- Can Churches and Charities Secure Mortgages in the UK?

- How Do You Qualify for Church and Charity Mortgages?

- Deposit Requirements for Church and Charity Mortgages

- How Much Can You Borrow?

- Interest Rates for Church and Charity Mortgages

- Who Offers Mortgages for Churches and Charities in the UK?

- Steps To Secure Mortgages for Churches and Charities

- Alternatives to Mortgages for Church and Charity Property

- Government Assistance Program

- Key Takeaways

- The Bottom Line

A Complete Guide To Mortgages For Churches and Charities

Relying on donations, grants, and community service revenue, makes it harder for churches and charities to secure a mortgage.

That’s because lenders are a careful bunch. They won’t lend the dosh to someone who can’t prove their ability to pay.

So, what’s the trick to getting a mortgage for your organisation?

You need three things:

- Understand how mortgages work for churches and charities.

- Meet the eligibility criteria (this includes proving your income)

- Get the right financial advice.

Curious? Here’s a deep dive of these three things in this comprehensive guide.

Can Churches and Charities Secure Mortgages in the UK?

Yes, churches and charities can get mortgages in the UK. For financing purposes, you are considered a commercial entity.

This means you have access to a variety of commercial mortgage products designed to meet your unique needs. However, it’s worth noting that there aren’t specific “church and charity mortgages.”

You have several commercial mortgage options, each suited for different commercial property needs.

Look for specialist lenders with experience in financing churches and charities, as they understand your specific challenges.

A specialist commercial broker can also be invaluable. Their knowledge of lenders and the application process will make securing the right mortgage much easier.

How Do You Qualify for Church and Charity Mortgages?

While there are no one-size-fits-all criteria, getting a mortgage for churches and charities follows similar principles to regular mortgages: show you can comfortably afford the mortgage.

Here’s a breakdown of the key factors lenders consider:

- Financial Strength – Churches and charities need to present themselves as well-run organisations. This means providing audited financial statements for the past few years to prove consistent income and responsible financial management.

- Business Plan – A strong business plan outlining future goals and how the mortgage will be used is important. This shows the lender your vision for the property and how it contributes to your mission.

- Funding Sources – Lenders will assess your income streams. This includes regular donations, grants, and any other revenue sources. Showing a diversified income base strengthens your application.

- Cash Flow Forecast – A realistic forecast showcasing your ability to manage the mortgage payments over the loan term is crucial.

In addition, lenders are more likely to approve mortgages for acquiring property that directly supports your mission.

This could be a new building, expansion of existing facilities, or housing for staff involved in charitable work.

Some lenders might also require the church or charity to provide collateral to secure the loan.

Deposit Requirements for Church and Charity Mortgages

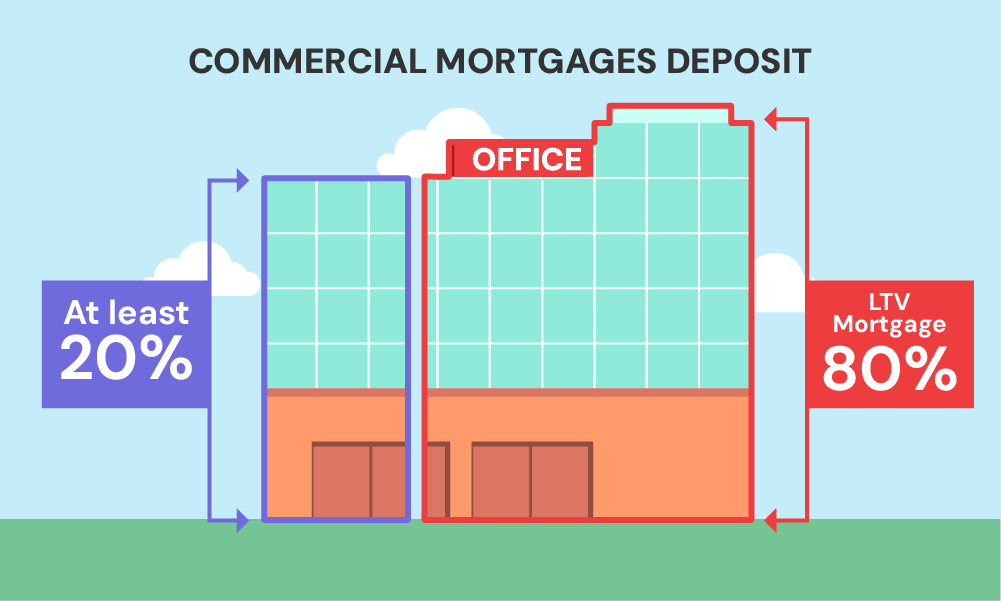

When you’re looking for a mortgage for your church or charity, lenders usually want a deposit of 20% to 40% of the property’s value.

