What Do Mortgage Brokers Really Do?

Getting a new home or changing your current mortgage are big money moves that can affect your life for years to come.

Right in the middle of all this are mortgage brokers and advisors. They’re the pros who help you understand the complex bits of mortgages.

Knowing what they do not only saves you time but also could get you a better deal for your money. But what do they actually do? Do you really need one? And how are they paid?

This article is here to clear up all the questions you might have about these important figures in the mortgage game.

What are Mortgage Brokers?

Mortgage brokers are licensed professionals who act as a bridge between you and lenders. They look at your financial situation and then find lenders who can offer you the right mortgage deals.

In simple terms, they do the hard searching for you, so you don’t have to.

These brokers have gained more importance these days. Why? Because mortgages are getting trickier to understand.

With new laws and many loan types, it’s easy to get lost. But a mortgage broker helps clear up the confusion. They explain your options in a way you can understand, making sure you’re well-equipped to make a smart choice.

Whether you’re a first-time buyer or thinking of changing your current mortgage, a broker can make the process simpler.

They give you personalised advice and find deals that fit just you. That way, you can make well-informed decisions, whether you’re buying a new home or sorting out your existing mortgage.

So, in short, mortgage brokers save you time, clear up the confusion, and help you make the best choice for your financial future.

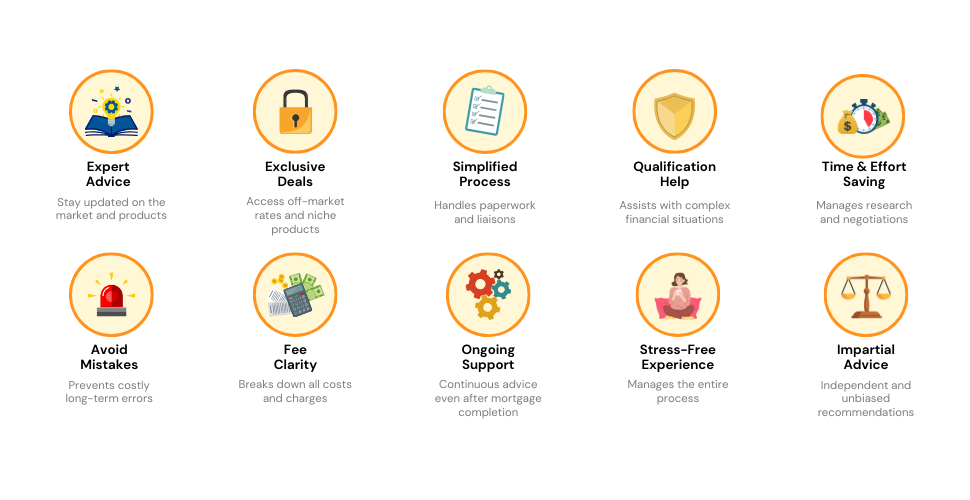

How Can a Mortgage Broker Help You?

A mortgage broker is like your personal finance coach when it comes to home buying. Here are the many ways they can guide you:

1. Full Financial Check-Up

They’ll go through your entire financial picture: income, debts, and even your spending habits. This helps in creating a budget for your future home.

2. Picking the Right Mortgage Type

There are many types of mortgages, like fixed-rate, variable-rate, and more. The broker will explain these to you and help you pick the one that fits.

3. Deal Hunting

They will scour the market to find mortgage deals that match your budget and needs, so you don’t have to.

4. Application Assistance

From filling out forms to gathering needed documents, they’ll help make the application process a breeze.

5. Explaining Legal Jargon

Mortgage agreements can be filled with complicated terms. They’ll simplify this for you, making sure you know exactly what you’re signing up for.

6. Post-Completion Support

Some brokers offer support even after you’ve gotten your mortgage, like advice on when to refinance.

The Ups and Downs of Working with a Mortgage Broker

As discussed, mortgage brokers can be your ace in the hole when dealing with mortgages. But like anything in life, there are both pros and cons to consider.

Let’s weigh them up, shall we?

The Plus Side

- Hassle-Free. If the idea of diving into mortgage jargon and stacks of paperwork makes you cringe, a broker is a godsend. They handle all the nitty-gritty details, freeing you to focus on finding your dream home.

- Variety. Being restricted to a few mortgage options can feel like eating at a buffet with only three dishes. A mortgage broker expands your menu by offering a broad range of options from various lenders. More choices often mean better deals.

- Expert Guidance. Mortgages aren’t a one-size-fits-all thing. Each has its quirks, rules, and fine print. A broker’s expertise saves you from pitfalls that you didn’t even know existed, ensuring you make a sound financial decision.

