How To Buy Someone Out of a House for a Fresh Start

Sharing a property with your spouse or friend can be fun with all the laughter, the savings, and the occasional “whose turn is it to take out the trash” squabbles.

But then circumstances change, and we have to adapt. If you and your partner share a mortgage and decide to part ways, you might want to buy them out of a house to become the sole owner.

Mortgage buyouts are becoming increasingly popular with divorce rates on the rise in the UK. However many are not sufficiently informed to ensure a smooth process.

To help you negotiate with your partner trouble-free, we explore how mortgage buyouts work and what you can do to maximise the benefits.

What is a Mortgage Buyout?

A mortgage buyout is when you buy out your co-owner’s share of a property and assume the entire mortgage yourself.

This can be a popular option for friends, family, or business partners who have jointly invested in a property.

To do this, you would need to pay off your co-owners outstanding balance on the mortgage and give them a fair price for their share of the property.

When one partner wants to leave, there are two main options:

- Sell the property and split the proceeds, or

- One person can buy out the other’s share.

If you choose to buy out your co-owner, you will need to pay them the following:

- the fair market value of their share of the property.

- Any outstanding balance of the mortgage, and

- Any unexpected costs, such as repairs or renovations.

Before you consider a mortgage buyout, it is important to carefully consider your financial situation. This can be a big financial commitment, so it is important to make sure you can afford it before you proceed.

If both your names are on the mortgage, you both have to pay up. If one of you misses a payment, the lender will come after both of you, and both your credit scores could suffer.

In legal terms, this is called being “jointly and severally liable.“

Before going for a mortgage buyout, have a chat with a mortgage advisor. To get started, simply reach out to us.

We’ll pair you with a remortgage advisor who will look at your financial situation and help you figure out if a buyout is a good move for you.

How to Calculate Buying Someone Out of a House

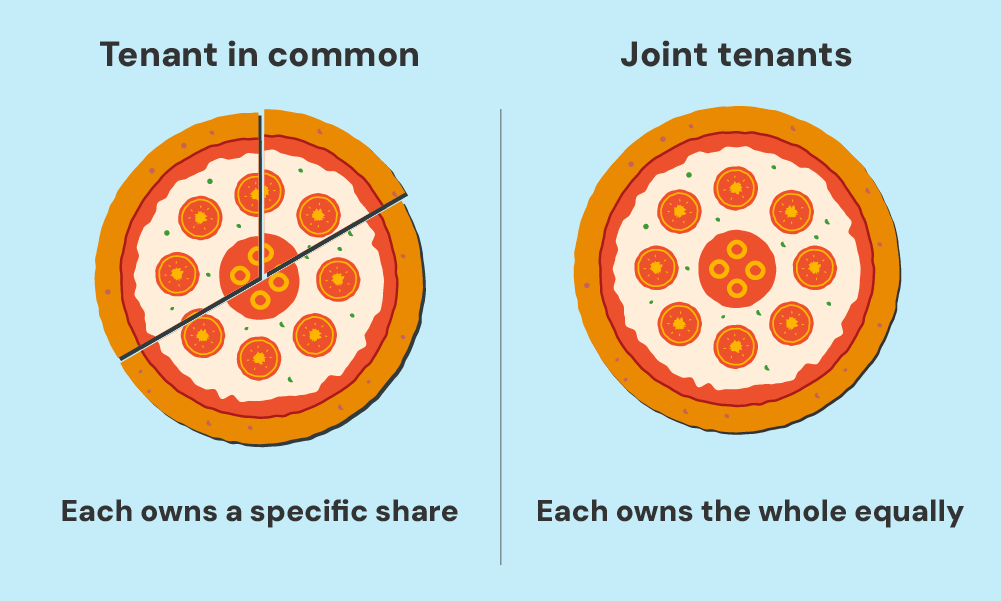

When you’re in ‘joint ownership’ and plan to part ways without a specific agreement like a divorce settlement dictating the division of equity, working out the buyout cost isn’t too complex.

Generally, both of you have equal ownership of the property, which means you each have a claim to 50% of the house’s equity.

To complete the buyout, you’ll need to hand over their half of the equity in a cash transaction, and subsequently remove their name from the mortgage.

But if you’re identified as “tenants in common“ in your agreement, things are a bit different. This setup allows for a split of ownership in different proportions, possibly among up to four people.

