- Why Consider a Bridging Loan?

- How Much Does a Bridging Loan Cost?

- When Should You Pay These Fees?

- How Much Will It Cost You?

- What About Bridging Loan Interest Rates?

- Factors Affecting Your Bridging Loan Interest Rate

- How You Can Pay Back Your Bridging Loan Interest

- Costs When Buying a House: What’s Different?

- Money-Saving Tips for Cheaper Bridging Loans

- The Bottom Line

How Much Does a Bridging Loan Cost in the UK?

If you’ve heard about bridging loans, you might be put off by the notion that they’re costly and come with additional fees like valuation, broker, and admin charges.

While it’s true that bridging loans are generally more expensive, don’t dismiss them outright.

These loans offer unique benefits such as quick approval and short-term flexibility, making them a viable financial tool for specific situations.

In this guide, we’ll provide you with a thorough breakdown of the costs you should be aware of when considering a bridging loan in the UK.

Why Consider a Bridging Loan?

The main draw of a bridging loan is speed.

When you spot your dream home or stumble upon an unbeatable investment, the last thing you want is to get bogged down in the slow-moving wheels of traditional financing.

Bridging loans help you act quickly to secure the property you’ve set your sights on. Other compelling reasons include buying at auctions, tackling renovation projects, leveraging your equity in a mortgage-free home, or even saving a stalled property chain.

So, let’s not mince words: A bridging loan could be the difference between seizing an opportunity and missing out.

How Much Does a Bridging Loan Cost?

When you’re looking to get a bridging loan, costs are usually at the top of your mind. It’s not just about the amount you’re borrowing; there are various other costs that come into play.

Let’s dive into each component, so you know exactly what to expect.

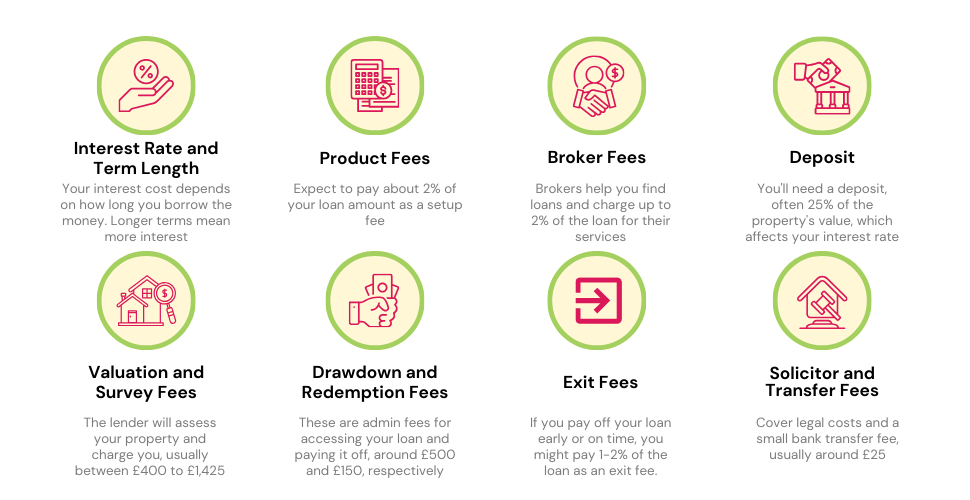

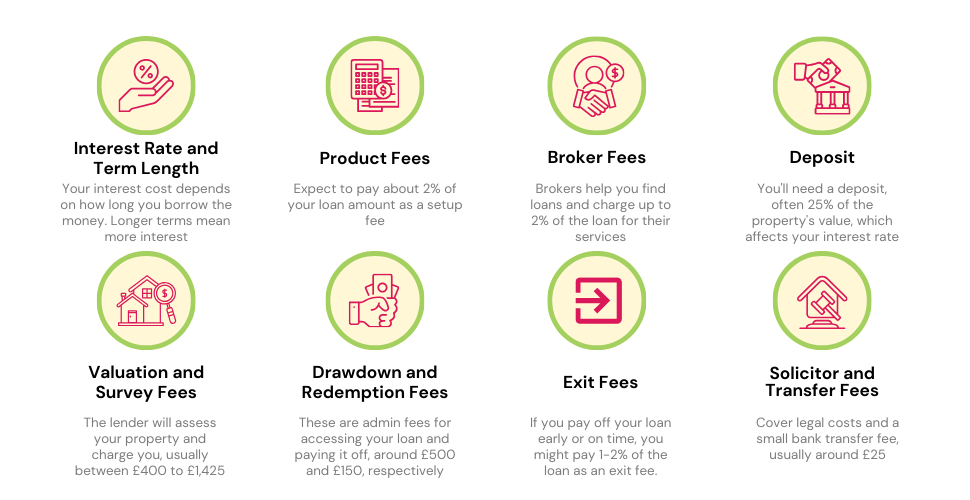

Interest Rate and Term Length

The most noticeable costs in bridging loans are the interest rate and the term, or length, of the loan. These can differ if you’re buying a house, purchasing land, or using the loan for business reasons.

The terms usually span from as short as 3 months to as long as 3 years. Remember, the longer you take to pay back the loan, the more you’ll end up paying.

