How to Get the Best Mortgages for Older Borrowers in 2025?

Older borrowers in the UK are getting more mortgages than ever.

In the third quarter of 2024, 33,840 new loans went to people over 55—a 2% rise from 2023. These loans were worth £5.2 billion, nearly 10% more than the year before.

For the first time, over half of new mortgages will go beyond the homeowner’s 65th birthday. This is thanks to a stamp duty cut that boosted home buying and more flexible lifetime mortgage options.

With so many choices, it can feel confusing. That’s why this guide breaks it all down for you. We’ll cover Lifetime Mortgages, RIO Mortgages, what affects rates, and why expert advice is helpful.

With the right support, finding a mortgage later in life is simpler than you think.

Mortgage Options for Older Borrowers

As an older borrower, you may find a wealth of mortgage choices at your fingertips.

While this can feel daunting, it is also an opportunity to select the option that aligns perfectly with your lifestyle, financial health, and future plans.

The two most common mortgage types for pensioners: Lifetime Mortgages (also known as Equity Release Mortgages) and Retirement Interest Only (RIO) Mortgages.

Let’s delve into the details of each.

Lifetime Mortgages (Equity Release)

Lifetime mortgages are a popular choice among older homeowners. With this type of mortgage, you borrow a portion of your home’s value at a fixed or capped interest rate.

The loan and the accrued interest are repaid when you move into long-term care or pass away.

Benefits:

- You retain the ownership of your home.

- There are no mandatory monthly repayments, although the option to make repayments to manage the interest is available.

- The ‘no negative equity guarantee’ ensures you never owe more than the value of your home.

Drawbacks:

- The interest can compound quickly, significantly increasing the amount you owe.

- It may reduce the amount you can pass on as an inheritance.

- The early repayment charges can be hefty if you decide to repay the mortgage early.

Retirement Interest Only (RIO) Mortgages

RIO mortgages provide another feasible route for older borrowers. These function similarly to standard interest-only mortgages but without a set end date.

You only pay back the interest monthly, with the loan amount repaid when the house is sold.

Benefits:

- The monthly repayments can be lower as you are only paying the interest.

- It can be a viable option if you have a steady retirement income to cover the interest payments.

Drawbacks:

- The loan amount does not decrease over time.

- Your property is sold to repay the loan after you move into care or pass away, which may affect any inheritance plans.

Both Lifetime Mortgages and RIO Mortgages offer pathways for older borrowers to leverage their property’s value in retirement.

The decision, however, depends on personal circumstances, financial health, and comfort with the associated terms and conditions.

How to Compare Retirement Mortgage Rates

Finding the right retirement mortgage isn’t just about picking the lowest rate — it’s about understanding the full picture.

From flexible repayment options to how much you can borrow, lenders differ in what they offer and what they look for.

Rates can vary significantly depending on the lender, the product type, your age, property value, and how much you want to borrow.

Some plans come with optional payments, others offer drawdown features, and most have fixed interest rates for life.

But here’s the catch: these rates change often, and what you see advertised may not reflect what you’ll actually qualify for.

Rather than trying to compare offers yourself, it’s best to speak to a specialist retirement mortgage broker.

They have access to the latest deals and exclusive rates, and can match you with lenders most likely to approve your application based on your circumstances.

Think of them as your guide through a complex process — making it easier, clearer, and tailored to you.

How Mortgage Lenders Determine The Rates

Mortgage rates for older borrowers aren’t plucked out of thin air. Several key factors come into play:

- Amount of Equity – Simply put, the more equity you hold in your home, the more favourably lenders view your application. More equity equals less risk for the lender, often leading to a more attractive rate for you.

- Loan to Value (LTV) –This is the percentage of the property’s value that you wish to borrow. A lower LTV generally equates to a lower rate as it signifies a lower risk to the lender.

- Age – Lenders have varying policies on lending to older borrowers, with your age at the time of application and expected age at the end of the term both considered.

- Property Type – Certain properties are deemed riskier than others. For instance, a traditional brick-built house might be seen as less risky than a high-rise flat or a listed building.

- Affordability – For Retirement Interest Only (RIO) Mortgages, lenders will want to ensure that you can comfortably afford the monthly interest payments with your retirement income.

Each lender weighs these factors differently, which is why rates can differ so much. Knowing what factors are considered can help you understand your potential mortgage rate and negotiate a better deal.

