- What Documents Should You Provide?

- How Does The Secured Loan Process Work?

- How to Get a Secured Loan: Step-by-Step

- How Long Does This Whole Process Take?

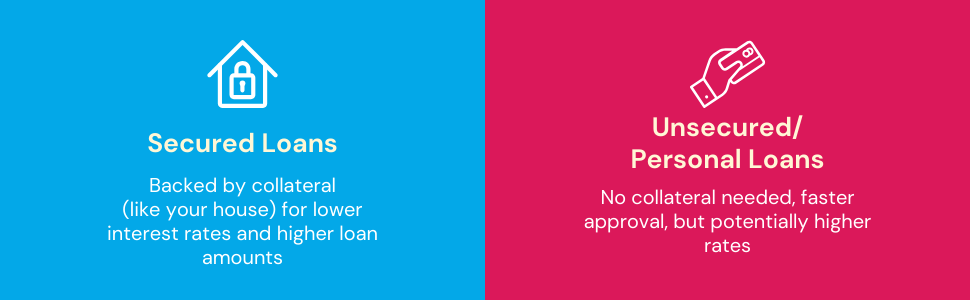

- How Do Secured Loans Compare to Unsecured and Personal Loans?

- Do You Need to Own the Property to Get a Secured Loan?

- How the Type of Property Influences a Secured Loan

- Key Takeaways

- The Bottom Line

What Documents Do I Need for a Secured Loan in the UK?

Secured loans offer a reliable way to access large sums of money, typically by using a valuable asset such as your property as collateral to assure the loan’s repayment.

Before you dive in, it’s key to arm yourself with all the necessary paperwork to speed up the process.

So, what exactly should you prepare before stepping foot into a lender’s office in the UK? Let’s take a closer look.

What Documents Should You Provide?

To prove you’re eligible for a secured loan, lenders will ask for various details to verify your identity and get a glimpse of your financial status, so they can assess the risks.

Here’s a checklist to help you get started:

Details of the Property to be Used as Collateral

- Property valuation report – A recent report that states the current market value of the property you are offering as collateral.

- Address and title deeds – Documentation confirming the address and your ownership of the property.

Personal identification documents

- Proof of identity – A government-issued photo ID such as a passport or driving licence to verify your identity.

- Proof of address – Bills or official letters received within the last three months to confirm your current residence.

- Date of birth – Verification through an official document like a birth certificate or a government ID that shows your birth date.

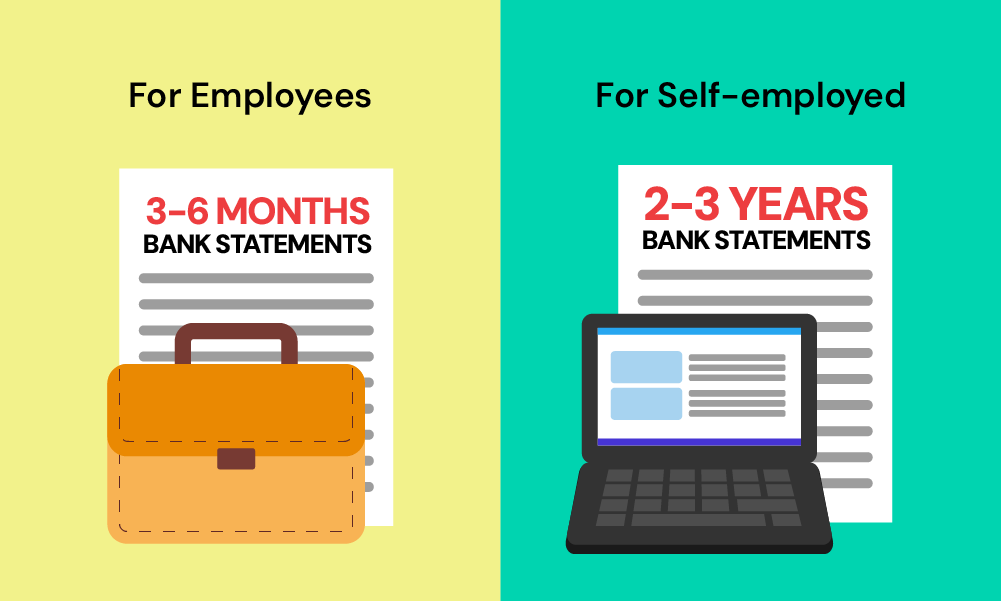

Proof of income

- P60 – The most recent three months of P60 forms, which outline your yearly income over the past three years.

- SA302 – For the self-employed, the SA302 forms from HMRC demonstrating your tax returns for the past 2-3 years.

- Bank statements – Bank statements covering the last three months, showcasing your financial patterns and regular earnings.

Proof of employment

- Employment confirmation letter – A letter from your employer confirming your current job position, employment type (either full-time or part-time), and the period you have been employed.

- Business documents – If self-employed, proof of business registration or other official documents that validate your business’s existence.

Evidence of financial standing

- Existing debts – Documents that show any existing debts like loans, mortgages, or credit card balances to provide a comprehensive picture of your financial commitments.

