How Do Bridging Loans Work for Mortgage Success?

Stuck in property limbo? Maybe you’ve found your dream home but haven’t yet sold your current one. Or perhaps you’re an investor eyeing a lucrative property deal that won’t wait for traditional mortgage approvals.

These are the make-or-break moments where the right financial move can set you on a path to success. Bridging loans could be that crucial stepping stone.

In this guide, we’re diving deep into bridging loans and mortgages—how they differ, how they work together, and when you should consider one over the other.

What is a Bridging Mortgage?

A bridging mortgage is not a type of mortgage in its own right. It is a term used to describe a type of financing that allows you to purchase a new home before you have sold your existing home.

Bridging mortgages are typically short-term loans, and they are repaid when you sell your existing home or obtain a long-term mortgage on your new home.

Bridging mortgages can be a complex financial product, but they can be a good option for borrowers who need to move quickly or who are unable to qualify for a traditional mortgage.

If you are considering using a bridging mortgage, it is important to speak to a good mortgage advisor to discuss your needs and to understand the risks and benefits involved.

When is a Bridging Loan Most Useful?

Here are the situations where a bridging loan typically comes into play:

Property Auctions

If you’re buying a property at auction, you’re usually required to pay the full amount within 28 days of winning the bid.

Traditional mortgages often can’t meet these tight deadlines due to their longer processing times. Bridging loans are an excellent alternative because they can be arranged far more quickly.

What’s the catch?

While bridging loans are quicker to secure, they also come with higher interest rates than traditional mortgages. However, if you plan to switch to a regular mortgage soon after, this can help you mitigate the costs.

Breaking a Property Chain

Have you found a new home but are still waiting for your current property to sell? If the sale takes longer than you anticipated, a bridging loan can provide the funds you need to continue with the new home purchase.

How does it work? The bridging loan serves as a temporary mortgage for the new property. Once your current home sells, you use the proceeds to pay off the bridging loan.

The clear advantage is that you don’t have to wait to move into your new home.

Developing a Buy-to-Let Property

Imagine finding a property that needs some work but has great potential for generating rental income. A lack of upfront capital for renovations doesn’t have to be a deal-breaker.

A bridging loan can offer you the financial flexibility to secure the property and begin necessary improvements. The quick availability of funds gives you a competitive edge, enabling you to proceed with the purchase before someone else snaps it up.

>> More about Bridging Loans in Property Development

Bridge-to-Let Agreements

Bridging loans not only finance your property purchase and renovations but also sets the stage for a future buy-to-let mortgage. Often termed bridge-to-let applications, these dual-purpose financial solutions offer a deal in principle while arranging the bridging loan.

It’s crucial to note that borrowers must meet the lender’s standard buy-to-let mortgage criteria for a seamless transition.

For Short-term Flips

If you aim to acquire, refurbish, and flip a property, then bridging loans offer a quick financial route. Mortgages, with their long-term commitment, might not be suitable here.

Instead, a bridging loan swiftly covers your purchasing and renovation costs, with the eventual property sale acting as your exit strategy.

To Borrow Against Increased Property Value

Bridging loans can offer the quick capital required for property improvements. These loans can be either a first or second charge, depending on your financial standing and the property involved.

Once you’ve elevated the property’s worth, a remortgage against this new value becomes your exit strategy. This strategy is particularly useful if other borrowing avenues, like secured loans, have turned you down.

To Buy an ‘Unmortgageable’ Property

While most lenders shun uninhabitable properties, bridging loans revel in such challenges. These loans are ideal for acquiring and renovating properties that are little more than empty shells.

Your loan approval largely depends on the credibility of your redevelopment plans and your experience in similar projects.

When You’ve Been Turned Down for a Mortgage

Suppose you’ve been declined for a traditional mortgage. In that case, a bridging loan might offer a temporary financial solution, especially if you’re expecting an income or credit score improvement shortly.

Bridging loans essentially ‘bridge’ the financial gap until you become mortgage-eligible.

Other Quick Sale Scenarios

Bridging loans shine when time-sensitive matters are at play.

For instance, if you’re involved in a self-build project that requires immediate financing or are looking to purchase a home abroad, bridging loans can be a godsend.

These loans also assist in urgent relocations due to personal circumstances, like a family illness.