Points to Consider

- Fees. While brokers can offer valuable services, they aren’t always charity workers. Some will charge you a fee, and this could be a flat rate or a percentage of the loan. Make sure to ask about this upfront so there are no nasty surprises later.

- Limited Scope. Some brokers may only have access to a limited list of lenders, thereby limiting your options. Always ask about their range before committing.

- Varying Quality. Not all brokers are experts; the quality of service can vary. So, it’s worth doing some digging. Check reviews, ask for referrals, or even interview a few before picking one

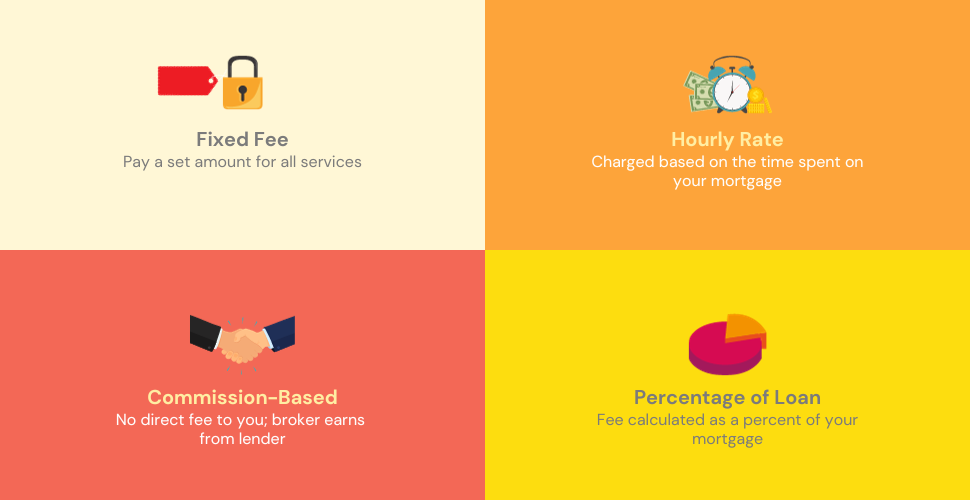

How Much Does a Mortgage Broker Cost?

Generally, mortgage brokers in the UK charge a fee ranging from £300 to £600, with many charging around £500. However, the fee can go up to £800 depending on the mortgage size and the broker you pick.

Here’s a look at how brokers might charge you:

- Fixed Fee – Some brokers charge a fixed fee to find and arrange a mortgage for you. It’s wise to agree on this fee in writing before starting.

- Hourly Rate – Although not common, some brokers charge by the hour. In this case, get a written estimate of the time it will take to arrange your mortgage, so you know the likely fee.

- On Commission – The term ‘fee-free‘ might appear enticing, but usually implies the broker is compensated through commissions from specific lenders. It’s important to ask if they work with specific lenders before you hire them.

- As a Percentage – Some brokers set their fee as a percentage of your mortgage amount, for example, a 1% fee on a £250,000 mortgage would be £2,500.

Payment timing can vary too. Some brokers ask for an upfront fee, while others only charge you when the mortgage deal is done.

Besides the broker’s fee, be ready for other costs like arrangement, booking, valuation, and mortgage account fees. These extra costs can add up.

If a broker charges a fee but can’t secure a loan for you, some will give back the upfront charges, which is a nice safety net.

Will a Mortgage Broker Check Your Credit?

The short answer is yes, most likely.

A mortgage broker will run a credit check to see if you can afford the mortgage you’re interested in, but only after getting your permission. They’ll also explain how it all works, so you’re not in the dark.

If you want, you can also check your own credit beforehand. Doing so can help you spot any issues early on and give you a chance to sort them out before getting into the mortgage process.

What Does a Broker’s Credit Check Include?

These checks usually cover:

- Your income level and where it comes from

- Any debts you might have

- Your age

- How many people depend on you financially

Remember, different lenders might use different credit agencies to check your financial history. Each agency could give you a different score, but they all aim to measure your creditworthiness.

Having a poor credit history can affect the lenders available to you, making it harder to get a mortgage. Checking your credit early on helps you make any necessary adjustments.

