- What Is Commercial Development Finance?

- How Does It Work?

- When Is It Most Useful?

- Types of Commercial Development Finance

- How Much Can I Borrow?

- Documents You Need for Commercial Development Finance

- What Rates Should You Expect?

- Additional Costs to Keep in Mind

- Where to Find Loans for Commercial Property Development

- Business Loan or Commercial Development Finance?

- Alternative Financing Options

- The Bottom Line

Fund Your Project With Commercial Development Finance: A Guide

Building something big—like a block of flats or a shiny new business space—takes more than just a good idea.

It takes serious money 💷.

The costs can stack up quickly, from buying land to construction and those pesky surprise expenses along the way.

Most people don’t have all that cash ready, and that’s where commercial development finance comes in.

This type of loan is designed for projects like yours, helping you cover the costs so you can focus on turning your vision into reality.

In this guide, you’ll learn how commercial development finance works, what you need to qualify, and how to find the best loan for your project.

What Is Commercial Development Finance?

Commercial development finance is a flexible, short-term lending option available to various entities—individual investors, corporations, limited liability partnerships, charitable organisations, and even pension funds.

This financial instrument can cover:

- Retail spaces

- Industrial sites

- Hospitality establishments

- Educational institutions

- Care facilities

- Office buildings

- Places of worship

- Residential properties for resale or leasing

How Does It Work?

With commercial development finance, you don’t get all the money in one go. Instead, the funds are released in stages as your project moves forward.

For example, you might get money every few months or after hitting certain milestones, like finishing the foundation.

One great thing about this type of loan is that you only pay interest on the money you’ve actually used. This makes it a cheaper option compared to other loans. However, some lenders might charge a fee for the money you haven’t spent yet, so it’s important to check the details carefully.

Before a lender agrees to give you the loan, they’ll want to know your exit plan. This means showing how you’ll pay the loan back—either by selling the property or switching to a long-term mortgage.

When Is It Most Useful?

This financing option is versatile and can suit various development objectives:

- Acquiring new development sites while capital is committed elsewhere

- Purchasing un-mortgageable properties for renovation or conversion

- Securing properties at auctions for redevelopment and sale

- Funding ‘Build to Let‘ projects

- Supporting self-build ventures

- Investing in commercial venues like pubs, hotels, and restaurants

Types of Commercial Development Finance

As we’ve discussed, commercial development finance can help with different goals, like buying land, renovating, or building to rent.

The type of loan you need depends on what you plan to do with the property—sell it, rent it out, or use it yourself.

Here are the main types:

Building to Sell

This is when you build or renovate a property with the aim of selling it for profit. Lenders want to know how quickly and easily the property can sell and how much it’s likely to be worth once finished (its Gross Development Value).

For example, you might buy an old retail unit in Birmingham, completely refurbish it, and sell it as a modern shop space.

Building to Keep

Here, you’re building or fixing up a property to rent it out for steady income. Lenders will look at how easy it is to rent and if you can manage it financially once it’s ready.

Building for Your Business

This is for when you’re developing a property for your own business to use.

Lenders aren’t as concerned about selling or renting it out—they’re more focused on whether your business can handle the loan repayments.

How Much Can I Borrow?

The amount you can borrow for your project usually falls between 60% and 100% of the total costs. It depends on your business plan, how well you negotiate, and what the lender thinks of your project.

Here are the main things that lenders consider:

- Project Size. The size and scope of your project affect how much you can borrow. Bigger projects might mean larger loans, but they also face more scrutiny from lenders to ensure they’re worth the risk.

- Gross Development Value (GDV). Lenders assess how much your project will be worth when it’s finished. This is called the GDV, and it plays a big role in how much they’re willing to lend. A higher GDV often means a larger loan.

- Credit History. If you have a strong credit history, lenders are more likely to trust you with a higher loan amount and might offer better interest rates.

- Exit Strategy. A well-thought-out exit strategy—like selling the property or refinancing with a long-term loan—gives lenders confidence that you’ll repay the loan. This can directly impact how much you’re approved for.

- Interest Reserves. Lenders often want to see that you can handle interest payments during the project. If you can’t cover these costs, it might reduce the amount they’re willing to lend.

- Experience. If you’ve completed similar projects before, lenders are more likely to approve larger loans. A strong track record shows you know how to deliver.

