- What is a Self-Build Mortgage?

- Types of Self Build Mortgages

- Should You Opt for a Self Build Mortgage as a First-Time Buyer?

- How Much Funding Will You Need for Your Self-Build Project?

- Can a First Time Buyer Get a Self-Build?

- What Are the Eligibility Criteria for a Self-Build Mortgage?

- How Much Deposit is Needed for a Self-Build Mortgage?

- Documents Needed for a Self-Build Mortgage

- How Can a First-Time Buyer Secure a Self-Build Mortgage?

- Where Should You Apply for a Self-Build Mortgage?

- What Are the Alternatives to a Self-Build Mortgage?

- Things to Consider Before Getting a Self-Build Mortgage as a First-Time Buyer

- The Bottom Line

First-Time Buyer’s Guide to Self Build Mortgages

More and more people are choosing to build their own homes these days. It’s a great way to save money and bring your dream home to life.

Imagine that perfect bedroom with a walk-in closet or your ideal kitchen – it’s all within reach.

But before you get lost in the excitement of planning your dream home, there’s something important you need to consider: funding.

Firstly, you should know that a regular home loan won’t cover a self-build. You’ll need a special type of mortgage designed for this purpose.

Secondly, having planning permission and a detailed budget for your project is essential. And thirdly, it’s crucial to have the right team of experts to guide you.

So, how do you manage all these steps?

This guide is here to support you, especially if you’re a first-time buyer. We’ll walk you through everything you need to know about self-build mortgages, from how they work to tips for a successful building project.

What is a Self-Build Mortgage?

A self-build mortgage is a special type of loan designed for people who want to build their own home.

Unlike a standard mortgage, where you get all the money at once when you buy a house, a self-build mortgage releases the money in stages.

These stages usually match key points in the building process, like buying the land, laying the foundations, and completing the roof.

This way of doing things helps manage the finances of building a house. It ensures you have the money you need when you need it.

Plus, it reduces the lender’s risk because they only give out money as your home build progresses and gains value.

Interest rates for self-build mortgages might be a bit higher than regular mortgages, as building your own home is seen as more risky.

But, the big plus is you get to create a home that’s exactly what you want, and it can even be more cost-effective than buying an existing property.

Types of Self Build Mortgages

In the UK, you’ve got two main types of self build mortgages to choose from:

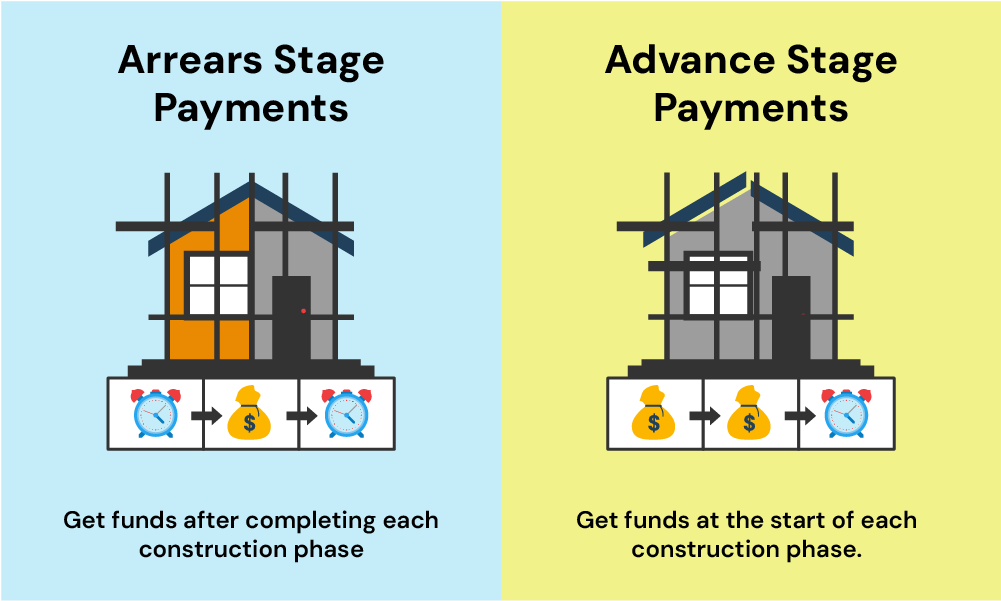

- Arrears Stage Payments. This is the more common type. You get money after finishing each part of the build. It’s good if you can pay for things upfront because you’ll spend your own money first and then get paid back. You usually get funds after key steps like laying the foundations, making the building watertight, and completing the inside.

