- What Are the Mortgage Options in Wales?

- First-Time Buyers Options in Wales

- Government Schemes in Wales

- Can You Get a Mortgage in Wales with Bad Credit?

- Whatâs the Process for Getting a Mortgage in Wales?

- What Deposit Do You Need for a Mortgage in Wales?

- What Are the Costs Associated with Mortgages in Wales?

- How Does Land Transaction Tax Work in Wales?

- Can You Remortgage in Wales?

- How Can You Improve Your Chances of Getting a Mortgage in Wales?

- The Bottom Line: Where Should You Start?

Getting a Mortgage in Wales: What You Need to Know

If you’ve fallen in love with the idea of owning a home in Wales – maybe a cosy cottage or a stylish city apartment.

You might be wondering about mortgages, government schemes, and whether you can afford it.

Don’t worry – we’ve got you covered.

Whether you’re a first-time buyer, remortgaging, or moving to Wales, you’ll find everything you need to know about getting a mortgage here.

We’ll explain your options, explain the process, and help you make informed decisions.

Let’s get started.

What Are the Mortgage Options in Wales?

When it comes to mortgage options, Wales offers a variety of choices similar to the rest of the UK.

From fixed-rate mortgages to variable-rate and tracker options, the same range of products is available. However, there are certain nuances and local factors to consider.

For first-time buyers in Wales, there are specific schemes like the Welsh Government’s Help to Buy initiative, which can significantly lower the barrier to entry.

This scheme allows buyers to secure a new build home with just a 5% deposit, with the government lending up to 20% of the property’s value.

It’s a popular option, especially in areas like Cardiff and Swansea where the property market is thriving.

For those looking to invest, the buy-to-let market is also strong in Wales.

Cities like Cardiff, Newport, and Swansea are hotspots for rental properties, and many lenders offer competitive rates for buy-to-let mortgages.

However, you’ll need a larger deposit—often around 25%—and the interest rates tend to be higher compared to residential mortgages.

First-Time Buyers Options in Wales

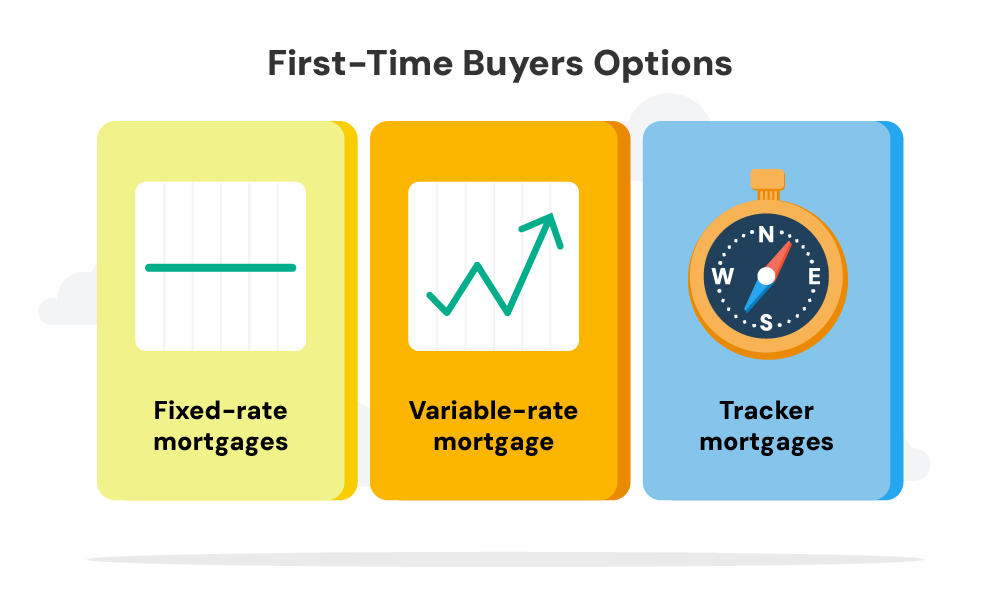

As a first-time buyer in Wales, you’ve got several mortgage choices: fixed-rate, variable-rate, and tracker mortgages.

Fixed-rate mortgages are popular because they offer stability with set monthly payments for a specific period, usually two to five years.

If you prefer flexibility, a variable-rate mortgage might be better for you.

Your monthly payments can change as interest rates rise or fall, often following the Bank of England base rate.

While these mortgages may start with lower rates, your payments could increase.

Tracker mortgages link your interest rate to the Bank of England base rate plus a fixed amount.

This option can be good if you expect low interest rates, but your payments will rise if rates increase.

How Can You Benefit from 95% Mortgages in Wales?