Product Fees (Arrangement or Facility Fee)

Most lenders charge what’s known as a product fee to set up your loan. This fee is often a percentage of the amount you’re borrowing, usually around 2%.

For example, if you’re borrowing £100,000, you’d pay a product fee of £2,000.

Broker Fees

Although you can go directly to a lender, it’s often wise to use a broker. They can help you find the best deal and handle the paperwork.

Brokers usually charge a fee, either a flat amount or a percentage of the loan you’re taking, which can range from 0.5% to 2%. Look for brokers who charge only when they successfully get you a loan.

Deposit

Expect to put down a deposit, usually around 25% of the property’s value. The higher your deposit, the lower your interest rate could be. Some lenders may even lend up to 80% or 85% of the property value.

In some cases, it may be possible to get a bridging loan for 100% of the property’s value. However, this is typically only available if you can offer additional security, such as a second property.

If you are considering a 100% bridging loan, it is important to speak to a qualified financial advisor to discuss your options.

Valuation and Survey Fees

Before lending you money, the lender will inspect the property to ensure it’s worth the amount you’re asking to borrow and that it’s in good enough condition.

If you’re using additional properties or assets as collateral for the loan, the lender may charge separate valuation fees for each. The costlier the property, the higher the valuation fee is likely to be. These fees typically range from £400 to £1,425 on average.

Drawdown Fees (Assessment fee or Admin Fee)

In addition to the product fee, you’ll also face a drawdown fee to access your loan. This fee can vary between lenders but expect to shell out around £500. It may also be referred to as an assessment fee or an admin fee.

Redemption Fees

When it’s time to pay off your loan, a redemption fee applies to remove the legal claim against your property. This fee usually falls between £100 to £150.

Your loan is recorded as a “charge” against your property, and this fee takes care of removing that charge.

Exit Fees

While bridging loans usually allow early repayments without extra charges, you might still face an exit fee when you clear the debt.

Typically ranging from 1% to 2% of the loan amount, this fee is due upon loan closure, whether you pay early or on schedule.

Unlike early repayment fees common in other secured loans, bridging loans generally don’t include this specific charge.

Solicitor and Transfer Fees

Lastly, you’ll need to cover your own solicitor costs related to buying a property. On top of that, lenders will pass on their legal fees to you for organising the loan.

And don’t forget about the bank transfer fee, usually around £25, to move the funds to you or your solicitor.

In a nutshell, a bridging loan can be your ticket to grabbing that perfect property or investment opportunity. Just make sure you’re aware of all the costs involved, so you can budget accordingly.

When Should You Pay These Fees?

Most of the time, you can choose to roll these fees into your loan, paying them off when your term ends.

While this may seem more convenient, keep in mind that you’ll be paying interest on these fees monthly, making it pricier in the long run.

You’ll need to pay some fees right away, though:

- Survey/Valuation fees

- Legal fees

- Broker’s fees (unless your broker only charges upon success)

How Much Will It Cost You?

The amount you can borrow isn’t set in stone. It could be as low as £5,000 or go all the way up to a staggering £25 million.

Two things influence this: how much your property is worth and your financial health.

Lenders will usually loan up to 75% of your property’s value. In special cases, especially if this loan is your primary loan against the property, you could qualify for even more.

To get an idea about how much the loan will set you back each month and in total, use our handy bridging loan calculator.

What About Bridging Loan Interest Rates?

Your eye will likely first catch the loan’s interest rate. This cost is variable and depends on several factors we’ll discuss later.

Unlike regular loans, the interest on bridging loans is given at a monthly rate. Why? Because you may not need the loan for a full year.

After the initial month, the interest is calculated every day. That means you can pay off your bridging loan whenever you want and only owe interest up to that day.

Pro Tip: Extra Funds for Renovations

You have the option to include refurbishment costs in your bridging loan. This way, you can make aesthetic improvements or even extensive changes, like adding a new kitchen or building an extension, before selling the property.

Factors Affecting Your Bridging Loan Interest Rate

1. Loan-to-Value Ratio (LTV)

Your LTV is a crucial factor in determining your bridging loan interest rate. A lower LTV typically leads to a more favourable interest rate.

For instance, an LTV of 50-60% will offer you a considerably lower interest rate than an LTV of 75%. In a similar vein, a 100% bridging loan will be your most expensive option.

Interest rates are not only tied to the Bank of England base rate but also vary from lender to lender. They’re influenced by the lender’s comfort level with different types of properties and clients.

A seasoned mortgage broker can guide your application to the most suitable lender for you, making sure you get the best terms possible.

2. Amount and Duration of Loan

Having an “exit strategy” can also make a difference. If a buyer has already expressed interest in your property, you’re less of a risk, and your broker could help you secure a lower interest rate.

3. Property Condition and Plans

The state of your property and your plans for it also play a role. Riskier ventures, such as major renovations, may lead to higher interest rates.

Your bridging adviser will gather this information and direct your application to lenders most inclined to accommodate your situation.

4. Regulated vs. Unregulated Loans

Is your loan regulated by the Financial Conduct Authority? If so, it’s generally because the property involved is your home.

