Solve Your Cash Gap: How Bridging Finance Brokers Can Help

If you’re in a pinch between selling one home and buying another, bridging finance could be your lifesaver. It’s a short-term loan that fills the financial gap.

But finding the right loan isn’t a walk in the park. That’s where a bridging loan broker comes in handy. These experts guide you through the loan selection process, making sure you get the best terms and rates.

In this article, we’ll talk about what this loan is and how a broker can help you get the best deal.

What is a Bridging Loan?

A bridging loan is a short-term financial solution that you can use to “bridge” the gap between making a purchase and securing long-term financing. Imagine you’ve found your dream home but haven’t yet sold your existing property.

A bridging loan can cover the purchase cost, allowing you to seal the deal while you wait for your old house to sell.

These loans are not just for property transactions; you can also use them for business investments, funding renovations, or even settling tax bills.

While bridging loans offer fast access to cash, they come with higher interest rates compared to traditional loans. So, it’s crucial to have a clear repayment plan.

Many people use them as a last resort, but they can be incredibly useful in the right circumstances. You’ll often hear them being used in property auctions, real estate investments, or complex mortgage situations.

Types of Bridging Finance a Broker Can Secure

When it comes to bridging finance, a broker can help you secure various types of loans tailored to your needs:

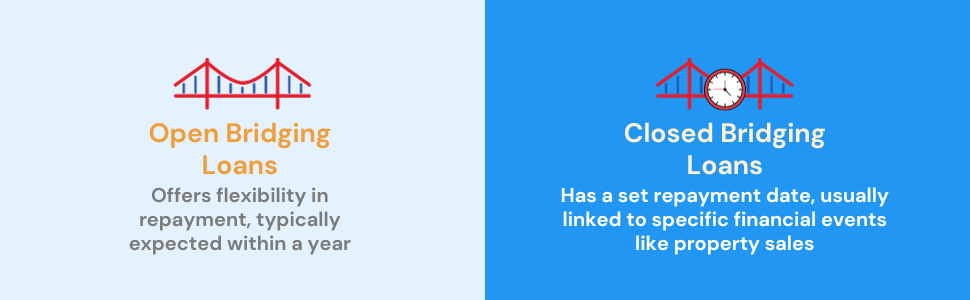

Open Bridge Loan

If your repayment date isn’t set in stone, an open bridge loan offers flexibility.

You won’t have to commit to a fixed date for repayment but remember, these are still short-term loans, usually with a maximum term of around three years.

Closed Bridge Loan

In contrast, a closed bridge loan requires you to agree on a specific repayment date.

This type is ideal if you’ve got a property sale or contract exchange coming up and you know exactly when you’ll have the funds to pay back the loan.

A specialist broker’s expertise can be invaluable in choosing the right type of bridging finance for you. They can navigate the complexities and help you avoid any pitfalls, making sure you get a loan that suits your situation perfectly.

What is a Bridging Loan Broker?

A bridging loan broker is a financial specialist who serves as an intermediary between you and potential lenders. They provide expert guidance in selecting the most appropriate bridging loan tailored to your unique financial situation.

Far from being just a middleman, a bridging loan broker uses extensive market knowledge to find deals that fit your financial goals.

Here’s What a Bridging Loan Broker Can Do For You:

- Get You Lower Interest Rates – Brokers use their lender relationships to secure competitive interest rates.

- Find Loans for Bad Credit – If your credit history is spotty, a broker knows which lenders are more forgiving.

- Help First-Time Investors – If you’re new to bridging loans, a broker demystifies the process for you.

- Tailor Loans for Commercial Properties – Looking to invest in a business property? Brokers can find you the right loan.

- Enable Non-Standard Property Purchase – Want to buy a unique or unconventional property? A broker knows which lenders to approach.

- Assist in Land Buying – If land is your investment goal, brokers can find you loans specific to that need.

- Secure Larger and Longer Loans – If you need a big loan or extra time to pay it back, brokers find you suitable terms.