For instance, two of you might own 40% each, leaving the remaining two with a 10% stake each. This setup will directly influence how much each person receives when dividing the property’s equity.

Remember, it’s always wise to consult with a professional to ensure a smooth and fair transaction for everyone involved.

How to Calculate Your Home’s Equity

The first step is to get your property valued, and it’s recommended to hire a surveyor for this task as they offer a more accurate valuation compared to estate agents who might overstate the property’s worth.

Equity is basically how much of your home you truly own. It is the difference between the property’s current market value and the remaining balance on the mortgage.

You can think of it as the portion of the house that is mortgage-free.

As you continue to make mortgage payments, and as the property’s market value rises, your equity increases.

Here’s a straightforward way to calculate it:

Equity = Property Value – Outstanding Mortgage Balance

For example, suppose your property is worth £400,000, and there’s £300,000 left to pay on the mortgage. In this case, the total equity would be £100,000.

Divide Equity Among Owners. Divide the total equity by the number of owners, unless there’s a specific agreement that dictates otherwise.

> Equal Ownership Example:

If two individuals equally own a property with £100,000 equity, the division is:

| Owner | Equity Share |

|---|---|

| 1 | £50,000 |

| 2 | £50,000 |

> Unequal Ownership Example:

Imagine three partners own a property, but their shares are 50%, 30%, and 20%. For a total equity of £100,000, the breakdown would be:

| Owner | Ownership % | Equity Share |

|---|---|---|

| 1 | 50% | £50,000 |

| 2 | 30% | £30,000 |

| 3 | 20% | £20,000 |

Being thorough with your valuation and clear on ownership percentages will help sidestep potential disagreements later on.

Steps to Buyout Someone Out of a House

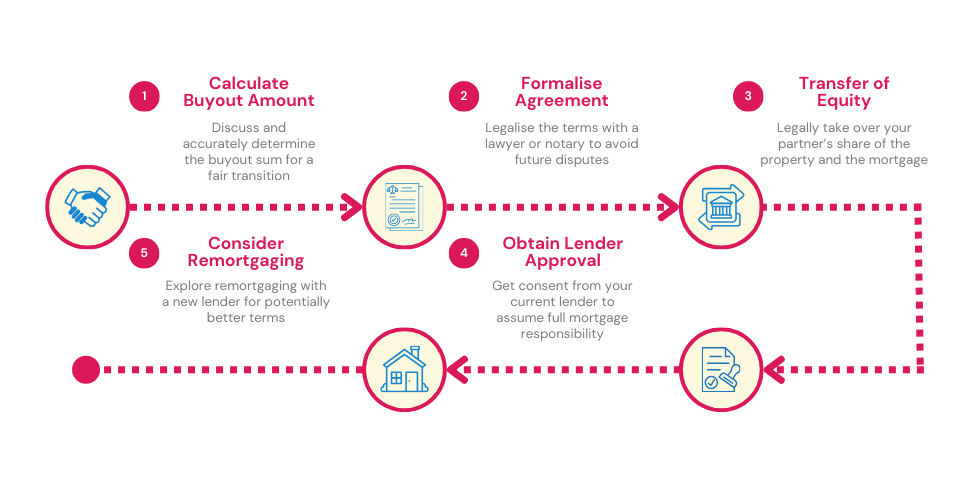

In the journey of buying someone out of a house, initially, it’s essential to calculate the buyout amount accurately.

Open discussions with your partner will pave the way for a tranquil transition, fostering a mutual understanding that benefits both parties.

After reaching a consensus, make sure to formalise this agreement into a legally binding document to avoid future disputes.

Bringing a lawyer or notary into the process will ensure that the terms are transparent and mutually agreed upon.

A crucial part of this process is undergoing a “transfer of equity“, a legal procedure where you take over your partner’s share of both the property and the mortgage, in exchange for the agreed equity.

This not only makes you the sole owner but also transfers the full mortgage responsibility onto you. However, before embarking on this, you need your mortgage lender’s nod of approval.

If you decide to stick with your current lender, getting a letter of consent from them is the next step. They would evaluate your credit history and financial capability to see if you can handle the mortgage payments alone.

Once they confirm your eligibility, the transfer of equity can proceed without any hitches.

Generally, if no changes are made to the balance or term of the mortgage, an early repayment fee is unlikely.

