- What Is A Mortgage Deposit?

- How Much Deposit Do I Need For A Mortgage?

- Why Should I Aim For A Larger Deposit?

- What If Iâm Struggling To Save?

- Are There Mortgages With No Deposit Needed?

- Who Gets The Deposit When Buying A House?

- Can I Get My Mortgage Deposit Back?

- What is the Average Deposit for First-Time Buyers in the UK?

- Do I Need a Deposit When Remortgaging or Moving Home?

- What’s The Minimum Deposit For A Buy-To-Let Mortgage?

- Do I Need a Larger Deposit if I Have Bad Credit or am Self-Employed?

- How Do I Save For A Deposit?

- Key Takeaways

- The Bottom Line

How Much Mortgage Deposit Do I Need?

A home is built on dreams, but securing it starts with the right mortgage. For a favourable mortgage deal, you’ll need a decent deposit.

It’s key to know how much to save and the smartest ways to build up this sum.🤓

A large deposit not only secures better mortgage terms but also eases your financial burden down the line.

Whether you’re a first-time buyer or planning to invest in property, nailing your deposit is your first step towards owning your dream home. 🏡

This guide explains everything you need to know about mortgage deposits in the UK.

What Is A Mortgage Deposit?

A mortgage deposit is the money you pay upfront when buying a home. This sum is part of your total purchase price and is not borrowed from your mortgage lender.

The size of your deposit directly influences the cost of your monthly mortgage repayments, as it determines how much you need to borrow.

Image

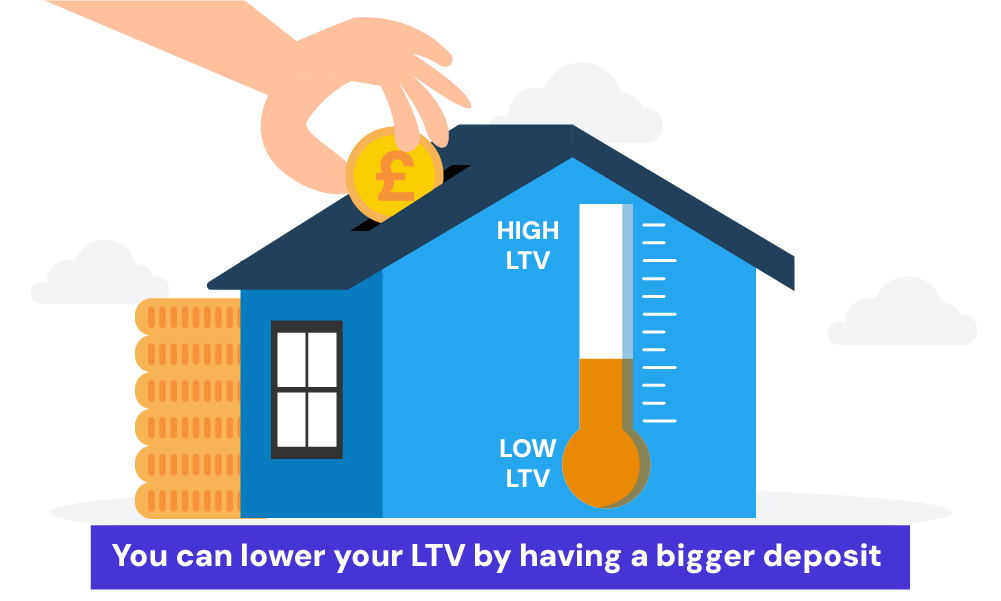

What Is LTV Ratio?

LTV or Loan-to-value ratio shows how much of your home is paid for with your mortgage. You’ll often see this figure on mortgage comparison websites or property listings, like “75% LTV” or “80% LTV.”

Here’s an example: For instance, you’ve found a property worth £200,000 and your mortgage is £150,000. Your LTV is 75% (£150,000 mortgage / £200,000 value). This means you’d need a £50,000 cash deposit (25% of the purchase price).

There’s a link between your deposit and LTV. Generally, a larger deposit results in a lower LTV, which can lead to better mortgage rates and terms.

How Much Deposit Do I Need For A Mortgage?

The minimum deposit for a mortgage is usually 5% of the property price. So, with the UK average house prices set at £282,000, you’d need a deposit of at least £14,100.

