- Can You Get a 7 Times Salary Mortgage?

- How Can You Borrow Seven Times Your Salary?

- What If You Donât Have a High Net Worth Exemption?

- How to Get a Bigger Mortgage

- Mortgage Calculations: How Much Can You Borrow?

- Which Lenders Offer 7 Times Salary Mortgages?

- Is a 7 Times Salary Mortgage Right for You?

- Key Takeaways

- The Bottom Line

7 Times Salary Mortgages: Everything You Need To Know

Most lenders in the UK offer mortgages based on 4-4.5 times your salary, but what if you need more? Is it possible to get a mortgage worth 7 times your income?

In this article, we’ll explore the reality of 7 times salary mortgages, what it takes to qualify, and alternative options if you don’t meet the criteria.

Can You Get a 7 Times Salary Mortgage?

The short answer is yes, but it’s far from common.

Mortgages based on a 7 times salary multiple are generally reserved for a small group of high-net-worth individuals.

These are people who either earn a substantial annual income—usually over £300,000—or have assets worth at least £3 million.

For these individuals, lenders may be willing to bend the usual rules and offer bespoke mortgage deals with higher income multiples.

For the average borrower, however, getting a 7 times salary mortgage is unrealistic.

Most lenders cap their income multiples at 4-4.5x salary, with some extending to 6x for those with strong financial profiles.

Beyond this, you’re stepping into a niche market that requires specific conditions to be met.

How Can You Borrow Seven Times Your Salary?

If you’re among the high-net-worth individuals who qualify, you’ll need to navigate a few steps to secure this type of mortgage.

First and foremost, you’ll need to work with a specialist broker.

These brokers have relationships with private lenders who are willing to offer 7 times salary mortgages, and they understand the intricacies of high-value lending.

What If You Don’t Have a High Net Worth Exemption?

If you don’t qualify as a high-net-worth individual, your options are more limited.

Some private lenders might still offer a 7 times salary mortgage, but this is rare and usually requires a perfect financial record and a large deposit.

In most cases, you’ll need to find other ways to increase how much you can borrow.

This could mean using extra income sources, getting a joint mortgage, or using assets like your existing property.

How to Get a Bigger Mortgage

If a 7 times salary mortgage isn’t feasible, there are several strategies you can use to increase the amount you can borrow.

Here’s how:

1. Increase Your Deposit

One of the most effective ways to get a bigger mortgage is to save up for a larger deposit.

The more you can put down upfront, the less risky you appear to lenders. This can result in better terms, a lower interest rate, and potentially a higher income multiple.

2. Include Additional Income Sources

Lenders don’t just consider your salary when calculating how much you can borrow.

They may also take into account additional income such as bonuses, commissions, overtime, freelance work, and even rental income.

By including all your income streams, you may be able to boost your borrowing capacity.

3. Opt for a Joint Mortgage

A joint mortgage allows you to combine incomes with another person—whether it’s a partner, friend, or family member.

This can significantly increase the amount you can borrow, as the lender will consider the combined income when applying their income multiple.

4. Consider a Secured Loan

If you already own a property, you might be able to take out a secured loan against its equity.

This is known as a second charge mortgage and can allow you to borrow a significant amount, sometimes up to 10 times your income.

However, be aware that interest rates on secured loans are typically higher, and there’s a risk of losing your property if you fail to repay.

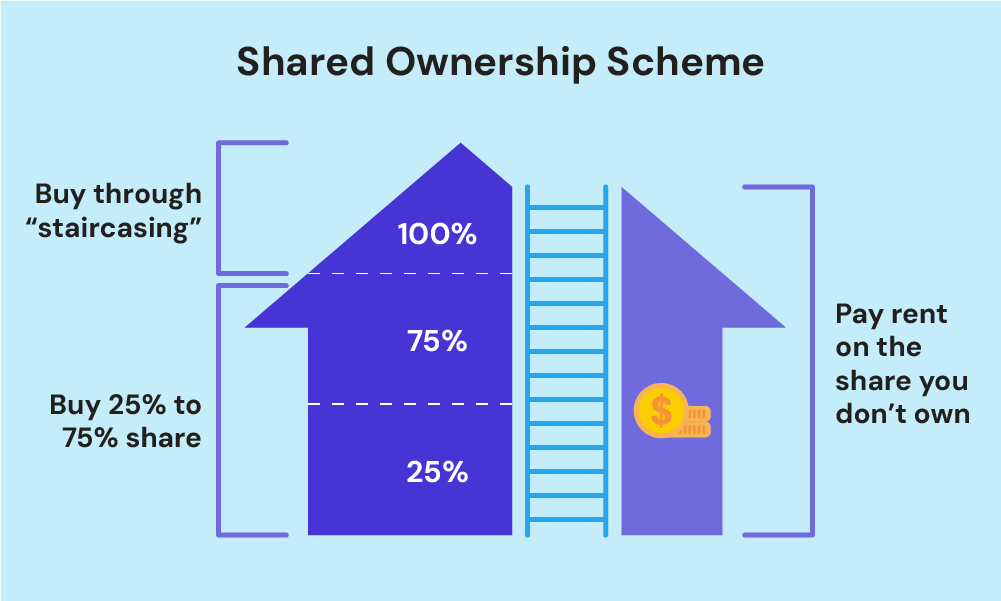

5. Explore Government Schemes

There are several government schemes designed to help you buy a home, especially if you’re a first-time buyer.

