What Is The Deposit For A Commercial Mortgage?

Thinking about getting a commercial mortgage for your business? One big question might be: how much deposit do I need?

Usually, you need a bigger deposit for these than for a home loan because they’re seen as more of a risk.

The exact amount varies, and we’ll explain why in this article. We’ll go through how much you might need, what affects this, and some tips if you’re finding it tough to meet the usual deposit amounts.

We’ll also look at how to gather the funds for your deposit and why talking to an expert is a smart move.

How Much Deposit Do I Need for a Commercial Mortgage?

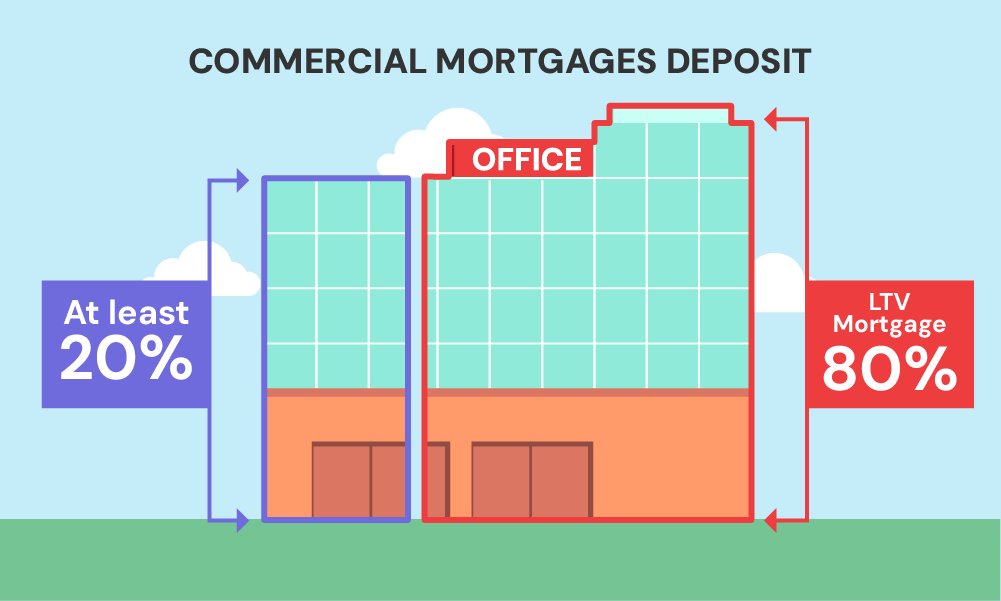

Generally, you’ll need to put down between 20% and 40% of the property’s value as a deposit for a commercial mortgage in the UK.

But, this amount can change.

It all depends on how the lenders view the risk. If your business has been doing well and your financial records are strong, you might get away with a smaller deposit.

The type of business you run also matters here. Some types of businesses are considered riskier, so they might need a bigger deposit.

Remember, getting a commercial mortgage isn’t just about the deposit. There are other costs and fees to think about too.

Make sure you understand all the expenses to see if the mortgage fits your budget.

What Impacts Your Commercial Mortgage Deposit Requirement?

When you’re looking at getting a commercial mortgage, lenders look at a few key things:

- Your industry experience. If your business has been successful for a long time, lenders see you as a safer choice than a brand-new or struggling company. This good history can mean you need a smaller deposit.

- Business Profitability. If you’ve got a solid business plan with a track record of making money and predictions for more of the same, lenders are more likely to see you as a low risk. If there’s doubt about your business’s future earnings, you might need to pay a bigger deposit.

- Your Business Type. High-risk businesses, like nightclubs or pubs, often need to put down more money upfront than more predictable, stable businesses, like those in office spaces.

- Your Credit History. Past financial problems for you or your business can make lenders cautious, potentially leading to a higher deposit. Sometimes, specialist lenders might be your best option here.

- What You’re Planning with the Loan. Buying a property for your own business use is usually seen as less risky than buying one to rent out. Investment properties generally need a larger deposit, often around 25% or more, because the risk is higher.

- The Property Itself. Unique or fixer-upper properties are riskier for lenders, so they ask for more money down. And some lenders have set minimum deposits no matter what.

Can You Get a Commercial Mortgage with a Low Deposit?

Yes, it’s possible to get a commercial mortgage even if you can’t afford a big deposit. There are ways to work around it.

For starters, if you have other assets, like equipment or another property, you can use them as security for the loan.

This means the lender has something else to fall back on if things don’t go as planned, allowing them to offer you the mortgage with a smaller deposit.

There’s even a way to get the mortgage without any cash upfront through what’s called 100% commercial mortgages. This involves using your assets’ value to back the entire loan.

Keep in mind: With a lower deposit, your lender options might be limited, potentially affecting interest rates.

If using another property as security, ensure you have enough equity and potentially get approval for a second charge on your existing mortgage. You can also combine some cash with asset value to reach the deposit threshold.

Where Do I Get Funds For a Commercial Mortgage Deposit?

Putting down cash is the most common way to fund your deposit, but there are other options!

You can use money from your business operations, partner with an external investor, or explore specific loans like bridging finance to bridge the gap until securing permanent funding.

Some lenders might even accept a gifted deposit, although they’ll want to verify the source for transparency.

The good news? You can combine these methods to reach the deposit threshold and secure the best deal possible.

Speaking with a commercial mortgage broker can help uncover creative solutions to maximise your deposit amount.

Key Takeaways

- You usually need to pay 20% to 40% of a property’s price as a deposit for a commercial mortgage in the UK, but the exact amount depends on how safe lenders think your business is.

- If your business has been making money for a while and seems stable, lenders might ask for less deposit. Riskier businesses, like nightclubs, often need to pay more upfront.

- If you don’t have enough cash for a big deposit, you can use other things like equipment or property you own to cover part of it, or even get a loan that covers the whole amount.

- There are lots of ways to save up for a deposit, like using your business’s profits, teaming up with an investor, or getting help from family or friends. A mortgage expert can help you figure out the best plan.

The Bottom Line

We’ve gone over a lot about commercial mortgage deposit requirements. Remember, how much deposit you need can vary widely based on many factors.

Getting advice from an expert can make a huge difference. They can help negotiate better terms, making your deposit go further.

Choosing the right broker, someone who knows the ins and outs of your industry is crucial.

If you’re not sure where to start, reach out to us. We can match you with a broker who’s the perfect fit for your needs.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

Is it always better to pay a higher deposit upfront?

Generally, yes. A higher deposit lowers your loan amount, leading to potentially lower interest rates and smaller monthly payments. It also shows lenders you’re financially stable, increasing your chances of approval.

However, there are situations where a smaller deposit might be strategic, so discuss your options with a professional.

How can you negotiate deposit amounts?

Negotiation depends on your financial situation and the property itself. A strong credit history, healthy business finances, and valuable property can strengthen your bargaining position for a lower deposit.

Having a broker can also be helpful, as they can leverage their experience to negotiate on your behalf.

What security do you need for a commercial mortgage?

For lower deposits, lenders often require additional security to minimise risk. This can include property (with sufficient equity), equipment, or other valuable assets you own. In some cases, you might even be able to use a combination of these assets to meet the security requirements.