Pensioner Mortgages Guide: Clearing Your Doubts

Mortgages might sound like a young person’s game, but they’re not.

Plenty of pensioners secure mortgages every year, whether it’s for a new home, financial flexibility, or a smart investment.

This guide breaks it all down for you—no jargon, no confusion, just straightforward help to get you started.

Can Pensioners Get a Mortgage?

Yes, you can. Despite what you might have heard, getting a mortgage as a pensioner isn’t impossible.

There are plenty of reasons you might need one in retirement, such as:

- Moving to a more suitable home

- Investing in a buy-to-let property for additional income.

- Releasing equity from your property to supplement your other retirement income.

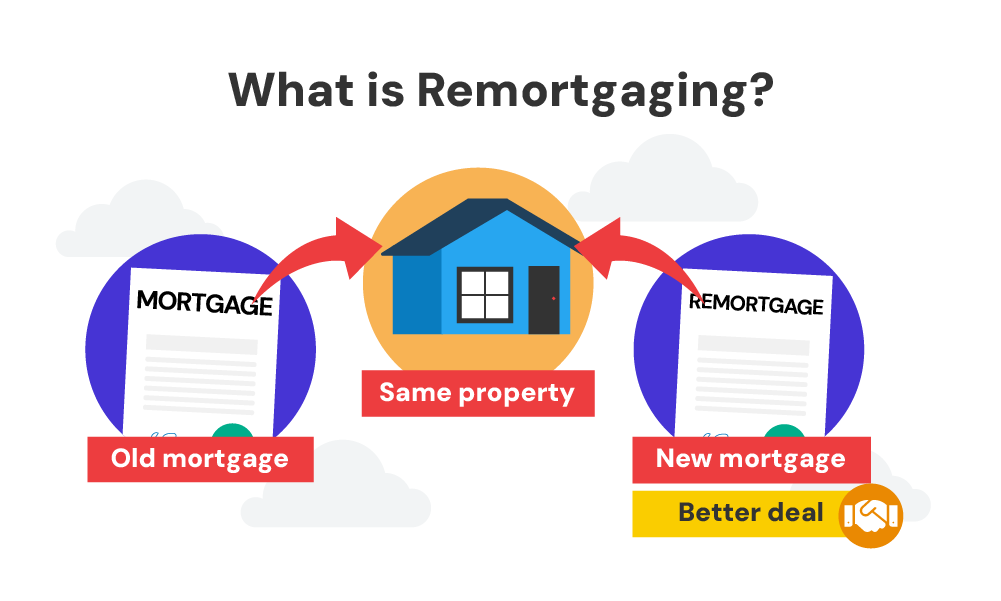

- Remortgaging to clear off an outstanding interest-only mortgage.

- Supporting family members financially, such as helping children or grandchildren with their housing needs.

While the pool of lenders is smaller for retirees, there are still plenty of options.

Specialist lenders cater specifically to older borrowers, offering tailored and flexible products to meet your unique circumstances.

Some lenders even focus on pensioners, so you’re not alone in this journey.

Eligibility Criteria: What Lenders Look For

When assessing your mortgage application, lenders consider various factors. These include:

- Age – While age is not a barrier to getting a mortgage, it can affect the terms of the mortgage, including the length of the repayment period.

- Employment status – Being retired does not disqualify you from getting a mortgage, but lenders will want to see proof of a stable income.

- Income type and frequency – Lenders will consider the type and regularity of your income, including pensions, investments, and any other sources.

- Term length – The length of the mortgage term can affect your monthly payments and the total amount you repay.

- Deposit size – A larger deposit can increase your chances of securing a mortgage and may help you access better interest rates.

- Property type – The type of property you’re buying can affect your eligibility for certain types of mortgages.

- Number of applicants – If you’re applying for a mortgage with another person, this can affect your borrowing amount.

How Much Can Pensioners Borrow?

