- How Long Does It Take to Get a Mortgage?

- What Factors Affect Mortgage Approval Time?

- How Can You Get a Quick Mortgage Approval?

- Can You Apply for a Mortgage Online and Get an Instant Decision?

- What Are Fast Mortgages?

- How Long Does a Mortgage Application Take Through a Broker?

- How Quickly Can You Get a Mortgage Offer?

- Which Lenders Have the Fastest Approval Times?

- What Can Slow Down Your Mortgage Application?

- How to Prepare for a Quick Mortgage Approval

- The Bottom Line

Fast Mortgages: How Quickly Can You Get A Mortgage?

Securing a quick mortgage approval is crucial in the property market.

Maybe the seller is looking for a swift sale, you’ve had a last-minute mortgage decline, or multiple offers mean you need to submit your paperwork quickly.

You might need to move out of your current property at a specific date or be buying at auction with a tight deadline.

Whatever reasons you have, knowing how to get quick mortgage approval is key .

Here’s a deep dive to securing your dream home faster.

How Long Does It Take to Get a Mortgage?

Typically, the mortgage approval process in the UK takes around 4-6 weeks on average.

However, this can vary significantly depending on your circumstances and the lender you choose.

Some lenders can process applications in as little as 10 days, while others might take up to 8 weeks.

The good news? There are ways to speed things up.

What Factors Affect Mortgage Approval Time?

Several factors can influence how quickly you get your mortgage approved:

- Your financial situation – If you have a straightforward case – good credit score, stable income, and a sizable deposit – your application is likely to be processed faster.

- The lender’s workload – Some lenders process applications quicker than others, especially during busy periods.

- Property type – Standard properties are usually quicker to approve than unusual or complex ones.

- Your preparation – Having all necessary documents ready can significantly speed up the process.

- Use of a mortgage broker – An experienced broker can often fast-track your application.

How Can You Get a Quick Mortgage Approval?

Want to speed up your mortgage approval? Here are some tips:

- Prepare Your Documents in Advance – Gather all necessary documents, including proof of identity, proof of address, bank statements, payslips, and tax returns if you’re self-employed. Having these ready can significantly reduce delays.

- Get an Agreement in Principle (AIP) – An AIP gives you a good idea of how much you can borrow and shows sellers that you’re a serious buyer. Most lenders can provide an AIP within 24 hours.

- Choose the Right Lender – Some lenders are quicker than others. Research and choose a lender known for their fast turnaround times. Your mortgage broker can help identify these lenders.

- Use a Mortgage Broker – Brokers have access to a wide range of products and can often find you a better deal faster than if you were to go it alone. They also handle much of the paperwork, ensuring it’s completed correctly.

- Respond Promptly to Requests – If your lender or broker requests additional information, provide it as quickly as possible to avoid delays.

Can You Apply for a Mortgage Online and Get an Instant Decision?

In today’s digital age, applying for a mortgage online and receiving an instant decision is increasingly common.

Many lenders offer online applications with a decision in principle provided within minutes. This initial decision gives you an idea of how much you can borrow and is based on a soft credit check.

However, remember that an instant decision in principle is not a formal mortgage offer.

Once you proceed with a full application, the lender will conduct a more thorough review, including a hard credit check and a detailed examination of your financial circumstances.

What Are Fast Mortgages?

“Fast mortgages” or “quick mortgages” refer to mortgage products designed for rapid approval.

These are ideal if you need to complete a property purchase quickly, such as at an auction or to secure a sought-after property.

Fast mortgages often involve:

- Streamlined application processes

- Quicker property valuations (sometimes desktop valuations)

- Dedicated underwriting teams

- Higher fees in exchange for speed

While fast, these mortgages may not always offer the best rates. It’s crucial to weigh the benefits of speed against potential additional costs.

How Long Does a Mortgage Application Take Through a Broker?

Using a mortgage broker can often speed up your application process.

On average, applications through brokers can be completed in 2-4 weeks, compared to 4-6 weeks when applying directly to lenders.

Good brokers can accelerate the process by:

- Matching you with suitable lenders

- Ensuring your application is complete and accurate

- Having established relationships with lenders

- Chasing up your application

Moreover, good brokers have access to a wider range of products, including some exclusive deals not available directly to consumers.

