- Are There Tailor-Made Bridging Loans for Property Development?

- How Much Will It Cost You?

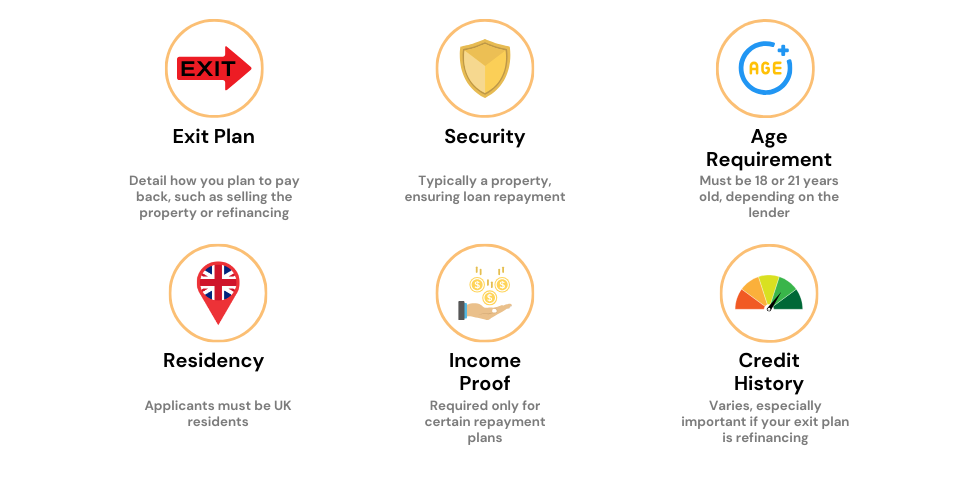

- Eligibility: What You Need To Secure Bridging Finance

- Is Bridging Finance Right for Your Project?

- 6 Tips for Getting a Bridging Loan for Property Development

- How Do Bridging Loans Work for Land Development?

- Can You Use Bridging Finance for Property Renovation?

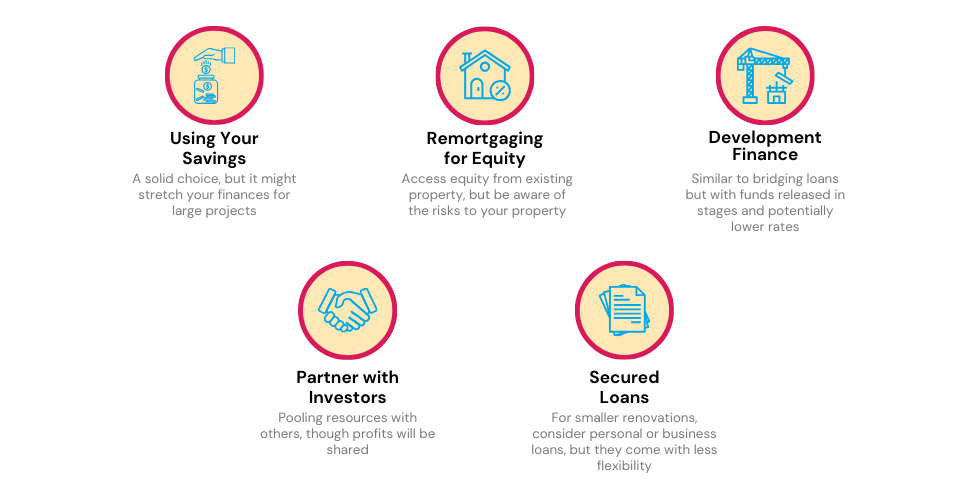

- Exploring Alternatives

- The Bottom Line

Seize the Moment: Bridging Loans in Property Development

When it comes to seizing opportunities, timing is key.

Development bridging finance provides quick funding to keep your plans in motion, whether you need as little as £10,000 or a much larger sum.

There’s no set borrowing limit. But be cautious: quick and accessible funding comes with its own set of risks and costs.

This article will guide you in determining if a bridging loan is the right fit for your project, explore other financial options, and explain how consulting a broker could save you a significant amount of money.

Are There Tailor-Made Bridging Loans for Property Development?

Not exactly. Bridging loans are like versatile tools in your financial toolbox, capable of tackling various tasks. But here’s the twist – when you apply for one, you’ll need to specify what you’re planning to use it for.

