- What are Enhanced Lifetime Mortgages?

- Who Can Apply?

- How Much Can You Borrow?

- How to Get an Enhanced Lifetime Mortgage?

- Which Lenders Offer Enhanced Lifetime Mortgages?

- Which Lenders Offer Enhanced Lifetime Mortgages?

- What are the Pros and Cons of Enhanced Lifetime Mortgages?

- Is It Worth It?

- Alternatives to Enhanced Lifetime Mortgages

- Key Takeaways

- The Bottom Line

Are Enhanced Lifetime Mortgages Right For You?

Imagine this: You’re retired, living comfortably in your lovely home, but a bit of extra money could make life even better. Maybe you want to travel, fix up the house, or just feel more secure about your finances.

That’s where lifetime mortgages come in. They let you release some of your home’s value without having to move out.

But there’s an exciting option for those with specific health or lifestyle conditions: enhanced lifetime mortgages.

These can offer special benefits, like borrowing more or getting a lower interest rate.

Curious? Let’s break it all down.

What are Enhanced Lifetime Mortgages?

Imagine enhanced lifetime mortgages as the upgraded version of regular ones.

They’re for people whose health or lifestyle might mean they won’t live as long as average. That might sound a bit strange, but it can actually work in your favour.

Here’s how it works: lenders look at your situation and may offer you better deals, like:

- Lower interest rates

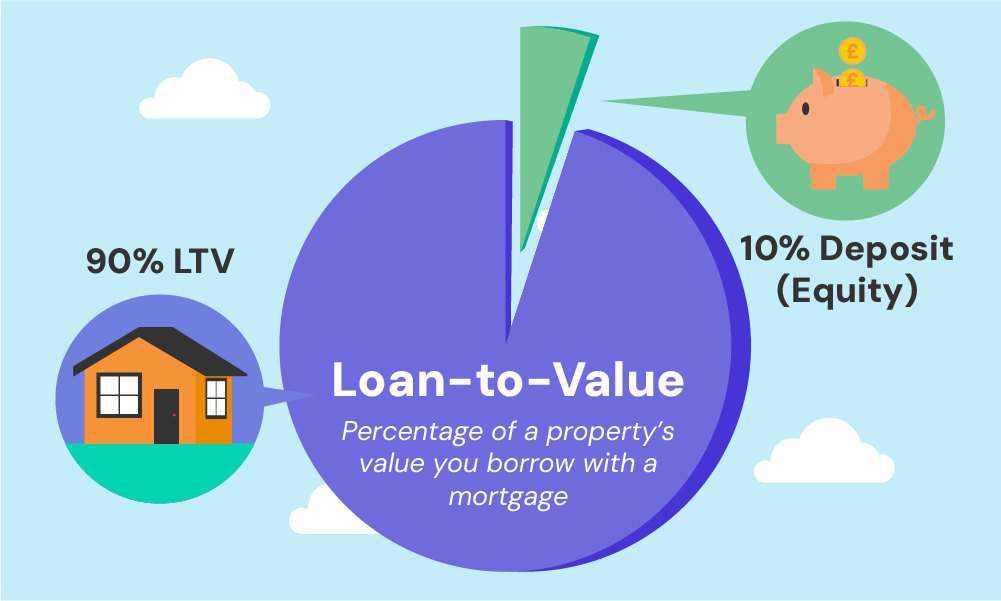

- Higher loan-to-value (LTV) ratios, which is just a fancy way of saying you can borrow more money against your house.

For example, if you have certain health issues (like high blood pressure) or lifestyle habits (like smoking), lenders might think they’ll get their money back sooner. Because of that, they’re often happy to make the deal better for you.

But here’s the catch: you usually have to pick one benefit. You can either get more cash or enjoy lower interest rates. Sadly, it’s not a “you can have it all” situation.

If this sounds interesting, a specialist broker can help you figure out if it’s a good choice and find the best deal for your situation.

Who Can Apply?

Enhanced lifetime mortgages aren’t for everyone. To qualify, you’ll need to tick a few boxes. Let’s start with the basics:

- You usually need to be 55 or older.