How Quickly Can You Get a Mortgage Offer?

The fastest mortgage offers can come through in about 10 days, but this is exceptional.

More realistically, you’re looking at 2-3 weeks for a quick mortgage offer. Here’s a rough timeline:

- Agreement in Principle: 24 hours or less

- Property Hunting: 1-3 months (This can vary greatly based on individual circumstances)

- Full application application: 1 to 7 days

- Property valuation: 1 – 3 days

- Underwriting: 2-5 days

- Final mortgage offer: Same day to 2 days after underwriting

Remember, these are best-case scenarios. Complex cases or busy periods can extend these timelines.

Which Lenders Have the Fastest Approval Times?

When time is of the essence, knowing which lenders offer the quickest approvals can be invaluable.

Based on our research and publicly available data, the following lenders are known for their speedy mortgage approvals:

- BM Solutions – Leads with an impressive average approval time of just 3 days.

- Barclays – Known for efficient processing, usually taking around 5 days.

- Coventry Building Society – Also averages around 5 days for approvals.

- Digital Mortgages by Atom Bank – Offers approvals typically within 6 days.

- Halifax – Often cited for quick decisions, generally within 7 days.

- Nationwide and Santander – Both typically take around 7 days.

However, it’s not just about speed. It’s crucial to ensure that the lender you choose offers competitive rates and terms that suit your needs.

Always compare multiple lenders to find the best overall deal for your circumstances.

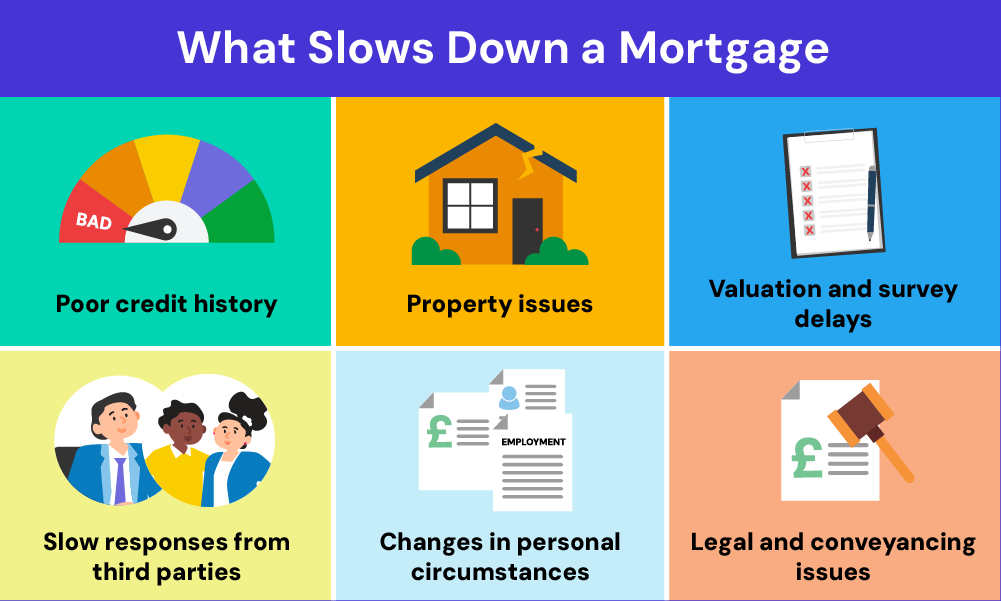

What Can Slow Down Your Mortgage Application?

While we’ve focused on speeding up approvals, it’s also important to understand what can cause delays.

Here are some common issues that could slow down your mortgage approval:

Missing or Wrong Documents

A common delay in mortgage approval is missing or incorrect documents.

Lenders need certain papers to check your finances, and any errors or omissions can slow things down.

Make sure you have everything ready and check for accuracy before sending them in. These usually include:

- Proof of identity (passport or driving licence)

- Proof of address (utility bills or bank statements)

- Recent bank statements

- Recent payslips or tax returns if self-employed

- Proof of deposit (savings or gift documentation)

Complex Financial Situations

If your finances are complicated, like having multiple income sources, being self-employed, or irregular earnings, lenders might need more time to review your application.