As a retiree, the amount you can borrow varies greatly between lenders. Your age and circumstances as a pensioner can shake things up a bit.

In the UK, lenders often use income multiples when determining the loan amount. But there’s no one-size-fits-all system.

Even though you might have fixed retirement and steady income, you may not get offered top-tier income multiples. Most lenders stick to 4 to 4.5 times your annual income.

For instance, if your annual pension income is £30,000, your potential borrowing amount would be £120,000 (£30,000 x 4) to £135,000 (£30,000 x 4.5).

Besides your pension income, lenders assess other aspects such as additional income sources and expenses. Here are a few areas lenders might focus on:

- Current health condition

- Monthly spending habits.

- Existing debt and financial obligations.

- Pension income, benefits, and savings.

- Asset value – Owning properties or other assets could reduce the lender’s risk. This can get you greater flexibility on the loan-to-value (LTV) ratio.

- Age – This could affect your borrowing limit or shorten the loan term.

Borrowing in your golden years involves a more nuanced process than just your pension income.

Some may apply stricter checks, and offer lower loan amounts. It’s about finding the right lender who recognises your overall financial health.

Is Age Just a Number in Mortgage Applications?

Your age can greatly influence your mortgage possibilities.

Indeed, some lenders put a cap on age, often making it tricky for pensioners over 65 to secure a mortgage.

However, the mortgage market has changed over time, and getting a mortgage isn’t impossible. No matter how many candles are on your birthday cake.

There are options for more mature borrowers, with some lenders even specialising in mortgages for the retired.

If you’re over 70 or 75, securing a solid deal might seem like a challenge. But, there are fitting solutions hidden in plain sight if you’re willing to dig a bit.

The key is to show a reliable income, offer accurate financial details, get the right advice, and look into mortgage paths that are tailored to older borrowers.

Pensioners must explore all the available options to them.

Exploring Alternatives: Other Financial Options for Pensioners

There are several alternative finance options and unique mortgage products available for pensioners. These include:

Equity Release Options – These allow you to unlock the value tied up in your home without having to move.

There are two main types:

- Lifetime Mortgage – This is a common option. Much like a traditional mortgage, it’s a loan secured against your home, but you only need to pay it back when you either pass away or move into long-term care.

- Home Reversion – This involves selling part or all of your home to a home reversion company in return for a lump sum or regular payments.

Government Schemes

- Older People’s Shared Ownership (OPSO) – This works similarly to a standard shared ownership scheme. You get to buy a portion of your home – anywhere between 10% and 75% – and you pay rent on the rest. Once you’ve bought 75% of your home, you don’t have to pay rent on the rest. It’s available to people aged 55 and over.

- Home Ownership for People with Long-Term Disabilities (HOLD) – If you have a long-term disability, this scheme can help you buy any home for sale on a Shared Ownership basis.

Retirement Interest-Only Mortgages

These are suitable for pensioners who can afford to make monthly interest payments but don’t want a mortgage that requires a lump sum payment at the end.

The loan is usually repaid when you sell your home, move into long-term care or pass away.

This is a good option if you want to switch to a better mortgage deal or release equity from your home. But, it’s important to consider the costs involved, including early repayment charges and exit fees.

Joint Mortgages with Family and Friends

This can be a viable option if you’re struggling to get a mortgage on your own. By pooling your resources with others, you may be able to afford a larger mortgage.

Downsizing

If your current home is larger than you need, you might consider selling it and buying a smaller, less expensive property. The money left over could then be used to supplement your retirement income.

Securing a Mortgage in Retirement: A Step-by-Step

Getting a mortgage in retirement might seem tricky, but it’s possible. Let’s break it down into manageable steps.

Step 1: Get Finances in Order

Understand how much you can comfortably afford each month. Calculate your income, including pensions, investments, and any additional sources of income.

Consider your monthly expenses and debts to understand your affordability level. This includes all your current expenses and a buffer for unexpected costs.

Get a copy of your credit file to address any issues that can affect your application.

