- What is an Agriculture Mortgage?

- How Do They Work?

- Who Can Apply?

- How Much Do I Need for a Deposit?

- How Much Can I Borrow?

- Agricultural Mortgages Rates

- Should You Get an Agriculture Mortgage?

- Steps to Get a Mortgage for Farm and Agriculture Business

- What Are My Alternatives?

- Key Takeaways

- The Bottom Line

What You Need To Know About Agriculture Mortgages in 2024

For most farmers, the satisfaction of a bountiful harvest or thriving livestock is unbeatable.

Every day, you’re hands-on, nurturing crops, tending to animals, and planning your finances. This life can be demanding for some but for those drawn to it – the rewards are immense.

If the dream of owning a farm calls to you, yet the fear of hefty debts and the challenge of finding the right mortgage looms large, don’t worry – we got you.

This guide covers everything from eligibility criteria to different options, along with top tips to help you smash your application.

Let’s get started!

What is an Agriculture Mortgage?

An agricultural mortgage is a loan used to buy or improve farm land and buildings.

It works similar to regular commercial mortgages, except they are tailored to support different agricultural industries.

This loan can help you buy land, make your farm better, or get some money out of your property’s value.

How Do They Work?

Agricultural mortgage repayment periods vary from 1 to 25 years.

You have two main choices: a repayment mortgage, paying off the loan and interest monthly, or an interest-only loan, where you pay interest monthly and the total loan amount at the end.

You can use these loans for many rural properties, like:

- Commercial farms

- Working farms and farm homes

- Farms operated as lifestyle businesses

- Other rural businesses and country estates

- Equine businesses, such as stables and livery yards

- Renewable energy projects on agricultural land

It’s important to know if the land has any agricultural ties—rules about what you can do on the land or who can live there. Check for these ties and talk to your lender about them to avoid any issues later.

Additionally, to protect themselves, lenders will take a legal charge over the property as security.

This means they hold a claim against your property until the mortgage is fully repaid, ensuring they can recover their funds if necessary.

Who Can Apply?

To qualify for an agricultural mortgage in the UK, your involvement in farming or ownership of agricultural land is key.

Lenders evaluate:

- Industry Experience. Having a background in farming boosts your chances, especially if you’re expanding a successful business. New farmers and rural start-ups can find options too, though rates might be higher.

- Business Finances. Lenders usually review the last three years of your business accounts to assess affordability. Healthy finances and positive future projections improve your likelihood of approval and securing favourable rates. If your business is newer or you’re aiming to restructure debts, specialist advice could be beneficial.

- Credit File. Your business’s earnings and financial health are crucial, but some lenders will also check your personal credit history as part of their assessment.

- Loan Size and Property Type. The amount you wish to borrow and the property securing the loan affect your application. Unique or non-standard properties common in agriculture might attract higher interest rates due to perceived risks.

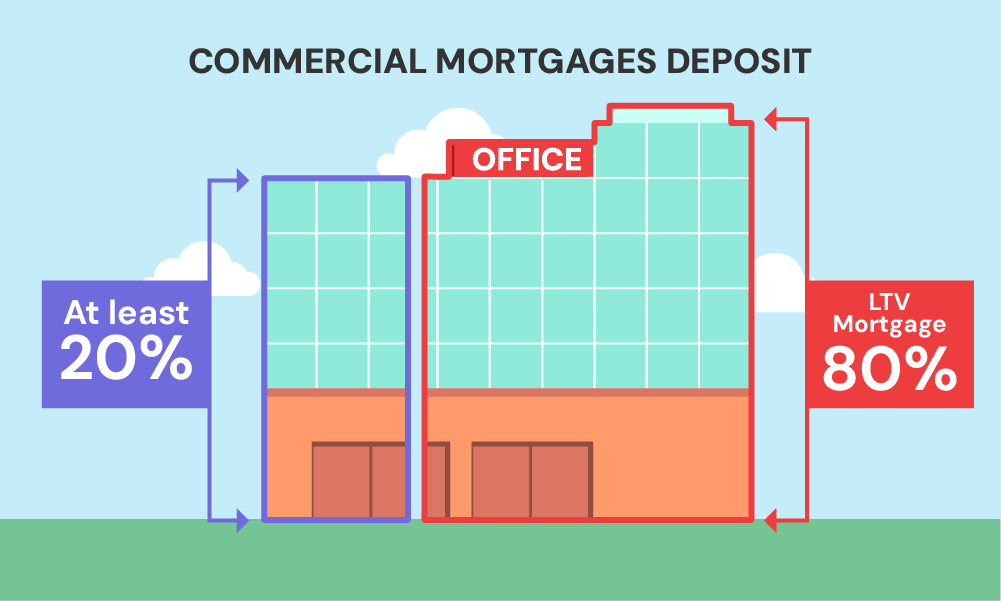

How Much Do I Need for a Deposit?

For an agricultural mortgage, you’ll usually need a larger deposit than for a house mortgage. Expect to put down at least 20% to 30% of the property’s value.