A larger deposit can work in your favour, making you a more appealing borrower.

It’s possible to find mortgages with an 80% loan-to-value (LTV) ratio, but remember, higher LTV ratios might lead to higher interest rates or shorter repayment periods.

To help, some lenders, like Kingdom Bank, offer lower interest rates for deposits that result in a 60% LTV or less.

This approach rewards you for paying a bigger part of the property’s price upfront.

How Much Can You Borrow?

It really depends.

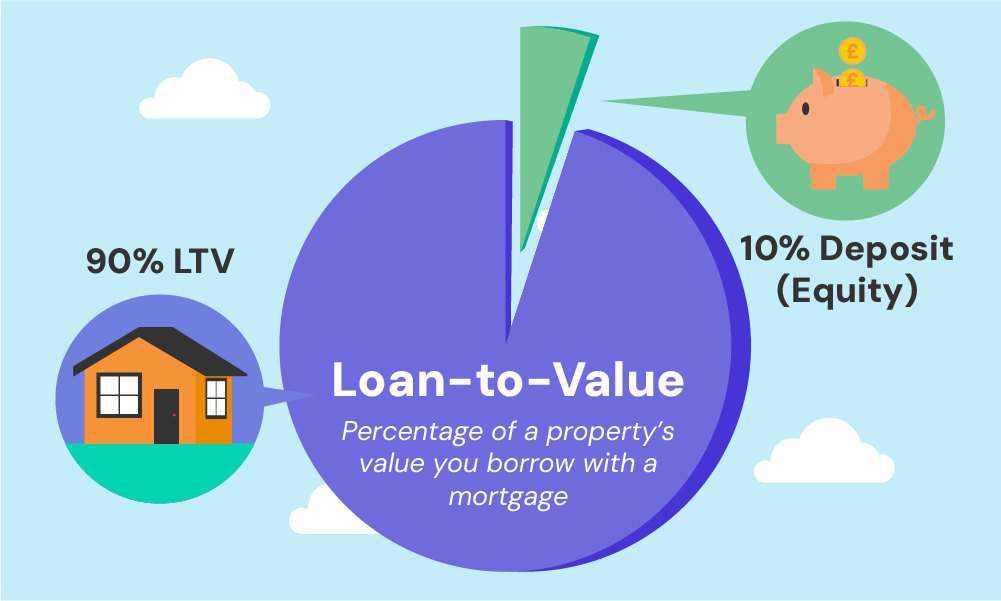

Different lenders have different rules, and how much you can borrow is based on how well your organisation can pay back the loan.

Lenders look at your organisation’s income, financial stability, and the property’s value.

They use the loan-to-value (LTV) ratio, typically up to 70-80%, to decide the loan amount. This ratio compares the loan to the property’s value.

Sometimes, you might get a higher LTV for special situations. Your ability to borrow also depends on the loan’s interest rates and repayment terms.

You’ll need to show lenders your income, financial statements, and business plans to prove you can afford the repayments.

Since there’s no one-size-fits-all answer, it’s wise to consult with a specialist broker. They understand loans for churches and charities and can guide you to the best terms for your situation.

Interest Rates for Church and Charity Mortgages

When churches and charities look for mortgages, lenders often view them as more risky. This means the interest you pay could be higher than with a standard loan.

Interest rates for these special mortgages vary a lot.

Generally, they’re about 3% to 12% more than what the Bank of England sets as its base rate.

For example, if the Bank of England’s base rate is 1%, the interest rate for your church or charity mortgage could be anywhere from 4% to 13%.

What you end up paying can depend on several things such as the loan-to-value (LTV) ratio, the percentage of how much you’re borrowing against the property value and the financial health of your organisation.

The less you borrow compared to the property’s value and the better your financial situation, the more favourable your interest rate might be.

Who Offers Mortgages for Churches and Charities in the UK?

Finding a lender willing to offer mortgages to churches and charities can be a challenge.

The truth is, there aren’t many lenders out there who specialise in this niche.

While some mainstream banks and building societies might lend to charities, they often shy away from churches.

But, there are a few who stand out for their commitment to supporting these organisations:

- Kingdom Bank

- MCA Funding for Churches

- Stewardship

- CAF Bank

- Church Mortgages

Each of these lenders has its own set of criteria and offerings, making it important to explore which one aligns best with your church or charity’s values and needs.

Steps To Secure Mortgages for Churches and Charities

Assuming you’ve got everything ready – you’ve reviewed your finances, gathered documents, and now you’re looking to apply for a commercial mortgage. Here’s what you need to do:

1. Speak with Specialist Commercial Broker

Find a mortgage broker who specialises in commercial mortgages for churches and charities. They’ll know the ins and outs of what you need.

Once you’ve found the one, talk to your broker about what you’re looking for.

Be clear about how much you want to borrow, the type of property you’re looking at, and your financial situation.