Moreover, you might also consider the option of remortgaging to a new lender as a solo borrower. This path allows for a fresh start, potentially with better terms.

In this case, after securing a mortgage offer from your new lender, they would coordinate with your previous lender to settle the old mortgage, releasing your ex-partner from the financial obligation and removing their name from the property title deeds.

Pro Tip

Remortgaging as a solo application, especially on a low income can be a challenging endeavour.

To ensure a successful mortgage buyout that aligns with your long-term goals, consider seeking advice from a remortgage broker who can properly evaluate your financial capacity.

Remortgaging

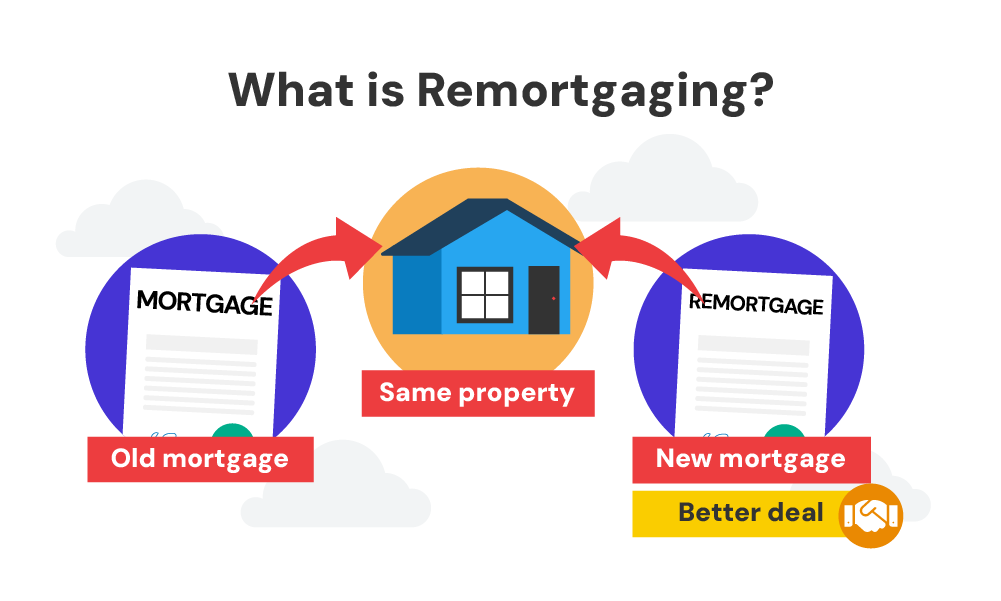

Remortgaging is one of the most popular financing options for mortgage buyouts. The plan lets you replace your existing mortgage deal with a new one, often with another lender.

Here are a few reasons you might consider this route:

- To reduce your monthly mortgage payments

- To free up some equity for home improvements

- To consolidate various debts into a single manageable amount

The goal is to negotiate new repayment terms that align more closely with your financial needs.

Within the context of a mortgage buyout, the primary role of remortgaging is to unlock some of the equity in the property, thus facilitating the acquisition of a lump sum to settle your partner’s share.

Let’s say your property is currently valued at £250,000 and you’ve accumulated £150,000 of equity.

By opting for remortgaging, you can borrow an additional amount, let’s say £50,000, based on the available equity. This extra sum can then be used to complete the mortgage buyout.

How much can you borrow? It depends.

Remortgaging is vast and varied, with each lender setting their upper limit. To give you a rough idea, the threshold for most lenders ranges from around 75% to 80% or less of your home’s worth.

There also are rare instances where the limit could be set as high as 85% or more, but in this case, the pool of potential lenders shrinks significantly.

Use the remortgage calculator to see what remortgage options could be within your reach. If you’re planning to cash out some equity, include that amount; otherwise, feel free to leave that field empty.

If for any reason remortgaging doesn’t work for you, don’t fret. There are alternatives out there that could help.

What are the Alternatives?

Trading Marital Assets

Divorce can be a tricky game of give and take, especially when it comes to dividing assets.

In some cases, rather than a straight cash payment, the buying spouse may choose to trade other marital property to even out the value of the spouse’s share.

For instance, one spouse might get to keep the beloved family home, but in return, they give up their claim on marital investments and retirement accounts.

It’s a classic swap, ensuring that both spouses walk away with their fair share of the pie.