However, be cautious when relying on bridging loans for projects that may face delays. You must be confident in your ability to repay the loan under unexpected circumstances.

Pro Tip

Before taking out a bridging loan, know how you’ll pay it back. Whether it’s selling a property or switching to a standard mortgage, a clear exit strategy can save you money and stress.

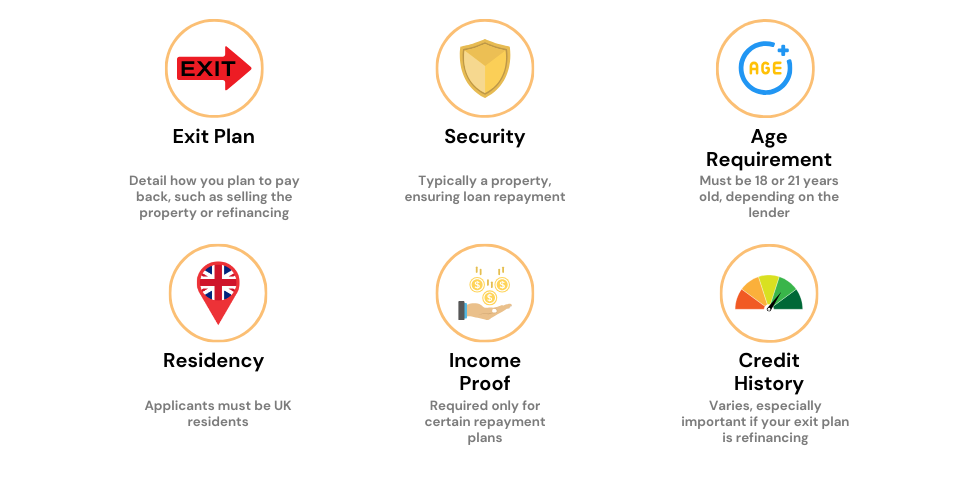

What You Need to Know to Qualify for a Bridging Loan

If you’re considering getting a bridging loan for your next property deal, the first thing you’ll want to do is make sure you meet the lender’s criteria. Each lender is different, but most will consider a few key factors.

Your Exit Plan Matters

Exit strategy isn’t just a formality; it’s vital.

Most commonly, you’ll either sell the property or remortgage it to pay off the loan.

Be prepared, as lenders often request documented evidence, like an agreement in principle, to support your strategy.

Unconventional exit plans, like using investments or an inheritance to pay back the loan, are sometimes acceptable too.

However, in such cases, lenders may charge interest daily instead of monthly. Solid proof is essential here as well.

Credit Score Counts

Don’t fret if you don’t have a sparkling credit history.

Some bridging loan providers are more lenient. However, bear in mind that a healthier credit score generally leads to more favourable terms.

If your exit plan involves a bad credit remortgage, underwriters could be cautious. They may also consider any further risks of credit deterioration during the loan term.

Your Property Is Your Collateral

Your collateral, usually the property in question, can be a deciding factor in your loan approval. Factors like location, construction type, and even whether it’s a freehold or leasehold property can affect its valuation.

The lender assesses how quickly and easily the property can be sold, especially if that’s your exit strategy.

Property Development Experience

Having experience in property development isn’t essential, but it can give you an edge.

Some lenders specialise in helping those without any development experience. However, if you do have a track record in property, you’re likely to secure a loan at more competitive rates.

How Much Should You Deposit?

In most instances, the lender will ask for a deposit ranging between 30-35% of the property’s value.

Low-risk borrowers may even qualify for a maximum Loan-to-Value (LTV) of 70-75%. If you’re perceived as high-risk, you may need to settle for a lower LTV.

Exceptionally, some lenders offer up to 80-100% LTV but will require additional assets as security. Keep in mind that separate valuation assessments, sometimes at your cost, are necessary for each security property or asset involved.

How Much Can You Borrow?

The amount you can borrow ranges from £5,000 to a mind-blowing £25 million. It depends on how much your property is worth and your financial situation.

Generally, lenders will let you borrow up to 75% of your property’s value. If it’s a first-charge loan, you might even get more.

To get a better grasp of your potential loan repayments, use the calculator provided below.

