- What is the Six Month Rule for Remortgage?

- How Soon Can You Remortgage After Buying a Property?

- Can I Remortgage My Property Within 6 Months?

- How Can I Remortgage Early?

- Can You Get a Day-One Remortgage?

- Lenders Willing to Lend Within 6 Months

- Can I Remortgage After Six Months of Purchase?

- Which Lenders Offer These Mortgages?

- Eligibility Criteria When Remortgaging Within Six Months

- The Bottom Line: Why You Should Partner With a Remortgage Expert

How Soon Can I Remortgage? The 6-Month Rule Explained

If you’ve recently bought a property, chances are, you’re already thinking about the ways to make the most of your NEW investment.

Maybe you’re considering a fresh coat of paint or perhaps even a full-blown renovation to boost its value 🏠.

But what about the financial side of things? Don’t worry, with the right approach, you might be able to remortgage your home within the first six months of purchase? 💡

In this article, we’re breaking down the “six-month rule” – a guideline that often pops up when considering an early remortgage. We’ll walk you through the steps and tips to navigate this process smoothly and without the jargon.

From the nitty-gritty details of day-one remortgages to finding the right lender for your needs, we’ve got you covered.

So, grab a cup of coffee and let’s get started. ☕

What is the Six Month Rule for Remortgage?

The “six-month rule” is a precautionary measure to prevent property owners from taking out a new mortgage on their property within the first six months of ownership.

This rule was introduced to stop a previous practice where homeowners and property investors quickly borrowed up to 100% of the property’s value soon after purchase.

Having this rule in place ensures a steadier property market and prevents people from getting into too much debt too quickly.

It’s a standard most lenders, especially those that lend within 6 months, adopt to promote responsible borrowing.

How Soon Can You Remortgage After Buying a Property?

Most of the time, lenders suggest you hang tight for about six months after your name pops up on the Land Registry as the new owner before you even think about remortgaging.

This is often referred to as the “six-month rule“.

But don’t fret, as this isn’t a hard and fast rule – some lenders might give you the approval to remortgage earlier.

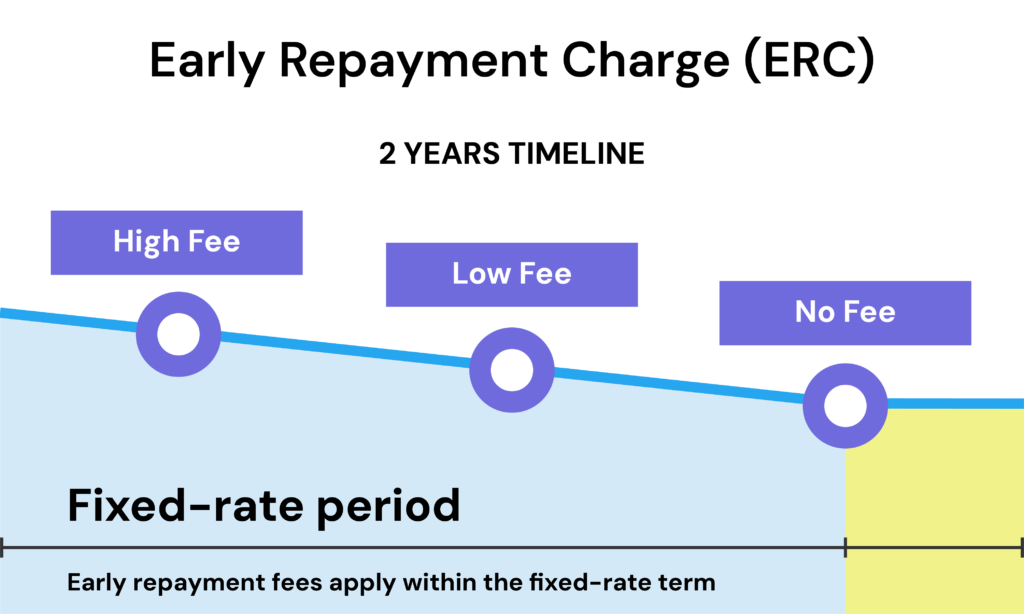

Now, while the thought of remortgaging early might seem tempting, you need to consider the potential costs of leaving your current mortgage too soon.

If you’ve got a two-, three-, or five-year fixed-rate deal, stepping away early could mean you’ll be hit with extra charges.