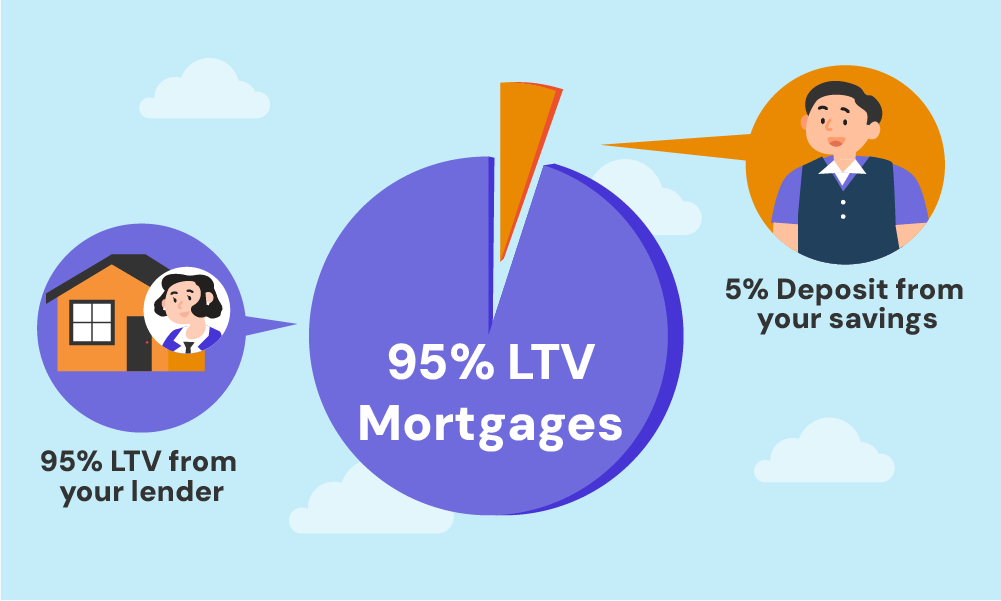

Saving for a deposit is one of the biggest challenges for first-time buyers. But in Wales, you can benefit from 95% mortgages, where you only need a 5% deposit.

These mortgages have become more accessible thanks to the government’s Mortgage Guarantee Scheme, available across Wales.

This scheme makes it easier for you to get a high loan-to-value (LTV) mortgage by offering lenders a government guarantee.

The scheme has been extended and will run until June 2025, giving you more time to take advantage of this opportunity.

To qualify for a 95% mortgage, you’ll need a good credit history and proof of stable income.

The property must be your primary residence and should not exceed the £600,000 price limit set by the scheme.

Government Schemes in Wales

Help to Buy Wales Scheme

The Help to Buy Wales scheme is here to help you as a first-time buyer or if you’re looking to move up the property ladder.

It’s similar to the schemes in England and Scotland but with some unique features for the Welsh market.

With this scheme, you can buy a newly built home with just a 5% deposit.

The Welsh Government will lend you up to 20% of the property’s value, so you only need to secure a mortgage for the remaining 75%.

Plus, the government loan is interest-free for the first five years, making it an appealing choice for many.

To qualify, the property price must not exceed £250,000, and the home must be your primary residence—not a second home or a buy-to-let.

The scheme has been extended until March 2025, giving you more time to take advantage of this support in Wales.