Some of these schemes allow you to borrow more than the standard income multiple by providing additional support, such as equity loans or shared ownership options.

6. Improve Your Credit Score

Your credit score plays a crucial role in how much you can borrow and the terms you’re offered.

A higher credit score signals to lenders that you’re a reliable borrower, which can increase your chances of getting a larger mortgage.

If your credit score isn’t where you’d like it to be, take steps to improve it by paying off debts, avoiding new credit applications, and ensuring all your bills are paid on time.

Mortgage Calculations: How Much Can You Borrow?

To give you an idea of what a 7 times salary mortgage looks like, here are some example calculations:

| Annual Salary | 7 Times Salary Mortgage |

|---|---|

| £25,000 | £175,000 |

| £32,000 | £224,000 |

| £45,000 | £315,000 |

| £55,000 | £385,000 |

| £75,000 | £525,000 |

| £125,000 | £875,000 |

| £300,000 | £2,100,000 |

These numbers are just examples and should be used as a rough guide.

The actual amount you can borrow will depend on various factors, including your overall financial profile, the lender’s criteria, and your credit history.

For exact estimates, use the mortgage affordability calculator. This will give you a ballpark figure of how much you can borrow based on your income.

Which Lenders Offer 7 Times Salary Mortgages?

Finding a lender who will offer a mortgage based on 7 times your salary is incredibly rare.

In the past, a few specific products like the Habito 7x mortgage were available, but these have since been withdrawn due to market changes.

Currently, only private lenders and the private arms of major banks may consider such high multiples, and even then, they reserve these for high-net-worth clients.

Given the limited availability, working with a specialist broker is crucial. These brokers have relationships with lenders who might not advertise these products publicly.

They can connect you with the right lender, guide you through the bespoke application process, and help negotiate terms that suit your financial situation.

Is a 7 Times Salary Mortgage Right for You?

Even if you can get a mortgage that’s 7 times your salary, it might not be the best choice.

Borrowing that much money is risky, especially if your financial situation changes or interest rates go up.

Think carefully about your long-term finances and if you’re comfortable with so much debt.

It might be better to get a smaller mortgage and find other ways to borrow more money, like the things we talked about earlier.

Here are the pros and cons you can consider before jumping in:

The Pros:

- You can borrow a larger amount, letting you buy a higher-value property.

- Ideal if you’re a high-net-worth individual needing more borrowing power for prime real estate.

- Helps you secure a home in a competitive market where prices are high.

- Gives you more flexibility to choose a property that suits your long-term needs.

The Cons:

- High risk if your financial situation changes, like a loss of income or unexpected expenses.

- You’re more exposed to interest rate increases, which could lead to much higher monthly payments.

- Taking on more debt can be stressful and affect your financial stability.

- Fewer lender options, often meaning you’ll need to work with private lenders or specialist brokers.

- Mostly reserved for high-net-worth individuals, so it’s out of reach for most borrowers.

- You may need a large deposit and a spotless credit history to qualify.

Key Takeaways

- 7 times salary mortgages are rare and usually only available to high-net-worth individuals.

- Most lenders cap income multiples at 4-4.5x salary, with some extending to 6x for those with strong financial profiles.

- To qualify for a 7 times salary mortgage, you’ll need an annual income of at least £300,000 or assets worth £3 million.

- If you don’t qualify, consider increasing your deposit, including additional income, opting for a joint mortgage, or exploring secured loans and government schemes.

- Work with a specialist broker to navigate the complexities of high-value mortgages and find the best deal for your situation.

The Bottom Line

If you’re thinking about a 7 times salary mortgage, think carefully about the risks and benefits.

It can help you buy a more expensive house, but it’s also risky, especially if your money situation changes.

A good mortgage advisor can help you:

- Finding lenders who offer these rare products

- Providing tailored advice based on your financial situation

- Negotiating the best possible terms and rates

- Simplifying the application process and saving you time

If you want to save time and reduce stress in finding the right broker, get in touch with us. We’ll connect you with a trusted broker who can help with your specific mortgage needs.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

What is the maximum mortgage multiple of salary in the UK?

For most borrowers, the maximum mortgage multiple is around 4-4.5x salary. Some lenders may offer up to 6x salary for those with strong financial profiles.

Can I get a 10 times salary mortgage?

While no lenders advertise a 10 times salary mortgage, it may be possible for high-net-worth individuals through bespoke arrangements with private lenders.

How much can I borrow on a second mortgage?

The amount you can borrow on a second mortgage depends on the equity in your existing property and your overall financial profile. Some lenders may allow you to borrow up to 10 times your income with a secured loan.

Can self-employed people get a mortgage that's 7 times their salary?

Yes, but it’s very difficult. You need to have a lot of money and be able to prove that you’ve earned a good income for several years.

You’ll also need to give the lender a lot of financial information and have a big deposit.

It’s best to work with a mortgage advisor who specialises in helping self-employed people. They can find lenders who are willing to give you a mortgage like this.

What is the highest salary multiple for a mortgage?

The highest mortgage you can usually get is 6 times your salary. This is for people with very good finances or who work in certain jobs.

A mortgage that’s 7 times your salary is very rare. It’s usually only for people who are very rich.

Most lenders won’t give you a mortgage that’s more than 4-4.5 times your salary.