- Get 100% LTV Options – While many lenders cap their loan-to-value (LTV) ratios at 75%, a skilled broker can find your options for 100% LTV. This means you can potentially secure a bridging loan without a deposit. Keep in mind that you’ll likely need a high-value asset as security due to the increased risk.

By using a bridging loan broker, you simplify your loan experience and align it closely with your specific financial objectives.

Why You Should Consider Using a Bridging Loan Broker

When you’re exploring bridging loans, a specialised broker can be your best ally. Here’s why.

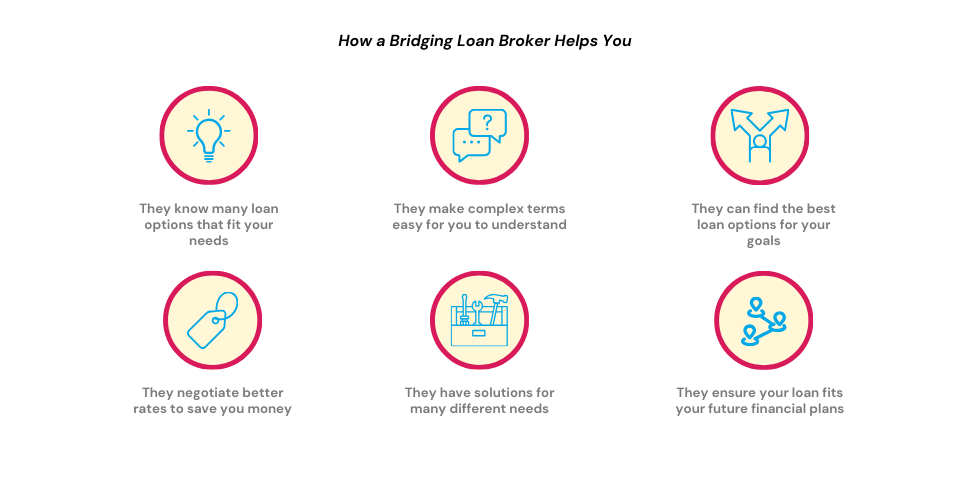

Expertise Matters

A broker knows the bridging loan market inside and out. They pinpoint loan options that fit your needs, even ones you didn’t know were possible.

This expertise is crucial, whether you’re looking for commercial loans, buying non-standard property, or you’re a first-time investor.

Cutting Through Jargon

Financial terminology can confuse the best of us. A broker simplifies these terms, so you understand your loan’s ins and outs. No more scratching your head over interest rates or hidden fees.

Choice Simplified

The UK bridging loan market can overwhelm anyone with its range of lenders and loan types. A broker sifts through these for you, presenting you with a list that best matches your financial goals.

Tailored Rates

Brokers not only find you a loan but also secure the best rates. Their strong ties with lenders allow them to negotiate rates that you wouldn’t get otherwise.

This could mean lower interest rates, which can save you significant money in the long run.

Wide Range of Services

Are you interested in a 100% bridging loan? Do you have a bad credit application? Perhaps you’re looking to invest in property, buy land, or need a larger and longer loan.

Brokers offer solutions for a wide range of specific needs, making them invaluable assets.

More than Just a Loan

Brokers set you up for a better financial future. They ensure the loan you get aligns well with your financial plans, be it for commercial properties or individual investments.

While brokers offer extensive services and expertise, they may also come with upfront fees or commission-based charges.

Additionally, they might not have access to all the lenders in the market, which could limit your options. It’s always good to double-check their recommendations independently.

To ensure you land the right broker and ultimately, the best deal, don’t hesitate to reach out to us. We’ll pair you with a top-tier, whole-of-market broker who can demystify the process and secure a loan that really suits you.

Costs Involved in Using a Broker

Let’s get straight to the point: using a broker isn’t free.

However, the costs can vary and you’ll likely find the value they offer well worth it.