Selling The Property

Another way is to sell the property and split the money with your partner. This can be the best choice if you struggle to reach a financial agreement or when the property’s value has surged in value over time.

Consider this scenario. Due to your current financial hardships, you cannot afford to buy out your partner’s share even through a remortgage.

But there is good news: your property has skyrocketed in value since its purchase. These two factors can become strong reasons for you to sell the property.

By capitalising on favourable market opportunities, you could milk every penny of your home’s appreciation and divide the proceeds fairly, ensuring both parties are satisfied.

Second Charge Loans

A second-charge mortgage is a type of loan that lets you access extra funds without having to alter your existing mortgage agreement.

It lets you obtain an additional loan on top of your primary mortgage, using your property as collateral. This means you’ll have two mortgages on your property—one primary and one secondary.

You could opt for a second-charge loan if you’re a fan of your current mortgage terms and don’t need to change anything.

Remortgaging, on the other hand, is a better option if you need to renegotiate your current terms and land a better mortgage deal.

Personal Loans

When it comes to buying out your partner, sometimes you may only need a modest amount of money to bridge the gap. In such cases, a personal loan could be the best solution.

Personal loans are unsecured loans that can be used for various purposes, including property buyouts.

Keep in mind though that these loans typically come with higher interest rates compared to mortgages, and the loan amount may be limited based on your income and creditworthiness.

The Bottom Line

So there you have it, the secrets to a successful mortgage buyout. Even if you and your soon-to-be-ex don’t have any disputes and wish to separate amicably, you must conduct thorough research to ensure your mortgage buyout aligns with your long-term goals.

As with any important decision, the worst thing you can do is rush. Happy buyout-ing!

If you ever need more guidance about successful mortgage buyouts, don’t hesitate to reach out. We will connect you with a remortgage broker who can make the whole process of mortgage buyout easier and more effective.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

How long does it typically take to buy someone out of a house?

The timeframe can vary depending on your unique circumstances. If the equity split goes smoothly and there are no major disagreements, the process usually takes around four to six weeks.

But, certain circumstances can extend the timeline. Say if there are issues with equity shares or finding a suitable lender, the process may take longer.

Can I borrow money from a family member to fund a mortgage buyout?

Certainly, your family members can decide to lend you the money. This can be given to you in one lump payment or put into a specific savings account that will serve as the lender’s security.

This arrangement, also known as a springboard mortgage or family guarantor mortgage, often involves your family member depositing 10% of the property price into the savings account.

After a specific period, they’ll receive their money back with interest, but only if you keep up with your monthly mortgage repayments.

What fees are involved when buying someone out of a mortgage?

The transfer of equity involves legal processes, and you will probably need to enlist the services of a solicitor or conveyancer. The cost of legal fees for the transfer typically ranges from £250 to £500.

Professionals will handle the necessary paperwork, ensure a smooth transfer of ownership, and protect your interests throughout the process.

Here are some other fees you might have to face:

- Land Registry Fee: You’ll need to pay the Land Registry Fee to officially register the change in ownership. The fee starts from around £50, but it can vary based on the value of the property.

- Valuation Fee: A lender or mortgage provider may also require a property valuation. This fee covers the cost of assessing the value of your property and ensuring it aligns with the mortgage requirements. The valuation fee varies depending on the property’s location, size, and other factors.

- Mortgage Broker Fee: If you decide to seek the assistance of a mortgage broker, they may charge a fee for their service. The fees vary depending on the broker and the complexity of the mortgage arrangement.

- Lender Fee: Depending on the specific mortgage product you choose, the lender may also charge a fee for processing the mortgage and facilitating the buyout. These fees vary among lenders and mortgage products, so it’s important to carefully review and compare the terms before committing.

Should I hire a professional property appraiser to determine the value of the home in a mortgage buyout?

Hiring a professional property appraiser is a popular and reliable method to establish the value of a home in a mortgage buyout.

While it may be more expensive, ranging from $300 to $800 for a formal appraisal and report, it can be a valuable investment if there is a disagreement about the house’s value.

If the parties cannot reach a consensus through negotiation or mediation, resorting to a court decision may be necessary. In such cases, a judge will rely on the appraiser’s report to determine the value of the home.

Alternatively, if there are two appraisals available, the judge may consider the average of the two reports.

This article has been fact checked

This article was created, checked, and verified by the expert team at Money Saving Guru. Trust us, you’re in good hands.