- Advance Stage Payments. This one’s less common but really helpful if you don’t have much savings. You get cash at the start of each building stage. This way, you have the money right when you need to start each new phase of the build.

Your choice should match your savings and how you plan to run the project. Both types need you to have a solid plan and budget in place.

Should You Opt for a Self Build Mortgage as a First-Time Buyer?

Choosing a self build mortgage really depends on what you want and what you can handle. It offers both control and potential savings but comes with its own set of challenges.

Pros

- Save on Stamp Duty. You only pay stamp duty on land costs over £125,000, not the building work or the finished home. This often means lower costs than if you were buying a pre-built house.

- Control Your Budget. When you build your own home, you can make choices that save money. From picking materials to hiring workers, you’re in charge of the spending.

- Increase Home Value. Often, the value of a self-built home is more than what you spend building it, which means you could end up with a property worth more than the cost of creating it.

Cons

- Risk Awareness. Building a house can bring unexpected costs and delays. It’s important to plan carefully and be ready for surprises.

- Higher Costs. You’ll likely need a bigger deposit for a self build mortgage, and the interest rates might be higher too. This means you need to have a good amount of savings.

- Time Commitment. A self-build project is a big time commitment. You’ll be involved from buying the land to finishing the construction, so be prepared to dedicate a lot of time and effort.

When deciding if a self build mortgage is right for you, weigh these pros and cons.

If the idea of creating your custom home excites you and you’re ready for the financial and time commitments, then it can be a rewarding experience.

It’s about assessing whether you have the necessary resources and determination to tackle a project of this scale.

How Much Funding Will You Need for Your Self-Build Project?

The amount you’ll need to borrow for your self-build project varies. It depends on several factors – the cost of the land (if you haven’t already got it), construction costs, and your project’s overall scale and complexity.

Typically, lenders offer up to 75% to 80% of the project cost, which includes both land purchase and building expenses.

You’ll need to work out the total expected cost of your project first. This includes everything from materials to labour costs.

Once you have a figure, you can then estimate how much you need to borrow. Remember, the more accurate your cost projections are, the smoother the borrowing process will be.

Along with this, it’s crucial to have a contingency fund.

Construction projects often exceed initial budgets, so having a contingency fund of around 10-20% of the total project cost is generally advised in the UK. This extra fund can cover unexpected expenses and ensure your project stays on track.

Can a First Time Buyer Get a Self-Build?

Absolutely! If you’re buying a home for the first time, you can certainly go for a self-build mortgage. This choice is a bit different but offers great chances to make your own home.

Self-build mortgages are special loans for people who want to build their homes. They’re not quite the same as regular home loans.

The main difference is in the choices you have. There aren’t as many lenders for self-build homes as there are for traditional house purchases.

But don’t worry, you still have good options. Some lenders focus just on self-build projects and they understand what you need.

With a self-build mortgage, you get money in parts, step by step, as you build your house. This way works better for building because it makes sure you have the funds you need at each important stage of making your home.

Remember, while self-build mortgages open doors to creating your dream home, they come with their own set of rules and requirements, which we will explore in this guide.

What Are the Eligibility Criteria for a Self-Build Mortgage?

To qualify for a self-build mortgage, you need to meet certain criteria that lenders look for:

Reliable Income

Your income needs to be stable and sufficient to cover mortgage repayments. Lenders usually apply ‘income multiples’ to decide how much they’ll lend you.

This method involves multiplying your annual salary by a set figure, often around 4 to 4.5 times. For instance, if your annual salary is £30,000, lenders might offer you a loan between £120,000 and £135,000.