Shared Ownership in Wales

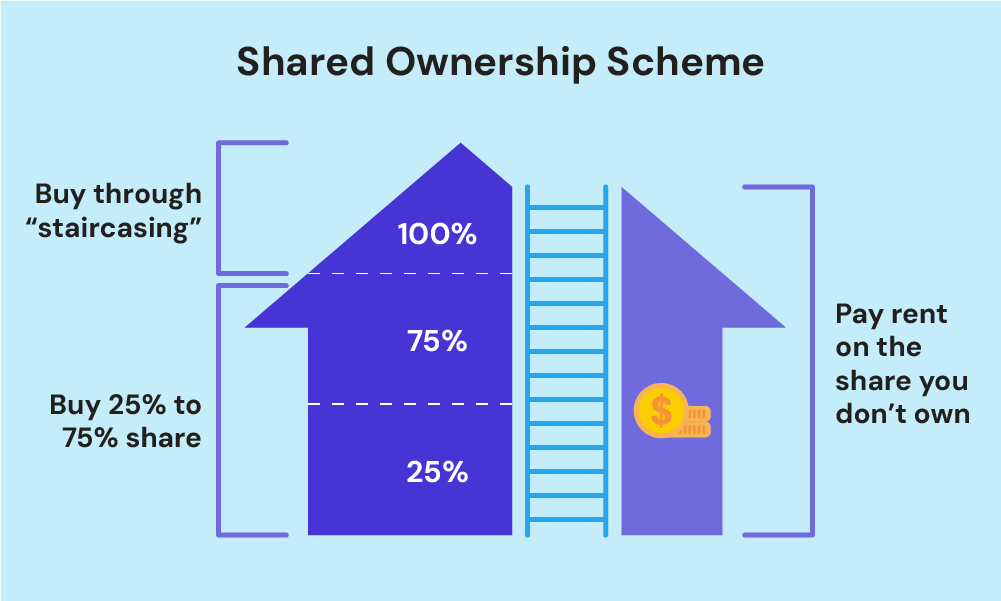

Shared Ownership is a great option in Wales if you’re struggling to afford a full mortgage.

With this scheme, you can buy a share of a property—usually between 25% and 75%—and pay rent on the part you don’t own.

Over time, you can gradually buy more shares, known as “staircasing,” until you own 100%.

This option is perfect if you’re a first-time buyer without a large deposit or the means to secure a full mortgage.

It offers a more affordable way to own a home, with the flexibility to increase your ownership as your finances improve.

Properties under this scheme are typically provided by housing associations.

To qualify, you’ll need to meet specific eligibility criteria, including income thresholds. Be sure to consider the long-term costs of both the mortgage and the rent payments.

Right to Buy Scheme in Wales

The Right to Buy scheme, which allowed tenants in social housing to buy their homes at a discount, ended in Wales in January 2019.

But don’t worry—other options like Help to Buy and Shared Ownership are still available, offering great alternatives if you’re looking to own a home.

These government schemes are designed to make homeownership more accessible and support the property market in Wales.

Whether you’re a first-time buyer or looking to move up the property ladder, using these schemes can give you the financial help you need to make your dream of owning a home in Wales a reality.

Can You Get a Mortgage in Wales with Bad Credit?

Bad credit doesn’t necessarily mean you’re out of luck when it comes to securing a mortgage in Wales. But it does make the process more challenging.

Lenders will look at your credit history, including any missed payments, defaults, or bankruptcies.

The good news is that there are specialist lenders in Wales who cater to individuals with poor credit.

These lenders may offer mortgages at higher interest rates or require a larger deposit to offset the perceived risk.

It’s a good idea to speak with a mortgage broker who knows how to handle bad credit cases. They can guide you to the right lenders and help improve your chances of approval.

What’s the Process for Getting a Mortgage in Wales?

Getting a mortgage in Wales is similar to the rest of the UK. Here’s a basic guide:

1. Assess Your Finances

First, check your finances.

Look at your credit score, work out your debt-to-income ratio, and decide how much you can save for a deposit.

This will show you what you can afford and the mortgage options open to you.

2. Get a Mortgage in Principle

A mortgage in principle shows you how much a lender might lend you. It’s not a guarantee, but it helps you budget and proves you’re a serious buyer.

Estate agents often ask for one, and it speeds up the house-hunting process.

3. Find a Property

Now you know what you can afford, start looking for homes.

Decide where you want to live – maybe Cardiff or a quieter area.

Think about size, what’s nearby, and the home’s future. Visit several places to compare them before choosing.

4. Apply for the Mortgage

Once you’ve found a place, apply for your mortgage. You’ll need paperwork like payslips, bank statements, and ID.

The lender will check your finances carefully to see if you can afford the mortgage.

This includes looking at your income, spending, and credit history. You might need to talk to the lender too.

5. Valuation and Survey

The lender will check the property’s value to make sure it’s worth what you’re borrowing.

You can also get a detailed survey to find any problems with the house. This is especially important for older or changed homes.

6. Offer and Completion

If everything checks out, the lender will make a formal mortgage offer. This explains the mortgage terms, like the interest rate and repayments.

Once you agree, you complete the purchase. Your solicitor or conveyancer will handle the legal side, including transferring the property to your name.

What Deposit Do You Need for a Mortgage in Wales?

The size of your mortgage deposit depends on a few things: the type of mortgage, the home’s value, and your credit history.

Typically, a minimum deposit of 5% is required, especially if you’re taking advantage of the Help to Buy scheme.

However, a larger deposit—say 10% to 20%—can give you access to better mortgage deals with lower interest rates.

For those with bad credit, a larger deposit is often necessary to secure a mortgage. Lenders may require up to 25% or more to mitigate the risk.

Additionally, if you’re purchasing a buy-to-let property, expect to put down at least 25% of the property’s value as a deposit.

What Are the Costs Associated with Mortgages in Wales?

When taking out a mortgage in Wales, it’s essential to factor in the various costs associated with the process. These can include:

- Valuation Fees. The lender will charge a fee to assess the property’s value. This is typically around £200 to £600, depending on the property’s value and the level of valuation required.

