- What Is a Buy-to-Let Mortgage and How Does It Work?

- Can You Get a Mortgage with Bad Credit in the UK?

- How Does Bad Credit Affect Buy-to-Let Mortgages?

- What Interest Rates Should I Expect?

- How Much Deposit Do I Need?

- Are There No Credit Check With Buy-To-Let Mortgages?

- How to Get a Buy-to-Let Mortgage with Bad Credit

- Who Offers Buy-To-Let Mortgage With Bad Credit?

- Can You Remortgage A Buy-To-Let Even With Bad Credit?

- Key Takeaways

- The Bottom Line

How To Get Buy To Let Mortgages with Bad Credit?

Are you looking into the UK’s buy-to-let mortgage market? If yes, you’re in good company.

Many are turning to property investment as a way to build wealth. But, what if your credit score isn’t perfect? Don’t worry.

This guide explains how you can still secure a buy-to-let mortgage, even with bad credit.

What Is a Buy-to-Let Mortgage and How Does It Work?

A buy-to-let mortgage is for those who want to invest in property to rent out. It’s different from a standard mortgage, which is for a home you plan to live in.

The biggest difference? For a buy-to-let, lenders look at potential rental income, not just your salary. This could be good news if you’re aiming to invest in property but have bad credit.

Can You Get a Mortgage with Bad Credit in the UK?

You might be able to get a mortgage with bad credit in the UK, but it’s not always straightforward.

Credit scores play a big role in mortgage decisions, as they show lenders how you’ve managed loans and debts in the past.

With bad credit, lenders may see you as a higher risk and worry about your ability to keep up with payments.

This often means stricter terms, higher interest rates, and closer scrutiny of your application.

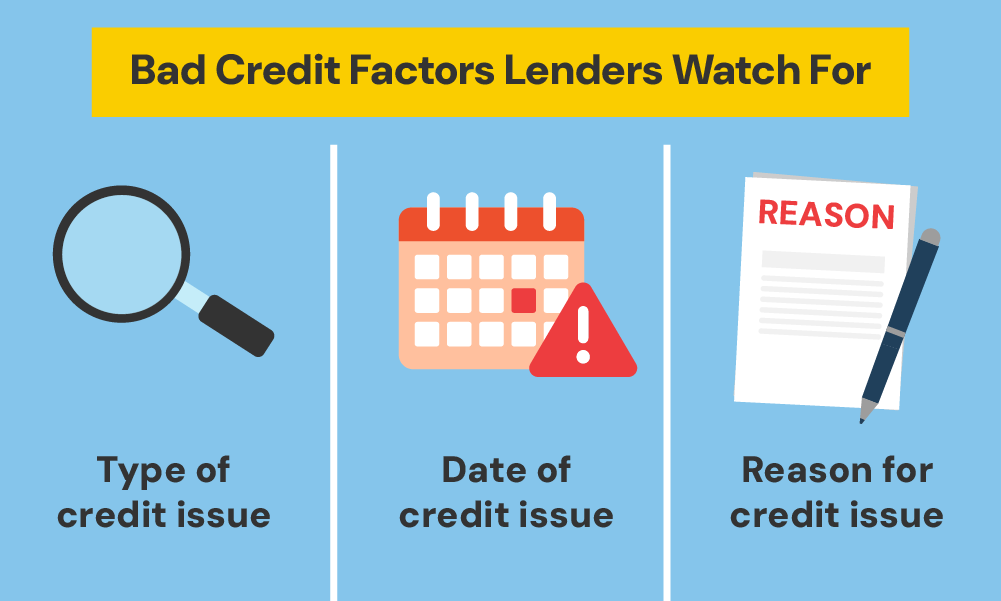

When you apply, lenders will typically look at:

- The type of credit issue you’ve had.

- How serious it was and when it happened.

- The reason for your poor credit.

Beyond this, they will consider your income, outgoing, age, employment, and property type.

With buy-to-let mortgages, your lender will also assess if your rental income can cover at least 125% to 145% of the mortgage payments.