To find out how much deposit you need, check property prices on Rightmove, Zoopla or similar estate agent websites. These sites list properties with prices, locations and details.

You can also check the house price index on government websites for reliable estimates and property value trends.

Finally, contact local estate agents for expert advice and up-to-date market prices in your chosen area.

Then, decide how much you can save or afford for the deposit. Consider your monthly income and expenses to see what’s feasible for you to set aside.

Remember, your mortgage repayments will depend on the loan amount, interest rate, and the loan term.

Also, account for other costs like solicitor’s fees, survey costs, stamp duty (if applicable), and any mortgage arrangement fees. These will ALL add to the initial amount you need when buying a home.

If your credit history isn’t great, be prepared to pay a larger deposit. Lenders see bad credit as a risk, so they might ask for more money upfront to secure your mortgage.

A larger deposit reduces their risk, giving them more security on the loan they offer you.

Why Should I Aim For A Larger Deposit?

While the minimum deposit lets you buy a house sooner, saving more upfront has advantages. Here’s why aiming for a bigger deposit (ideally 10% or more) is a good idea:

- Lower monthly payments. With more money down upfront, you borrow less. This results in reducing your monthly mortgage repayments.

- Better mortgage rates. A bigger deposit lowers the risk for the lender, so they often offer you lower interest rates. For instance, loans with a 90% loan-to-value (LTV) ratio typically have lower rates than those with 95% LTV.

- Wider mortgage options. A bigger deposit makes you a more attractive borrower to lenders. This means more lenders will offer you loans, giving you a wider selection of mortgage products to choose from.

- Avoid Higher Lending Charges. Some lenders impose extra fees on mortgages with smaller deposits to mitigate their risk. A larger deposit helps you avoid these costs.

- Stronger buying power. In competitive markets, a larger deposit can make you a more attractive buyer to sellers.

- Reduced risk of negative equity. By owning more of your home outright, you’re less likely to end up in negative equity, where the value of your home falls below the amount you owe on the mortgage. This can make it difficult to sell or refinance.

In short, saving for a larger deposit doesn’t just improve your mortgage terms, it also solidifies your financial position as a homeowner.

What If I’m Struggling To Save?

We get it–saving for a deposit can be challenging for some. If you find it tough, you can consider these options that might help:

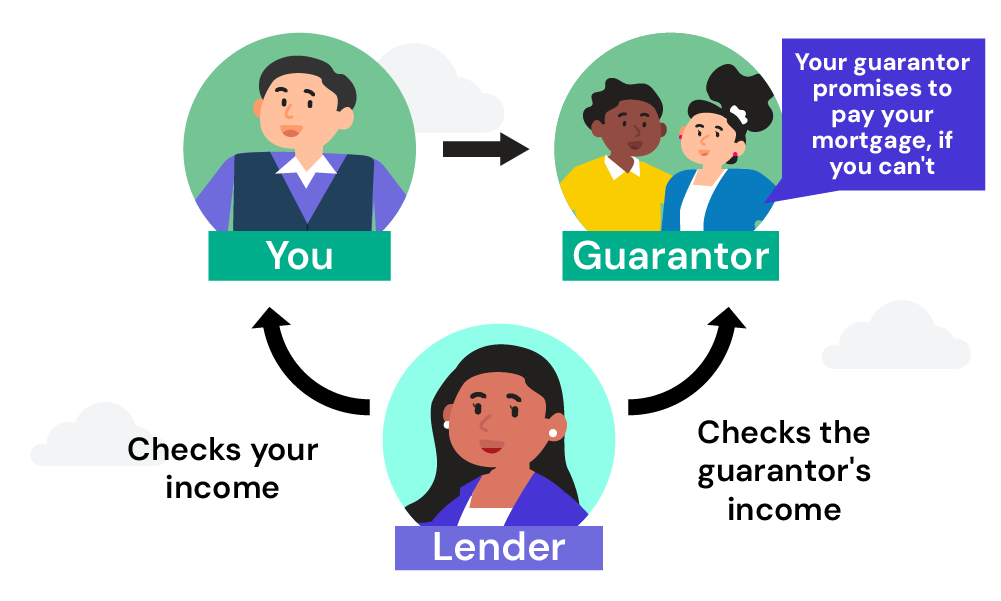

- Guarantor Mortgages. This lets a parent or family member help you by guaranteeing to cover the payments if you can’t. This can allow you to get a mortgage with a smaller deposit. Sometimes, guarantors can even use their property or savings as collateral to support your application.

