- What is a Fixed Rate Mortgage?

- How Do Fixed Rate Mortgage Rates Work?

- What Happens When the Fixed Period Ends?

- What To Do After Your Fixed Rate Ends?

- The Benefits of a Fixed Rate Mortgage

- The Drawbacks of Fixed Rate Mortgages

- What are the Best Fixed Rate Mortgage Deals?

- How Long Should I Fix My Mortgage For?

- Should I Fix For A Shorter or Longer Fixed Rate Mortgage?

- What Are The Cheapest Fixed Mortgage Rates?

- Can I Remortgage During My Fixed Rate?

- Can I Extend My Mortgage Term During The Fixed-Rate?

- Can I Pay My Fixed-Rate Mortgage Early?

- What Are My Options After A Fixed Rate Mortgage?

- Key Takeaways

- The Bottom Line

A Complete Guide To Fixed Rate Mortgages

Buying a house is a dream for many, but it often involves taking out a mortgage.

Mortgages are secured loans from a bank or lender that helps you buy your home. Part of this deal is paying for the interest rates – a fee you pay for the opportunity of borrowing money.

It’s the percentage based on the total amount of your loan, and it gets added to your regular payments.

Generally, there are 2 types of mortgage rates: ‘fixed-rate’ and ‘variable-rate.’ This guide will focus on fixed-rate mortgages and how they work in the UK.

Ready?

What is a Fixed Rate Mortgage?

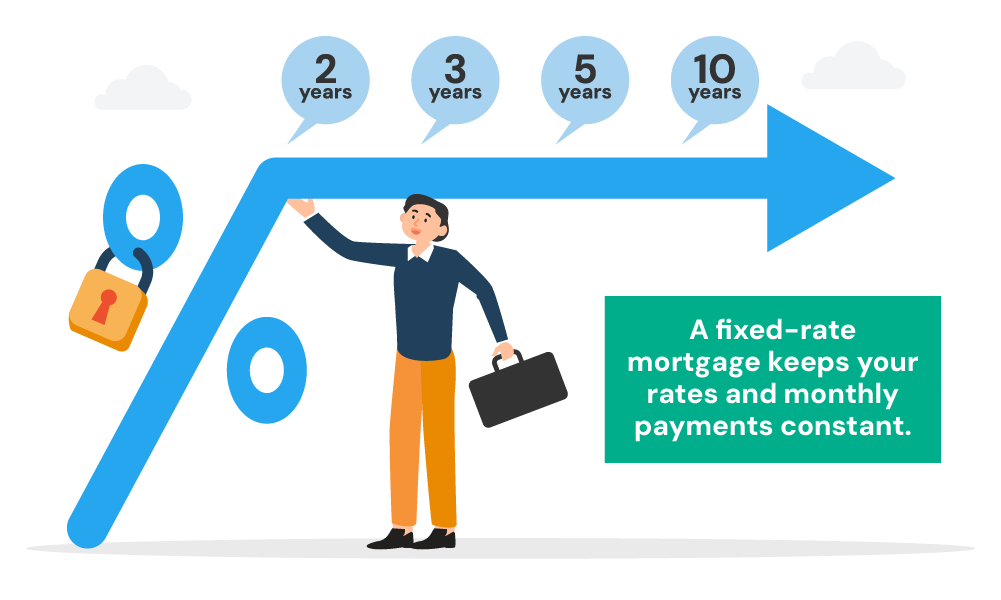

A fixed rate mortgage is a type of mortgage where the interest rate remains constant for an agreed period, typically between 2-10 years.

With a fixed rate deal, your monthly repayments stay the SAME for the duration of the fixed term, regardless of whether interest rates rise or fall.

This provides homeowners with certainty over their housing costs.

How Do Fixed Rate Mortgage Rates Work?

When you take out a fixed rate mortgage, the lender calculates your interest charges based on the fixed interest rate agreed at the outset.

This rate is then applied to your outstanding mortgage balance to determine your monthly repayments, which remain unchanged until the fixed period ends.

