- Can You Get a Mortgage If You Have Outstanding Debt?

- How Does Debt Affect Your Mortgage Application?

- What Types of Debt Are Acceptable When Applying for a Mortgage?

- How Much Debt is Too Much for a Mortgage?

- Tips To Get a Mortgage Even If You’re in Debt.

- Can You Get a Mortgage with Bad Credit and Debt?

- What About Remortgaging with Debt?

- Should I Clear Off Debt Before Applying for a Mortgage?

- Key Takeaways

- The Bottom Line

Can You Get a Mortgage When in Debt?

Debt shouldn’t stop your dream of owning a home in the UK.

While it can affect your mortgage application, there are ways to improve your chances of getting approved.

Let’s explore how debt impacts mortgages and what steps you can take to increase your success.

Can You Get a Mortgage If You Have Outstanding Debt?

Yes, it’s possible to get a mortgage even if you have outstanding debt.

Mortgage lenders understand that many people have some form of debt, whether it’s student loans, car finance, or credit card balances.

What matters most to lenders is your ability to manage your existing debts while taking on a mortgage.

When you apply for a mortgage, lenders will conduct an affordability assessment.

This evaluation looks at your income, expenses, and existing debts to determine if you can comfortably afford mortgage repayments.

If you can demonstrate that you’re managing your current debts responsibly and have sufficient income to cover a mortgage, you may still be approved.

How Does Debt Affect Your Mortgage Application?

Your existing debts can impact your mortgage application in several ways:

Debt-to-Income Ratio

Lenders use this ratio to see how much of your monthly income goes towards debt repayments.

A lower ratio, ideally around 36% or less, is more favourable. Different lenders may have cut-off points, but many draw the line at 50%.

See how you measure up by checking your DTI ratio here.

Your credit score reflects how well you manage debt.

A good credit score can improve your chances of mortgage approval and better interest rates.

Paying off as many debts as possible and using less than 20% of your credit limit on credit cards can help boost your score.

Affordability

Lenders will calculate how much you can afford to borrow based on your income minus your existing debt obligations.

Your Expenses

Showing that you’ve controlled your spending to repay your debts can be positive.

Providing bank statements proving your low-cost lifestyle and regular repayments can help convince lenders of your responsible attitude.

They may also look favourably if you can show you’ve reduced other expenses to manage your debt.

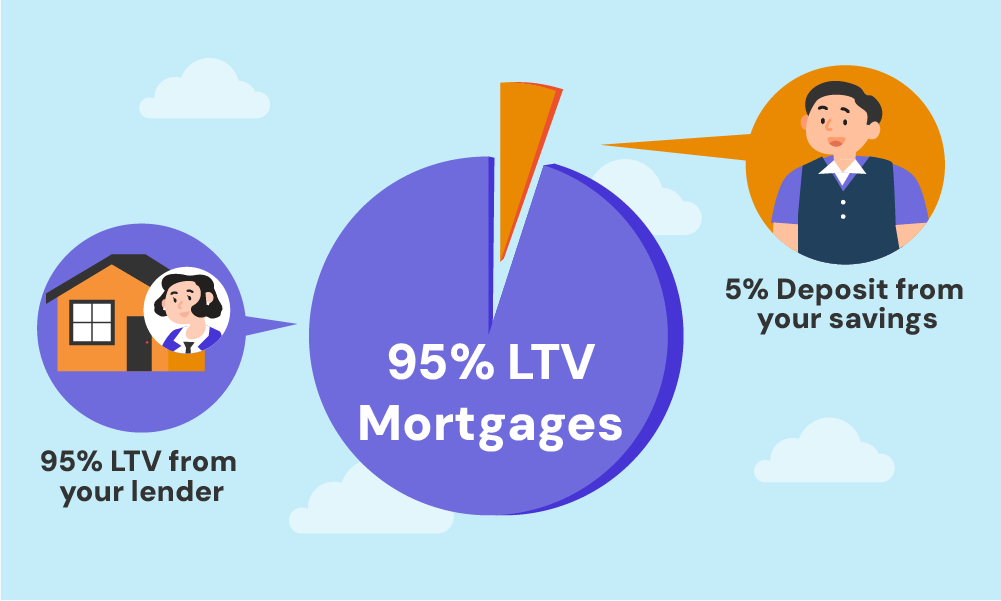

Your debts may affect how much deposit you can save, which in turn impacts the loan-to-value ratio of your mortgage.