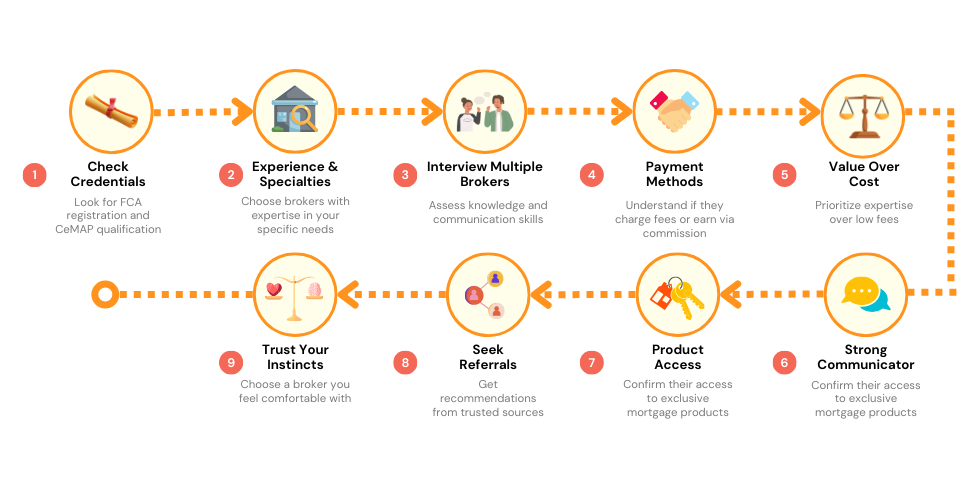

How To Find the Right Mortgage Broker

When it comes to finding a mortgage that suits you, your choice of broker can make all the difference.

To begin your search, tap into your network and ask friends who’ve recently bought homes; their experience can provide invaluable insights.

Keep in mind that brokers have different strengths—some specialise in helping those with a poor credit history, while others are skilled in assisting first-time buyers or the self-employed.

You’re not limited to the first broker you chat with, or the one your estate agent might recommend. Here’s what you should consider to make an informed choice:

Lender Access

Ask if the broker can look at options from a broad range of UK lenders or if their options are limited.

Your broker should be able to cater to your needs, whether you’re looking for a niche lender or more mainstream choices.

Fee Structure

Know the costs upfront. Ask about any fees and when they’re due to avoid any surprises later.

Credentials Check

Ensure the broker is qualified and registered with the Financial Services Register. The CeMAP qualification is a common one to look for in the UK.

If you’re unhappy with the service later on, know that you can lodge a complaint with the Financial Ombudsman Service, but only after you’ve formally complained to the broker first.

So, spend some time doing your homework and asking pointed questions. This will help you find a mortgage broker who’s not just qualified but also the right fit for your unique needs.

The Bottom Line

Buying a home or sorting out your existing mortgage is a big deal, and it can feel overwhelming. That’s where mortgage brokers come in.

They act like your personal guide, helping you make sense of all the numbers, forms, and options. They even find the best mortgage deals that fit just you, saving you time and effort.

But remember, all brokers aren’t the same. It’s crucial to ask about fees, check their credentials, and see how many lenders they work with.

You want to make sure you’re choosing someone who’s not just qualified but also a good match for what you need.

So, when you’re about to make a huge financial decision like buying a home, don’t go it alone. Get the right advice from a reliable mortgage broker.

Looking for the perfect mortgage broker? Get in touch with us now. We’ll arrange a free chat with a broker who matches your unique needs, no strings attached.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

What information does a mortgage broker need?

When you meet a mortgage broker, they’ll ask you a range of questions to get a full picture of your financial health. Expect questions like:

- Have you had a mortgage before?

- What’s your budget?

- How long have you been in your current job?

- How much deposit do you have, and where did it come from?

- What type of property are you looking to buy and where?

- Do you have any debts or monthly expenses?

- Is your credit score good, bad, or somewhere in the middle?

- Do you have any dependents?

- Are you a first-time buyer?

- Will you live in the property or rent it out?

- Have you ever declared bankruptcy?

The time you’ll spend with the broker can vary. If your financial situation is complicated, it may take a bit longer. Don’t worry; brokers know you’re busy and will be flexible with timing.

What documents should I bring?

To make sure the meeting goes smoothly, you’ll need to bring along some important documents. These not only confirm who you are but also give the broker a better understanding of your finances.

Here’s what you might need:

Identification

- A current passport

- Driving licence

- Other valid photo IDs, like a shotgun licence or an identity card from an EU or EEA country

- Proof of legal status if you’re not a citizen (like a visa or green card)

Proof of Address

- A current passport

- Driving licence with your current address

- Recent utility bills or bank statements

- Your rental agreement or mortgage statement

Income Proof

- Recent payslips

- A P60 form

- Tax returns if you’re self-employed

- Employment contract or job offer letter if you’ve recently switched jobs

- Any proof of extra income like bonuses or alimony

Bank Statements

- Usually, you’ll show the last three months of bank statements, but some brokers might want to see up to six months for a fuller picture.

Investment Accounts

- If you have any, bring along your investment account statements.

Remember, these are just guidelines. The exact documents you’ll need can vary based on your individual circumstances.