So, what might you expect to pay? Some brokers charge an upfront fee for their services, usually around 1% of the loan amount.

Others operate on a commission basis, earning their cut from the lender once the deal is sealed. In some cases, brokers may not charge you directly at all if they’re receiving a commission from the lender.

Another cost you should be aware of is the arrangement fee from the lender, typically around 2%. While these numbers might seem small, they can add up quickly depending on the size of your loan.

But remember, a good broker can also save you money by negotiating better terms and avoiding hidden charges.

Documents to Prepare for Your Broker

Preparation is key when you’re looking to secure a bridging loan, and having the right documents ready can speed up the process. So, what should you gather up before meeting your broker?

- Exit Strategy Plan – This outlines how you intend to repay the loan. Your broker can help fine-tune this plan, but it’s good to come up with a draft.

- Proof of ID– Whether it’s your passport or driving licence, you’ll need a form of photo ID for verification.

- Proof of Address – A utility bill, council tax, or mortgage statement should do the trick.

- Bank Statements – At least three months of statements will give the broker an idea of your financial stability.

- Income Information – Payslips, P60s, or tax returns will suffice, particularly if you’re self-employed.

- Credit Scores – Knowing your credit score in advance can help you and your broker understand what loan options are realistic for you.

- Asset and Liability Details – Information about other properties, loans, and significant assets or debts should also be disclosed.

- Relevant Documents – Planning permissions, valuation certificates, or anything else related to your property can also be beneficial.

- Solicitor’s Contact Details – Having this info ready will streamline the legal aspects of the loan.

The Bottom Line

When you’re in the market for a bridging loan, a broker can be an invaluable asset. From decoding jargon to securing tailored loan options, brokers make the entire process far more manageable.

They can even help you secure 100% LTV loans or find solutions for bad credit and non-standard property investments. However, it’s essential to be aware of potential upfront fees and to verify their advice independently.

If you’re serious about securing the best terms on your bridging loan, don’t go it alone. We offer a broker-matching service designed to pair you with the most suitable expert for your needs.

Get in touch for a free, no-obligation chat. We’ll connect you with a bridging loan broker who can guide you through the ins and outs, ensuring you make the most informed decisions.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

What is the main advantage of using a Bridging Loan Broker?

The biggest benefit of using a broker is their expertise in finding a loan tailored to your specific needs. They can secure lower interest rates, find loans for poor credit, and guide first-time investors.

How does a broker evaluate which loan suits me?

Brokers consider multiple factors, including your financial stability, credit score, property value, and specific requirements, to recommend the most suitable loan.

How quickly can I get a bridging loan through a broker?

The timeline can vary, but brokers often expedite the process due to their market knowledge and lender relationships. Generally, it can take anywhere from 24 hours to two weeks.

What is a 100% LTV Bridging Loan?

A 100% Loan-to-Value (LTV) bridging loan means you can secure the loan without a deposit. However, you’ll likely need to provide a high-value asset as security.

What's the difference between regulated and unregulated bridging loans?

Regulated bridging loans are overseen by the Financial Conduct Authority (FCA) and are typically geared towards residential uses. They come with specific rules and protections but can be less flexible due to these regulations.

Unregulated bridging loans, on the other hand, are more flexible and are often used for commercial or buy-to-let properties. These loans don’t come with the consumer protections that regulated loans offer, allowing for terms to be customised to fit your business needs.

How long is the repayment period for a bridging loan?

Bridging loans are generally designed to be short-term solutions, most commonly requiring repayment within 12 months. However, terms can vary, and there is room for flexibility depending on the lender and the specifics of your financial situation.

Unlike traditional loans, which often have monthly repayments, you’ll typically repay the bridging loan in one lump sum at the end of the loan term. That said, some lenders may require borrowers to make monthly interest payments during the life of the loan.

How do I choose the right broker?

Look for brokers with good reviews, transparent fee structures, and a broad network of lenders. Or, reach out to us for a broker-matching service that pairs you with a suitable expert.