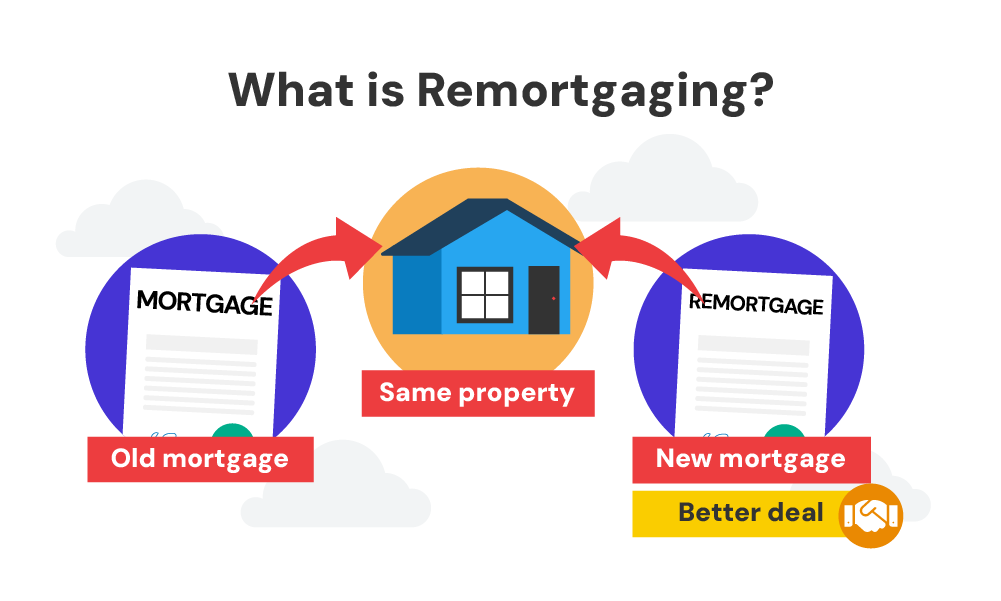

Understanding Remortgaging in Retirement

Even as you relish your golden years, there’s still a world of opportunity when it comes to mortgages. One avenue open to you is remortgaging.

If your current deal isn’t quite hitting the mark or you fancy unlocking some of your home’s value, remortgaging can be the solution.

Yes, the landscape changes a bit as you age. Some lenders impose upper age limits, which could limit your options. But don’t let that dampen your spirits.

Many providers are ready to extend competitive rates to older borrowers who can prove their affordability and meet specific criteria.

Some names like Barclays, HSBC, and Cambridge Building Society stand out for not setting an upper age limit on some mortgage products, although they may have unique ways of assessing retirement income.

Therefore, securing a good remortgaging deal in retirement needs a dash more determination and the right guidance.

Considerations for Retirement Buy-To-Let Mortgages

The world of property investing might have caught your eye. After all, a steady rental income can make a lovely addition to a comfortable retirement.

Navigating the buy-to-let mortgage scene as a retiree, however, has its peculiarities.

For starters, lenders focus sharply on your rental income and Loan-to-Value (LTV) ratios when considering a buy-to-let mortgage.

They need to be assured that the rent will comfortably cover the mortgage payments with a bit to spare for any surprises that property ownership can spring.

Age, too, makes its appearance in this scene. Certain lenders might have age caps, potentially limiting the deals you qualify for.

But don’t let this discourage you. With the right information and a thorough evaluation of your situation, getting a buy-to-let mortgage in retirement can be more than a pipe dream.

Why Seek Professional Mortgage Advice?

Finding the best mortgage deal in retirement isn’t always a walk in the park. Yes, there’s a lot of information out there, but how do you separate the wheat from the chaff?

Enter: professional mortgage advice.

A seasoned mortgage broker doesn’t just bring a wealth of knowledge; they bring a wealth of tailored knowledge. They can zero in on deals that best match your individual circumstances and needs.

They understand the ins and outs of lender criteria, can unlock deals not available to the general public, and can guide you step-by-step through the application process.

And the best part? They do the hard work for you. So, while they’re busy matching you with your ideal mortgage deal, you can enjoy your retirement, stress-free.

The Bottom Line

Retirement is a time for relaxation, exploration, and well-earned enjoyment. So why let mortgage concerns cast a shadow over these golden years?

Whether you’re considering a lifetime mortgage, a retirement interest-only mortgage, or a buy-to-let mortgage, there’s a suitable option out there for you.

True, factors like loan-to-value ratios, your age, and your property type play a part in the type of deal you can secure. But with a thorough understanding of these factors and a good mortgage broker at your side, you’re well on your way to finding the perfect fit.

The path to securing the right mortgage in retirement isn’t always straightforward, but with careful consideration and the right advice, it can be rewarding.

We’re here to help make that journey easier. Reach out today and get matched to an experienced mortgage advisor.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

Is age a problem in getting a mortgage?

Age can factor into the mortgage process as different lenders have various age-related criteria. However, age in itself isn’t a barrier to securing a mortgage. Several options cater specifically to older borrowers, and many lenders are more focused on your ability to meet repayments than your age.

What is the oldest age for a mortgage in the UK?

There’s no hard and fast rule, as the maximum age can vary between lenders. Some lenders impose age limits, while others don’t. So while it might be a bit more challenging, it’s not impossible to get a mortgage even at a more advanced age. Your best bet is to engage a good mortgage broker who specialises in mortgages for older borrowers.

Is 50 too old for a 30-year mortgage?

Not at all. As long as you can demonstrate your ability to meet the repayments, being 50 isn’t a barrier to securing a 30-year mortgage. Keep in mind that some lenders may have age limits, but there are still many options available to you.

Mortgages in later life can seem daunting, but they don’t need to be. It’s about finding the right help and knowing your options. Feel free to get in touch and be matched to a good broker, if you want to explore these options further.

Can a 60-year-old get a mortgage in the UK?

Absolutely! A 60-year-old can indeed secure a mortgage in the UK. Many lenders offer mortgage options to older borrowers, especially if you can demonstrate affordability and meet other eligibility requirements.

Can a 65-year-old get a mortgage in the UK?

Certainly! At 65, there are still numerous mortgage options available to you in the UK, particularly retirement-specific products like lifetime or retirement interest-only mortgages. The key is to seek advice from a specialist broker who can help guide you through the process.

Can a 70-year-old get a mortgage in the UK?

Yes, a 70-year-old can get a mortgage in the UK. While some lenders might have age limits, others, especially those specialising in retirement mortgages, don’t. It’s essential to consider affordability and discuss your options with a professional mortgage advisor.