This percentage can vary based on the lender’s view of the risk involved and the quality of your land or business.

If your farm has strong financial records and a clear growth potential, you might get away with a smaller deposit.

To prepare, save up and keep your business finances in good shape. This will show lenders you’re serious and capable of handling the loan.

If you’re refinancing, note that the equity in your property or other assets can count as a deposit. In some cases, lenders may offer loans up to 100% LTV with sufficient collateral.

How Much Can I Borrow?

Generally, lenders offer up to 70% of the property’s value, depending on your creditworthiness.

The amount you can borrow depends on a few things.

Lenders look at the value of the property you’re buying or using as security. They also consider how much money your farm is expected to make.

The healthier your farm’s financial outlook, the more you might be able to borrow.

Lenders want to see that you have a solid plan for your farm and that you can pay back the loan. So, having clear income projections and a strong business plan can help.

Agricultural Mortgages Rates

The actual rate you’ll get depends on how well you can present your business case to the lender.

But in general, agriculture mortgage rates may be around 2% over the Bank of England’s base rate. They tend to have higher rates than residential mortgages because of the unique nature of farming businesses.

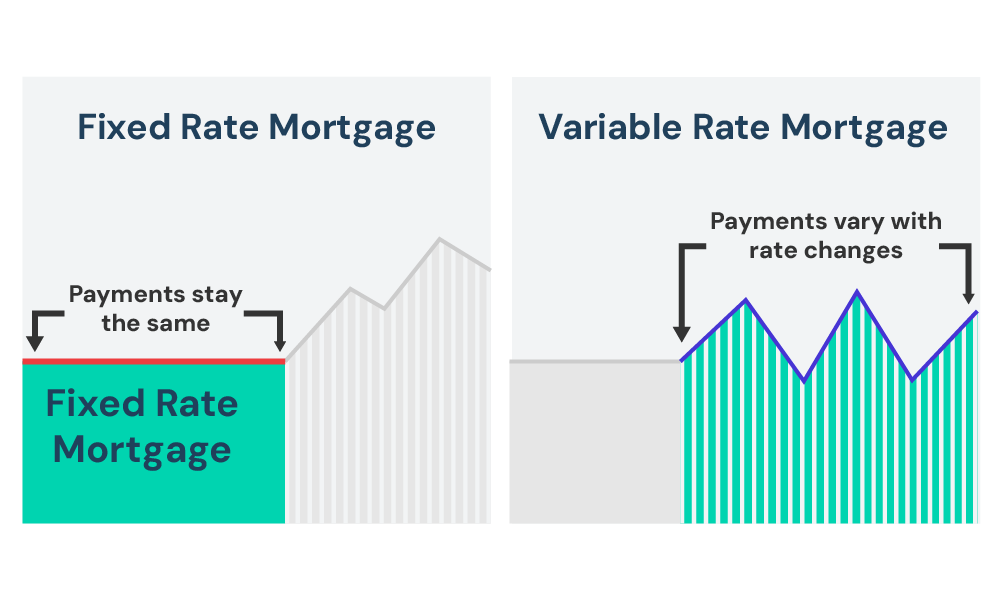

You have two main choices: a fixed rate, where your interest rate stays the same for a set period, or a variable rate, which can change with the market.

Fixed rates offer certainty in your repayments, while variable rates might offer savings if rates go down.

Should You Get an Agriculture Mortgage?

This boils down to how your finances look, your business goals, and your personal choice.

Agriculture mortgages come with their fair share of complexities and risks, especially since they’re tied to your property.

Here’s a simple look at the pros and cons

Pros

- Enjoy repayment plans that align when you earn, helping smooth out cash flow.

- Get the chance to borrow large loans to expand your farm and be more profitable.

- Possibly lower your taxes, as the interest you pay on the mortgage might count as a business cost.

- Use the loan to buy more land or improve what you’ve got, raising your farm’s value.

Cons

- Face higher interest rates than usual, as farming is seen as riskier by lenders.

- Go through a tough application process that asks for a solid business plan and financial forecasts.

- Face the real risk of losing your farm if you can’t keep up with payments.

- Watch out for changes in the market and weather that could make paying back the loan harder.

- Stick to a long-term loan, which needs careful thinking about your farm’s future money situation and stability.

It’s a big decision to take on an agricultural mortgage.

But, if you believe in your farm and can handle the repayments, this type of mortgage might be right for you.

Steps to Get a Mortgage for Farm and Agriculture Business

Let’s use an example to better guide you in the steps.

Say you’re in the farming business, looking for additional land to expand your operations. You’ve found the perfect land, priced at £300,000.

Here’s what your journey might look like:

1. Initial Consultation

To save time and stress, you chat with an agricultural mortgage broker.

They’ll explain what you can afford based on your farm’s income and what documents you’ll need for your application.

2. Sorting Out Finances

Next, it’s time to get your finances in order.

This means reviewing your farm’s income, expenses, and overall financial health. Your broker can help you with this.