While fixed rate periods can vary, it usually lasts anywhere from 2 to 10 years depending on the agreement you choose.

So if you obtain a £200,000 mortgage on a 5-year fixed rate of 3%, your monthly repayment would initially be around £948.

This amount would stay the same for the full 5 years, even if the Bank of England (BoE) base rate increased during that time.

What Happens When the Fixed Period Ends?

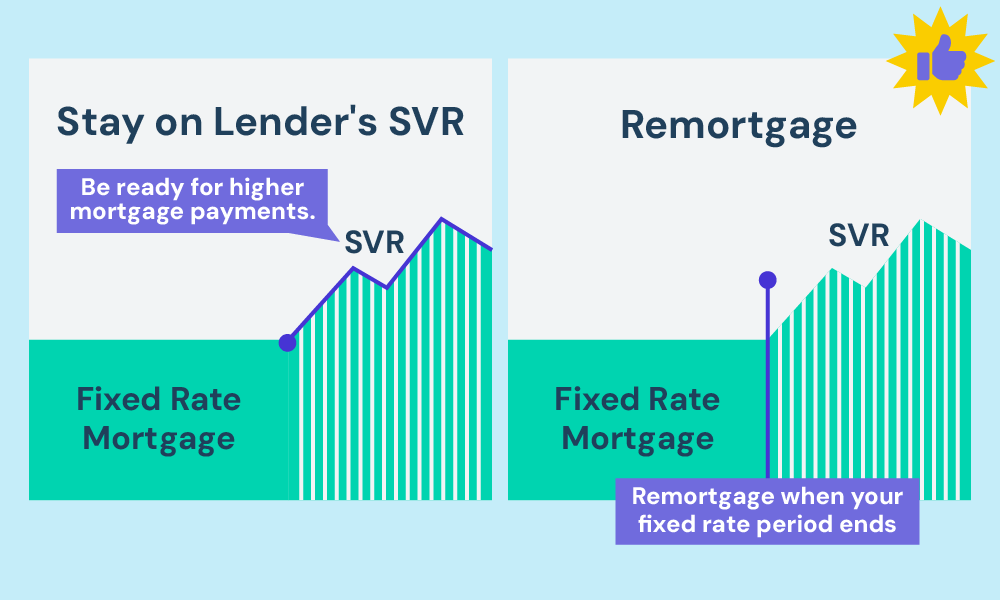

Once your fixed rate period finishes, you’ll be transferred onto your lender’s standard variable rate (SVR) mortgage.

The SVR can change regularly based on your lender’s discretion and response to external factors like the base rate.

This means your monthly payments could rise or fall accordingly. And you might pay MORE interest rate on your mortgage.

To avoid potential payment shocks, most borrowers choose to remortgage to a new deal BEFORE their fixed period expires. This allows you to get another fixed or tracker rate in line with current market pricing.

What To Do After Your Fixed Rate Ends?

First, check your current financial situation and consider any changes in your income, expenses, and financial goals.

Once you’ve got it ALL sorted, ask yourself: is it best to stay on SVR or switch to a new deal? 🤔

Staying on the SVR

If you decide to stay on the SVR or if you choose a new variable rate mortgage, be prepared for potential rate increases.

Switching To A New Mortgage Deal

On the other hand, if you opt to remortgage, you might find a better deal and lower your monthly payments.

Just make sure to start looking for a new mortgage rate up to 6 months before your fixed rate ends. This gives you ample time to make a decision and switch mortgages without having to rush into a decision.

Be aware of any exit fees from your current mortgage and setup fees for a new mortgage. These fees can add up, so it’s important to factor them into your decision.

In most cases, remortgaging to a cheaper rate is the best way to go.

Unsure which is BEST for you? Speak with a good mortgage advisor. They can offer you valuable insights about the pros and cons of your mortgage options.

