What Are The Best Alternatives To Equity Release in 2025?

Have you ever thought about how much your home could help you with money?

Last year, thousands of people in the UK did just that. Over 93,421 homeowners, maybe even people like you, decided to use a part of their home’s value to help them in retirement.

This choice has been getting more popular, growing by 23% in just one year – the biggest jump since 2018.

Altogether, people borrowed an incredible £6.2 billion this way – twice as much as five years ago (Equity Release Council, 2023).

If you’re 55 or older, you can look into equity release plans, which can be a handy way to get extra money for retirement.

But here’s the thing: these plans aren’t the right choice for everyone. It all depends on your situation.

That’s where we come in! 😀

In this article, we’ll share 10 other ways you could boost your finances without using equity release. Our goal is to help you make the best choice for your future, with all the facts you need.

Is Equity Release Right for You?

If you’re over 55 and own your home, equity release could be an option. It allows you to release the equity (cash) tied up in your home, without having to sell it.

But, it’s important to consider your circumstances and the reasons you need the cash before taking out an equity release plan.

Equity release can be a costly way to borrow, especially if you’re just reaching the eligible age. This is because the scheme runs until you pass away or move into long-term care.

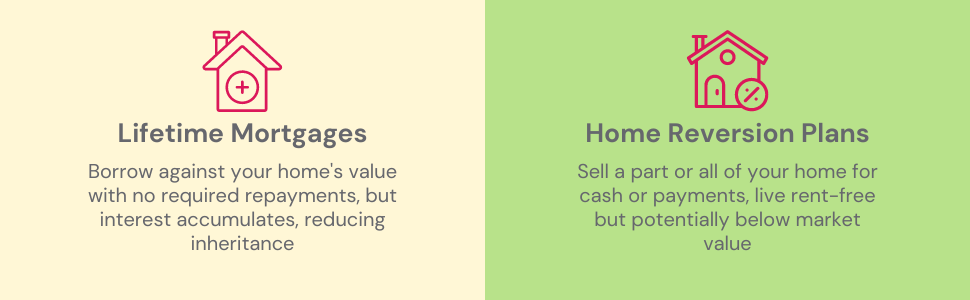

There are two ways you can go about releasing equity:

Lifetime Mortgages

This popular choice lets you take out a mortgage on your property while you keep ownership. You can choose to let the interest add up, instead of making regular repayments.

But, this means the inheritance you leave might be significantly less due to this accumulated interest being paid back when the loan ends.

Home Reversion Plans

With this scheme, you can sell part or all of your property to a home reversion provider in exchange for a lump sum or regular payments.

While this allows you to live in your property rent-free for the rest of your life, you might end up selling your property for less than its market value.

So, while equity release can be a helpful way to tap into your home’s value during retirement, remember that any mistakes could be expensive.

It’s important to be sure this is the right option for you, so consider all the alternatives before you decide.

>> More about Is Equity Release A Good Idea?

10 Alternatives to Equity Release

If you’re on the fence about whether equity release is the right choice for you, don’t worry. There’s a wealth of other options you can contemplate before you decide.

Some of these are:

- Retirement Interest-Only Mortgage (RIO)

- Downsizing Your Home

- Remortgaging

- Personal Loans

- Using Savings and Investments

- Renting Out a Room

- Using Credit Cards

- Financial Support from Family and Friends

- Claiming Grants and Benefits

- Budgeting

Retirement Interest-Only Mortgage (RIO)

Exploring a Retirement Interest-Only Mortgage, or RIO could be worthwhile. This particular mortgage allows you to:

- Pay only the loan’s interest each month, offering lower monthly payments.

- Settle the main loan amount when you sell your house, move into long-term care, or pass away.

For retirees, this can be quite attractive. It promises more manageable monthly payments compared to a regular mortgage, and the bonus of staying in your home for life.

But, there are important factors to consider:

- Your potential inheritance could be affected.

- A steady retirement income is necessary to cover the interest payments.