- Gifted Deposit. A family member or friend can give you money towards your deposit. This is a great way to reduce the amount you need to save yourself. Remember, the money must be a genuine gift with no expectation of repayment, and you may need a written letter from the donor confirming this.

- 95% Mortgages. With these mortgages, you only need to put down a 5% deposit. While the interest rates might be higher, they offer an opportunity if you are ready to manage the larger repayments.

- Lifetime ISAs. This savings account helps you save for your first home with a 25% government bonus on your contributions, up to a maximum of £1,000 a year. The account is available to those aged 18-39, and the property purchased must not exceed £450,000.

- First Homes. This scheme is specifically for first-time buyers in England, offering at least a 30% discount on new-build homes. Local councils might set additional criteria, like prioritising local buyers or key workers.

- Right to Buy. As a council tenant, you can buy your home at a discount (up to 70% off in some cases) depending on how long you’ve lived there. This discount could cover your deposit or lower your borrowing amount.

- Mortgage Guarantee Scheme. Ending in June 2025, this scheme lets you get a mortgage with only a 5% deposit. The government helps lenders in case you can’t repay. Expect slightly higher interest rates.

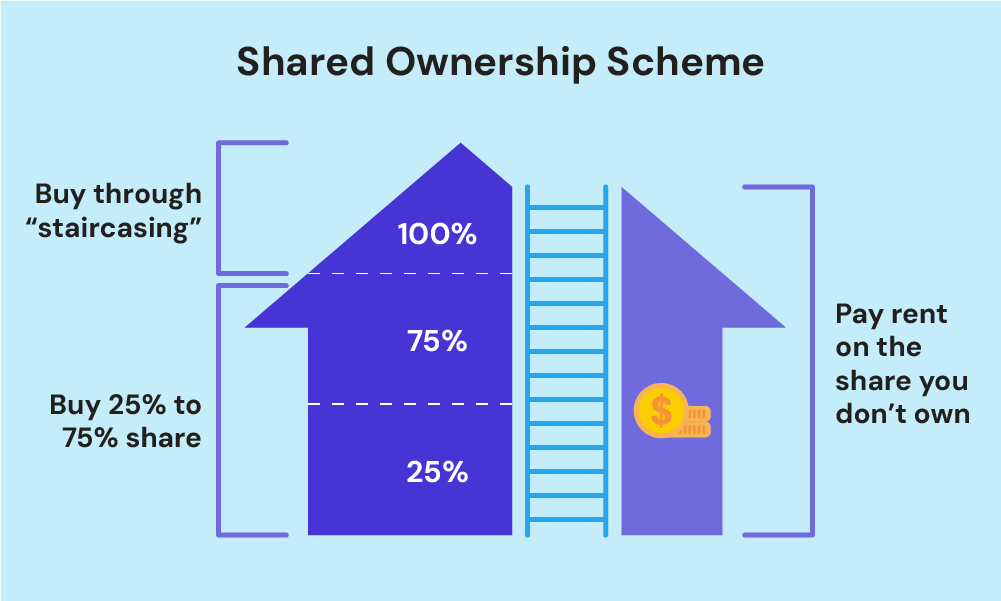

- Shared Ownership. You can buy a portion of a property—usually starting from 25%—and pay rent on the rest. This scheme allows you to increase your ownership over time and is ideal for those who cannot afford to buy a home outright. While this lowers the upfront cost, remember to factor in mortgage, rent and service charges.

Are There Mortgages With No Deposit Needed?

Yes, 100% mortgages exist but are rare and typically require a guarantor. These mortgages allow you to borrow the entire value of the property without a deposit.

As we’ve discussed, a guarantor, usually a parent or close family member, agrees to cover the mortgage payments if you default. They may need to offer their property or savings as security.

While this removes the burden of a deposit, it involves significant risk for both you and your guarantor.

Who Gets The Deposit When Buying A House?

When you buy a house in the UK, the deposit is paid to the seller’s solicitor as part of the exchange process.

This happens once all parties agree to the terms and are ready to legally commit to the transaction.