The Benefits of a Fixed Rate Mortgage

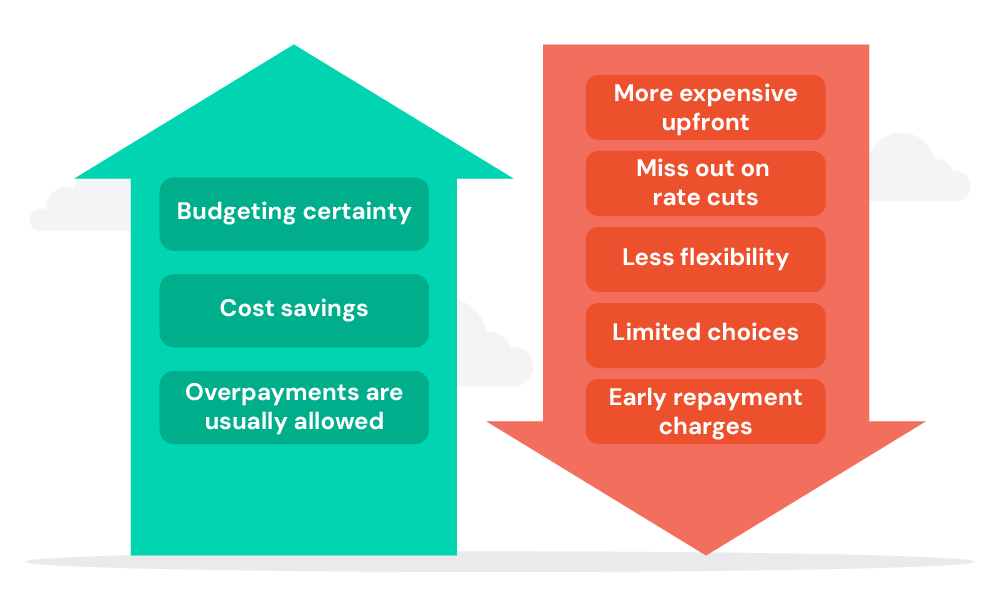

The primary benefit of a fixed rate mortgage is to protect you from interest rate hikes during the fixed period. You could end up paying less overall if interest rates rise significantly.

Here’s an overview of its other benefits:

- Budgeting certainty. Fixed regular payments make budgeting and financial planning easier throughout the fixed term. No surprises from rising rates.

- Cost savings. If interest rates rise while you’re on a fixed deal, you’re locked in at a lower rate, potentially saving you thousands.

- Overpayments are usually allowed. Most fixed-rate deals let you make extra payments (up to a limit) annually or regularly without penalty, helping you pay off the mortgage faster.

The Drawbacks of Fixed Rate Mortgages

While fixed rates provide short-term security, there are some potential downsides to consider.

- More expensive upfront. Fixed-rate mortgages typically have higher interest rates compared to variable-rate mortgages at the outset.

- Miss out on rate cuts. Your payments stay the same even if interest rates fall significantly during the fixed period, so you could pay more compared to variable rates.

- Less flexibility. Strict rules around overpayments and exit charges make fixed deals less flexible than tracker or discount-rate mortgages.

- Limited choices. You generally have fewer options for 10-year fixed rates compared to shorter fixed terms or variable mortgages.

- Early repayment charges. You’ll usually have to pay an early repayment charge if you switch to another mortgage deal before your current fixed term ends.

What are the Best Fixed Rate Mortgage Deals?

The best fixed rate mortgage deals provide a balance of low interest rates and flexible features to suit your requirements.

🔑 Key factors that influence available rates include:

- Mortgage Type (purchase, remortgage etc.)

- Mortgage Term (25, 30 years etc.)

- Loan-to-Value (% of the property’s value being borrowed)

- Your Income & Credit Rating

Generally, the LOWER the loan-to-value and the BETTER your financial profile, the more attractive fixed rate deals you can access.

But the cheapest rates aren’t always best – you need to consider the OVERALL package, including fees.

For example, a 5-year fix at 2.5% with a £1,499 fee may work out cheaper overall than a 2.2% deal with £2,500 in upfront costs, depending on your mortgage balance.

How Long Should I Fix My Mortgage For?

There’s no single ‘best’ fixed rate mortgage term as it depends on your personal circumstances and forecasts for interest rates.