Step 2: Prepare Your Documents

- Gather necessary documents such as:

- Proof of identification (passport, driving license)

- Proof of address (utility bills,

- Proof of pension income (pension statements, a recent P60, pension payslips, State pension statements, benefits letters)

- Bank statements, and Tax returns.

- Additional documents such as proof of assets, debts, and any outstanding loans.

Step 3: Seek Professional Guidance

Consult with a mortgage broker who specialises in assisting pensioners. There are a lot of options for retirees seeking a mortgage, but finding them alone can be tricky.

With them, you can get tailored advice and deals that suit your needs.

Step 4: Apply for Pre-approval

You can work with a good mortgage broker or alone to apply for pre-approval from potential lenders.

Pre-approval indicates the mortgage amount you may qualify for, helping you narrow down your property search. Note that this is not a guarantee that you’ll get a mortgage.

Step 5: Find the Right Mortgage

You could tackle this step solo, or lean on your mortgage broker for their know-how in picking out fitting mortgage choices.

Keep an eye on things like interest rates, repayment conditions, and flexibility, ensuring they all gel with your retirement goals.

Pro Tip

Don’t rush. Take your time to choose a mortgage by comparing rates and understanding different options.

Seek professional advice and ask questions to ensure clarity on your decision. The right choice can save you time and money in the long run, so thorough research is essential.

Step 6: Submit Your Application

If you’ve found the right mortgage, submit your application to the chosen lender. Be patient, as it might take time for approval.

Step 7: Mortgage Offer and Completion

Once the lender approves your application, they will issue a mortgage offer outlining the terms and conditions.

Review the offer carefully and seek legal advice if necessary.

Upon acceptance, the mortgage completion process begins, including legal and financial arrangements.

Key Takeaways

- Pensioners can get a mortgage. Although your options may be more limited, there are specialist lenders who offer flexible mortgage products to pensioners.

- Lenders typically use an income multiple of 4 to 4.5 times your salary to determine how much you can borrow. Other factors such as your age, other income sources, spending habits, and health can affect your mortgage amount.

- Age can impact your mortgage options, but it’s possible to get a mortgage at any age.

- There are several alternative finance options and unique mortgage products available for pensioners.

The Bottom Line

Securing a mortgage as a pensioner can be a complex process, and expert guidance is invaluable. A good broker can make your mortgage journey smoother and less stressful.

Not only can they help find a deal that’s right for your financial situation, but they can also provide valuable insights and advice.

The benefit? You get peace of mind, and potentially, a better deal.

Our free broker-pairing service is ready to link you up with a specialist who gets your needs and can guide you through the mortgage minefield.

So, don’t hesitate to drop us a line. Simply answer a handful of questions, and we’ll pair you with a top-notch broker experienced in retirement mortgages.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

Can pensioners get a mortgage for buy-to-let properties?

Yes. Buy-to-let mortgages are typically interest-only, and age isn’t as big of a deal. The potential for rental income is usually more relevant to the investment than your pension income or personal finances. But bear in mind, some lenders have age caps, so it’s crucial to find the right one to match your property investment ambitions.

Is there a maximum age for having a mortgage?

These days, you can get a mortgage deal at any age. Yes, some lenders might impose an age cap, but it’s not a universal rule.

Your financial situation and personal circumstances hold the key to the perfect solution. With solid advice, arranging mortgages for mature folks and pensioners of all ages has become less of a hurdle than it used to be.

Are short-term mortgages the only option for pensioners?

While it could be a possibility, it’s not the sole route to consider. Some lenders might present this choice to make the mortgage feasible, but it’s not the only choice available. Opting for a shorter term means higher monthly payments, which might not suit your needs.

Determining the right term length is yet another reason to partner with a mortgage lender who can truly cater to your unique circumstances as a retiree or older borrower.

This article has been fact checked

This article was created, checked, and verified by the expert team at Money Saving Guru. Trust us, you’re in good hands.