What Types of Debt Are Acceptable When Applying for a Mortgage?

Not all debts are viewed equally by mortgage lenders. Here’s how different types of debt might affect your application:

- Student Loans – Generally, these are viewed more favourably as they’re seen as an investment in your future earning potential. Government-backed student loans from the Student Loans Company (SLC) won’t affect your chances. Butr, any commercial loan from your student days could make a difference.

- Car Finance – If manageable and necessary for work, this is often considered acceptable debt. Lenders understand a car is a significant expense, so it makes sense to pay for it over time.

- Credit Card Debt – Small, well-managed credit card balances can be okay, but high balances or multiple maxed-out cards are red flags. Using your credit card wisely by staying below your limit and paying your bill in full each month shows responsible borrowing.

- Personal Loans – These can be acceptable if you’re managing the repayments well and they’re for a good reason.

- Payday Loans – These are viewed very negatively and can seriously harm your chances of mortgage approval. Some lenders won’t approve your application if you’ve had a payday loan in the last six years.

- IVAs and CCJs – If you have an Insolvency Voluntary Arrangement (IVA) or a County Court Judgement (CCJ) on your record, it can make getting a mortgage very tough. Most lenders see this as too risky. But, putting down a large deposit might improve your chances.

- Bankruptcy – If you’ve been declared bankrupt, securing a mortgage becomes very hard. During the first year after bankruptcy, getting approved is nearly impossible. But some lenders may consider you after that year, with your chances increasing over time.

- Mobile Phone Contracts – Many people have mobile phone contracts, and they are seen as essential expenses. It’s important to keep up with your monthly payments. Missed payments or defaults can damage your credit score.

How Much Debt is Too Much for a Mortgage?

There’s no fixed amount of debt that’s considered “too much” for a mortgage. Instead, lenders look at your debt-to-income ratio.

While this can vary between lenders, many prefer to see a debt-to-income ratio of 36% or less. But, some may accept 50% depending on other factors, such as your credit score and deposit.

This means your total monthly debt payments (including your potential mortgage) should ideally be no more than half of your gross monthly income.

For example, if your gross monthly income is £4,000, your total monthly debt payments, including your potential mortgage, shouldn’t exceed £2,000.

Keep in mind that some lenders may have stricter requirements, especially for larger mortgages or if you have a lower credit score.

Tips To Get a Mortgage Even If You’re in Debt.

If you’re concerned about getting a mortgage with debt, there are several steps you can take to improve your chances:

Tip #1 – Improve Your Credit Score

First, check your credit score with Equifax, Experian, and TransUnion. Make sure everything’s accurate.

Even small errors can trip you up, so fix them promptly. Keeping your credit card usage below 30% shows lenders you’re responsible.

Always pay on time – late payments hurt. Clear small debts and close those accounts. Less debt means a better profile.

If you’re not on the electoral roll, get on it. It helps lenders verify your address and boosts your score.

In the months leading up to your mortgage application, avoid applying for new credit as multiple applications can drag your score down.

Lastly, you may consider getting a credit card for small purchases and pay it off immediately to show consistency and reliability.

Tip #2 – Lower Your Debt-to-Income Ratio

As we’ve discussed, DTI is one of the factors that affect your mortgage. Lenders would like to know your financial position.

Here’s what you can do to lower your DTI ratio:

- Reduce Existing Debts. Prioritise paying off high-interest debts first. This not only lowers your DTI but also saves you money in the long run.

- Avoid New Debts. Steer clear of taking on new loans or credit cards before applying for a mortgage. New debts can spike your DTI and raise red flags for lenders.

- Increase Your Income. Look for opportunities to boost your income. Whether it’s taking on extra work, freelancing, or seeking a raise, higher income lowers your DTI.

- Budget Wisely. Review your expenses and cut out non-essentials. Every bit you save can be used to reduce your debts and improve your financial position.