As a rule of thumb:

- 2-year fixes suit borrowers who want low short-term costs and flexibility to review in 2 years. However, you may end up paying more if you need to remortgage and rates have risen.

- 5-year fixes are a popular middle-ground balancing cost and certainty.

- 10-year fixes provide the longest period of payment security. But remember, if rates drop, you could be paying more than necessary.

You can use a mortgage comparison calculator to compare the total costs of different fixed periods based on your mortgage details. This will indicate which term is likely to be cheapest.

Should I Fix For A Shorter or Longer Fixed Rate Mortgage?

Here are the potential benefits and drawback of opting for a shorter fixed rate versus a longer one:

Choosing a shorter fixed rate mortgage

Pros

- Typically lower interest rates, meaning potentially lower monthly payments.

- Flexibility to switch to a better deal or different mortgage type in a few years.

- Easier to adapt to your changing financial circumstances due to the shorter lock-in period

Cons

- Potential for higher payments if interest rates rise when you remortgage.

- More frequent remortgaging fees, increasing overall costs.

- Less security – your payments could change sooner.

Opting a longer fixed rate mortgage

Pros

- Consistent monthly payments for a long period, offering peace of mind.

- Protection from rising interest rates throughout the term.

- Less frequent remortgaging, saving you fees and hassle.

Cons

- Potentially higher interest rate compared to shorter deals, meaning potentially higher initial costs.

- Stuck with a higher rate if interest rates drop – you can’t benefit unless you remortgage (which may incur fees).

- Changing your mortgage during the term can be expensive due to early exit penalties.

What Are The Cheapest Fixed Mortgage Rates?

Currently, average mortgage rates are set at 4.74% for a 5 year fixed rate, and 5.10% for a 2-year fixed rate (Rightmove, 2024).

These rates can constantly change as lenders update their ranges, influenced by funding costs, competition and demand levels.

Higher LTV mortgages command higher rates to offset increased risk for lenders. The cheapest overall deals are reserved for those with bigger deposits or equity stakes.

Remember that rates are just one part of the overall mortgage package – you still need to factor in product fees which can be £999+ with some lenders.

Using a good broker can ensure you secure a true best-buy deal for your circumstances.

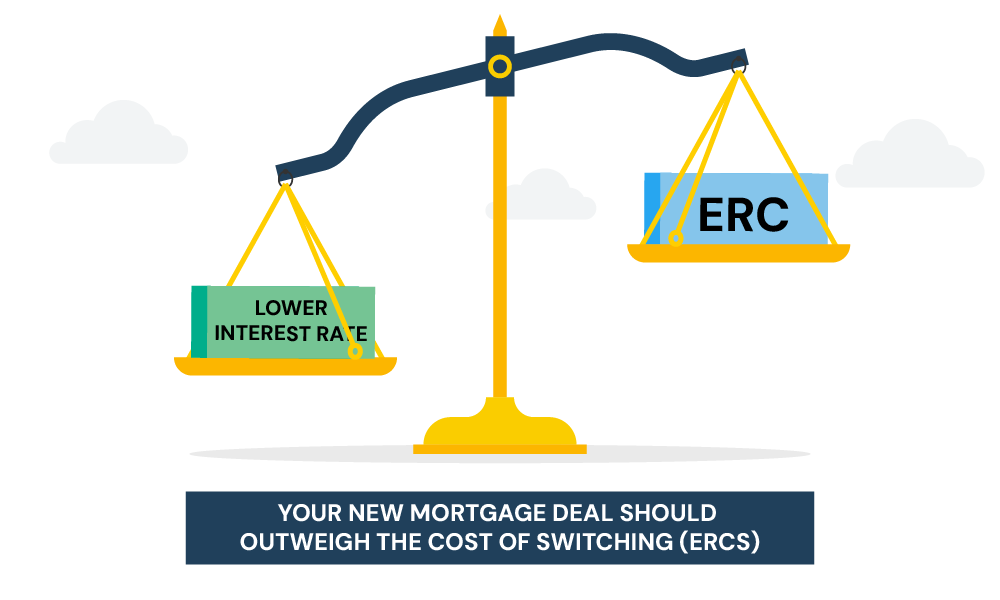

Can I Remortgage During My Fixed Rate?