Each lender has different rules on what counts as ‘bad credit’. You can check your credit report for free in the following credit agencies: Experian, Equifax, and TransUnion.

A specialist mortgage broker can be helpful in finding lenders who are more open to working with people in your situation.

But, even with a broker’s help, there’s no guarantee you’ll secure a mortgage. It all depends on your finances, how well you meet the lender’s criteria, and what options are available at the time.

While bad credit can make things trickier, it doesn’t mean it’s impossible.

Many people in similar situations have found success, but it’s important to be prepared for the challenges.

How Does Bad Credit Affect Buy-to-Let Mortgages?

Here’s how each type of credit issue affects your chance for a buy-to-let mortgage:

| Type of Credit Issue | Severity | Impact on a Buy-To-Let Mortgage |

|---|---|---|

| No Credit History | Low | May face challenges due to a lack of borrowing history, but not insurmountable. |

| Late and Missed Payments | Low to Moderate | Might lead to slightly stricter terms, but many lenders still consider them. |

| Mortgage Arrears | Moderate | Can limit options and lead to more stringent terms, especially recent arrears. |

| Debt Management Plans (DMPs) | Moderate | With fewer lending options available, terms may be more restrictive. |

| Defaults | High | Significantly limits lender options, expect higher interest rates. |

| County Court Judgements (CCJs) | High | Severely restricts lending options, stringent terms likely. |

| Individual Voluntary Arrangements (IVA) | High | Very limited lending options may need specialist lenders. |

| Bankruptcy | High | Few lenders consider terms will be strict, significant deposit is required. |

| Repossession | High | Most severe impact, very few lenders willing to consider, strictest terms. |

Working with a specialist mortgage broker can help you find lenders open to accepting your application despite your bad credit. This improves your chances of securing the right mortgage deal and entering the property investment market.

What Interest Rates Should I Expect?

For a buy-to-let mortgage, the interest rates are generally higher than those for residential mortgages.

If you have bad credit, expect these rates to be even higher. Lenders view bad credit as an increased risk and raise rates to compensate.

It’s wise to shop around or consult a broker to find the best possible rate.

Keep in mind, even a slight difference in the interest rate can significantly affect your monthly payments and the total cost over time.

How Much Deposit Do I Need?

Buy-to-let mortgage lenders usually offer at least 75% loan-to-value (LTV)–the amount you borrow compared to the property value you’re buying.

This means you need to cover at least 25% of the property price. But, if you have bad credit, lenders might ask around 30% or more.

This is because they see you as a higher risk. A larger deposit helps reduce that risk from their perspective.

So, with a shaky credit history, be prepared to put down more upfront to secure your mortgage.

Are There No Credit Check With Buy-To-Let Mortgages?

No credit check buy-to-let mortgages are pretty rare. Most of the time, lenders will want to look at your credit history, even if they say they don’t focus on credit scores.

Some lenders might be more flexible and not weigh your credit score as heavily, but they’ll still check your financial past.

Going for these less usual options might come with higher costs and risks, so it’s good to be careful.

How to Get a Buy-to-Let Mortgage with Bad Credit

The application process for a buy-to-let mortgage is the same, but with bad credit, your best bet is to work with a mortgage broker. Here’s how they can assist:

- They’ll review your credit report with you, pointing out areas that need work.

- Brokers understand what lenders are looking for and can advise you on how to improve your appeal.

- They’ll calculate your rental yield to show the potential income from the property, making your application stronger.

- Brokers have access to deals that you might not find on your own, especially those suited for people with bad credit.

- They can negotiate with lenders on your behalf, often securing better terms or rates.

- A broker can save you time by handling most of the paperwork and liaising with lenders.

- They provide personalised advice, tailoring their services to your specific financial situation.

If bad credit has been holding you back, remember, it doesn’t have to derail your investment dreams. Many have found success before you, and with the right approach, you can too.

