- What Do Joint Mortgage Lenders Look For?

- How Does Bad Credit Impact a Joint Mortgage Application?

- What Happens to a Joint Mortgage When One Applicant Has Bad Credit?

- What Happens to a Joint Mortgage When Both Applicants Have Bad Credit?

- Remortgaging a Joint Mortgage with Bad Credit

- Potential Lenders for Applicants with Bad Credit

- Understanding Mortgage Rates for Applicants with Bad Credit

- Improving Your Mortgage Approval Chances

- Key Takeaways

- The Bottom Line: Getting Help

How To Get a Joint Mortgage With One Bad Credit Applicant?

For many couples, getting a joint mortgage feels like an exciting step—finally buying a home together, creating new memories, and reaching a big milestone.

But if one of you has bad credit, that excitement can quickly turn into stress.😟

Bad credit can make things harder, leading to higher interest rates, stricter terms, or even rejection from lenders.

It’s natural to feel stuck and worry that your dream of owning a home might not happen.

But here’s the thing: bad credit doesn’t mean it’s impossible. 🙌

A joint mortgage can be a smart way to afford a home by combining your incomes to qualify for a better property.

If done right, it’s a powerful step forward. But if you rush in without a plan, it could lead to financial strain and put pressure on your relationship.

The good news? There are ways to make it work.

This guide will help you understand how lenders assess applications, why credit scores matter, and what steps you can take to improve your chances of approval—even if your credit isn’t perfect.

What Do Joint Mortgage Lenders Look For?

When applying for a joint mortgage, understanding the lender’s viewpoint can be significantly helpful.

They look at a variety of factors, and these factors contribute to the size of the mortgage you may be granted.

The list of factors includes:

- Relationship status (living together, married, family)

- Application in single or joint names

- Each applicant’s age

- Each applicant’s level of experience (first-time buyers, investors, etc.)

- Job status (employed, self-employed, contractor, etc.)

- Each applicant’s income

- The total amount of outstanding credit (if any)

The size of the deposit you can afford plays a role as well. A higher deposit usually means lower monthly repayments, which could boost your chances of getting a mortgage.

But, if your deposit is smaller, say 5%, and one applicant has bad credit, lenders might see this as a high risk. This could lead to your mortgage application being declined.

Fortunately, some lenders are willing to consider single applicants, even if they’re married. Their focus will be on whether the single applicant can manage the mortgage repayments.

Finally, it’s worth noting that joint mortgage applications are often preferred by lenders. Having two incomes instead of one brings an extra layer of stability, making the repayments more reliable.

How Does Bad Credit Impact a Joint Mortgage Application?

When you apply for a joint mortgage, lenders will run a credit check on both applicants. This helps them decide how reliable you are with managing money.

If either you or your co-applicant has bad credit, it can complicate things. Here are some common credit issues lenders might flag:

- Late or missed payments/ Arrears

- County Court Judgements (CCJs)

- Individual Voluntary Arrangements (IVAs)

- Bankruptcy

- Defaults

- Debt Management Plan (DMP)

When you apply for a joint mortgage, lenders will run a credit check on both applicants. This helps them decide how reliable you are with managing money.

Some lenders are more lenient than others. For instance, an old missed payment might not matter much to some lenders if you’ve improved your financial habits.

Others, however, could still view it as a risk. It really depends on the lender and their criteria. Here are the factors lenders look at during your application:

- The nature and seriousness of your credit problems

- The recency of these credit issues

- The causes for your credit issues (isolated or recurrent)

- The amount of debt involved

- Whether the credit issues have been addressed and settled

- The kind of credit involved (credit card, home loan, utility bill, and so forth)

Even if your co-applicant has excellent credit, their strong score won’t cancel out your bad credit. Lenders assess both applicants together.

So if your partner has bad credit, chances are, you’ll face these consequences:

- Higher interest rates due to higher perceived risk

- Lower borrowing limits, restricting the amount you can access

- Larger deposit requirements to offset the lender’s concerns

- Fewer mortgage options, with some mainstream lenders likely to decline the application

- Stricter conditions, like needing guarantors or extra documents

- Potential rejection if the credit issues are unresolved or too recent

Don’t worry though—working with a specialist mortgage advisor could help you find lenders who are more open to bad credit.

That said, mortgage approval and your options aren’t guaranteed. It will depend on how serious your credit issues are, how stable your finances are, and the specific requirements of the lender.

What Happens to a Joint Mortgage When One Applicant Has Bad Credit?