Yes, you can remortgage any time during your fixed rate mortgage.

However, it can be costly due to early repayment charges (ERCs) or exit fees for leaving your deal early.

These are penalties, often a percentage of the outstanding mortgage balance.

Reasons you might consider remortgaging during a fixed rate include:

- Interest rates have dropped significantly, so remortgaging could secure a lower rate

- You need to borrow more capital against your property

- You want to switch to a new lender offering better rates/service

But, the ERCs can outweigh any potential savings from remortgaging early. It only makes sense if the cost of switching is LOWER than what you’d save with a new deal.

Can I Extend My Mortgage Term During The Fixed-Rate?

Most lenders will allow you to extend your overall mortgage term during a fixed-rate period, but NOT lengthen the fixed rate itself.

Extending the term lowers your monthly payments by spreading the balance over more years, but results in paying more interest.

For example, moving from a 25-year to 30-year term on a £200,000 mortgage at 3% could reduce payments by around £100 per month.

However, the total interest paid increases substantially over the longer timeframe.

Can I Pay My Fixed-Rate Mortgage Early?

Many fixed-rate mortgages permit overpayments up to 10% of the balance per year without an early repayment charge. This allows you to pay off the mortgage faster if you can afford higher repayments.

If you want to fully clear the mortgage during the fixed rate, you’ll likely face an ERC penalty from the lender.

As discussed, these can be expensive, so ensure the savings from paying it off early outweigh the ERC.

>> More about Paying Fixed Rate Mortgages Early

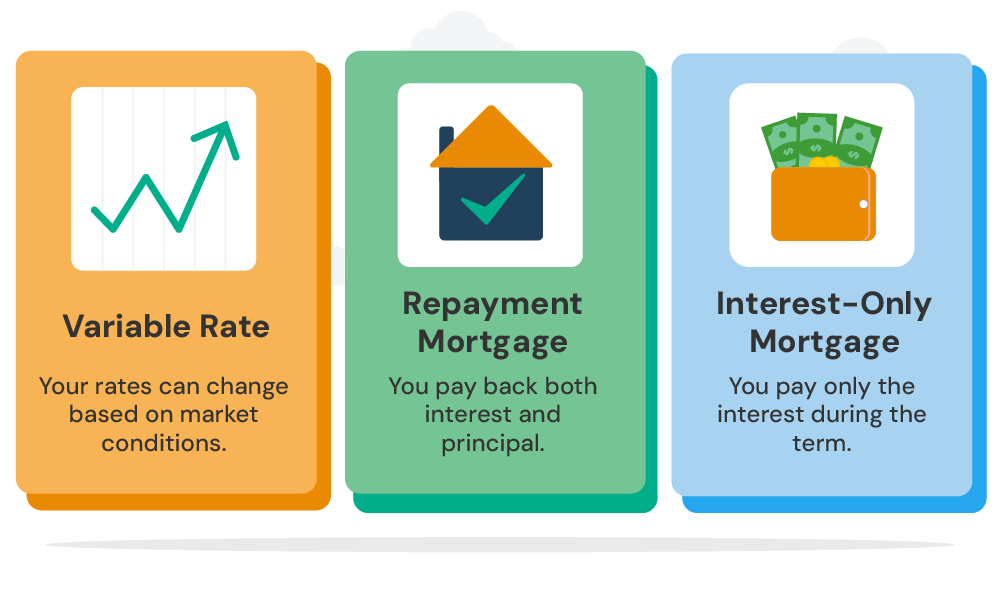

What Are My Options After A Fixed Rate Mortgage?

Variable Rate

This type of mortgage has an interest rate that can change. The rate moves up or down based on the Bank of England’s base rate and your lender’s own standard variable rate (SVR).

If interest rates go up, your monthly payments will increase. If they go down, your payments will decrease. This makes it a bit tricky to predict your future payments.