- Survey Fees. If you opt for a more detailed survey, such as a Homebuyers Report or full structural survey, expect to pay between £400 and £1,000.

- Solicitor Fees. Legal fees for handling the purchase, including conducting searches and registering the property, usually range from £500 to £1,500.

- Stamp Duty. In Wales, you’ll pay Land Transaction Tax (LTT) instead of Stamp Duty. The amount depends on the property’s value, with rates starting at 0% for properties up to £180,000.

- Broker Fees. If you use a mortgage broker, they may charge a fee for their services, typically around £300 to £500.

How Does Land Transaction Tax Work in Wales?

Land Transaction Tax (LTT) is Wales’ equivalent to Stamp Duty in England and applies to property purchases above certain thresholds.

The rates for LTT are tiered, meaning you’ll pay different rates on different portions of the property’s price, not on the entire property price.

Here’s how it works:

Standard Rates:

| Property Price (£) | LTT Rate |

|---|---|

| Up to £225,000 | 0% |

| £225,001 to £400,000 | 6% |

| £400,001 to £750,000 | 7.5% |

| £750,001 to £1.5 million | 10% |

| Over £1.5 million | 12% |

If you’re buying a second home or a buy-to-let property, an extra 4% is added to these rates. This can increase your tax bill significantly, so be sure to factor it into your budget.

Can You Remortgage in Wales?

Yes, you can remortgage in Wales, and it’s a great option if you’re looking to secure a better deal, release equity, or switch to a more suitable mortgage.

When you remortgage, you’re replacing your current mortgage with a new one, either with the same lender or a different one.

This can help you reduce your monthly payments, especially if your property’s value has gone up since you first took out your mortgage.

Be sure to consider the costs involved, like early repayment charges if you switch before your fixed term ends.

But, long-term savings often make remortgaging a smart financial move.

How Can You Improve Your Chances of Getting a Mortgage in Wales?

Securing a mortgage in Wales, like anywhere else, requires careful preparation. Here are some tips to improve your chances:

- Check Your Credit Report – Ensure your credit report is accurate and up to date. Address any errors and work on improving your credit score if necessary.

- Save for a Larger Deposit – The more you can put down, the better your chances of securing a favourable mortgage deal.

- Reduce Your Debt – Lenders will assess your debt-to-income ratio, so paying down existing debts can improve your affordability.

- Consider Government Schemes – Take advantage of schemes like Help to Buy Wales to boost your purchasing power.

- Use a Good Mortgage Broker – A good broker with experience in the Welsh market can guide you to the right lenders and products, increasing your chances of approval.

The Bottom Line: Where Should You Start?

If you’re ready to buy a home in Wales, the first step is to understand your finances.

Check your credit score, save for a deposit, and work out your budget. This will help you find the right mortgage and increase your chances of getting a good deal.

If you’ve had trouble getting a mortgage, or if the process feels overwhelming, a mortgage advisor can help.

They know the Welsh market well and can find deals that suit you, even if you’ve had problems before.

To save time and stress, reach out to us. We’ll connect you with a qualified broker who can find and get the right mortgage deal for you in Wales.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

Can I use my Help to Buy ISA in Wales?

Yes, you can use your Help to Buy ISA to buy a home in Wales. But there’s a catch: you can’t open a new one. You can only use one if you opened it before November 2019.

If you’ve got one, keep saving until November 2029. Then you can get a bonus from the government to help you buy a home up to £250,000.

Are there any specific eligibility criteria for Shared Ownership in Wales?

To be eligible for Shared Ownership in Wales, you generally need to be a first-time buyer or someone who doesn’t currently own a home.

Income thresholds apply, and you’ll need to meet criteria set by the housing association providing the property.

Typically, your household income should be below £60,000 per year.

What happens if I want to sell a property bought through the Help to Buy Wales scheme?

If you want to sell a home you bought with Help to Buy Wales, you’ll need to pay back the government’s money.

How much you pay back depends on how much your home is worth now (current market value), not what you paid for it (original purchase price). If your home’s value has gone up, you’ll pay more.

Can I apply for a mortgage in Wales if I’m self-employed?

Yes, you can get a mortgage in Wales even if you’re self-employed. But you’ll usually need to show at least two years of your business accounts or tax returns to prove you’ve got a steady income.

Lenders will also look at how well your business is doing and how much you’re likely to earn in the future.

What are the additional costs of buying a second home in Wales?

If you buy a second home in Wales, you’ll pay more tax. This is called Land Transaction Tax (LTT).

You’ll pay an extra 4% on top of the normal LTT. This can add up to a big extra cost. Make sure you have extra money saved for this extra tax.