[Embedded Bridging Loans Calculator]

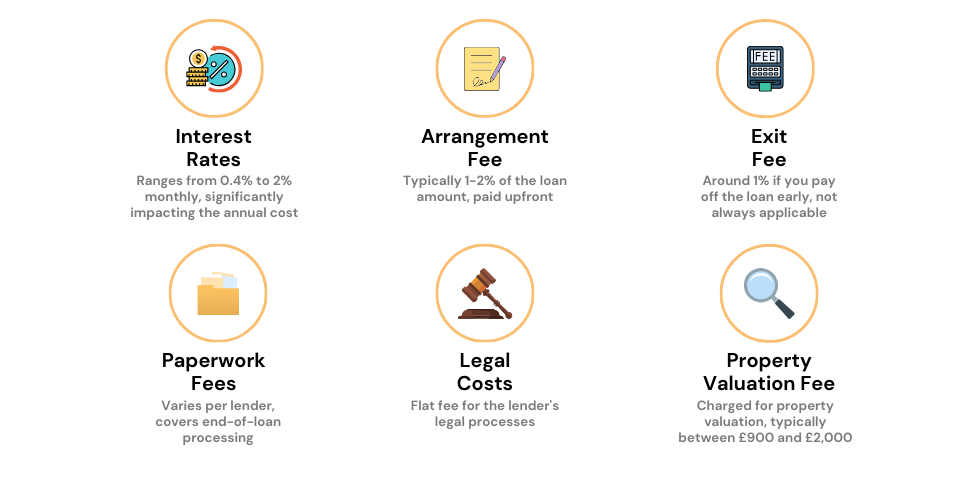

What’s the Real Cost of a Bridging Loan?

Before you jump in, it’s crucial to understand the true cost of a bridging loan. (Spoiler alert: they’re not cheap.)

Watch Those Interest Rates

Interest rates for bridging loans are steep, often charged every month. You might see rates as low as 0.4% a month, but don’t be deceived.

When compounded, a 1% monthly rate becomes an APR of 12.7%, and a 2% monthly rate skyrockets to an eye-watering 26.8% APR. So, always double-check the APR to grasp the real cost.

In addition, some lenders offer you the luxury to defer your interest payments to the end of the loan term. It might sound like a dream, but hold your horses. The longer you delay these payments, the more it’ll cost you in accumulated interest.

Extra Fees to Keep an Eye On

- Arrangement Fee – Pay this upfront; it’s usually around 1-2% of the loan amount.

- Exit Fee – Fancy paying off early? Some, not all, lenders charge a 1% fee for the privilege. Always delve into the fine print.

- Paperwork Fees – Once you’ve settled the loan, you’re not off the hook. These admin costs can vary, so consult your lender for specifics.

- Legal Fees – A set fee for legalities. No escaping this one.

- Property Valuation Fee – Expect to shell out between £900 and £2000 for a property survey.

And don’t forget, some lenders toss in extra fees, hiding them in the fine print. So, never underestimate the power of asking questions and thorough reading.

To sum it up, bridging loans have high rates and multiple fees. Always read the fine print and don’t hesitate to pose questions to know exactly what you’re committing to.

How to Get a Bridging Loan?

If you’re thinking about a bridging loan, the application can get a bit complicated. But don’t worry, we’re here to help.

Talk to a Broker Right Away

Many people think of talking to a broker as a last step, but it’s better to start with one. Brokers are loan experts.

They know what each lender wants and can help you plan your loan application. Trust us, chatting with a broker at the start can save you time and cash.

Here’s what a broker can do for you:

- Check Your Money Situation – Review your income, and debts, and figure out how much you can borrow.

- Get Your Paperwork Ready – Gather all the papers you’ll need, like ID, proof of where you live, and bank statements.

- Plan Your Payback – Outline how you’ll pay back the loan, whether it’s by selling a property or some other way.

- Find the Right Lenders – A broker can match you up with lenders that fit your financial needs.

- Learn About Costs – Find out what fees and interest rates you’ll have to pay so there are no surprises.

- Know the Rules – Understand what lenders want so you can boost your chances of getting approved.

- Decide How Much to Borrow – Your broker can help you figure out the smartest amount to borrow based on your finances.

Spot Potential Hurdles

While you’re getting ready, look for any issues that could hurt your application, like a low credit score or not having enough money upfront. Your broker can help you sort these issues out.