While there’s no one-size-fits-all bridging loan for property development, certain lenders have honed their expertise in different aspects of bridging finance. Finding the right lender for your unique situation is the key.

How Much Will It Cost You?

The amount you can borrow isn’t set in stone. It could be as low as £5,000 or go all the way up to a staggering £25 million.

Two things influence this: how much your property is worth and your financial situation.

Lenders will usually loan up to 75% of your property’s value. In special cases, especially if this loan is your primary loan against the property, you could qualify for even more.

To get an idea about how much the loan will set you back each month and in total, use our handy calculator.

Eligibility: What You Need To Secure Bridging Finance

Bridging finance takes a different path compared to mortgages, with most lenders prioritising the property and your business plan over your finances.

When you’re ready to apply, remember that your application will be evaluated on a case-by-case basis. However, there are some key factors you should keep in mind before taking the plunge.

Exit Strategy

To secure a bridging loan, you’ve got to show them your game plan. That means a clear development strategy and a solid exit plan to settle the loan when the time comes.

Some common exit strategies include:

- Selling the completed units

- Remortgaging (sometimes with an agreement in principle)

- Remortgaging to a buy-to-let mortgage with the same provider (often called a bridge-to-let)

Deposit Requirements

The amount you can borrow depends on your deposit:

- A deposit of 40% or more opens the door to a wide range of lenders and better rates.

- If you have less than 30%, your options narrow, and your rates climb.

But here’s the twist: if you have other assets to secure the loan against, you can potentially borrow up to 100%. These assets can include other properties, cars, jewellery, or gemstones. However, this 100% option is often reserved for experienced developers.

For commercial properties like restaurants, hotels, B&Bs, or petrol stations, which are considered higher risk, the maximum Loan-to-Value (LTV) ratio may be capped at 50%. To secure the best rates for such deals, you’ll want to work with specialist lenders experienced in these areas.

Development Experience

Having a track record in property development is a major plus. It gives lenders confidence.

Show evidence of your previous successful projects, and you’ll boost your chances of approval, possibly securing a higher LTV or lower rates.

However, if you’re new to development, it’s essential to find a lender who understands your situation. In this case, partnering with an experienced developer can strengthen your application.

If your goal is to develop commercial property for rental purposes, lenders will typically want to see a viable business plan that aligns with their risk assessment.

Credit Counts

Bad credit isn’t necessarily a deal-breaker, but it’s worth noting. A strong exit strategy can often put lenders at ease.

However, if your loan repayment relies on securing a mortgage, a history of poor credit might raise concerns for some providers.

Also, if you’re going for a high LTV or your application has other high-risk elements, your choice of lenders might be limited, and the rates offered could be higher.

Your Financial Snapshot

While bridging loan lenders place more emphasis on the property and your plans, some may want a glimpse into your current financial situation to feel confident in your ability to repay the loan.

For instance, even if you have no personal income, lenders will want to know how you intend to finance the development.

Is Bridging Finance Right for Your Project?

Bridging finance can be a game-changer, but it’s not a one-size-fits-all solution. Below, we break down the situations where bridging finance shines and where you should proceed with caution.

Pros

- You spot a golden investment opportunity and need quick cash.

- You’re preparing to snag a property at an auction.

- You own land with planning permission but lack the start-up funds.

- You’re running low on cash mid-project and need an influx to finish up.

- You’ve amassed various financing options and need to streamline costs.

- You’re laying out plans for a self-build home.

- You’re aiming to renovate distressed properties for a quick flip.

Cons

- High interest rates can take a bite out of your profits.

- Short repayment timelines put you under pressure.

- Defaulting risks the forfeiture of your property.

- Additional and sometimes hidden fees could inflate costs.

- A robust exit strategy is mandatory to avoid late fees or defaults.

- Lenders might have less oversight, increasing your risk.

- Mismanagement could trap you in a costly cycle of debt.

6 Tips for Getting a Bridging Loan for Property Development

Here’s your step-by-step guide to increasing your likelihood of loan approval:

- Develop Your Business Plan – Know what you need and how much you want to borrow.

- Set Your Exit Strategy and Timeline – Plan how and when you’ll repay the loan.

- List Your Assets – Keep an inventory ready in case you need additional collateral.

- Compile Your Success Stories – Have a portfolio of your past successful projects to show.