Your broker will help you look at different mortgages from various lenders. They’ll explain the pros and cons of each option.

2. Apply for the Mortgage

Once you’ve chosen a mortgage, your broker will help you fill out the application. Make sure all your information is accurate and complete.

Your chosen lender will then proceed with the property valuation.

3. Property Valuation

Property valuation (performed by a professional surveyor) is to prove the worth of your property. This ensures that the property value matches the amount you want to borrow.

Lenders will always ask to do this as a safety measure. That’s because if you can’t repay the loan, they want to be sure they can sell the property to cover the outstanding amount.

This check also helps them decide on fair loan terms for you, like your interest rate and how much of the property’s value you can borrow.

4. Approval and Offer

If everything checks out, the lender will approve your mortgage and make an offer. Review this offer carefully with your broker.

5. Legal Checks and Completion

Once all checks are done, and you’re happy with the offer, you can accept it.

During this process, you’ll need a solicitor to handle the legal aspects of buying a property. They’ll check for any issues and ensure the property is suitable.

Make sure to work with your solicitor to complete the purchase.

This process can take anywhere from 4 to 8 weeks, from application to funds being released. So, patience is key.

However, if you don’t get approved for a commercial mortgages, here are other ways to fund your church or charity’s property:

Alternatives to Mortgages for Church and Charity Property

- Loans from Charitable Foundations or Trusts. Organisations like Charity Bank and Big Society Capital offer loans to charities and social enterprises. These loans usually have better terms than regular bank loans, making them a great option.

- Grants. The National Lottery Heritage Fund and The National Lottery Community Fund give out grants for various projects, including those for property. Grants don’t need to be paid back, but you’ll need to show how your project makes a positive impact.

- Donations and Fundraising Campaigns. Using platforms like JustGiving, you can gather donations or run fundraising campaigns. This not only helps financially but also brings your community closer.

- Partnerships and Sponsorships. Teaming up with local businesses or other organisations can provide direct financial support or help in kind. This could be a win-win for publicity and community spirit.

- Investment Income. Charities can invest their existing funds to generate additional income, although careful management is crucial to ensure the responsible use of resources. You may check out CAF to see investment plans that might work for you.

- Fundraising Events. Organising events like charity dinners, galas, auctions, sponsored walks or runs, or even online fundraising campaigns can generate significant funds.

- Trading Activities. Some churches and charities run social enterprises like cafes, and shops, or offer services that generate income to support their core activities.

>> Find out more funding options here.

Government Assistance Program

After the pandemic, the UK government introduced several schemes to help businesses, including churches and charities, to recover.

One of these is the Recovery Loan Scheme, which might offer the financial support you need.

These programs are designed to help organisations like yours get back on their feet, providing an alternative or supplementary option to traditional financing methods.

It’s a good idea to research these initiatives to see if your church or charity qualifies for any support.

Key Takeaways

- Churches and charities can secure commercial mortgages in the UK, but they need to work with lenders or brokers who understand their unique needs, as there aren’t specific “church or charity mortgages.”

- To get approved, they need to show they can manage money well with proof like financial reports, a clear plan for the property, and how they’ll make repayments.

- Deposits typically range from 20% to 40% of the property’s value, with larger deposits improving loan terms by reducing interest rates and increasing approval chances.

- Interest rates for church and charity mortgages are usually higher than standard loans, often 3% to 12% above the Bank of England’s base rate, depending on the organisation’s finances and loan terms.

- If they can’t get a loan, they could try other ways like fundraising, grants, teaming up with local businesses, or government programs to help pay for the property.

The Bottom Line

Getting mortgages for churches and charities is possible. But it can be tricky.

You might feel stressed out with the high-interest rates, the big deposit needed, and the complicated process.

But here’s the good news: you don’t have to handle it all on your own

A commercial mortgage broker can be your best mate in this journey. They know exactly how to help churches and charities get a mortgage.

They’ve got the contacts, the know-how, and the knack for snagging the best deals out there. Plus, they’re ace at negotiating, which could save you a pretty penny.

Looking for the right broker? Drop us a line, and we’ll hook you up with a commercial mortgage broker who knows the score with organisations like yours.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

Is it possible to purchase a church building and turn it into a living space?

You can buy and convert a church into a home. However, you’ll need a special type of mortgage known as a Church Conversion Mortgage. Make sure to check all the legal and planning requirements first.

What should I consider if the church I want to buy has a graveyard?

Buying a church with a graveyard comes with specific responsibilities and legal considerations. You’ll need to understand who maintains the graveyard and any access rights for the public or relatives of the deceased.

Who holds the mortgage for a church?

The church itself or the governing body that oversees the church, such as a religious denomination or organisation.

If a member, including a minister, leaves the church, they do so without any obligation to the mortgage. That responsibility stays with the church or its main organisation, not with the people leaving.