- Your home should typically be worth at least £70,000. (Lenders want enough equity to make it worth their while.)

- If you’ve got an outstanding mortgage, it either needs to be cleared with the loan or be small enough to meet the lender’s criteria.

Now, let’s add the “enhanced” bit: your health and lifestyle. Lenders will look at certain conditions to decide if you qualify. These might include:

Health Conditions

- High blood pressure (hypertension)

- Diabetes

- Heart attacks or strokes

- Cancer

- Multiple sclerosis

- Parkinson’s disease

- Dementia

- Kidney or liver disease

- Motor neuron disease

- HIV

Lifestyle Factors

- Smoking

- High Body Mass Index (BMI)

Essentially, the riskier your health or lifestyle looks on paper, the better your chances of being eligible.

How Much Can You Borrow?

Let’s break this down nice and easy.

How much you can borrow with an enhanced lifetime mortgage boils down to a simple formula: your property’s value, your age, and—here’s where it gets interesting—your health.

If you’ve got certain health conditions, you might actually qualify for a bigger loan.

Enhanced lifetime mortgages can offer loan-to-value (LTV) ratios around 50% or even higher.

Basically, the more severe your health condition, the more you might be able to borrow. It’s a strange perk, but one worth knowing.

When you’re filling out the lender’s health and lifestyle questionnaire, take your time. The more detailed and honest you are, the better your chances of getting terms that work in your favour.

But don’t get carried away with the higher LTVs without thinking it through.

Borrowing more usually means paying more interest in the long run, so chatting with a good financial advisor is a smart move.

How to Get an Enhanced Lifetime Mortgage?

Getting an enhanced lifetime mortgage isn’t too different from the usual mortgage route, but there’s a twist: medical underwriting.

That means the lender takes a closer look at your health and lifestyle to offer potentially better terms.

Here’s a quick step-by-step guide to keep things simple:

Step 1: Find the Right Broker

Look for a broker who knows their stuff about enhanced lifetime mortgages.

They’ll help you handle the whole process and make sure you’re ticking all the right boxes, from property value to your health details.

Step 2: Get Checked for Eligibility

This is where the medical underwriting comes in. Expect to share details about any chronic illnesses, lifestyle habits (like smoking), and your overall situation.

Your broker will guide you through this step to determine how much you can borrow.

Step 3: Pick and Apply

Once you know what you qualify for, your broker can help you find a lender that matches your needs.

The process is pretty similar to a regular mortgage, just with that added layer of medical consideration.

Step 4: Seal the Deal

Before signing on the dotted line, take a good look at the numbers. Compare the costs, benefits, and overall terms to make sure they align with your retirement goals.

If everything checks out, finalise the deal and get ready to enjoy that extra financial flexibility.

Which Lenders Offer Enhanced Lifetime Mortgages?

Which Lenders Offer Enhanced Lifetime Mortgages?

Here’s a quick look at a few well-known lenders offering enhanced lifetime mortgages, along with what their plans include.

Keep in mind that availability and details may have changed since this was written, so it’s always wise to check directly with lenders or speak to a broker for the latest options.

- Just For You Lifetime Mortgages – Open to applicants up to age 85, offering loans up to £1m in England, Scotland, and Wales, or £250,000 in Northern Ireland. Additional features include the option to release more funds later and make monthly interest payments.

- More2life – Their Tailored plan provides loans up to £800,000, with flexibility for cash withdrawals and partial repayments.

- Aviva – Known as the Lifetime Flexible Option, this plan provides loans up to £1m, with choices for a lower interest rate or higher loan-to-value. Additional options include cash reserves and partial repayments.

Always double-check the details before making a decision, as lenders often update their offerings.

What are the Pros and Cons of Enhanced Lifetime Mortgages?

Enhanced lifetime mortgages have their ups and downs. Let’s break it down simply so you can see if it’s the right choice for you.

Pros:

- You can borrow more money, which means more cash to enjoy your retirement or fix up your home.

- Some plans let you choose lower interest rates, which can save you money in the long run.