- Be Open and Inquisitive – Flexibility is key in bridging finance, so ask questions and explore different loan structures.

- Seek Expert Advice – Consult with a knowledgeable bridging finance broker for tailored guidance.

Remember, you usually don’t have to worry about upfront payments. Most of the time, interest is added to your loan, and you only start repayments after your project is completed.

How Do Bridging Loans Work for Land Development?

Bridging loans typically cover land without existing structures, although not every lender caters to this specific need.

You can buy land with or without planning permission, but lenders usually favour land that already has planning. Because few lenders specialise in this area, it’s crucial to find the right one to avoid high costs.

Interest rates tend to be higher for land development bridging loans than for property loans. This is because land sells less quickly, making fast sales uncertain. However, if the land is in a prime location, you might secure a better rate.

Can You Use Bridging Finance for Property Renovation?

Yes, you can. Bridging finance is often the go-to option for developers eyeing a property in need of a facelift. Here’s why:

Bridging finance provides quick access to cash, sometimes within a matter of hours. This allows you to snap up properties in poor condition that a standard mortgage wouldn’t cover. We’re talking about properties lacking essentials like kitchens, bathrooms, or even running water.

Moreover, bridging finance is handy for securing properties that don’t meet traditional mortgage criteria. These could be non-standard builds or properties facing unique challenges.

If you plan to repurpose a property, bridging finance can help you lock in the site.

Typically, you’d use the bridging loan to elevate the property to a mortgageable standard. Once you’ve done that, you can remortgage through various options, including:

- Buy to Let Mortgage

- Buy to Sell Mortgage

- Standard Mortgage

- Commercial Mortgage

But there’s a caveat: As you make progress, the property’s value might dip temporarily, especially if you’re removing major structural elements like walls.

Such fluctuations make mainstream lenders wary. In most situations, you’ll need to consult a specialist lender familiar with these unique challenges.

Exploring Alternatives

Before diving into bridging loans, it’s wise to explore alternatives:

Your Savings

Using your savings can be a solid choice, but it might leave you financially stretched if the project requires a substantial portion of your nest egg.

If you have an existing property, you might consider remortgaging it to access equity for your development project. While interest rates are typically lower than bridging finance, you’ll need enough equity to cover the required amount.

Be cautious, as this puts your existing property at risk if you can’t meet the payments. Remortgage applications can take weeks to approve, and some lenders may hesitate to lend for certain development projects.

This option operates somewhat like a bridging loan but releases funds in stages as your project advances. Interest rates are usually lower, but some providers may charge to reevaluate the property before each tranche, which can increase costs.

Keep in mind that development finance tends to have longer application timelines and less flexibility compared to bridging finance.

Partnering with Investors

Team up with others to pool resources. However, remember that profits will be divided based on your investment level, so crunch the numbers first.

If your project promises significant returns, the borrowing costs of going solo might be outweighed by the potential gains.

Loans

For lighter refurbishments on existing properties, business loans, secured loans, or personal loans could be an option. Be aware that these types of loans are less flexible, and you’ll need to demonstrate your ability to make regular payments.

Loans might also come with early repayment fees, potentially increasing the overall cost. Expect a longer securing process due to additional checks.

The Bottom Line

Choosing development bridging finance is a big step. The speedy access to cash is appealing, especially when every moment counts. But ask yourself: is this the right finance option for me?

Remember, these loans often come with higher interest rates. You also need a clear exit strategy for paying it back. So, weigh the costs carefully.

If it all sounds complicated, seek expert advice. A specialised broker can break down the terms and guide you through your options, saving you both time and money.

Ready to move forward? Fill out this form. We’ll connect you with a broker who can fast-track the process and find you the best deal.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

What is development bridging finance?

Development bridging finance is a short-term loan option for people who need quick funds. It’s often used in property development to cover costs while waiting for long-term financing to come through.

Can a limited company get a bridging loan?

Yes, both individuals and limited companies can get bridging loans. Even if you’re a foreign national or an overseas company, you can get a loan if you pass the due diligence checks.

How do bridging loans benefit property developers?

Bridging loans are super helpful for property developers. They can help you buy a new site that still needs planning permission, or fund a smaller project like a property conversion. They’re also good for remortgaging while you’re waiting for your completed projects to sell.