Repayment Mortgage

This is the most common type of mortgage where you pay back part of the loan (the principal) along with the interest each month. Over time, this reduces the amount you owe.

At the end of the mortgage term, you will have paid off everything and own your home outright. You can choose to have a fixed, variable, or tracker rate with this mortgage.

Interest-Only Mortgage

In an interest-only mortgage, your monthly payments only cover the interest on the loan, not any of the principal amount you borrowed.

You won’t reduce the loan amount over time with your payments. At the end of the mortgage term, you must pay back the full amount borrowed.

This type of mortgage usually requires you to have a plan in place to pay back the loan, like savings or selling the property. It’s often used by people buying to let, as it keeps monthly costs down while they rent out the property.

Key Takeaways

- A fixed rate mortgage keeps your interest rate the same for a set period, ensuring consistent monthly payments..

- When the fixed term ends, you’ll move to a standard variable rate (SVR), which can cause your payments to increase or decrease.

- Remortgaging before the fixed term ends can help you avoid potential payment increases under the SVR.

- Fixed rate mortgages offer budgeting stability but can have higher upfront costs and less flexibility compared to variable rate mortgages.

- Remortgaging during the fixed term is possible but can incur early repayment charges.

- After your fixed rate ends, explore other options like variable, repayment, or interest-only mortgages.

The Bottom Line

Always look at the bigger picture when selecting the best fixed rates deal. Consider how long you plan to stay in the property and compare the whole package.

Remember, mortgage rate is only one part of the overall cost–look at ALL fees, incentives, and features to ensure you’re genuinely getting good value from the deal.

An independent mortgage broker can help YOU in this process. They can assess your full circumstances, find the ideal lender, and guide you throughout your mortgage application.

Looking for a broker? Reach out to us. We’ll connect you to a qualified mortgage broker who can help you get the BEST deal and SAVE thousands of money from your mortgage.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

Should I get a fixed mortgage rate or a variable mortgage rate?

Choosing between a fixed mortgage rate and a variable mortgage rate depends on your need for stability versus your willingness to take risks for potential savings.

A fixed mortgage rate offers certainty with consistent monthly payments, making budgeting easier.

On the other hand, a variable rate might decrease over time, potentially saving you money, but it could also increase, which would raise your payments.

If you prefer predictable costs, go for a fixed rate. If you’re comfortable with some uncertainty and think rates might drop, consider a variable rate.

Should I go for 2, 3, or 5-year fixed rates?

The best fixed rate mortgage term for you depends on your future plans and how comfortable you are with risk. Here’s a breakdown of your options:

- 2-year fixed rate: This offers lower initial rates and more flexibility, but you’ll need to reassess your mortgage more often.

- 3-year fixed rate: This strikes a balance between stability and flexibility.

- 5-year fixed rate: This offers the most stability, protecting you from rate rises for the longest period. This is a good option if you prefer not to worry about fluctuating rates.

Consider how long you plan to stay in your home and your risk tolerance before making your decision.

>> More about How Long Should I Fix My Mortgage For? 2,3, or 5 Years?

Is a fixed rate mortgage a good idea now?

There’s no one-size-fits-all answer for this. It all boils down to your financial situation and current market conditions.

While no one can tell exactly what will happen with interest rates, it’s best to get a fixed deal if rates are likely to go up. This could protect you from rising costs and keep your payments steady.

For personalised advice, talk to a mortgage advisor. They can help you decide if opting for a mortgage deal is a good idea.

Can I get a buy to let fixed rate mortgage?

Yes, you can. Many lenders offer fixed rate mortgages for buy-to-let properties. This can help you manage your rental costs predictably.

I am a first time buyer, should I get a fixed rate mortgage?

Yes, a fixed rate mortgage is usually a good choice if you’re a first-time buyer. It makes your payments steady, so you can budget easier each month.

Can I always overpay with a fixed rate mortgage?

Not always. Some fixed rate mortgages let you overpay a certain amount each year without charge. Check your mortgage terms to see what’s allowed.

This article has been fact checked

This article was created, checked, and verified by the expert team at Money Saving Guru. Trust us, you’re in good hands.