- The amount you can borrow is tied to your age and your property’s value.

- The influence of interest rates over time needs to be assessed.

Because of these various elements, it’s wise to get advice from a seasoned mortgage adviser before deciding if an RIO mortgage suits your needs.

Downsizing Your Home

One way to free up money invested in property is to downsize – to sell your existing house and buy a smaller, cheaper one. This could create a substantial lump sum, useful for funding your retirement.

Another perk of living in a smaller home is that it typically involves less upkeep, which could further slash your living expenses.

But, keep in mind the costs involved in this process, such as estate agent fees and stamp duty. These expenses should be taken into account when figuring out your potential profits.

On the emotional front, downsizing can have its challenges too. Saying goodbye to a family home full of memories can be hard.

There’s also the likelihood of leaving a familiar community behind. But, it could also be seen as an exciting new chapter.

A chance to declutter and embrace a simpler, more cost-effective lifestyle. It’s a very personal decision and merits serious consideration.

Remortgaging

This involves replacing your current mortgage with a new deal. You can do this with your current lender or shop around for a better deal with different lenders.

This practical move can offer several benefits:

- It lets you to take advantage of a better interest rate if the mortgage market has shifted favourably.

- If your home’s value has increased since your original purchase, you can release equity.

Furthermore, remortgaging offers flexibility. If your income rises or you get a lump sum, some remortgage deals let you pay off more of your mortgage earlier. This lets you to become mortgage-free sooner.

But, remember that once a fixed-rate deal ends, you may shift to a higher standard variable rate (SVR).

Financial decisions like this should always be made after considering all your options.

While remortgaging is a strong alternative to equity release, it’s important to seek professional advice to ensure it’s the right choice for your circumstances.

Personal Loans

Personal loans could be a viable alternative to equity release, particularly if you need a smaller sum and can manage repayments with a steady income.

These loans offer fixed monthly payments for a set period, providing predictability.

But, the interest rates can be higher than mortgage rates, making larger loans expensive. Not keeping up with repayments can damage your credit score and may lead to legal consequences.

Though personal loans may seem convenient, they require careful consideration and planning. Always compare loan terms and rates before deciding.

Using Savings and Investments

Another option to cover your retirement needs is by utilising your savings and investments.

If you’ve managed to save a considerable amount, it might be a more cost-effective method than borrowing money.

You could also liquidate investments like stocks, bonds, or mutual funds to obtain the funds you require. Yet, this decision needs careful thought.

Assess the potential returns from your investments against the cost of borrowing. Keep in mind the tax implications too.

Making large withdrawals from your savings or selling off your investments could increase your tax bracket, leading to a bigger tax bill.

Renting Out a Room

Renting out a spare room in your home is another possible income source. You can earn a decent sum, which can go towards your living costs.

Plus, there’s a tax advantage: under the UK’s ‘Rent a Room‘ scheme, you can earn up to £7,500 per year tax-free from letting out furnished accommodation in your home.

But remember, opening your home to a lodger isn’t for everyone. You’ll be sharing your living space, which might compromise your privacy.

Using Credit Cards

Credit cards, when used wisely, can help manage temporary cash shortages and provide fund access when necessary.

Some cards offer low or even 0% interest for a certain period. But be careful, after this period, the interest rate often skyrockets, and accumulated interest can grow quickly if the balance isn’t cleared.

Excessive use can trap you in a cycle of debt. It’s crucial to plan to pay off the balance during the low-interest period, or soon after.

Financial Support from Family and Friends

Asking your family or friends for financial assistance is another alternative to equity release. This can be a way to get the funds you need without incurring interest, but it’s important to have open discussions about expectations and repayment plans to avoid any misunderstandings.

Some advantages of this arrangement include the comfort of knowing you’re backed by your loved ones and the possibility of more flexible repayment terms.

Claiming Grants and Benefits

The UK government provides various grants and benefits that could serve as a viable alternative to equity release. For example, Pension Credit and Housing Benefits can help top up your income or cover your rent.

