- What Is Halifax Mortgage Debt Consolidation?

- Halifax Mortgage Basics: Rates, Terms, and More

- Top 5 Benefits of Mortgage for Debt Consolidation

- Potential Risks of Mortgage For Debt Consolidation

- Different Types of Mortgage Halifax Offers for Debt Consolidation

- How Much Can I Borrow to Consolidate?

- What Should I Consider Before Heading Straight to the Bank?

- How To Apply for a Halifax Mortgage for Debt Consolidation?

- The Bottom Line: Is Halifax’s Mortgage for Debt Consolidation Right for You?

Debt Consolidation with Halifax Mortgage: A Smart Move?

Big news in the banking world – Halifax has just announced a drop in their mortgage rates. They’ve gone down by as much as 0.46 percentage points, bringing their five-year fixed mortgage rate to an appealing 4.53%.

This is especially interesting if you’re dealing with several debts. We all know how tough it can be to keep track of different payments.

That’s why many people are looking into ways to bring all their debts together under one roof. Now, if you’re in this boat, you might have heard about Halifax’s new rates and thought about using their mortgage for debt consolidation.

It’s a big step, so getting the full picture is important. We’re here to help with that.

In this article, we’re going to walk you through everything you need to know about using a Halifax mortgage for debt consolidation, so you can decide if it’s the right move for you.

What Is Halifax Mortgage Debt Consolidation?

Debt consolidation means taking out a new loan or credit card to pay off several other debts. You bring all your debts together into one larger one.

The idea is to get a new credit source with a lower interest rate than the combined rate of your existing debts. This makes your monthly payments more manageable.

If the new loan or credit card offers a break in payments or a period with no interest, it can be especially helpful.

Halifax Mortgage has a special option for this called Halifax Mortgage for Debt Consolidation. It’s a type of remortgaging, where you refinance your home to get money to pay off your debts. Your debts are then part of your mortgage.

This can be a good idea, but remember it’s a loan secured against your home. If you can’t make the payments, you could lose your house.

Halifax Mortgage Basics: Rates, Terms, and More

Halifax has different mortgages with fixed and variable rates. As of 2023, their rates start from 4.53%. Here are some examples:

- A mortgage fixed at 4.53% until 28/02/2029, then changing to an 8.74% variable rate, with a maximum loan-to-value (LTV) of 60%.

- Another fixed at 4.63% until 28/02/2029, then the same 8.74% variable rate, but with a higher LTV of 75%.

- A longer fixed term at 4.79% until 28/02/2034, then switching to an 8.74% variable rate, with a 75% LTV.

The rate and terms you get depend on your situation, like your credit history, income, and property value.

While Halifax’s mortgage for debt consolidation might work for some, it’s smart to look at other options too.

Some customers like Halifax’s clear and easy process, but they’re not rated as highly for value compared to other banks like Lloyds Bank and Santander.

Source: Halifax mortgage rates, fees and review

Top 5 Benefits of Mortgage for Debt Consolidation

Before diving into the benefits, it’s essential to understand that a debt consolidation mortgage can be a smart financial move for many. Here’s why:

- Easier Money Management. It turns many payments into one. This means it’s simpler to keep track of your money and less likely you’ll miss a payment or get charged a late fee.

- Lower Interest Rates. Compared to credit cards and personal loans, these mortgages often have lower interest rates. Over time, this could save you a lot of money in interest.

- Longer to Pay Back. You usually get more time to pay back the money than with other debts. Your monthly payments could be lower, but remember, you might pay more interest in the long run.

- More Cash in Hand. Switching high-interest debts to a lower-rate mortgage can mean more money available each month. This extra cash can help cover other costs or investments.

- Better Credit Score. Combining several debts into one mortgage payment can improve your credit score over time, as it’s easier to manage and you’re more likely to pay on time.

Potential Risks of Mortgage For Debt Consolidation

It’s important to consider the risks as well:

- Your Home as Security. The biggest risk is using your home as security for the loan. If you have financial problems later, you might lose your house.

- Paying More Over Time. Your monthly payments might be smaller, but the total you pay back could be a lot more than your original debts, because of the longer interest period.

- Higher Total Interest. Even with a lower rate, long-term mortgages can end up costing more in interest over the entire period.

- Qualifying Challenges. Not everyone can get a debt consolidation mortgage. If you don’t meet the lender’s criteria, you might miss out on this opportunity to manage your debts better.

- Risk of More Debt. If you don’t change your spending habits, there’s a danger you’ll start accumulating new debts on top of your consolidated mortgage debt.

Different Types of Mortgage Halifax Offers for Debt Consolidation

Halifax offers various mortgage products with competitive rates and features aimed at consolidation. Their most popular options include:

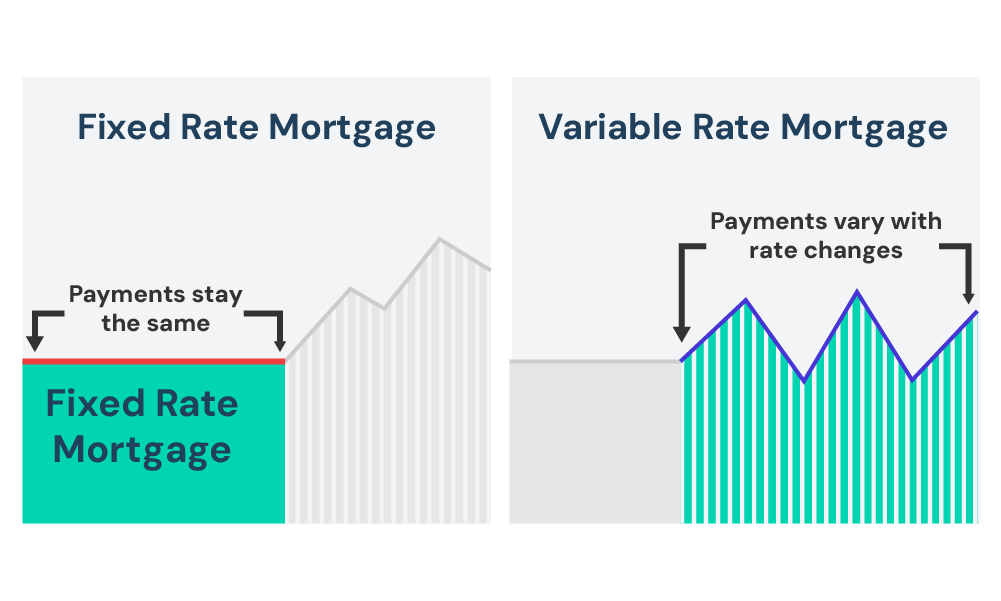

Fixed-Rate Mortgages. A fixed interest rate and payment for an agreed term, usually 2-5 years. This allows you to budget confidently each month.

Variable-Rate Mortgages. The interest rate can change. Sometimes you might pay less when rates drop, but you could pay more if rates go up.

Tracker Mortgages. The interest tracks a benchmark rate, usually the Bank of England base rate. Your payments fluctuate but initial rates can be very low.

Equity Release Option. If your home’s value has gone up, you might be able to get some of that extra value as cash. This can be handy for things like home improvements or consolidating debts.

Product Transfer. This is when you switch to a different mortgage deal with Halifax. It’s often easier than a full remortgage because you don’t need a new valuation of your property or a solicitor.

Switching Lenders. Halifax also lets you remortgage by moving to a different lender. This can be good if you find better terms somewhere else.

Each of these options has its benefits and considerations, and the choice will depend on financial circumstances, plans, and the current market conditions.

It’s always advisable to consult with a mortgage broker to understand which type of mortgage best suits your needs.

How Much Can I Borrow to Consolidate?

With Halifax, how much you can borrow for debt consolidation depends on a few things, like your debts, your home’s value, and your credit history.

You might be able to borrow more than you owe, but not more than your home is worth. Halifax usually lends on homes worth at least £40,000.

What Should I Consider Before Heading Straight to the Bank?

If you’re thinking of taking a mortgage for debt consolidation. Here’s what you should know:

Debt-to-Credit Ratio

This is a big part of the application. It’s all about how much you owe compared to how much credit you have. Halifax looks at this to decide if you can get a debt consolidation mortgage.

Seek Expert Advice

It’s a smart move to talk to a mortgage advisor who knows about remortgaging for debt consolidation. They can tell you if it’s a good idea for you and might suggest other options like Individual Voluntary Arrangements (IVAs) or Debt Relief Orders (DROs) if needed.

Credit File Check

Before you apply, make sure there aren’t any mistakes in your credit file. These errors could mess up your application. You can use a free trial from a credit reference agency to check your credit file.

How To Apply for a Halifax Mortgage for Debt Consolidation?

If you want to apply for this kind of mortgage with Halifax, you’ve got a few choices:

- Over the Phone – You can apply by calling them (0345 604 7292).

- In a Branch – Visit a Halifax branch and get help from a mortgage advisor.

- Online – Apply on the Halifax website. Just remember, if you apply online, you won’t get as much advice as you would from a Halifax advisor in person.

In all these ways, think carefully about your finances and what Halifax offers. It’s usually a good idea to talk to a mortgage advisor to fully understand what a Halifax mortgage for debt consolidation means for you

The Bottom Line: Is Halifax’s Mortgage for Debt Consolidation Right for You?

Whether Halifax’s mortgage for debt consolidation is right for you depends on your situation.

Their fixed-rate deals are around 4.53%-4.94%, depending on factors like loan-to-value (LTV) ratios and term length. This range provides options for different financial needs and preferences.

While Halifax offers competitive rates and a clear process, it’s always wise to compare with other banks like Lloyds Bank and Santander. These institutions might have different rates or terms that better suit your specific financial circumstances.

If you’re interested to know more about other debt solutions, consulting with a mortgage advisor is highly recommended. They can provide you personalised insight, and help you weigh the pros and cons based on your financial status.

For a hassle-free journey, get in touch with us. We’ll match you with the right mortgage advisor who will give you the best debt solutions and advice tailored to your situation.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

How long does a Halifax debt consolidation mortgage take?

The process to secure a remortgage deal with Halifax for debt consolidation typically takes one to two months. However, this is a general guideline, and the timeframe can be extended if there are complications or unexpected issues during the application process.

Can I take my debt consolidation mortgage elsewhere?

Halifax offers some portable mortgage options, meaning you can transfer your mortgage to a different property. This feature is beneficial if you plan to move houses. However, it’s crucial to confirm whether the specific mortgage you’re considering is portable

How quickly can I receive funds from a Halifax Debt Consolidation?

If your application is approved, the funds could be in your account within 2 hours for non-Halifax customers and even quicker for existing Halifax customers, often within minutes.

Can I apply for a Halifax debt consolidation if I am self-employed?

Yes, self-employed individuals can apply for a Halifax Debt Consolidation, but they will need to provide proof of stable income.