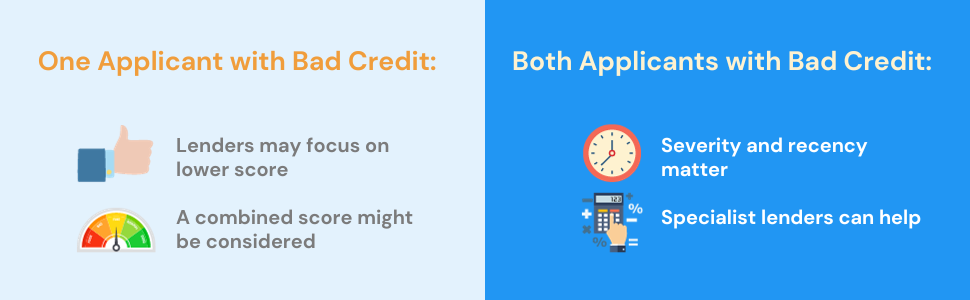

The situation becomes more complex when one applicant has a good credit score and the other has poor credit. Each lender has their way of evaluating this scenario.

Some lenders focus on the lower credit score of the two applicants when considering the application. In this case, even if one applicant has an excellent credit rating, the bad credit of the other party could potentially affect the mortgage approval or the interest rate offered.

Other lenders take a different approach. Instead of focusing solely on the lower score, they consider both credit scores to calculate a “joint score.”

This joint score takes into account both the good and bad credit, and a decision is then made based on this combined rating.

This approach may result in more favourable conditions, especially if one party has particularly strong credit.

What Happens to a Joint Mortgage When Both Applicants Have Bad Credit?

The complexities increase when both applicants have a history of poor credit. Factors such as the severity of the credit issues and their recency come into play.

For example, minor credit issues from a few years ago may not carry as much weight as more recent or severe incidents, such as bankruptcy or repossession.

In such cases, turning to specialist lenders may be a viable option. These professionals work with a range of mortgage products designed specifically for people with bad credit histories.

They assess the unique circumstances of each application and can provide solutions tailored to meet these specific needs.

Remortgaging a Joint Mortgage with Bad Credit

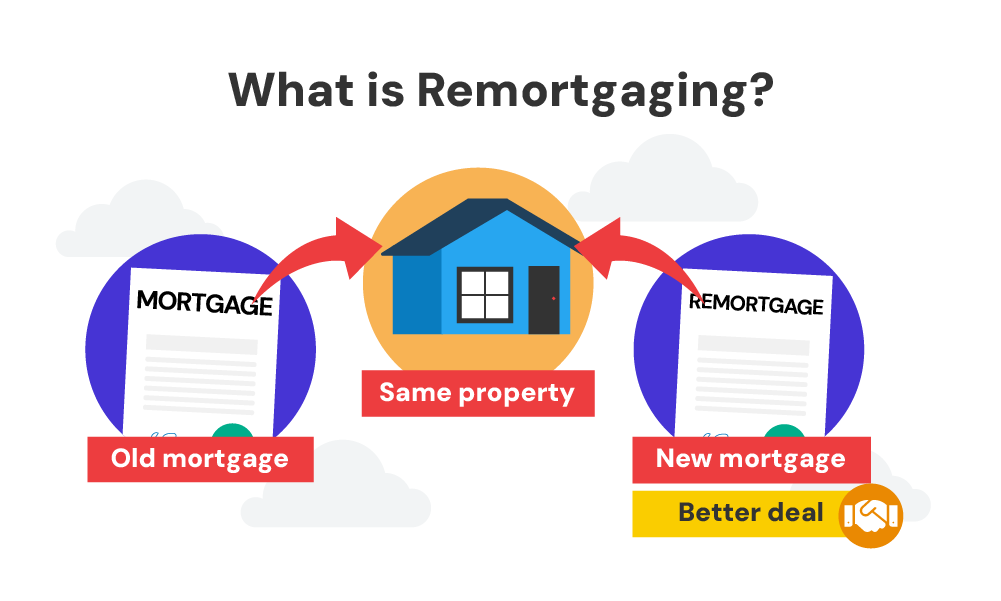

Remortgaging can help you adjust your loan terms or find lower interest rates. But if your credit isn’t in good shape, it might make the process more challenging and come with some downsides.

Lenders will check your credit history when you apply. If you or your co-borrower have bad credit, it could limit your chances of getting better terms, like lower rates, and might lead to higher costs.

Remortgaging can also involve fees or penalties that might cancel out the benefits, depending on your situation.

There are lenders who work with borrowers with poor credit and may offer options that suit your needs better.

Still, there’s no guarantee you’ll find a suitable deal. Your financial situation, the lender’s criteria, and your credit history will all play a part in what’s available.

Remortgaging could help improve your mortgage, but it’s important to weigh the benefits against risks like higher rates or fees.

Getting advice from a mortgage expert can help you decide if it’s the right move for you.

Potential Lenders for Applicants with Bad Credit

If you have bad credit, the pool of lenders willing to offer you a mortgage might be smaller. But, a few might be willing to consider your application, depending on your specific credit issues.