But here’s a little nugget of wisdom: In certain cases, remortgaging early can actually be a smart move. Maybe you’ve spotted a chance to snag a better interest rate, or perhaps you’ve got some urgent home improvements on the horizon.

So, as you mull over the idea, remember to weigh up all the pros and cons. After all, making a savvy choice here could set you up nicely for the future

Can I Remortgage My Property Within 6 Months?

Remortgaging within the initial six months is possible, but it can be more challenging than remortgaging later.

Most lenders will charge you a higher interest rate if you remortgage within 6 months, as they see it as a higher risk.

You may also have to meet stricter eligibility criteria, such as having a higher deposit, a lower debt-to-income ratio, or a longer credit history.

There are several reasons why someone might want to remortgage so soon, such as:

- To handle the finances of a property they have inherited

- To access some equity due to unexpected life events

- To avoid higher repayments after a sudden increase in variable mortgage rates

- To change to a buy-to-let mortgage scheme

- To leverage the increased value of a property post-renovation

- To secure extra funds for home upgrades or consolidate debts

- To facilitate the buyout of another party from a mortgage

In these cases, your top priority will be to find a lender who is not strict about the six-month rule. It’s also key to assess the implications and costs of exiting your current mortgage early.

This will help you determine if remortgaging is the BEST option for you at this time. There may be other financial solutions that could meet your needs just as well.

Pro Tip

Consider equity and early repayment charges before remortgaging within 6 months.

The SHORTER the time you have owned your property, the LESS equity you will have built up. This could LIMIT your borrowing amount.

You may also have to pay an early repayment charge if you exit your current mortgage early.

It’s important to speak to a mortgage advisor to get professional advice before remortgaging within 6 months.

How Can I Remortgage Early?

To successfully remortgage in the initial period following a property purchase, consulting a good mortgage broker can boost your chances.

Reach out to us, and we’ll connect you with a remortgage advisor skilled in aiding clients who wish to refinance swiftly.

A competent broker can help you in the following ways:

- Verify the latest land registry updates on your property purchase.

- Assess your current mortgage deal to see if there are any early repayment fees if you want to switch soon.

- Provide a clear picture of the potential remortgaging costs so you can make an informed decision.

- Review and update your credit reports to ensure that all of the information is accurate and up-to-date.

- Search the market for the best deals, including those that are only available to brokers.

- Gather all of the necessary paperwork to make the application process go smoothly.

In this way, you’ll be well-prepared to handle the early remortgaging process, guided by expert advice every step of the way.

Can You Get a Day-One Remortgage?

Yes, you can.

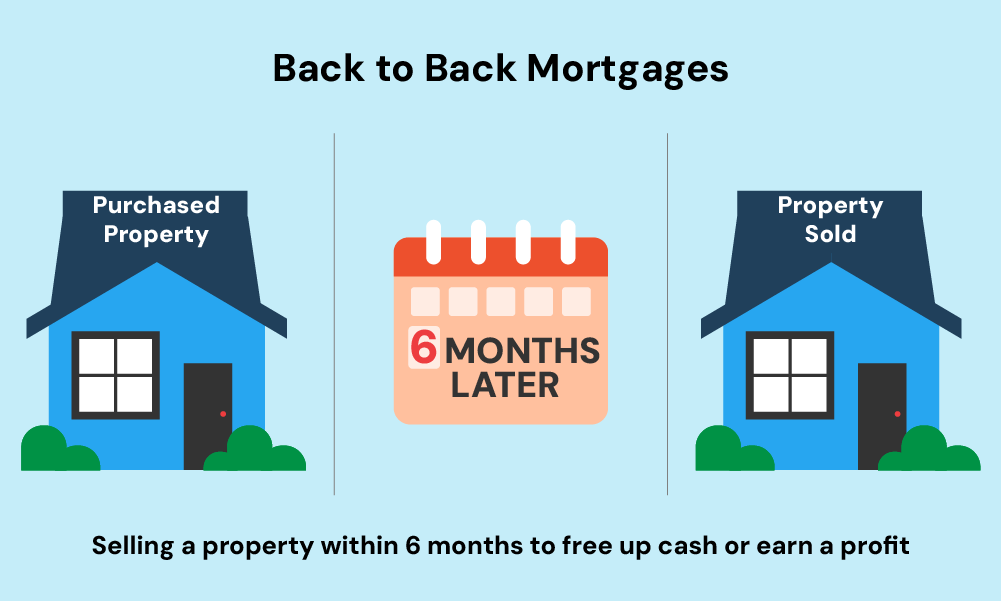

Day-one remortgages are a real option, but they are rare. They occur when a property owner refinances their home immediately after completing their first purchase.