- No need to worry about monthly payments, giving you more financial freedom.

- It’s usually easy to qualify without needing a medical exam.

- The “no negative equity guarantee” means your family won’t owe money if the loan is bigger than the house’s value.

Cons:

- Borrowing more means paying more in interest, which can get expensive over time.

- There might be less money left to pass on to your family.

- The process can take longer, especially if you need to provide a doctor’s report.

- A lump sum could affect benefits you receive based on your income.

- If you want to pay the loan back early, there might be extra charges.

Is It Worth It?

Enhanced lifetime mortgages aren’t for everyone, but they can be a lifeline for the right person.

Here are a few scenarios where they might make sense:

- You want to fund a dream. Whether it’s a trip around the world, helping your family financially, or renovating your home, this could be your ticket.

- You have health or lifestyle factors that qualify you. If you’re eligible for better terms, it’s worth exploring.

- You prefer to stay put. Selling up and moving isn’t for everyone. This lets you stay where you’re most comfortable.

That said, it’s not all smooth sailing. These mortgages come with long-term implications, so it’s essential to look at the bigger picture.

Consider things like the effect on your family’s inheritance, fees, and how interest will add up over time.

Alternatives to Enhanced Lifetime Mortgages

Enhanced lifetime mortgages aren’t the only option. If they don’t seem like the right fit, here are some other ideas to consider:

- Downsizing. Selling your home and moving to a smaller or cheaper place can give you money without needing a mortgage. It’s quick but might mean extra costs for moving and adjusting to a new home.

- Retirement Interest-Only (RIO) Mortgages. This lets you pay only the interest on a loan, while the full amount gets paid back when you sell your home. It can help keep your monthly costs low but means you’ll still need to make regular payments.

- Reverse Mortgages. With these, you borrow money against your home’s value without needing monthly repayments. The loan gets paid back when you sell your house or after you pass away.

- Personal Loans or Credit Lines. If you have good credit, you could get a loan or a line of credit that doesn’t use your home as security. This can be handy, but you’ll still have to repay it.

- Home Reversion Plans. You sell part or all of your home to a company for a lump sum or regular payments. You can stay in your home, but it’s no longer fully yours.

- Other Equity Release Schemes. There are different types of equity release plans that might be easier to qualify for or suit your needs better than an enhanced lifetime mortgage.

Key Takeaways

- Enhanced lifetime mortgages let you borrow money against your house, with options to take more cash or pay lower interest, especially if your health or lifestyle qualifies you for better deals.

- You don’t have to make monthly payments, but borrowing more means higher costs over time, which could leave less for your family.

- If this isn’t right for you, options like downsizing, reverse mortgages, or equity release schemes may be considered, each with its own considerations.

The Bottom Line

Enhanced lifetime mortgages can be a brilliant way to access your home’s value while keeping your feet firmly planted in it.

They’re especially useful if you’ve got specific health or lifestyle factors that qualify you for better terms.

But… and it’s a big but… these mortgages aren’t a one-size-fits-all solution.

That’s why it’s important to speak with a specialist before deciding.

Equity release brokers can help you understand all the pros and cons, tailor options to your needs, and find the best deal available.

Still confused? Fill out this quick form, and we’ll connect you with a top mortgage advisor specialising in enhanced lifetime mortgages.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

Can I make repayments on an enhanced lifetime mortgage, or do I have to wait until the end?

Most enhanced lifetime mortgages don’t need monthly payments, but some plans let you pay back bits of the loan or just the interest if you want. A broker who knows about these can help you find a plan that works for you.

What happens if I want to move house while I have an enhanced lifetime mortgage?

Good news—many of these mortgages let you take them with you if you move, as long as your new house meets the lender’s rules. Just check with your lender or broker to know what’s allowed.

Are enhanced lifetime mortgages safe, and how do I find a trustworthy lender?

Yes, they’re regulated by trusted groups like the Financial Conduct Authority (FCA) in the UK and follow rules from the Equity Release Council (ERC). To find a reliable lender or broker, look for these accreditations and check reviews or ask for recommendations.