You should pay the deposit on the day of the exchange. This is when contracts are swapped between the buyer and seller’s solicitors, making the sale legally binding.

The deposit serves as your commitment to go through with the purchase and secures the property for you.

Usually, this deposit is around 10% of the property’s purchase price, although it can vary based on the agreement and your mortgage terms.

Once paid, the deposit is held in the solicitor’s client account until completion of the sale, when it becomes part of the total payment to the seller.

Can I Get My Mortgage Deposit Back?

Unfortunately, once you’ve exchanged contracts and completed the purchase of a property, your deposit is non-refundable.

It’s a down payment that contributes to your ownership of the property and is a significant financial commitment.

However, there are scenarios where you may be able to recoup some or all of your initial deposit:

- Releasing Equity. If your property increases in value over time, you may be able to release some of the equity (the difference between your home’s value and the remaining mortgage balance) through a remortgage or equity release scheme.

- Selling at a Profit. If you sell your property for a higher price than you paid for it, you’ll effectively recoup your initial deposit, plus any additional profits.

What is the Average Deposit for First-Time Buyers in the UK?

According to recent data, the average deposit for first-time buyers in the UK is around 19% of the property’s value. But, this figure can vary significantly depending on factors such as location, property prices, and your circumstances.

In London and other expensive areas, first-time buyers may need to save up a larger deposit due to the higher property prices.

Conversely, in more affordable regions, a 10% deposit may be sufficient.

Do I Need a Deposit When Remortgaging or Moving Home?

When remortgaging, you typically won’t need to provide a new deposit, as you’ll be using the equity you’ve built up in your current property as collateral for the new mortgage.

But, if you’re moving to a more expensive property, you may need to reapply for a larger mortgage.

In this case, any equity you’ve accumulated can be used as a deposit for the new property, potentially allowing you to access better interest rates and loan terms.

What’s The Minimum Deposit For A Buy-To-Let Mortgage?

You’ll usually need at least 25% of the property’s value. For more competitive interest rates, aiming for a deposit of 40% can offer cheaper deals.

Buy-to-let mortgages require HIGHER deposits than residential mortgages. This is because lenders view these investments as higher risk.

There’s a chance you might struggle to find tenants, leaving you with a vacant property and mortgage payments to cover.

A bigger deposit reduces this risk for the lender, allowing them to offer you better deals.

If you want to be a landlord, you must also prepare for other fees for taxes, letting agents, and upkeep costs.

Do I Need a Larger Deposit if I Have Bad Credit or am Self-Employed?

Having a poor credit score or being self-employed can make it more challenging to get a mortgage. In these cases, lenders may ask for a larger deposit as a way to lessen their perceived risk.

For borrowers with poor credit, some mainstream lenders may ask for a deposit of 15% or higher.

But, there are specialist lenders who cater to borrowers with adverse credit histories. They offer tailored mortgages that take individual circumstances into account.

Similarly, self-employed individuals may be required to provide a bigger deposit due to the perceived complexity of verifying their income.

Lenders may seek a deposit of 15% or more to offset the perceived risk associated with self-employment.

In both scenarios, working with a reputable mortgage broker can be invaluable. They can help you navigate the market, find the right lender, and present your application in the best possible light.

How Do I Save For A Deposit?

Saving for a deposit means being mindful about where your money goes. Make saving for your deposit a priority and avoid unnecessary splurges. Here’s how you can get started:

Set A Goal Amount

First, determine how much you need to save. This amount is usually determined by the price of the house you want to buy and the mortgage terms you seek.

Use our loan to value calculator to get an estimate based on your specific circumstances, which will help you set a clear and achievable savings target.

Budget Realistically

To save effectively, you need a realistic budget. Track all your income and expenses to understand where your money goes each month.

Tools like budgeting apps or spreadsheets can be incredibly helpful. Identify areas where you can cut back and reallocate that money to your savings.

Open A Savings Account

Choose a high-interest savings account where your money can grow. Here are some accounts you can opt for:

- Lifetime ISAs. Offers up to a 25% bonus on contributions, up to £1,000 per year, ideal for first-time home buyers.

- Fixed-Rate Bonds. Typically offer higher interest rates in exchange for locking in your money for a set period.

- High-Interest Current Accounts. Some accounts offer competitive interest rates, although they might require a minimum monthly deposit or have a limit on the balance that earns interest.