Tip #3 – Increase Your Deposit

Boosting your deposit can be a game-changer for your mortgage approval. It reduces the lender’s risk, making your application more attractive even with existing debts.

A larger deposit also means lower monthly payments and better interest rates. It’s a clear signal to lenders that you’re financially committed and responsible.

Tip #4 – Show Stable Employment

Lenders want to see a reliable financial picture.

Keep your income steady and avoid big changes like switching jobs at least six months before applying for a mortgage.

Stability in your employment history sends a strong signal that you’re a dependable borrower who can meet mortgage repayments without a hitch.

Tip #5 – Work with a Good Mortgage Broker

A good mortgage broker is your ace up the sleeve.

They connect you with lenders who are more inclined to accept your application, even with unique financial circumstances.

Good brokers understand the market intricacies, uncovering the best deals and smoothing your path to approval.

Can You Get a Mortgage with Bad Credit and Debt?

Getting a mortgage with both bad credit and debt is challenging, but not impossible.

Some specialist lenders cater to applicants with poor credit histories. However, you may face higher interest rates and stricter lending criteria.

To improve your chances, focus on repairing your credit score, saving a larger deposit, and demonstrating a period of responsible financial management.

You might also benefit from waiting a year or two to allow negative marks on your credit report to age and have less impact.

What About Remortgaging with Debt?

If you’re already a homeowner with existing debts, you might be wondering about remortgaging.

The good news is that remortgaging with debt follows similar principles to getting a new mortgage.

Lenders will assess your current financial situation, including your income, debts, and the equity in your home.

In some cases, remortgaging can be a strategy to consolidate debts, potentially lowering your overall monthly outgoings.

However, this approach comes with risks and should be carefully considered with professional advice.

Should I Clear Off Debt Before Applying for a Mortgage?

While it’s not always necessary to be completely debt-free before applying for a mortgage, reducing your debt can significantly improve your chances of approval and potentially secure you better interest rates.

If you have high-interest debts or multiple small debts, paying these off could improve your debt-to-income ratio and credit score.

However, don’t deplete your savings entirely to pay off debt – lenders also want to see that you have savings for a deposit and to cover unexpected expenses.

Key Takeaways

- You can get a mortgage with outstanding debt, but lenders will check if you can manage both your debts and mortgage payments.

- Debt-to-income ratio and credit score are crucial factors in mortgage approval.

- Debts like student loans, manageable car finance, and small credit card balances are usually acceptable, but payday loans and recent bankruptcies can seriously hurt your chances.

- To improve your chances, boost your credit score, lower your debt-to-income ratio, increase your deposit, and keep stable employment.

The Bottom Line

Getting a mortgage while in debt is achievable, but it requires planning and thought.

Understanding how lenders view various debts, responsibly handling your current obligations, and improving your financial health can boost your chances of approval.

Remember, lender criteria differ. What one approves, another might reject.

A good mortgage broker can be helpful in finding the right lenders and improving your mortgage application. They can:

- Connect you with a wider range of lenders and mortgage deals.

- Offer expert advice tailored to your financial situation.

- Simplify complex mortgage terms and conditions for you.

- Secure better rates and terms through their industry connections.

- Handle all the paperwork and communicate with lenders on your behalf.

- Find mortgage options for unique situations like poor credit or self-employment.

- Provide continuous support throughout the entire mortgage process.

- Access exclusive deals and offers not available to the public.

- Help improve your financial profile to boost your approval chances.

- Give you peace of mind with professional management of your application.

Need a good broker? Get in touch. We’ll set up a free, no-obligation consultation with a qualified mortgage broker to help you ace your mortgage application.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

How long after paying off debt can I get a mortgage?

You can apply for a mortgage immediately after paying off your debt.

However, it’s best to wait three to six months for your credit score to update, reflecting the improved financial history, which can help you get better mortgage terms.

Can you get a mortgage with a personal loan?

Yes, you can get a mortgage with a personal loan. Lenders will consider your total debt-to-income ratio.

As long as your debt-to-income ratio is below 43% and you can manage both the personal loan and mortgage payments, having a personal loan won’t disqualify you.

This article has been fact checked

This article was created, checked, and verified by the expert team at Money Saving Guru. Trust us, you’re in good hands.