- Fees and Rates. Don’t forget about extra costs like upfront fees, valuation costs, and the type of interest rate you choose. These can affect how much of the loan you’ll actually have available for your project.

- Loan Term. These loans are typically short-term, lasting 6 to 24 months, though some lenders offer longer terms.

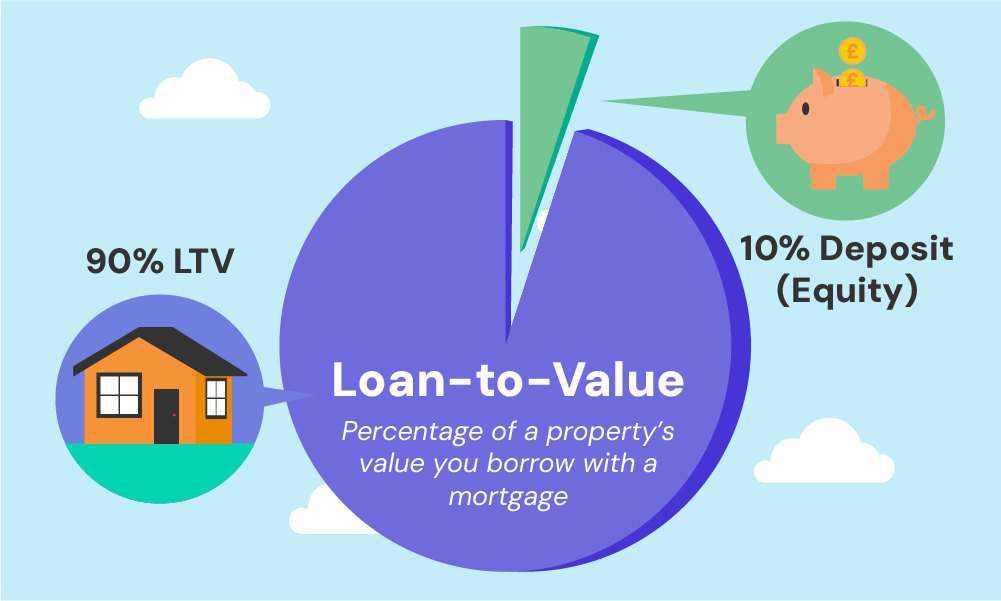

- Loan-to-Value (LTV). This is how much of the property’s value the lender will cover. It’s usually 70–75%, but factors like your credit history, the project’s viability, and other risks could impact this ratio.

Documents You Need for Commercial Development Finance

Preparation is important. Having the necessary documentation at hand can expedite the process and increase your chances of approval. Here’s what you’ll usually need:

- Business Plan – A comprehensive business plan outlines your project in detail, highlighting the market demand, timelines, and financial forecasts.

- Cash Flow Projections – Provide a detailed cash flow statement for at least the next 12 to 24 months to show how you plan to manage the finances during the development period.

- Property Valuation – Lenders often require a professional valuation report of the property to understand its current worth and its potential value post-development.

- Planning Permission – Evidence of planning permission or at least preliminary discussions with local authorities can show the lender that your project is viable and legal.

- Personal and Business Financial Statements – Lenders will want to scrutinise your personal and business financial statements to assess your ability to repay the loan.

- Credit History – Though not a deal-breaker, your credit score can influence the terms of your loan. Be prepared to discuss any financial issues you’ve had in the past.

- Asset and Liability Statements – Listing your assets and liabilities gives lenders a fuller picture of your financial health.

- Identification Documents – You’ll also need to provide standard ID verification, such as a passport or driving licence, along with proof of address.

Having these documents ready can smooth your path to securing the finance you need for your commercial development project.

What Rates Should You Expect?

If you occupy the property post-development, rates usually start at around 3.5% per annum. For projects intended to be sold or leased, you’re looking at interest rates between 7% to 11.4% per annum.

Note that interest is often rolled up into the loan amount, so you won’t have to worry about monthly payments.

How Your Income Factors In

For commercial development loans, lenders don’t look at your personal income like they do for regular loans.

If you’re borrowing for your own business, they care more about whether your business can switch to a commercial mortgage later. That’s because the mortgage is how they’ll expect to get their money back.

Additional Costs to Keep in Mind

While the loan itself is crucial, it’s important to budget for other expenses:

- Arrangement Fee. This is a setup charge by the lender, typically ranging from 1-2% of the loan value.