Age Limit

The minimum age for applicants is typically 18 years.

However, some lenders might prefer applicants for self-build mortgages to be over 25, considering the additional responsibilities and complexities involved in such projects.

Credit History

A solid credit history is essential. It assures lenders of your reliability in repaying the loan.

If your credit history has issues, it’s still worth exploring options with a mortgage broker who can guide you to specialist lenders or advise you on improving your credit score.

Deposit Requirements

The deposit for a self-build mortgage is generally higher than for standard mortgages. Typically, you’ll need at least 25% of the total build cost as a deposit, though this can go up to 40% in some cases.

Planning Permission

Having valid planning permission is crucial. It shows lenders that your project complies with local building regulations and is legally authorised to proceed.

Detailed Building Plans

Your building plans should be comprehensive, including detailed cost breakdowns, a realistic construction timeline, risk assessments, and contingency plans.

These plans demonstrate to lenders that you’ve thoroughly prepared for the project.

Professional Team Involvement

Working with experienced professionals, like architects and builders, is often a requirement.

This reduces the risk associated with the construction process and can strengthen your mortgage application.

Project Viability

Lenders evaluate the practicality and feasibility of your self-build project.

This involves assessing whether your project is well-planned, financially sensible, and likely to be completed successfully within the set budget and timeframe.

Meeting these criteria is crucial in demonstrating to lenders that you are prepared for the challenges of a self-build project and are a trustworthy borrower.

How Much Deposit is Needed for a Self-Build Mortgage?

The deposit for a self-build mortgage is usually more than what you’d need for a regular mortgage. For most self-build projects, you’ll need at least 25% of the build cost as your deposit. Sometimes, this could be as high as 40%.

This is different from buying an existing house, where you might get a mortgage with a smaller deposit, like 5%.

The reason for a bigger deposit in self-builds is that these projects are seen as a bit riskier by lenders. But don’t worry, with the right planning and budgeting, it’s something you can work towards.

Documents Needed for a Self-Build Mortgage

For a self-build mortgage, you’ll need:

- Basic Mortgage Documents – These are things like your ID, proof of how much you earn, and your bank statements.

- Planning Permission – A copy showing you’re allowed to build.

- Project Cost Estimate – A detailed breakdown of what your build will cost.

- Building Regulations Approval – A document proving your plans meet legal standards.

- Construction Plans – Your building’s detailed drawings and plans.

- Insurance and Warranty for the Site – These cover your building site during construction.

- Architect’s Insurance – If you’re using an architect, include their professional insurance cover.

Getting these documents ready will help speed up your self-build mortgage application.

How Can a First-Time Buyer Secure a Self-Build Mortgage?

Securing a self-build mortgage involves a few key steps:

- Prepare Your Finances. Make sure your finances are in order. This includes having a stable income, a good credit score, and enough savings for the required deposit.

- Develop a Detailed Plan. Create comprehensive building plans with cost estimates, a construction timeline, and all necessary permissions. Lenders will assess these plans for viability.

- Seek Professional Advice. Consulting with a specialist mortgage broker can be a game-changer. They have expertise in self-build projects and can guide you through the intricacies of the application process, helping you find the best deals and meet all lender requirements.

- Choose the Right Lender. Not all lenders offer self-build mortgages and those that do have varying terms. A mortgage broker can help you identify the most suitable lenders for your project.

- Complete the Application. With your broker’s assistance, fill out the mortgage application, providing all the required documentation about your income, credit history, and building plans.

- Follow Through with the Lender’s Requirements. Be prepared to meet additional criteria or provide extra documentation as requested by the lender.

Where Should You Apply for a Self-Build Mortgage?