As of October 2023, the following lenders could potentially assist:

- Nationwide Building Society might consider you if your County Court Judgements (CCJs) are more than a year old. But, they might not if you have an active debt management plan.

- HSBC could be an option if you have previously declared bankruptcy but have been discharged for over three years.

- NatWest may be willing to work with you if your property was repossessed more than six years ago. But, your credit score and bank account behaviour will be considered.

- Leeds Building Society could potentially assist if you have a current debt management plan in place, especially if it was a one-off incident and you meet other criteria.

- Barclays might be willing to accept you if you have had a previous Individual Voluntary Arrangement (IVA) that was satisfied over six years ago.

As you can see, several mainstream lenders might consider applicants with past credit issues. But, these issues should ideally be a few years old.

If your credit problems are more recent, you’ll likely need to explore specialist options. You might also benefit from the support of an experienced broker who specialises in arranging mortgages under such circumstances.

Understanding Mortgage Rates for Applicants with Bad Credit

Let’s be honest—having bad credit can mean higher mortgage rates. Lenders see poor credit as a risk, and this often leads to higher costs for you.

That said, it’s not all bad news. There are mortgage deals out there for people with bad credit, but they can vary a lot.

Taking the time to compare your options and explore what’s available can make a big difference.

Improving Your Mortgage Approval Chances

Even with a poor credit history, there are steps you can take to increase your chances of securing a joint mortgage. Here are some practical tips:

- Take a look at your credit reports. It’s good to regularly keep an eye on your credit reports. This helps you understand your credit status and spot any errors. Various services can help you do this for free.

- Work on lowering your debts. If you can, try to pay off what you owe. This could boost your credit score and make lenders see you as a safer bet.

- Put aside a bigger deposit. If you can save up a bigger deposit, it could balance out your bad credit. This could lessen the risk for the lender.

- Think about a guarantor. A guarantor mortgage lets a third person, often a family member, promise to cover the mortgage payments if you can’t.

- Get advice from a pro. A skilled mortgage broker can point you towards lenders more likely to say yes to your application. They can also haggle for better terms for you.

Key Takeaways

- Getting a joint mortgage is easier if both applicants have good credit, but bad credit from one or both applicants can lead to stricter rules, fewer lender options, and higher interest rates.

- Lenders consider factors like credit scores, income, deposit size, and the type of credit issues (e.g., missed payments, defaults). Recent or severe problems make approval harder, but older or resolved issues may have less impact.

- Saving for a bigger deposit, paying off debts, and checking your credit report for errors can improve your chances. Adding a guarantor may also help.

- A specialist broker can guide you to lenders open to bad credit cases, but approval isn’t guaranteed, and terms may still be less favourable.

The Bottom Line: Getting Help

Securing a joint mortgage with bad credit may seem like a tough challenge, but with the right support, it’s far from impossible.

An experienced broker can be invaluable in these scenarios. Not only can they provide specialist advice, but they can guide you towards lenders that are most likely to approve your application, helping to reduce stress and save time.

Plus, they might be able to secure better rates than you would alone. Don’t hesitate to reach out. We can link you with a good broker who can help you solve your dilemma about getting joint mortgages with bad credit.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

Can I get a joint mortgage with an IVA?

Yes, but it can be more challenging. An Individual Voluntary Agreement (IVA) is viewed as serious adverse credit. Some lenders may decline your application outright, while others could consider it depending on factors like the deposit size and the age of the IVA.

Will my bad credit affect my partner buying a house?

If your partner is applying for a mortgage alone, your credit history won’t be considered. But, if you apply jointly, lenders will examine both credit histories, and your bad credit could influence their decision.

Whose credit score is used on a joint mortgage in the UK?

In the UK, lenders will review the credit histories of both applicants on a joint mortgage. Depending on the lender, they may base their decision on the lower of the two scores, or they may calculate a joint score.

Can I secure a mortgage with poor credit but a strong income?

Yes, it’s possible. While a bad credit history can make it harder, a strong income is a positive factor that lenders consider. This could help offset the impact of your poor credit history.

Can I buy a house using someone else's credit?

While you can’t use someone else’s credit to buy a house in your name, you can apply for a joint mortgage or use a guarantor, both of which involve the other person’s credit being taken into account.

What happens to a joint mortgage if one person defaults?

If one person defaults on a joint mortgage, the other person is still responsible for the full mortgage payment. Failure to meet these payments can lead to the lender repossessing the property.

What credit score do you need for a joint mortgage?

The required credit score can vary significantly between lenders. Some may accept scores as low as 580, while others might require a score of 680 or above. An experienced broker can provide guidance based on your circumstances.

This article has been fact checked

This article was created, checked, and verified by the expert team at Money Saving Guru. Trust us, you’re in good hands.