Provide clear and thorough documentation to explain your situation.

This could include detailed tax returns, business accounts, or letters from your accountant.

Poor Credit History

A bad credit history can slow things down.

Lenders are wary of approving mortgages for those with missed payments, defaults, or other issues.

If you have poor credit, expect longer reviews or the need to find a more accommodating lender.

Improve your chances by boosting your credit score before applying: pay off debts, fix errors on your credit report, and avoid new credit applications.

Property Issues

The type of property you want to buy can slow down your mortgage application.

Homes made of unusual materials, listed buildings, or those with structural issues need extra checks. This means more surveys and reports, which can cause delays.

To avoid this, get a survey done early and be ready to provide any extra information the lender needs.

Valuation and Survey Delays

Property valuation is key to the mortgage process. Delays happen if the survey isn’t scheduled promptly or the report takes too long.

To speed things up, make sure the property is accessible and schedule the valuation as soon as you apply.

Slow Responses from Third Parties

The mortgage process involves many players, like lenders, brokers, surveyors, and solicitors.

Slow responses from any of them can cause delays.

To avoid this, choose experienced professionals known for their efficiency and stay in regular contact to follow up on any pending tasks.

Changes in Personal Circumstances

Changes in your life, like a new job, marital status, or taking on new debt, can delay your mortgage application.

Lenders may need to reassess everything, which takes time. Keep things stable during the application process to avoid these delays.

Legal and Conveyancing Issues

Transferring property ownership, or conveyancing, can cause delays.

Issues like unclear titles, boundary disputes, or problems found during searches can slow things down.

Choose a proactive solicitor and ensure all searches and checks are done promptly. Being aware of these pitfalls can help keep your application on track.

How to Prepare for a Quick Mortgage Approval

To set yourself up for the fastest possible mortgage approval:

- Save a substantial deposit (aim for 15% or more) and get proof, especially if it’s a gift or asset sale.

- Download your credit reports from Equifax, Experian, and TransUnion, and check for accuracy.

- Register on the electoral roll at your current address.

- Ensure all application information matches your identification and is up-to-date.

- Avoid major life changes (like switching jobs) just before applying.

- Get your documents in order early (payslips, bank statements, ID).

- Close inactive bank accounts to avoid questions.

- Avoid payday loans and gambling as they can delay approval.

- Get an agreement in principle before property hunting.

- Consider using a mortgage broker for expert guidance.

Remember, while speed matters, it shouldn’t come at the expense of getting the right mortgage for your needs.

Always consider the long-term implications of your mortgage choice.

The Bottom Line

While average mortgage approval takes 4-6 weeks, with the right preparation, you can secure it in as little as 10 days.

Understand the process, prepare thoroughly, and consider using a broker.

A good broker can:

- Find the best mortgage deals for you

- Speed up approval with their lender connections

- Organise paperwork to prevent delays

- Advise on improving your credit score

- Access special deals and lenders

- Negotiate better terms and rates

- Guide you through each step

- Spot and fix potential issues

- Save you time by doing the hard work

- Offer personalised advice based on your finances

Whether you want an instant decision or a fast-tracked application, options are available to help you move into your new home sooner.

Need a good broker? Get in touch. We’ll connect you with a qualified mortgage broker who can help speed up your mortgage approval.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

How long does mortgage underwriting take in the UK?

In the UK, mortgage underwriting usually takes 1 to 2 weeks.

The exact time depends on the lender, the application’s complexity, and the completeness of your documents.

During underwriting, the lender checks your finances, credit history, and the property value to decide on your mortgage.

If your application is simple and all documents are in order, it can be quicker. More complex cases, like self-employment or poor credit, may take longer.

How to pay off my mortgage fast?

To pay off your mortgage faster:

- Make extra payments towards the principal whenever possible. Even small amounts reduce your interest and shorten the loan term.

- Switching to biweekly payments adds up to one extra payment a year, which also helps.

- If you can, refinance to a shorter term, like 15 years instead of 30, to save on interest and pay off sooner.

- Use bonuses, tax refunds, or windfalls for lump-sum payments.

- Cut back on unnecessary expenses and direct those savings towards your mortgage.

Always check with your lender for any prepayment penalties before making extra payments.