Before taking the plunge, it’s crucial to familiarise yourself with all legal and financial aspects. Your broker is an ideal person for this discussion, as is a legal advisor if you have one.

Once you’re confident, set up a final review session with your broker, who can then guide you towards lenders likely to approve your loan application.

Other Choices to Consider

A bridging loan can be a quick fix for short-term money needs, but don’t forget there are other options out there for you.

Remortgaging your home can free up some extra cash. But slow down—this is a big, long-term decision.

You have to think about how changes in interest rates could mess up your budget. If you’re not sure, talking to an expert is a smart move.

Switching your current mortgage to a buy-to-let mortgage is another choice. This lets you use your home’s value to buy a different property while renting out your first home.

But be careful—what happens if you can’t find renters? Or if interest rates shoot up and you’re stuck with two expensive mortgages? If you’re having any doubts, get professional advice.

These loans often offer better interest rates and let you borrow more money compared to personal loans.

But watch out—just like with bridging loans, you could lose your property if you don’t make payments on time.

Personal Loans

You might only need a small amount of money, like £25,000. In that case, a personal loan could be your best option.

Interest rates are usually charged yearly, not monthly, which might save you money in the end. Also, these loans are not tied to your home, so it stays safe.

Mortgages

Perhaps you’re in the market for something more stable and long-term. A traditional mortgage could offer you that security. With a variety of loan terms and interest rates, it often provides a more cost-effective route for property acquisition.

Pro Tip

If you’re still on the fence between a mortgage and a bridging loan, consider your timeline and risk appetite.

Mortgages are generally more cost-effective but can be time-consuming to secure. Bridging loans are quicker but come with higher interest rates.

So, ask yourself—do you need funds right now, or can you afford to wait?

As one financial guru puts it: Speed is expensive, but sometimes necessary. Know your situation well.

The Bottom Line

You’ve weighed your options—from the fast but expensive bridging loans to more stable, long-term mortgages and everything in between.

But no matter which route you decide to go down, the guidance of a skilled broker is invaluable.

They’re not just a facilitator but a strategic advisor, particularly if you’re dealing with:

- Complex property ventures

- Unique or non-traditional properties

- Troublesome credit history

- High Loan-To-Value (LTV) needs

- Second or third charge loan considerations

Your safest bet for investing in UK property with a bridging loan is to go through a broker who knows this type of mortgage inside and out. This gives you a leg up in finding the best possible deals you qualify for.

Opting for a bridging loan in the UK is made easier when guided by a specialised broker, ensuring you get deals tailored to your situation.

If expert advice is what you’re after, feel free to reach out. We can link you up with knowledgeable bridging finance advisors who will guide you through each step.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

Is a bridging loan a good idea?

Bridging loans are specialised financing tools often viewed as a last resort. They’re most commonly utilised by seasoned investors. Before opting for this type of loan, it’s advisable to consult with an expert broker to discuss other potential options that may be a better fit for you.

Who offers bridging loans?

In the wake of the 2008 financial crisis, mainstream banks like Nationwide, Halifax, and Santander mostly ceased offering bridging loans.

Nowadays, alternative financial institutions like United Trust Bank, Precise Mortgages, and MT Finance provide such loans. Lloyds Bank continues to offer them, but only to their private banking clientele.

What is the typical repayment time for a bridging loan?

Generally, bridging loans require repayment within a short time frame, often within a year. However, the terms can be adjusted to accommodate your financial circumstances.

How do bridging loan payments work?

Payment methods for bridging loans differ. You might have a monthly interest payment or ‘rolled up’ interest that is paid along with the loan principal at the end.

Another option is ‘retained’ interest, where the interest is borrowed upfront and any unused portion is returned upon loan repayment.

Are bridging loans more expensive than mortgages?

Indeed, bridging loans usually carry higher costs than standard mortgages. However, they offer the advantage of flexibility and can be instrumental in closing a property deal.

To get a better grasp of the expenses involved, you can use our Bridging Loan Calculator.

What does development bridging finance mean?

Development bridging finance is a short-term lending option geared towards those in need of immediate funding. It’s commonly used in the realm of property development as a stop-gap measure while awaiting more permanent financial arrangements.