans

Some lenders offer personal loans of up to £50,000, although £25,000 is more typical. If you’re only after a smaller sum, a personal loan can be your best bet.

With interest charged annually instead of monthly, it can turn out cheaper in the long run. Plus, these loans aren’t tied to your property, keeping your home safe from repossession.

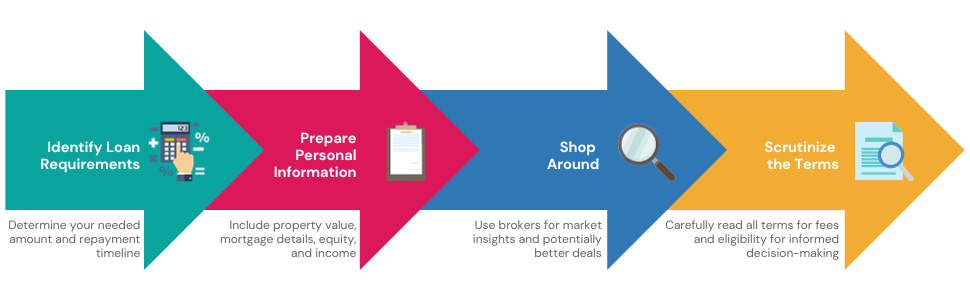

How to Choose the Right Bridging Loan for You

If you’re on the hunt for a bridging loan, it’s crucial to find one that suits your needs. Here are some key steps to guide you through the process:

1. Identify Your Loan Requirements

First and foremost, figure out the exact amount you need and for how long. Given the high cost of bridging loans, you’ll want to repay it as quickly as possible.

2. Prepare Your Personal Information

The lender you opt for will need to understand your financial situation. Have these details at your fingertips:

- The value of the property in question

- Current mortgage details and the amount you owe, if applicable

- The equity available in your property

- Your regular income and outgoings

3. Shop Around

Avoid settling for the first loan offer that comes your way. You have options.

Bridging loan brokers can help you survey the market, and though they might charge a fee, they could also land you some exclusive deals.

4. Scrutinise the Terms

Before you commit, make sure you’re aware of all the fees involved. Read the terms and conditions carefully.

Lastly, aim to apply for loans where you have a higher chance of approval.

The Bottom Line

If you’re scratching your head about how to lock in the right bridging loan, you’re not alone.

A specialist broker can be your best ally. They’ll sift through the market for you and might even haggle down those interest rates.

Usually, you’ll need at least one property as collateral. Let’s not forget that lenders love a good exit strategy. They’ll want to see your game plan for paying back what you owe.

If all of this sounds overwhelming, simply reach out to us. We’ll arrange a free, no-obligation consultation with a seasoned bridging loan broker who can demystify the process and help you snag better rates.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

Is a bridging loan a wise choice?

Bridging loans are specialist forms of financing, generally considered a last-resort option. They are primarily used by experienced or professional investors these days. Make sure to consult a specialist broker to explore more suitable alternatives before taking this route.

Who provides bridging loans?

Since the 2008 financial crisis, most high-street banks like Nationwide, Halifax, and Santander have stopped offering bridging loans. Now, alternative lenders such as United Trust Bank, Precise Mortgages, and MT Finance, as well as some regional building societies, offer them. Lloyds Bank still offers bridging loans but only to its private banking customers.

Is a bridging loan costlier than a mortgage?

Yes, bridging loans typically come with higher costs compared to traditional mortgages. But they offer flexibility and can help you secure a property deal. Use our Bridging Loan Calculator to understand the costs better.

How are bridging loan payments made?

The payment structure varies. If interest is charged monthly, you’ll make interest-only payments each month. If it’s rolled up, you’ll repay it along with the loan amount.

There’s also the ‘retained’ interest option, where you borrow the interest amount upfront and get any unused interest back when you repay the loan.

Can you use a bridging loan for a Buy to Let property?

Yes, you can use a bridging loan to finance a Buy to Let property.

Can you secure a bridging loan with poor credit?

Yes, you can get a bridging loan even if you have bad credit. However, expect higher interest rates. To improve your chances, focus on boosting your credit score; check out our guide on How to Improve Your Credit Score for a Mortgage.