Ensure that you’re claiming all the benefits you’re eligible for. There’s a wide range of support available from the government, from help with heating costs to support for those with disabilities.

You can visit the UK government’s website to see what benefits you could be eligible for.

Budgeting

Often overlooked, proper budgeting is a robust financial tool that can help free up unnecessary expenses.

It’s not as flashy as some other options, but don’t underestimate the power of a well-planned budget. Over time, small changes can make a significant impact on your financial health.

Effective budgeting involves a deep understanding of your income and expenses. Begin by tracking every pound that comes in and goes out.

Once you’ve got a clear picture of your spending habits, you can identify areas where you can cut back.

Here are some general tips to assist in budgeting:

- Write Down Your Income – Include pensions, earnings from part-time jobs, and investments.

- List All Your Expenses – Record fixed costs like rent and bills, and variable costs like groceries and leisure activities.

- Compare Income and Expenses – If you’re overspending, it’s time to re-evaluate your outgoings.

- Set a Realistic Budget – Make a sustainable budget based on your assessment.

- Review Regularly – As circumstances change, so should your budget.

By sticking to a well-planned budget, you can live within your means and build savings over time, decreasing reliance on options like equity release.

How to Choose the Right Alternative?

Your unique situation and desires will guide your decision. Before settling on an option, it’s vital to consult with an equity release expert to explore all available paths.

Consider how changes might affect your daily life. For instance, moving to a smaller home or renting out a room might bring more immediate lifestyle shifts.

In contrast, Retirement Interest-Only (RIO) mortgages and equity release schemes could have lasting implications for the legacy you wish to leave.

Your decision would also hinge on the sum you wish to borrow, its purpose, and the urgency.

Need quick cash for a lucrative investment opportunity? Then a quicker method may be more suitable than the least costly one.

But if you’re dreaming of home upgrades or that perfect vacation, there’s usually time to evaluate every possibility at your leisure.

It’s reassuring to know that you can’t just dive into an equity release without expert guidance. This ensures you think it through thoroughly. But, bear in mind that not every expert covers all options.

So, it’s crucial to conduct your investigation or consult a good mortgage broker to gain a complete understanding.

Key Takeaways

- While equity release is a popular choice among homeowners over 55, it’s not a one-size-fits-all solution. In general, you can opt for alternatives such as Retirement Interest-Only Mortgage (RIO), downsizing your home, remortgaging, borrowing money, using savings and investments, renting out a room, using credit cards, financial support from family and friends, claiming grants and benefits, and budgeting.

- It’s important to evaluate each alternative carefully. Consider your circumstances, the amount needed, its purpose, and your preferred time frame.

- The lifestyle implications of each choice also matter. Options like downsizing or renting out a room can have immediate lifestyle impacts, while choices like RIO mortgages can influence your financial legacy.

The Bottom Line: Speak with an Equity Release Advisor

Before you decide on the best way to increase your retirement income, seek advice from an expert.

They’ll provide a personalised view and help you weigh up all your options. Whether that’s equity release, downsizing, remortgaging, or something else.

Ready to explore your options? Get in touch with us. Simply fill out this quick form and we’ll connect you with an experienced mortgage advisor in equity release. They can give you tailored solutions to your financial concerns.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

Can credit cards be considered an alternative to equity release for major purchases?

Credit cards are meant for short-term borrowing and can become costly if debts accumulate. They’re not a suitable alternative for major purchases, especially if you’re nearing retirement with a likely decrease in income.

How safe is equity release in the UK?

Equity release schemes in the UK are regulated by the Financial Conduct Authority (FCA). Providers are usually members of the Equity Release Council (ERC), which has strict standards to ensure consumer protection.

But, it’s important to seek independent mortgage advice as equity release can have long-term implications for your finances and inheritance.

This article has been fact checked

This article was created, checked, and verified by the expert team at Money Saving Guru. Trust us, you’re in good hands.