Although it is called a “day-one” remortgage, this term can also refer to any remortgaging that takes place within the first six months of buying a property.

Getting a day-one remortgage can be challenging. Many lenders are reluctant to offer remortgaging products to people who have owned their property for less than six months or even a year.

These remortgages work similarly to standard mortgages, but with one key difference: you need to prove that you own the property.

This can be difficult, especially if the Land Registry has not yet updated its records, which can take six weeks or more. In this case, your solicitor may be able to help you.

In terms of financial requirements, you will need to have a significant amount of equity in the property to back up the loan.

For day-one remortgages, lenders typically prefer a loan-to-value (LTV) ratio of between 75% and 85%, although some may be willing to consider a higher percentage.

Lenders Willing to Lend Within 6 Months

Nationwide and Barclays are two well-established lenders that offer day-one remortgages. However, these products have stringent requirements, so it is wise to consult a mortgage broker.

A good broker can help you find the best mortgage for your circumstances and navigate the specific requirements of day-one remortgages.

In some cases, a broker may be a necessity, as some lenders only offer these products through specialized channels that are broker-accessible.

Can I Remortgage After Six Months of Purchase?

Yes, it is possible to remortgage after six months of buying a property. It is often easier to remortgage after six months, as more lenders will consider your application.

However, it is important to note that the six-month period begins from the date that the Land Registry updates your ownership details, not from the date of the property purchase.

If you remortgage within the first year of your mortgage, you may have to pay additional fees, such as early repayment charges.

However, remortgaging can still be a financially savvy move if you can get a better interest rate or other terms.

Which Lenders Offer These Mortgages?

As of the current period (September 2023), roughly 30 lenders are in the position to consider applications for remortgages within the six-month frame.

Nevertheless, they will scrutinise your application thoroughly, granting approvals only in select circumstances.

Here’s a glance at some of the lenders inclined to review such requests:

- Barclays

- NatWest

- HSBC

- Virgin Money

- Nationwide Building Society

Eligibility Criteria When Remortgaging Within Six Months

The requirements to qualify for a remortgage are similar to those of a standard mortgage, but you may be asked to provide additional paperwork to strengthen your application.

The specific documents you need will depend on your reason for remortgaging.

Here are some examples of additional documents you may need:

- A detailed record of the property purchase.

- A solicitor’s confirmation that they have initiated the update to the Land Registry (if your name is not yet on the register).

- A completion statement verifying the initial purchase value of the property.

- Documentation indicating an enhanced property valuation, if you have undertaken renovations.

The Bottom Line: Why You Should Partner With a Remortgage Expert

Remortgaging in the initial months after buying a property can seem like a tough maze to solve. The rules are many, and the paperwork is plenty.

But here’s the good news: you don’t have to figure it ALL out on your own.

A remortgage expert can be your shortcut to a hassle-free process. With an expert by your side, YOU won’t waste time interpreting complex terms or sorting through piles of paperwork.

They’ll swiftly find the best deals for you, potentially saving you a big chunk of money. Think of them as your guide, helping you make smart choices without the headache.

Ready to take the leap without the fuss? Fill out this quick form. We’ll connect you with a skilled remortgage broker equipped to simplify your journey and get the best deal for you.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

Can I switch my mortgage soon without extra charges?

Switching your mortgage early can incur charges, such as an exit fee from your current mortgage deal and possible arrangement or valuation fees for the new mortgage scheme you are considering. It is important to weigh the financial implications of switching before making a decision.

Can I remortgage a buy-to-let property within six months?

Yes, it is possible to remortgage a buy-to-let property within six months. However, you may need to find a lender who does not enforce the six-month rule and be prepared for your application to be subject to stricter scrutiny.

Can I purchase a property owned for less than six months?

It can be difficult to purchase a property that has been owned for less than six months, due to the six-month rule. However, some lenders do not enforce this rule, so it is possible to find one and proceed with the purchase.

Can I remortgage quickly if I bought the property through a cash purchase?

Yes, if you initially purchased the property with cash, you can access funds against the full equity of your property immediately. This is not considered a remortgage, but rather an “unencumbered mortgage“.

Can I port my mortgage within 6 months?

Yes, you can port your mortgage within 6 months, but it’s subject to your lender’s policy and may involve certain fees or conditions. It’s best to consult with your lender for specific details.