- Credit report – A recent report detailing your credit history and current score, enabling the lender to gauge your creditworthiness.

Detailed repayment plan

- Budget overview – A thorough budget that compares your monthly income with your expenses, proving your capability to manage the potential loan repayments.

- Repayment strategy – A clear strategy detailing how you intend to settle the loan, whether through rental income, your salary, or the sale of an asset.

How Does The Secured Loan Process Work?

Secured loans allow you to borrow money by using the value of a property you own or plan to buy as collateral. This type of loan is often in the form of a second mortgage.

It is an excellent solution for funding major expenses such as home renovations, debt consolidation, or other pressing financial needs.

Secured loans can also pave the way for investments in buy-to-let properties, where you buy a house to rent out to tenants.

But, it is important to be cautious and only borrow what you can comfortably afford to repay, as the loan is secured against your property.

Upon approval, the lender will establish a legal claim on your property, which means they have the authority to take possession of it if you default on the loan.

If you default on repayments, the lender may reclaim and sell the property to recoup the loan amount.

Therefore, it is vital to borrow responsibly and never exceed what you can afford, to prevent risking your property.

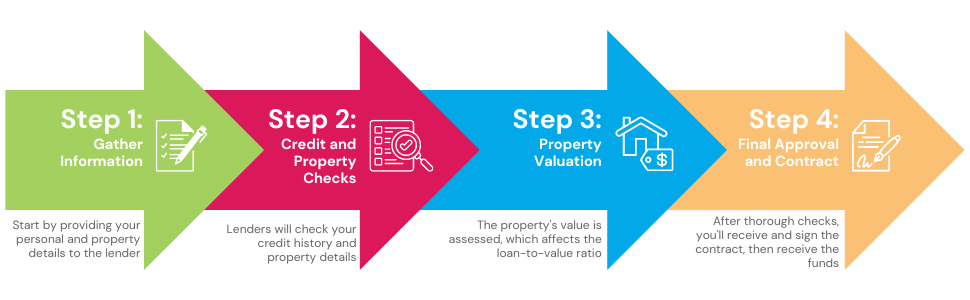

How to Get a Secured Loan: Step-by-Step

Getting a secured loan involves a series of steps that help the lender determine if you qualify for a loan. Let’s walk through each step so you know exactly what to expect.

1. Gather Your Information

The first step in securing a loan is gathering all your important details. The lender will ask for your name, where you live, your birthday, where you work, the type of property you have, and how much money you want to borrow.

They want to make sure that the loan suits you and that you meet the basic qualifications before asking for more info.

2. Conduct Searches

Even though secured loans are usually less of a risk for lenders, they still need to check your credit history. This means they will look into how well you’ve managed your loans or credit before.

Besides this, they also check the land registry for the property you are interested in to see if any problems might affect the loan.

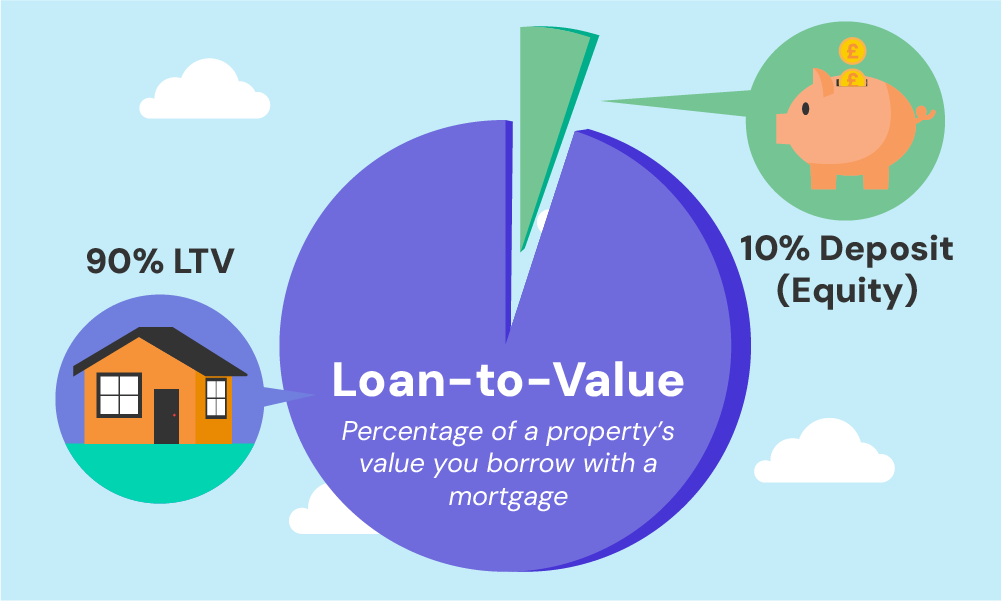

The results of these searches might change the loan’s terms, potentially altering the interest rates and the loan-to-value ratio (LTV).

3. Property Value

The next step is figuring out how much the property you’re interested in is worth. You can organise this yourself, or the lender can handle it.