- Exit Fee. Not all lenders charge this, but many do. It’s a fee due when you repay the loan, generally between 1-2% of the loan amount or the Gross Development Value (GDV).

- Broker Fees. If you go through a broker, you might also incur some additional charges. This can be about 1% of the loan amount.

- Valuation Fees. A chartered surveyor will evaluate your project, and the cost of this service scales with the GDV of your scheme.

- Professional Fees. Don’t forget about the fees for other experts like architects, quantity surveyors, and legal consultants. These can vary based on the complexity of your project.

Where to Find Loans for Commercial Property Development

When it comes to securing a loan for your commercial property development project, you have several options to consider. Broadly speaking, lenders for these loans can be classified into three main types:

- High Street Banks. High street banks are the go-to choice for many because of their low rates. However, they’re generally more cautious, and you’ll likely find you need a larger deposit compared to other lenders.

- Challenger Banks. These institutions are more relaxed in their approach, often requiring a smaller deposit. The application process can be simpler, but you’ll probably pay a slightly higher rate than at high street banks.

- Specialist Development Lenders. These lenders cater specifically to commercial development projects. They often require a smaller deposit and can offer rates that vary quite a bit, ranging from very low to rather high.

Business Loan or Commercial Development Finance?

If your project is small, with a budget not exceeding £25,000, a business loan could be the better fit as you won’t need to provide any security.

However, for larger-scale projects like buying land or renovating a building, commercial development finance is usually the better option. These loans are designed to be released in stages to cover the costs of your project.

In many cases, a commercial development loan is the starting point, which is then refinanced into a commercial mortgage once the development reaches a stage acceptable to more lenders.

Alternative Financing Options

Other options to ponder include:

- Bridging Finance. This is a short-term loan similar to commercial development finance but with funds released all at once.

- Mezzanine Finance. This can fill in financial gaps midway through your project.

- Joint Venture Property Development Finance. Some lenders offer a profit-share agreement that can cover 100% of the required funds. This doesn’t require a deposit, but the interest rates are higher, and you’ll typically share between 40-50% of the profits with the lender.

- Commercial Mortgage. While similar in some respects to commercial development finance, commercial mortgages are generally for already-built properties rather than funding a project from the ground up. They usually have a longer repayment term and are intended for properties that will generate income or capital gains. Commercial mortgages are generally less flexible when it comes to releasing funds in stages for development milestones.

The Bottom Line

Securing commercial development finance takes preparation. You’ll need a strong business plan and a clear strategy for paying the loan back. Even with everything in place, it can be challenging—lenders are often strict, and the competition is tough.

A development finance broker can make the process much smoother. They know what lenders are looking for, can fine-tune your application, and take care of the tricky paperwork so you can focus on your project.

If you’re ready to dive into commercial property development, working with a broker is a smart choice. Contact us, and we’ll connect you with an expert who can help you every step of the way.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

Can I consolidate my monthly payments?

Yes, it’s possible to roll your monthly interest into the overall loan when you opt for commercial property development finance.

No monthly repayments are necessary during the loan’s term, as long as you meet the lender’s Loan to Gross Development Value (LTGDV) criteria.

Lenders have their methods for handling interest—some may add it above the LTGDV limit, while others may subtract it.

Does bad credit or past financial troubles affect my eligibility?

Not really. Having poor credit or a history of financial issues like defaults, CCJs, or even bankruptcies doesn’t automatically disqualify you from securing commercial property development finance.

While a clean financial history is beneficial, lenders often prioritise the strength and viability of your business plan. So, even with financial setbacks, a strong project is less likely to be rejected unless those issues significantly risk the exit strategy.

How much deposit should I have to get commercial development finance?

You generally need to think about two main financial elements for a commercial development: the purchasing funds and the building costs.

Most lenders offer up to 75% of the purchase price, which means you should be prepared to put down a 25% deposit. However, if you have assets like property or equipment to secure against the loan, you might qualify for a 100% Loan-to-Value (LTV).

Can I fund an apartment building project with commercial development finance?

Yes, you can. Commercial development finance can be applied to an apartment building project. The key factor here is the strength and credibility of your business plan and exit strategy. Some lenders might see apartment projects as riskier, but a competent broker can guide you to those who specialise in this type of development.