When looking for a self-build mortgage, there are several lenders you can consider. Here’s a starting list, but keep in mind it’s not exhaustive:

- Ecology Building Society

- Saffron Building Society

- Earl Shilton Building Society

- Bath Building Society

- Buckinghamshire Building Society

- Darlington Building Society

- Furness Building Society

- Mansfield Building Society

- Tipton & Cosley Building Society

- Vernon Building Society

- Chorley Building Society

- Loughborough Building Society

- Newcastle Building Society

- Scottish Building Society

- Progressive Building Society

- Stafford Railway Building Society

- Beverley Building Society

- Halifax Intermediaries

To find the best mortgage for your self-build project, it’s essential to compare these options. A mortgage broker can be invaluable in this process, helping you navigate through the different offerings and pinpoint the one that best suits your project’s needs.

Interested in finding a reliable mortgage broker? Send us an enquiry, and we’ll connect you with a knowledgeable broker who can guide you through your self-build mortgage journey.

What Are the Alternatives to a Self-Build Mortgage?

If a self-build mortgage doesn’t seem right for you, there are other ways to finance your dream home. Here are some alternatives:

Government Schemes

Programs like the Help to Build initiative support self-builders. This scheme helps increase your deposit, making you more attractive to lenders.

Another option is the First Homes scheme, where first-time buyers can buy a new home at a reduced price.

Personal Loans

For smaller projects, a personal loan might be enough. It’s a straightforward way to borrow money, but it usually covers less than a mortgage.

These are short-term loans that can fund your construction. Once you finish building, you can pay back the loan by selling your old home or getting a traditional mortgage.

If you’re planning to use your property for business, like opening a shop, you could look into commercial finance options. This includes things like development finance or joint venture property development finance.

Each of these options has its pros and cons. It’s important to consider what works best for your situation and your project.

Things to Consider Before Getting a Self-Build Mortgage as a First-Time Buyer

Before you start your journey to build your first home, there are several key factors to keep in mind:

- Higher Borrowing Costs. Getting a loan for a self-build project often costs more than a standard mortgage. The interest rates and fees are usually higher due to the extra risk involved in building from scratch.

- Budget Overruns. Building your own home can sometimes be cheaper than buying, but costs can quickly escalate beyond your initial budget. If this happens, you might need to borrow more money, often at a higher interest rate.

- Penalty Fees for Early Completion. If you manage to complete your build sooner than expected and decide to remortgage for a better rate, be aware that you might face penalty fees.

- Need for Specialist Insurance. While building your home, you’ll need specific insurance to cover the construction phase. This is an additional cost to factor into your budget.

Remember, building your own home is a significant financial and personal commitment. It’s essential to weigh these considerations carefully to ensure you’re prepared for the road ahead.

The Bottom Line

Finding the right mortgage for your self-build project is a big step. You’ve learned about eligibility, how to apply, and different financing options.

The journey to getting a self-build mortgage involves lots of details – from your income and savings to planning permissions and building plans.

A key part of this journey is working with a mortgage specialist. They understand the unique challenges of self-build projects and know the ins and outs of the mortgage market.

A good specialist can guide you through the process, help you find the best deals, and ensure you meet all the lender’s requirements.

If you’re ready to start your self-build journey but want to save time and avoid stress, simply fill out this quick form. And we’ll connect you with a good mortgage broker who specialises in your situation.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

Can first-time buyers finance land purchases?

Yes, you can. As a first-time buyer, you can get a loan to buy land for your self-build project. These loans are similar to mortgages but are specifically for buying land. Remember, the interest rates might be higher compared to standard mortgages.

How does one get a planning permission for a self-build project?

To get planning permission, you need to apply to your local council. They will check your building plans to make sure they meet all the local building rules and regulations. It’s a good idea to work with an architect or planner who can help make sure your plans meet all the requirements.

You can also visit the gov. uk website to learn more.

Do you pay the mortgage while the house is being built?

With a self-build mortgage, you usually don’t pay the full mortgage amount right away. Instead, the mortgage is released in stages as the building work progresses. This means your repayments are smaller at the start and increase as more money is released for the build.

Can I get a self-build mortgage with bad credit?

Yes, but it can be more challenging. If you have bad credit, lenders may still consider you but might ask for a larger deposit and charge a higher interest rate.

The impact of your bad credit depends on its severity and how long ago it happened. There are specialist lenders for those with bad credit, and a mortgage advisor can help find the best options for you.