On the other hand, for non-family-occupied properties, you’ll require an unregulated loan.

Fewer options exist for regulated loans, but the trade-off is generally lower interest rates since lenders must adhere to more stringent regulations for your protection.

5. Property Location

The property’s location can make your loan a riskier or safer bet for lenders. If your property is in a less accessible, rural area, you might face higher interest rates.

Sadly, properties in northern Scotland and rural North Ireland tend to have limited financing options, reflecting this added risk.

6. Credit History

While your property’s value is usually more critical, don’t underestimate the impact of your credit history.

A poor credit score could still get you a bridging loan, but you may face a slightly elevated interest rate compared to someone with impeccable credit.

How You Can Pay Back Your Bridging Loan Interest

When it comes to bridging loans, you get to pick how you want to deal with the interest. You’ve got a few options, and the best one depends on what works for you.

- Monthly Payments – You can choose to pay just the interest each month. That way, you only have to worry about paying back the amount you originally borrowed when the loan term ends.

- Roll-up Interest – Another option is to not pay the interest every month but let it add up. At the end of the loan term, you pay back the total amount, which includes this rolled-up interest.

- Retained Interest – Here, the lender figures out the total interest you’d pay over the loan term and adds it to what you owe. You pay it all back at the end. If you can pay off the loan early, you get back the extra interest they added on.

Your unique situation and plans will influence which repayment option is best for you. A bridging loan broker can help you make the right choice.

Costs When Buying a House: What’s Different?

Bridging loans are versatile. You can use them to buy land, a commercial spot, or even a rental property. But, if you’re buying a house, some special rules come into play.

Regulated or Unregulated

Bridging loans can either follow official rules set by the Financial Conduct Authority (FCA) or not. The fees are usually the same, but the way you approach them changes depending on this.

Stamp Duty

Buying a second property? You’ll pay extra in Stamp Duty Land Tax. This is an added 3% on top of the regular Stamp Duty rate, which slides from 0% to 12% depending on the property value.

You can figure out the tax using an online calculator. Good news—this extra tax comes back to you if you sell the property within three years.

First or Second Charge

Generally, fees are the same whether it’s your first or second charge loan. However, a second charge loan usually has a maximum Loan-to-Value (LTV) that’s 5% less, meaning you’ll need a bigger upfront payment.

Money-Saving Tips for Cheaper Bridging Loans

Looking for a bridging loan without breaking the bank? Don’t worry, there are ways to shave off some of the costs.

Here’s how you can get a good deal:

- Use Multiple Properties as Security. If you’re in the process of buying a new property and haven’t yet sold your old one, consider using both as collateral. This could give you a more favourable interest rate.

- Go Big or Go Home. If you’ve got a small outstanding mortgage on your existing property, you might think a second-charge loan is the way to go. However, it might be more cost-effective to take out a larger bridging loan that also covers your remaining mortgage. This could secure you a better first-charge interest rate.

- Utilise Dual Representation. Some lenders offer the option for dual legal representation. This means you’ll only pay for one solicitor, not two, which can cut down your costs.

- Consider Desktop Valuations. If your Loan-to-Value ratio is low or your property type is well-known to the lender, you might be eligible for a desktop valuation. This avoids the cost of sending out a surveyor to assess your property.

Remember, the cheapest option isn’t always the best fit for your needs, so make sure to consider all angles before making a decision.

The Bottom Line

Don’t just hop online and pick the bridging loan with the lowest interest rate you see. Hidden costs can sneak up on you and make your loan more expensive. Plus, some good lenders might not show up on popular websites.

So, what’s the real way to get a cheap loan that works for you? Talk to an expert broker.

These brokers know the full market, even lenders you’ve never heard of. They look at your needs and find you the best loan that suits you; not just the cheapest one.

Taking the time to speak with a broker isn’t just a money-saver; it’s a strategic move that also saves you time.

Want a hassle-free way of finding the right broker? Get in touch with us. We will connect you with a broker who gets what you need. Then, we set up a free chat to help you speed up the process and get the loan you’re looking for.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

Is getting a bridging loan costly?

Yes, bridging loans can come with high costs. However, they can be worth it depending on your situation.

For example, if your property sale falls through but you’ve already committed to buying a new home, a bridging loan can help you make that purchase while giving you time to find a new buyer. Remortgaging your bridging loan quickly can also cut down on costs.

How fast can I secure a bridging loan?

Speed is often crucial when you need a bridging loan, like when buying a property at auction or closing a sale.

Typically, it takes two to three weeks to secure a bridging loan. But with the help of a broker, you can find lenders who can get you the funds much faster, sometimes even within a day.

>> More about Fast Bridging Loans

Is there an alternative to a bridging loan?

Yes, there are alternatives to bridging loans. Personal loans, home equity lines of credit, and remortgaging can serve as substitutes depending on your needs. Each option has its own pros and cons, so consult a financial advisor to find out which is best for you.

Can you repay a bridging loan early?

Yes, you can repay a bridging loan early. Most bridging loans come with flexible repayment options, allowing you to settle the debt before the term ends. However, make sure to check for any early repayment charges or penalties in your loan agreement before doing so.