Many times, this valuation is done quickly using modern technology, but sometimes it needs a personal visit from a surveyor.

This process can take a few days, plus some extra time to write and confirm the report. The valuation helps the lender decide the loan-to-value (LTV) ratio, which compares the amount of the loan to the value of the property.

4. Final Checks and Paperwork

Towards the end, the lender does several final checks. This might involve their legal team and higher-ups, who make sure everything is in order and check for any fraud before agreeing to give you the loan.

After these checks, they will send you a contract to look over and sign. Once all these steps are completed, they transfer the money into your bank account.

How Long Does This Whole Process Take?

The time it takes to get a secured loan can vary. If you are quick in responding and giving the needed information, it might take between 2 to 4 weeks.

Some lenders make the process faster by handling everything online, from the application to handing out the funds.

However, others might take longer as they prefer to send documents by post.

The speed can also depend on how quickly you sign and send back the necessary documents and how fast the lender can process your application and perform the necessary checks.

Sometimes, lenders offer a seven-day thinking period, during which you can decide to cancel the application without any charges.

How Do Secured Loans Compare to Unsecured and Personal Loans?

Unlike secured loans, unsecured and personal loans don’t ask you to use your property or belongings as a guarantee for paying back the loan. Instead, they focus on whether you can afford the loan and your credit history to see if you qualify.

Your income each month and what you spend determine if you can afford the loan. For approval, you need to show that you have a stable job and regular income.

But, some lenders might also consider those with poor or no credit history, as long as they can afford the loan amount.

Getting an unsecured or personal loan is usually faster than a secured loan because there’s no need to check and value any property.

This means less paperwork and quicker approval times – sometimes only a few minutes, with the money in your account in just a few hours!

Do You Need to Own the Property to Get a Secured Loan?

Not necessarily. Secured loans operate by using the equity, or the portion of the mortgage you have already settled, as security for the loan.

You can apply for a loan based on the equity in the property you own or partially own.

If the mortgage is fully paid off and you own the property outright, you have the opportunity to borrow larger sums through a secured loan, potentially benefiting from better terms and lower interest rates.

To be approved for a loan, the value of your collateral (the property) should be at least equal to the amount you wish to borrow.

This precaution ensures that the lender can recoup the loan amount in case you are unable to fulfil the repayments.

How the Type of Property Influences a Secured Loan

The policies and prerequisites set by lenders may vary based on the type of property you possess or intend to purchase.

Certain kinds of residential properties may pose more complications, necessitating additional paperwork or a substantial upfront deposit for the loan or mortgage.

Generally, a deposit of 20% is the norm for securing favourable loan agreements when acquiring properties, typically equating to an 80% Loan-to-value (LTV) ratio.

Nonetheless, if the lender perceives the property to be a higher risk, they might ask you to front a larger deposit.

For instance, if you are considering a secured loan for a newly constructed home, you might encounter specific limitations, such as the lender insisting on collaborating with certain builders or construction companies.

Properties with unconventional features might also bring about extra hurdles, demanding more detailed documentation and paperwork.

These properties might encompass:

- Homes that were formerly council houses

- Residences situated above commercial premises

- Buildings with unique structures, like thatched roofs or prefabricated elements

- High-rise studio flats or apartments

- Structures where harmful materials such as asbestos have been used in construction

- With these types of properties, securing a suitable loan deal can be a bit challenging. You might be faced with higher interest rates or the necessity for a larger deposit.

Key Takeaways

- Get a clear valuation of the property you want to use as collateral, and make sure you have papers showing you own it and where it’s located.

- Collect your personal documents, like a photo ID, proof of where you live (like a utility bill), and something that shows your date of birth.

- Find your recent financial papers, like your last three months of P60s. If you’re self-employed, you’ll need 2-3 years of tax summaries (SA302s) from HMRC.

- Show proof of your job, like a letter from your employer. If you run your own business, get documents that show your business is real and active.

- List all your current debts and financial commitments, grab a copy of your credit report, and have a plan ready to show how you’ll keep up with the loan repayments.

The Bottom Line

Getting a loan in the UK means you’ll need to prepare some important documents to show you’re eligible and financially stable.

Having your paperwork ready makes the whole process much easier and less stressful.

It also helps to have a loan broker on your side—they can explain everything in simple terms and help you find the best deal for your needs.

If you’re ready to get started, reach out to us. We’ll connect you with expert brokers who can guide you through picking the right mortgage.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

What checks are done for a secured loan?

Lenders conduct credit history checks, and property valuation, and assess your financial standing, including reviewing documents like income proof and evidence of existing debts.

How much collateral is needed for a secured loan?

The collateral amount depends on the loan value; typically, lenders require collateral that is at least equal to or exceeds the value of the loan. The exact percentage can vary based on the lender’s policies and the borrower’s creditworthiness.

Is it easy to get approved for a secured loan?

The ease of approval depends on various factors including your credit score, income stability, and the value of your collateral. Meeting the lender’s criteria can facilitate a smoother approval process.