Who Offers Buy-To-Let Mortgage With Bad Credit?

Several lenders offer buy-to-let mortgages despite bad credit. Here are some:

- Foundation Home Loans

- Hampshire Trust Bank

- Interbay

- Kensington

- Kent Reliance BS

- Keystone

- Landbay

- Lend Invest

- Lend Co

- MFS

- Pepper Money

- Precise Mortgages

- Quantum Mortgages

- Shawbrook Bank

- The Mortgage Lender

Remember, each lender has different criteria, and what works for one person might not work for another. Your specific credit issues, such as how recent and severe they are, will influence your options.

Can You Remortgage A Buy-To-Let Even With Bad Credit?

Yes, you can remortgage a buy-to-let property even with bad credit, but it will be more challenging than with good credit.

With bad credit your options narrow to specialist lenders who understand and accept a higher risk profile.

This translates to potentially higher interest rates and more intense scrutiny of your application.

The decision to remortgage should also consider your goals.

Are you looking to release equity from the property, or simply secure a lower interest rate on your current mortgage?

The amount of equity you have in the property will be a major factor for lenders, especially if you want to release equity.

If your primary goal is a lower interest rate, you might find remortgaging with your current lender, also known as a product transfer, to be a smoother option even with bad credit.

Since they already have a relationship with you and know your property, they might be more flexible.

However, it’s still wise to compare rates from other lenders to ensure you’re getting the best deal possible.

To increase your chances of success, try to improve your credit score beforehand. Even a small bump can help.

Key Takeaways

- A buy-to-let mortgage is for renting out property, with lenders focusing on rental income instead of your salary. Even with bad credit, you can still apply, but expect stricter terms and higher interest rates.

- Bad credit doesn’t mean no options. Lenders look at the type and severity of your credit issues, as well as rental income covering 125%-145% of mortgage payments. A mortgage broker may help you find lenders who specialise in bad credit cases.

- A bigger deposit (25%-30% or more with bad credit) can improve your chances, as it lowers the lender’s risk. You should also expect higher interest rates.

- Remortgaging a buy-to-let with bad credit is possible but challenging. Specialist lenders or sticking with your current lender for a product transfer might offer the best solutions.

The Bottom Line

A buy-to-let mortgage is possible even if you have bad credit. But, your options might be slim, and you might face higher rates and stricter terms.

So before you dive in, make sure to get answers to these three questions:

- How much do I need to get a buy-to-let mortgage with bad credit?

- Can I afford the overall cost, monthly payments and taxes, even with potential voids?

- Have I explored all options for improving my credit before applying?

A mortgage broker can help you figure out the answers to these questions. Apart from that, they can guide you to lenders more likely to accept your application and potentially secure more favourable terms.

Ready to get started? Reach out to us. We’ll link you with a good mortgage broker specialising in buy-to-let and bad credit mortgages.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

Can I get a buy-to-let mortgage with bad credit if I don't have a credit history?

Yes, you can still apply for a buy-to-let mortgage even if you have bad credit or no credit history. However, your options may be limited.

Lenders might ask for a larger deposit or offer higher interest rates to offset the risk. It’s a good idea to talk to a mortgage broker who can guide you to the right lenders.

Does bad credit affect the affordability assessment for a buy-to-let mortgage?

Bad credit can influence the affordability assessment for a buy-to-let mortgage. Lenders might be stricter in their evaluations, ensuring the rental income can comfortably cover mortgage payments.

They might also scrutinise your other financial commitments more closely. Building a strong case with solid rental yield projections can help.

Can I get a regulated buy-to-let mortgage even with bad credit?

Yes, it’s possible to get a regulated buy-to-let mortgage with bad credit, but it might be more challenging.

Regulated buy-to-let mortgages are those where the property is to be let out to a family member. These mortgages fall under stricter regulations compared to standard buy-to-let mortgages.

Lenders might be cautious due to the added regulatory scrutiny and your bad credit. But, with a strong application and possibly a larger deposit, you could improve your chances.