Automate Savings

Automating your savings can take the guesswork out of the equation.

Set up a direct debit from your checking account to your savings account shortly after each payday. This ensures you save before you have a chance to spend.

Reduce Unnecessary Expenses

Reducing your daily expenses can free up more money for your deposit.

Look for ways to save on groceries, cut out unnecessary subscriptions, and reconsider costly social outings. Even small savings can add up over time.

Boost Your Income

Consider ways to increase your earnings. Look for a higher-paying job, take on freelance work, or sell unwanted items.

The more you earn, the faster you can save.

Review and Adjust Regularly

Saving for a deposit is a long-term commitment. Review your progress regularly and adjust your budget and savings goals as needed.

This can involve tightening your spending further or adjusting your savings targets as your circumstances change.

Key Takeaways

- A mortgage deposit is the initial sum you pay when buying a home, not borrowed from your mortgage lender.

- The minimum deposit for a residential mortgage is typically 5%, while for a buy-to-let mortgage, you need at least 25%.

- Aiming for a higher deposit can secure lower interest rates, reduce monthly payments, and increase your mortgage options.

- If you’re struggling to save for a deposit, consider options like guarantor mortgages, gifted deposits, or government schemes like Lifetime ISAs and Shared Ownership.

- 100% mortgages are available but require a guarantor who provides additional security to the lender.

- The equity you’ve built up in your first property serves as the deposit when you remortgage.

- If you have poor credit or are self-employed, be prepared to save a larger deposit to compensate for the higher perceived risk by lenders.

- To save for a deposit, set a clear goal, budget wisely, open a high-interest savings account, automate savings, reduce expenses, and boost your income.

The Bottom Line

Buying a home involves emotional and financial decisions. To make your dream home a reality, you must have a solid financial foundation with a smart mortgage deposit.

Whether you’re a first-time buyer, looking to remortgage, investing in property, or with bad credit, using a knowledgeable mortgage broker can be a great asset here.

They can guide you on how much you need to save, find the best mortgage deals for you, and secure favourable terms.

They’ll also help you tackle the complex paperwork, making sure you understand every step of your mortgage application.

Need a mortgage broker? Get in touch with us. We’ll connect you with a top mortgage broker to help you buy your dream home successfully.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

How much deposit do I need as a first-time buyer?

As a first-time buyer in the UK, you usually need a minimum of 5% of the property’s purchase price as a deposit. But, saving more than 10% can give access to cheaper rates and more favourable mortgage options.

Can I use a loan to pay for a deposit?

Most mortgage lenders won’t accept a loan-funded deposit. This is because it increases your debt compared to your income (debt-to-income ratio), which can make you seem like a risky borrower. It’s best to use savings or gifts for your deposit.

Can I get a mortgage with a 10% deposit?

Yes, you can get a mortgage with a 10% deposit. Several lenders offer 90% loan-to-value (LTV) mortgages, which are designed for buyers who can only afford a smaller deposit.

Is getting a loan for a mortgage deposit a good idea?

Getting a loan for a mortgage deposit isn’t a wise move. It adds to your existing debts and hurts your mortgage application. Lenders prefer borrowers who’ve saved their deposit, showing financial stability.

Why does the bank require a deposit for a mortgage if you’re a high-earner?

Banks require deposits even for high earners for two reasons:

- Safer for them – A deposit means they lend you less, so if you can’t repay, they lose less money.

- Shows you’re serious – Putting your own money down proves you’re committed to buying and keeping up with payments.

Should I put all my cash into a deposit for a better mortgage rate or save some for home improvements?

There’s no one-size-fits-all answer to this. The best decision depends on your specific financial situation and priorities. To help you decide, take the time to answer these 3 questions:

- Does the house require significant repairs or upgrades to be livable or safe?

- Do you have a healthy emergency fund to cover unexpected expenses after the deposit?

- How important is securing the lowest possible mortgage rate for you?

If the house is in poor condition and requires urgent repairs, you may need to prioritise saving some cash for immediate improvements.

Conversely, if you have a solid emergency fund, you might be more comfortable putting more cash towards the down payment to secure a lower interest rate.

For personalised guidance, consult a good mortgage advisor. These experts can help you make wise decisions about your mortgage application and overall homebuying process.