Ensure you have enough for the deposit, which for a £300,000 land would be £60,000 (20%). Also, consider other costs like valuation fees (around £1,000) and legal fees (about £2,000).

You can also start compiling the necessary paperwork for the mortgage application. This includes recent bank statements, farm business accounts for the last 2-3 years, proof of income, a detailed business plan, and any existing property or asset valuations.

This step is crucial for making sure you’re ready for the financial commitment ahead.

3. Application Submission

With guidance from your broker, you submit your application to a lender, aiming to borrow £240,000, which is 80% of the land’s price.

This means you’re contributing a £60,000 deposit.

4. Property Valuation

The lender arranges an assessment to confirm the land’s value matches the £300,000 asking price, costing you about £1,000.

5. Approval and Offer

Impressed by your farm’s financials and the land’s valuation, the lender approves your mortgage. They offer you £240,000 at an interest rate of 4.5% over 20 years.

6. Legal Checks and Finalisation

Your legal team and the lenders conduct final checks, including legal fees estimated at £2,000.

7. Completion

With all checks clear and the paperwork signed, the deal is sealed. You secure the mortgage, setting your monthly payments at approximately £1,524 for the next 20 years.

Here’s a clear summary of your agriculture mortgage costs:

| Description | Cost (£) |

|---|---|

| Property Price | 300,000 |

| Deposit | 60,000 |

| Mortgage Amount | 240,000 |

| Valuation Fee | 1,000 |

| Legal Fees | 2,000 |

Keep in mind, these figures are just an example. Your actual costs might change based on the land, your finances, and the market.

To get advice that fits your situation, talk to an agricultural mortgage broker. They can help you understand everything and find the best deal for your farm.

Thinking about making your farm bigger? Get in touch with us. We can connect you with a mortgage expert for a free chat, guiding you on how to expand your farming business.

What Are My Alternatives?

Everyone’s situation is different, and an agricultural mortgage might not fit every need. Here are some alternatives:

- Commercial Bridging Finance – This is a quick option for short-term financing, ideal for purchasing land at auction or if you’re planning to buy and then sell agricultural property. However, it tends to come with higher costs.

- Commercial Loans for Projects – If you’re looking to renovate, redevelop your farm, or diversify your agricultural activities, commercial loans might be what you need. They’re tailored to larger projects, offering the capital required based on your specific plans.

- Remortgaging to Release Equity – Owning property already gives you an advantage. By remortgaging, you can unlock cash tied up in your property. This method is especially useful for funding your agricultural ventures, but it does increase the mortgage on your existing property.

Key Takeaways

- An agricultural mortgage is a loan to help you buy or improve farmland, buildings, or rural properties, with flexible repayment options up to 25 years.

- To get one, you’ll need some farming experience, good finances, and a clear plan for your farm. You’ll also need a deposit, usually 20–30% of the property’s price.

- Interest rates are a bit higher than normal home loans, starting around 2% above the Bank of England’s base rate. You can pick a fixed rate (stays the same) or a variable rate (can change).

- If a mortgage doesn’t work for you, other options include short-term loans for quick purchases, loans for farm projects, or borrowing money against property you already own.

- Before getting a loan, make sure you can afford it and plan for extra costs like deposits, valuation fees, and legal fees, so you’re ready to manage repayments.

The Bottom Line

Working with a whole-of-market or agricultural mortgage broker can help you find the best deal. They understand the market and can guide you to the right lender for your situation.

Ready to take the next step with your farm or agricultural property? Contact us. We’ll match you with the ideal mortgage broker who understands your needs and can help you secure the financing you require.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

Can someone with poor credit apply for an agricultural mortgage?

Even with a bad credit history, you might still qualify for an agricultural mortgage. Lenders will look at the overall health of your farming business and your plans for the future.

While your options might be more limited, and interest rates could be higher, working with an agricultural mortgage broker can help you navigate your options and find a suitable lender.

Is it possible to secure an agricultural mortgage throughout the UK?

Absolutely. Whether you’re in England, Scotland, Wales, or Northern Ireland, agricultural mortgages are available.

Do keep in mind, though, that specific areas, especially in Scotland and Northern Ireland, might have certain restrictions or requirements.

Are financial aids available for those looking to purchase agricultural land?

Yes, a variety of grants and support programs are offered for agricultural businesses, whether you’re just starting or looking to expand.

The best place to find up-to-date information on these opportunities is the official government website (gov. uk), where you can explore available grants tailored to your needs.

How long does it take to secure an agricultural mortgage?

On average, the process takes about 8 to 12 weeks from application to completion. However, the exact timing can vary based on the complexity of your situation.

More straightforward transactions might move faster, whereas more complicated ones could take a bit longer to finalise.

Can I use a residential mortgage for a property on agricultural land?

Yes, in certain situations, you can. If you plan to build a home on the land without any commercial agricultural activity, some lenders may accommodate this with a residential mortgage.

On the flip side, if the land will be used for farming purposes, then you’re likely looking at a commercial or agricultural mortgage instead.